PRE 14A: Preliminary proxy statement not related to a contested matter or merger/acquisition

Published on December 31, 2024

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Check the appropriate box:

| ☒ | Preliminary Proxy Statement | ||||

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | ||||

| ☐ | Definitive Proxy Statement | ||||

| ☐ | Definitive Additional Materials | ||||

| ☐ | Soliciting Material Pursuant to §240.14a-12 | ||||

VOLATO GROUP, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than The Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ☒ | No fee required | ||||

| ☐ | Fee paid previously with preliminary materials | ||||

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. | ||||

VOLATO GROUP, INC.

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

Dear Stockholder:

You are cordially invited to attend a Special Meeting of Stockholders (the “Special Meeting”) of Volato Group, Inc. (“we,” the “Company” or “Volato Group”). The virtual-only meeting will be held on February 18, 2025 at 9:00 a.m., Eastern Time via live webcast, providing stockholders with the ability to participate in the Special Meeting, vote their shares and ask questions.

| Time | 9:00 a.m. Eastern Time | |||||||

| Date | February 18, 2025 | |||||||

| Place | The Special Meeting will be conducted virtually via live webcast. You will be able to attend the Special Meeting by visiting www.virtualshareholdermeeting.com/SOAR2025SM, where you will be able to submit questions and vote online during the meeting. | |||||||

| Purpose | 1. To approve an amendment to the Company’s Second Amended and Restated Certificate of Incorporation to increase the number of authorized shares of Class A common stock from 200,000,000 to 600,000,000 (the “Authorized Share Increase Proposal”); | |||||||

| 2. To approve, for the purpose of complying with the NYSE American LLC Company Guide Section 713(a)(ii), the issuance of 20% or more of the Company's issued and outstanding shares of common stock pursuant to that certain Securities Purchase Agreement with the purchaser named therein (the “Investor”), dated December 4, 2024, including upon the conversion of convertible notes issued or issuable to the Investor (the “Issuance Proposal”); and | ||||||||

| 3. To approve a proposal to adjourn the Special Meeting to a later date, if necessary or appropriate, to permit further solicitation and vote of proxies in the event that there are insufficient votes for, or otherwise in connection with, the approval of the Authorized Share Increase Proposal or the SPA Issuance Proposal (the “Adjournment Proposal”). | ||||||||

| Record Date | December 23, 2024 | |||||||

| Meeting Admissions | All stockholders as of the record date, or their duly appointed proxies, may attend the virtual meeting. In order to attend the Special Meeting, you must register in advance at www.virtualshareholdermeeting.com/SOAR2025SM and provide the control number located on the Notice of Internet Availability of Proxy Material or proxy card. Upon completing your registration, you will receive further instructions via email. | |||||||

| Voting by Proxy | If you are a stockholder of record, you may vote via the internet, by telephone or by submitting a proxy card by mail. If your shares are held in street name, you will receive instructions from your broker or other nominee explaining how to vote your shares, and you may also have the choice of instructing the record holder as to the voting of your shares over the internet or by telephone. Follow the instructions on the voting instruction form you received from your broker or nominee. |

|||||||

Holders of our shares of Class A common stock, par value $0.0001 (the “common stock”), owning such shares of record at the close of business on December 23, 2024 are entitled to attend and vote at the Special Meeting and any continuation or adjournment thereof. The enclosed Proxy Statement more fully describes the details of the business to be conducted at the Special Meeting. The Company does not contemplate discussing any other business at the meeting.

Your vote is very important. Please vote whether or not you plan to attend the Special Meeting. Your promptness in voting will assist us in ensuring that a quorum is present or represented. The Notice of Internet Availability of Proxy Materials contains instructions on how to vote online or by telephone. If you have received a paper copy of our proxy materials, please mark, date, and sign and return the enclosed proxy card in the accompanying reply envelope to ensure receipt by our tabulator. You may also vote online or by phone by following the instructions contained in the accompanying Proxy Statement.

