• |

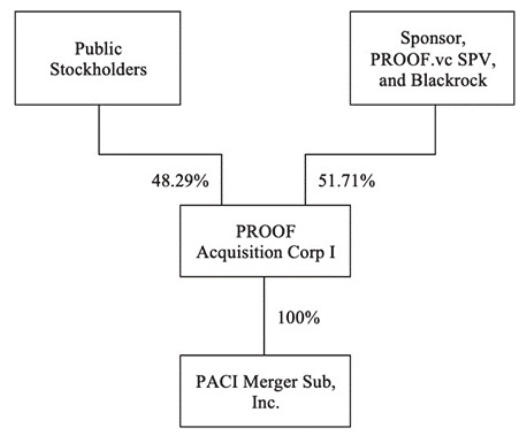

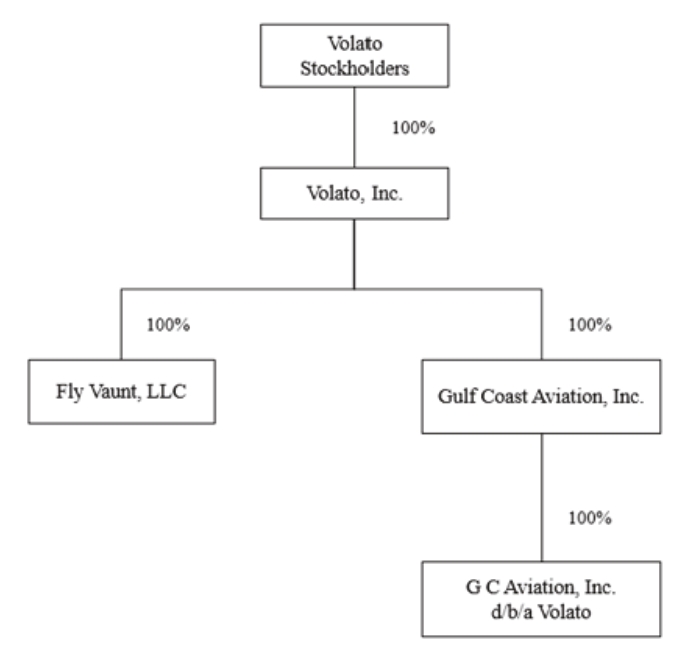

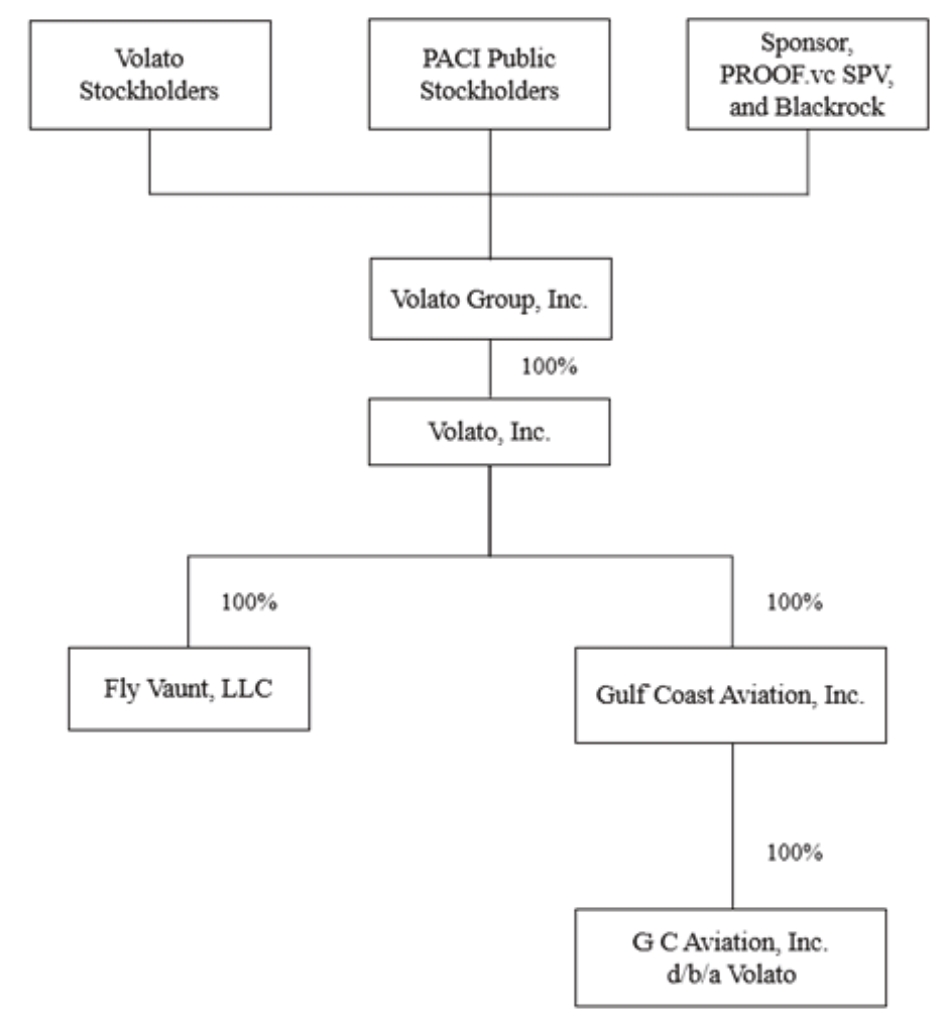

The BCA Proposal - To consider and vote upon a proposal to approve and adopt the Business Combination Agreement, dated as of August 1, 2023 (the “Business Combination Agreement”), among PACI, PACI Merger Sub, Inc., a Delaware corporation and a wholly-owned subsidiary of PACI (“Merger Sub”), and Volato, Inc., a Georgia corporation (“Volato”), pursuant to which Merger Sub will merge with and into Volato, with Volato surviving the merger as a wholly-owned subsidiary of PACI, including the other transactions contemplated by the Business Combination Agreement (such transaction, the “Business Combination” and such proposal, the “BCA Proposal”). A copy of the Business Combination Agreement is attached to this proxy statement/prospectus as Annex A. |

• |

The Stock Issuance Proposal - To consider and vote upon a proposal to approve, for purposes of complying with applicable listing rules of the New York Stock Exchange (“NYSE”), the issuance of up to 20,707,600 shares of Class A Common Stock of PACI, par value $0.0001 per share (“Class A Common Stock”), pursuant to the Business Combination Agreement (the “Stock Issuance Proposal”). The Stock Issuance Proposal is conditioned on the approval of the BCA Proposal. |

• |

The Charter Amendment Proposal - To consider and vote to approve and adopt an amended and restated certificate of incorporation of PACI (the “Proposed Charter”), which will amend, restate, and replace PACI’s Amended and Restated Certificate of Incorporation, dated November 29, 2021 (as amended, the “Current Charter”) upon the closing of the Business Combination (the “Closing”) (such proposal, the “Charter Amendment Proposal”). A copy of the Proposed Charter is attached to this proxy statement/prospectus as Annex B. The Charter Amendment Proposal is conditioned on the approval of the BCA Proposal and the Stock Issuance Proposal, but it is not conditioned on the approval of the Advisory Charter Proposals (as defined below). |