Sincerely,

/s/ Matthew Liotta

Matthew Liotta

Chair and Chief Executive Officer

Chamblee, Georgia

December [●], 2024

December [●], 2024

3

Table of Contents

| GENERAL INFORMATION | |||||

PROPOSAL 1: AUTHORIZED SHARE INCREASE PROPOSAL |

|||||

| PROPOSAL 2: ISSUANCE PROPOSAL | |||||

| PROPOSAL 3: ADJOURNMENT PROPOSAL | |||||

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | |||||

| WHERE YOU CAN FIND MORE INFORMATION | |||||

| IMPORTANT NOTICE REGARDING DELIVERY OF STOCKHOLDER DOCUMENTS | |||||

| OTHER BUSINESS | |||||

| APPENDIX A: FORM OF AMENDMENT TO SECOND AMENDED AND RESTATED CERTIFICATE OF INCORPORATION | |||||

i

VOLATO GROUP, INC.

PRELIMINARY PROXY STATEMENT - SUBJECT TO COMPLETION

FOR THE SPECIAL MEETING OF STOCKHOLDERS

TO BE HELD VIRTUALLY ON FEBRUARY 18, 2025

AT 9:00 A.M. EASTERN TIME

FOR THE SPECIAL MEETING OF STOCKHOLDERS

TO BE HELD VIRTUALLY ON FEBRUARY 18, 2025

AT 9:00 A.M. EASTERN TIME

This proxy statement (“Proxy Statement”) is furnished in connection with the solicitation of your proxy on behalf of the board of directors (the “Board”) of Volato Group, Inc., a Delaware corporation (the “Company” or “Volato Group”), in connection with a Special Meeting of Stockholders (the “Special Meeting”) to be held virtual via live webcast, on February 18 2025 , at 9:00 a.m. Eastern Time and at any adjournment or postponement thereof. You will be able to attend the Special Meeting virtually by visiting www.virtualshareholdermeeting.com/SOAR2025SM. Our Board has fixed the close of business on December 23, 2024 as the record date (“Record Date”) for determining Volato Group stockholders entitled to notice of and to vote at the Special Meeting and at any adjournment or postponement thereof.

Important Notice Regarding the Internet Availability of Proxy Materials for the Special Meeting. On or about January [●], 2025, the Company started mailing to its stockholders the Notice of Special Meeting of Stockholders, Proxy Statement, and form of proxy card (collectively, the “Proxy Materials”). The Proxy Materials are available online at www.proxyvote.com. Stockholders who receive a paper copy of the Proxy Materials, including this Proxy Statement and a form of proxy card or instruction card, may vote online, by telephone or by mail.

GENERAL INFORMATION

When Are This Proxy Statement and the Accompanying Materials Scheduled to Be Sent to Stockholders?

We have elected to provide access to our proxy materials to our stockholders via the internet. Accordingly, on or about January [●], 2025, we will begin mailing to our stockholders a Notice of Internet Availability containing instructions on how to access our Proxy Materials, including our Proxy Statement. The Notice of Internet Availability also instructs you on how to submit your proxy or voting instructions through the internet or to request a paper copy of our Proxy Materials, including a proxy card or voting instruction form that includes instructions on how to submit your proxy or voting instructions by mail or telephone. For shares held in street name (held for your account by a broker or other nominee), you will receive a voting instruction form from your broker or nominee.

Why Did I Receive a Notice of Internet Availability of Proxy Materials Instead of a Full Set of Proxy Materials?

Pursuant to rules adopted by the Securities and Exchange Commission (the “SEC”), we are providing access to our Proxy Materials over the internet rather than printing and mailing the Proxy Materials. We believe electronic delivery will expedite the receipt of materials, will help lower our costs and reduce the environmental impact of our Special Meeting materials. Therefore, a Notice of Internet Availability will be mailed to holders of record and beneficial owners of our common stock starting on or around January [●], 2025. The Notice of Internet Availability will provide instructions as to how stockholders may access and review the Proxy Materials, including the Notice of Special Meeting, Proxy Statement and proxy card, on the website referred to in the Notice of Internet Availability or, alternatively, how to request that a copy of the Proxy Materials, including a proxy card, be sent to stockholders by mail. The Notice of Internet Availability will also provide voting instructions. In addition, stockholders of record may request to receive the Proxy Materials in printed form by mail, or electronically by email, on an ongoing basis for future stockholder meetings. Please note that while our Proxy Materials are available at the website referenced in the Notice of Internet Availability, and our Notice of Special Meeting and Proxy Statement are available on our website, no other information contained on either website is incorporated by reference in or considered to be a part of this document.

What Am I Voting On?

At the Special Meeting, the stockholders will be asked to consider and vote upon the following proposals:

1

•To approve an amendment to the Company’s Second Amended and Restated Certificate of Incorporation to increase the number of authorized shares of Class A common stock from 200,000,000 to 600,000,000 (the “Authorized Share Increase Proposal”).

•To approve, for the purpose of complying with the NYSE American LLC Company Guide Section 713(a)(ii), the issuance of 20% or more of the Company's issued and outstanding common stock pursuant to a Securities Purchase Agreement with the purchaser named therein (the “Investor”), dated December 4, 2024, including upon the conversion of convertible notes issued or issuable to the Investor (the “Issuance Proposal”).

•To approve a proposal to adjourn the Special Meeting to a later date, if necessary or appropriate, to permit further solicitation and vote of proxies in the event that there are insufficient votes for, or otherwise in connection with, the approval of the Authorized Share Increase Proposal or the SPA Issuance Proposal (the “Adjournment Proposal”).

Who Is Entitled to Vote?

Holders of our shares of common stock as of the Record Date may vote at the Special Meeting. A total of 45,900,553 shares of common stock of the Company were outstanding on December 23, 2024 and entitled to be voted at the meeting. Holders of our shares of common stock have one vote for each share of common stock held on the Record Date. See “How Do I Cast My Vote?” below.

Who Is Soliciting My Vote?

The Board is soliciting your vote.

How Does the Board Recommend I Vote?

The Board recommends that you vote your shares:

•“FOR” the Authorized Share Increase Proposal;

•“FOR” the Issuance Proposal; and

•“FOR” the Adjournment Proposal.

You should carefully consider the detailed discussion of these proposals contained later in this Proxy Statement before voting your shares. If no instructions are indicated, your proxy will be voted FOR each proposal.

How Do I Vote?

If you are a stockholder of record and your shares are registered directly in your name, you may vote:

•By Internet. If you received the Notice of Internet Availability or a printed copy of the Proxy Materials, please follow the instructions in the Notice of Internet Availability or on the proxy card. Votes submitted by internet must be received by 11:59 p.m. Eastern Time on February 17, 2025.

•By Telephone. If you received a printed copy of the Proxy Materials, please follow the instructions on the proxy card. Votes submitted by telephone must be received by 11:59 p.m. Eastern Time on February 17, 2025.

•By Mail. If you received a printed copy of the Proxy Materials, please complete, sign, date and mail your proxy card in the enclosed, postage-prepaid envelope. If you sign and return the enclosed proxy card but do not specify how you want your shares voted, they will be voted FOR each proposal, and will be voted according to the discretion of the proxy holder upon such other matters that may properly come before the meeting or any adjournment or postponement thereof. If you are mailed or otherwise receive or obtain a proxy card or voting instruction form, and you choose to vote by internet or by telephone, you do not have to return your proxy card or voting instruction form. Votes submitted by mail must be received by February 17, 2025.

•In Person at the Special Meeting. You may also vote in person by attending the virtual Special Meeting by visiting www.virtualshareholdermeeting.com/SOAR2025SM. To attend the virtual Special Meeting and vote your shares, you must register in advance at www.proxyvote.com and provide the control number located on your Notice of Internet Availability or proxy card.

If your shares of common stock are held in street name (held for your account by a broker or other nominee):

2

•By Internet or By Telephone. You will receive instructions from your broker or other nominee if you are permitted to vote by internet or telephone.

•By Mail. You will receive instructions from your broker or other nominee explaining how to vote your shares by mail.

How Do I Attend the Special Meeting?

We will be hosting our Special Meeting online via live webcast at www.virtualshareholdermeeting.com/SOAR2025SM. Any stockholder can attend the Special Meeting by registering at www.proxyvote.com. In order to attend the Special Meeting, you must register in advance at www.proxyvote.com and provide the control number located on your Notice of Internet Availability or proxy card. Upon completing your registration, you will receive further instructions via email. The Special Meeting will start at 9:00 a.m. Eastern Time on February 18, 2025.

Why Are You Holding a Virtual Special Meeting?

We are utilizing a virtual-only meeting format in order to leverage technology to enhance stockholder access to the Special Meeting by enabling attendance and participation from any location. We believe that the virtual-only meeting format will give stockholders the opportunity to participate fully and equally, and without cost, and to exercise the same rights as if they had attended an in-person meeting. We have designed our virtual format to enhance, rather than constrain, stockholder access, participation and communication. For example, the virtual format allows stockholders to communicate with us in advance of, and during, the Special Meeting so that they can ask questions of our Board or management.