• |

The Advisory Charter Proposals -To approve and vote, on a non-binding advisory basis, certain governance provisions in the Proposed Charter, which are being presented separately in accordance with SEC guidance to give stockholders the opportunity to present their separate views on important corporate governance provisions (collectively, the “Advisory Charter Proposals”). Each of the Advisory Charter Proposals is conditioned on the approval of the BCA Proposal and the Stock Issuance Proposal: |

• |

The Stock Incentive Plan Proposal - To consider and vote upon a proposal to approve the 2023 Stock Incentive Plan (the “2023 Plan”), a copy of which is attached to this proxy statement/prospectus as Annex C, including the authorization of the initial share reserve under the 2023 Plan (the “Stock Incentive Plan Proposal”). The Stock Incentive Plan Proposal is conditioned on the approval of the BCA Proposal, the Stock Issuance Proposal, and the Charter Amendment Proposal. |

• |

The Adjournment Proposal - To consider and vote upon a proposal to approve the adjournment of the Special Meeting to a later date or dates, if necessary or appropriate, to permit further solicitation and vote of proxies in the event that there are insufficient votes for, or otherwise in connection with, the approval of the BCA Proposal, the Stock Issuance Proposal, the Charter Amendment Proposal, or the Incentive Plan Proposal (such proposal to approve the adjournment of the Special Meeting, the “Adjournment Proposal” and, together with the BCA Proposal, the Stock Issuance Proposal, the Charter Amendment Proposal, the Advisory Charter Proposals, and the Stock Incentive Plan Proposal, the “Proposals”). |