Who Pays the Cost for Soliciting Proxies?

The Company will pay the cost for the solicitation of proxies by the Board. The solicitation of proxies will be made primarily by mail and through internet access to materials. Proxies may also be solicited personally, by telephone, fax or email by employees of the Company without any remuneration to such individuals other than their regular compensation. The Company will also reimburse brokers, banks, custodians, other nominees and fiduciaries for forwarding these materials to their principals to obtain the authorization for the execution of proxies.

Will My Shares Be Voted if I Do Not Return My Proxy?

If your shares are registered directly in your name, you are a “stockholder of record” who may vote at the Special Meeting. As the stockholder of record, you have the right to direct the voting of your shares by voting over the internet, by telephone, by returning your proxy or by voting online during the Special Meeting.

If your shares are held in an account at a bank or at a brokerage firm or other nominee holder, you are considered the beneficial owner of shares held in “street name,” and these Proxy Materials are being forwarded to you by your bank, broker or other nominee who is considered the stockholder of record for purposes of voting at the Special Meeting. As the beneficial owner, you have the right to direct your bank, broker or other nominee on how to vote your shares and to participate in the Special Meeting. You will receive instructions from your bank, broker or other nominee explaining how you can vote your shares and whether they permit internet or telephone voting. Follow the instructions from your bank, broker or other nominee included with these Proxy Materials, or contact your bank, broker or other nominee to request a proxy form. We encourage you to provide voting instructions to your bank, broker or other nominee by giving your proxy to them. This ensures that your shares will be voted at the Special Meeting according to your instructions. If you want to vote in person virtually at the Special Meeting, you must register in advance at www.proxyvote.com. You may be instructed to obtain a legal proxy from your broker, bank or other nominee and to submit a copy in advance of the meeting. Further instructions will be provided to you as part of your registration process.

If you do not give instructions to your brokerage firm, the brokerage firm will still be able to vote your shares with respect to certain “routine” items, but will not be allowed to vote your shares with respect to “non-routine” items. A “broker non-vote” refers to a share represented at the meeting held by a broker, as to which instructions have not been received from the beneficial owner or person entitled to vote such shares and with respect to which, on one or more but not all matters, the broker does not have discretionary voting power to vote such share.

What Vote Is Required for Approval of the Proposals?

Assuming the presence, in person or represented by proxy, of a quorum:

3

•Approval of the Authorized Share Increase Proposal requires the affirmative vote of a majority of votes cast (excluding abstentions and broker non-votes) on the Authorized Share Increase Proposal. Abstentions and broker non-votes will have no effect on the outcome of the Authorized Share Increase Proposal.

•Approval of the Issuance Proposal requires the affirmative vote of a majority of votes cast (excluding abstentions and broker non-votes) on the Issuance Proposal. Abstentions and broker non-votes will have no effect on the outcome of the Issuance Proposal.

•Approval of the Adjournment Proposal requires the affirmative vote of a majority of votes cast (excluding abstentions and broker non-votes) on the Adjournment Proposal. Abstentions and broker non-votes will have no effect on the outcome of the Adjournment Proposal.

Could Other Matters Be Decided at the Special Meeting?

The Company does not know of any other matters that may be presented for action at the Special Meeting. Should any other business come before the meeting, the persons named on the enclosed proxy will have discretionary authority to vote the shares represented by such proxies in accordance with their best judgment. If you hold shares through a broker, bank or other nominee as described above, they will not be able to vote your shares on any other business that comes before the Special Meeting unless they receive instructions from you with respect to such matter.

Can I Change My Vote?

You may revoke your proxy at any time before it is voted by notifying the Company’s Secretary in writing, by returning a signed proxy with a later date, by transmitting a subsequent vote over the internet or by telephone prior to the close of the internet voting facility or the telephone voting facility. You may also attend the virtual meeting and vote during the meeting. If your stock is held in street name, you must contact your broker or nominee for instructions as to how to change your vote.

How Is a Quorum Reached?

The presence, by virtual attendance or by proxy, of holders of at least a majority of the outstanding shares entitled to vote is necessary to constitute a quorum for the transaction of business at the Special Meeting. Voted withheld, abstentions and broker non-votes, if any, will be counted for purposes of determining whether a quorum is present for the transaction of business at the meeting.

What Does It Mean If I Receive More Than One Notice or Proxy Card?

Your shares are probably registered in more than one account. You should vote all of your shares.

What Happens If the Special Meeting Is Postponed or Adjourned?

Your proxy may be voted at the postponed or adjourned meeting. You will still be able to change your proxy until it is voted.

How Can I Find Out the Results of the Voting at the Special Meeting?

Preliminary voting results will be announced at the Special Meeting. Final voting results will be published in a Current Report on Form 8-K (“Form 8-K”) that we expect to file with the SEC within four business days after the Special Meeting. If final voting results are not available to us in time to file a Form 8-K within four business days after the Special Meeting, we intend to file a Form 8-K to publish preliminary results and, within four business days after the final results are known to us, file an additional Form 8-K to publish the final results.

What Does It Mean If I Receive More than One Proxy Card or Voting Instruction Form?

It means that you have multiple accounts at the transfer agent or with brokers. Please complete and return all proxy cards or voting instruction forms to ensure that all of your shares are voted.

4

What If I Have Technical Difficulties or Trouble Accessing the Special Meeting?

If you encounter difficulties accessing the virtual meeting during the check-in or meeting time, please call the technical support number that will be posted on the virtual meeting log-in page.

Who Should I Call If I Have Any Additional Questions?

If you hold your shares directly, please call the Secretary of the Company at 844-399-8998. If your shares are held in street name, please contact the telephone number provided on your voting instruction form or contact your broker or nominee holder directly.

5

PROPOSAL 1: AUTHORIZED SHARE INCREASE PROPOSAL

Our Second Amended and Restated Certificate of Incorporation authorizes us to issue a total of 201,000,000 shares, consisting of two classes as follows: (a) 200,000,000 shares of Class A common stock, and (b) 1,000,000 shares of preferred stock, each with a par value of $0.0001 per share. Our Board has approved, and we are seeking stockholder approval of, an amendment to our Second Amended and Restated Certificate of Incorporation (the “Authorized Shares Amendment”) to increase the authorized number of shares of common stock from 200,000,000 shares to 600,000,000 shares (the “Authorized Share Increase”).

The Board has unanimously determined that the Authorized Shares Amendment, in substantially the form of Appendix A hereto, is advisable and in the best interests of the Company and our stockholders. In accordance with the DGCL, we are hereby seeking approval of the Authorized Shares Amendment by our stockholders and recommend that our stockholders approve the Authorized Share Increase Proposal.

If stockholders approve this proposal, we expect to file the amendment to our Second Amended and Restated Certificate of Incorporation with the Secretary of State of the State of Delaware to increase the total number of authorized shares of our common stock as soon as practicable following stockholder approval.

Purpose of the Authorized Share Increase

The Board believes that the proposed increase in the number of authorized shares of common stock will benefit the Company by improving our flexibility to promptly and appropriately use its common stock for business and financial purposes in the future. These business opportunities may include, but are not limited to, potential strategic transactions (such as mergers, acquisitions, and other business combinations), future stock dividends, equity or equity-linked offerings and other capital-raising or financing transactions, grants and awards under stock plans, and other types of general corporate purpose transactions. Without an increase in the number of authorized shares of common stock, the Company may be constrained in its ability to raise capital in a timely fashion or at all and may lose important business opportunities, which could adversely affect our financial performance and growth. We believe that it is important to have the flexibility to issue shares of common stock beyond the limited amount remaining.

In addition, the Company entered into a Securities Purchase Agreement (“Securities Purchase Agreement”) with an institutional investor (the “Investor”) on December 4, 2024, under which the Company (i) agreed to issue 10% original issue discount senior unsecured convertible promissory notes (collectively, the “Notes”) in an aggregate original principal amount of up to $36,000,000 that are convertible into shares of common stock. On the same day, we issued an initial tranche Note to the Investor in an aggregate principal amount of $4,500,000 at the initial closing (the “Initial Closing”) for a purchase price of $4,050,000, representing an original issue discount of ten percent (10%), and which matures on December 4, 2025 (the “Initial Tranche Note”). The Securities Purchase Agreement, among other things, requires the Company to have authorized and reserved sufficient shares of common stock equal to no less than 100% of the sum of the maximum number of shares of common stock issuable upon conversion of all the Notes issuable (without taking into account any limitations on the conversion of such Notes). We believe that an increase in the number of authorized shares of common stock will allow the Company to comply with its requirements under the Securities Purchase Agreement while maintaining the ability to issue shares of common stock in other strategically-important business opportunities. See the section in this Proxy Statement entitled “Proposal 2: Issuance Proposal” for more information on the Securities Purchase Agreement and the Notes.

Potential Effects of Approving the Authorized Shares Amendment

The proposed increase in the number of authorized shares of common stock will not have any immediate effect on the rights of our existing stockholders. However, the Board will have the authority to issue the additional shares of common stock without requiring future stockholder approval of such issuances, except as may be required by applicable law or rules of any stock exchange on which our securities may be listed, including the NYSE American. The issuance of additional shares of common stock may decrease the relative percentage of equity ownership of our existing stockholders, thereby diluting the voting power of their common stock. The perception that there might be additional dilution to our existing stockholders may put pressure on our stock price.

6

While the issuance of additional shares of common stock may be deemed to have potential anti-takeover effects, including by delaying or preventing a change in control of the Company through subsequent issuances of these shares and the other reasons set forth above, which, among other things, could include issuances in one or more transactions that would make a change in control of the Company more difficult, and therefore, less likely, this proposal to increase the authorized shares of common stock is not prompted by any specific effort of which we are aware to accumulate shares of our common stock or obtain control of the Company. A takeover may be beneficial to independent stockholders because, among other reasons, a potential suitor may offer such stockholders a premium for their shares of common stock as compared to the then-existing market price. Although the issuance of additional shares of common stock could, under certain circumstances, have an anti-takeover effect, this proposal to adopt the Authorized Shares Amendment is not in response to any effort to which the Company is aware to accumulate common stock or obtain control of the Company.

The additional authorized shares of common stock would have the same rights and privileges as the shares of common stock currently outstanding. Stockholders do not have preemptive rights with respect to our common stock. Therefore, should the Board determine to issue additional shares of common stock, existing stockholders would not have any preferential rights to purchase such shares in order to maintain their proportionate ownership thereof.We can provide no assurance that we will be successful in amending the Second Amended and Restated Certificate of Incorporation to increase the number of shares of common stock that are available for issuance, or that the Authorized Shares Amendment will not have an adverse effect on our stock price.

Potential Effects of Not Approving the Authorized Share Increase Proposal

If the Company’s shareholders do not approve the Authorized Share Increase Proposal, then the Company will not be able to increase the total number of authorized shares of common stock from 200,000,000 to 600,000,000 which, therefore, could prevent the Company from continuing the pursuit of effective strategies to access capital in the public and private markets.

Required Vote

Approval of the Authorized Share Increase Proposal requires the affirmative vote of a majority of votes cast (excluding abstentions and broker non-votes) on this proposal. Abstentions and broker non-votes will have no effect on the outcome of this proposal.

THE BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE “FOR”

THE AUTHORIZED SHARE INCREASE PROPOSAL.

THE AUTHORIZED SHARE INCREASE PROPOSAL.

7

PROPOSAL 2: ISSUANCE PROPOSAL.

Description of Securities Purchase Agreement

On December 4, 2024, we entered into the Securities Purchase Agreement with the “Investor. Under the Securities Purchase Agreement, the Company (i) agreed to issue the Notes, which are convertible into shares of common stock. On December 4, 2024, we issued the Initial Tranche Note to the Investor at the Initial Closing.

Pursuant to the Securities Purchase Agreement, the Company has agreed to issue a second tranche Note in an aggregate original principal amount of $1,500,000, following the satisfaction or waiver of certain conditions, including the Company having an effective registration statement for the resale of the shares of common stock issuable pursuant to the Notes, including upon conversion thereof and the Company having satisfied its obligations under the previously disclosed Settlement Agreement and Stipulation entered into with Sunpeak Holdings Corporation (“Sunpeak”) that became effective on November 6, 2024 and that relates to the settlement of outstanding claims owed to Sunpeak.

Any additional Notes will be in aggregate principal amounts agreed to by the Company and the Investor; provided, however, that no additional Note will be in an amount in excess of $4,000,000, unless otherwise mutually agreed to by the Company and the Investor. Further, no additional Notes will be issued at any time when the aggregate principal balance outstanding on all previously issued Notes is greater than $2,000,000. It is also a condition to closing on any additional Notes that during the twenty (20) trading days immediately preceding the most recent additional closing, a minimum of $500,000 in shares of common stock has been traded and the daily VWAP (as defined below) of the common stock is greater than the Conversion Price (as described below). “VWAP” is defined as the daily volume weighted average price of the Common Stock for a trading day on NYSE American (or such other market on which the Company’s Common Stock is listed) during regular trading hours as reported by Bloomberg L.P. Each Note will mature twelve (12) months after the issuance date of such additional Note.

The number of shares of common stock issuable upon conversion of any Note will be determined by dividing (x) the portion of the principal, interest, or other amounts outstanding under such Note to be converted (the “Conversion Amount”) by (y) the Conversion Price. The Conversion Price of the Note issued in the Initial Tranche is initially $0.3660 per share (the “Fixed Price”). Beginning on the three (3) month anniversary of the issuance date of each Note, and on the same day of each third month thereafter (each, a “Fixed Price Reset Date”), the Conversion Price will be reduced to the lower of (i) the then-effective Conversion Price or (ii) 90% of the lowest daily VWAP during the ten (10) consecutive trading days immediately prior to such Fixed Price Reset Date (the “Variable Price”), provided that the Conversion Price cannot be lower than the Floor Price (as defined in each Note) then in effect. Additionally, on any trading day on which the aggregate trading value of the shares of common stock (as reported on Bloomberg) is equal to or greater than $250,000 between 4:30 a.m. and 11:00 a.m. eastern time, the Conversion Price on such trading day (and only for such trading day) will be reduced to the lowest of (i) the Variable Price, (ii) the lowest price traded on such trading day until 11:00 a.m. eastern time, subject to the Floor Price then in effect or (iii) the then-effective Conversion Price. Upon the occurrence of an Event of Default (as defined in the Notes), with respect to any Event of Default, the Event of Default Conversion Price (as defined in the Notes) will be the lower of (i) the then effective Conversion Price or (ii) 85% of the lowest daily VWAP during the ten (10) consecutive trading days immediately prior to the date that the Investor delivers a conversion notice anytime after the occurrence of an Event of Default or an Event of Default Redemption Notice (as defined in the Notes), as applicable, subject to the Floor Price.

The initial Floor Price for the Notes is $0.0732 per share. However, beginning on the six (6) month anniversary of the Note’s issuance, and on the same day of every six (6) months thereafter (each, a “Floor Price Reset Date”), the Floor Price will be reduced to 20% of the average VWAP during the five (5) trading days immediately prior to such Floor Price Reset Date. Additionally, the Company may reduce the Floor Price to any amount set forth in a written notice to the Note holder, provided that any such reduction will be irrevocable and will not be subject to increase thereafter.

Interest on the outstanding principal balance of each Note will accrue at an annual rate equal to 4.0% (the “Interest Rate”) and interest may be paid in cash or shares of common stock. Each Note will contain customary events of default and the Interest Rate will increase to an annual rate of 18.0% upon the occurrence of an Event of Default.

8

As of December 23, 2024, the maximum number of shares of common stock issuable upon conversion of all the Notes issued or issuable pursuant to the Securities Purchase Agreement is 511,772,464 shares. However, such maximum number of shares may increase or decrease due to, including but not limited to, (i) changes in the amount of principal, interest, or other amounts outstanding under the Notes; (ii) a reduction of the Conversion Price on a Fixed Price Reset Date; (iii) a reduction of the Conversion Price on a trading day on which the aggregate trading value of the shares of common stock (as reported by Bloomberg) is equal to or greater than $250,000; (iv) a reduction of the Conversion Price as a result of an Event of Default; (v) a reduction of the Conversion Price as a result of a Dilutive Issuance (as defined below); or (vi) a reduction of the Floor Price on a Floor Price Reset Date. Furthermore, in no case will the Company issue shares of common stock in excess of the then-authorized number of shares of common stock that the Company is authorized to issue pursuant to its Certificate of Incorporation. In this regard, the Securities Purchase Agreement only requires that the Company have authorized and reserved a sufficient number of shares of common stock that would be issuable upon the conversion of any Notes then outstanding. If necessary, the Company will seek separate stockholder approval of an additional increase to the number of authorized shares of common stock that the Company may issue prior to closing on additional Notes that would be convertible into a number of shares of common stock in excess of the amount of shares that the Company is then authorized to issue.

If, any time after the issuance date of a Note, and from time to time thereafter, an Amortization Event (as defined below) occurs, then the Company will be required to make monthly payments beginning on the seventh (7th) trading day after the Amortization Event Date (as defined in the Notes) and continuing on the same day of each successive calendar month until the entire outstanding principal amount of any outstanding Notes is repaid. Each such monthly payment will be in an amount equal to the sum of (i) one sixth of the aggregate principal amount outstanding for all Notes (the “Amortization Principal Amount”), plus (ii) 20% of such Amortization Principal Amount, and (iii) accrued and unpaid interest as of each payment date. An “Amortization Event” is defined in the Note as (i) the daily VWAP being less than the Floor Price then in effect for three (3) trading days during a period of five (5) consecutive trading days, (ii) the Company’s failure to obtain stockholder approval within seventy-five (75) days after the date of the Note issued in the Initial Tranche, or (iii) the Company being in material breach of the Registration Rights Agreement (described below), and such breach remains uncured for a period of twenty (20) trading days, or the occurrence of certain events set forth in the Registration Rights Agreement. The obligation of the Company to make monthly payments related to an Amortization Event will cease upon cure of the Amortization Event, pursuant to the terms of the Notes.

A Note holder will not have the right to convert any portion of a Note (including the Note issued in the Initial Tranche), to the extent that, after giving effect to such conversion, the holder (together with certain of its affiliates and other related parties) would beneficially own in excess of 4.99% of the shares of common stock outstanding immediately after giving effect to such conversion (the “Beneficial Ownership Limitation”). However, a Note holder, upon notice to the Company, may increase or decrease the Beneficial Ownership Limitation, provided that the Beneficial Ownership Limitation in no event exceeds 9.99% of the shares of common stock outstanding immediately after giving effect to such conversion. Any increase in the Beneficial Ownership Limitation will not be effective until the sixty-first (61st) day after such notice is delivered to the Company.

At any time any Notes remain outstanding, the Company is prohibited from effecting or entering into an agreement to effect any Subsequent Placement (as defined in the Securities Purchase Agreement) involving a Variable Rate Transaction (as defined below) without the written consent of the Investor in its sole discretion. “Variable Rate Transaction” means a transaction in which the Company or any subsidiary of the Company (i) issues or sells any Convertible Securities (as defined in the Securities Purchase Agreement) either (A) at a conversion, exercise or exchange rate or other price that is based upon and/or varies with the trading prices of or quotations for the shares of common stock at any time after the initial issuance of such Convertible Securities, or (B) with a conversion, exercise or exchange price that is subject to being reset at some future date after the initial issuance of such Convertible Securities or upon the occurrence of specified or contingent events directly or indirectly related to the business of the Company or the market for the common stock, other than pursuant to a customary “weighted average” anti-dilution provision or (ii) enters into any agreement (including, without limitation, an equity line of credit or an “at-the-market” offering) whereby the Company or any subsidiary of the Company may sell securities at a future determined price (other than standard and customary “preemptive” or “participation” rights). The Investor is entitled to obtain injunctive relief against the Company and its subsidiaries to preclude any such issuances, which remedy shall be in addition to any right to collect damages. The restrictions contemplated in this paragraph shall not apply to any issuance of securities pursuant to any equity lines of credit or similar arrangement or transactions between the Company and the Investor.

9

Further, at any time any Notes remain outstanding, the Company is prohibited from effecting or entering into an agreement to effect an issuance or sale of shares of common stock (other than in connection with the Securities Purchase Agreement or a standby equity purchase agreement that may be entered into by and between the Company and the Investor), or Convertible Securities, for a consideration per share less than a price equal to the Fixed Price in effect immediately prior to such issue or sale (a “Dilutive Issuance”), if the effect of such Dilutive Issuance is to cause the Company to be required to issue, upon conversion of any Notes, any shares of common stock in excess of the number of shares of common stock which the Company may issue upon conversion of the Notes without breaching the Company’s obligations under the rules or regulations of the NYSE American LLC.

Pursuant to the terms of the Securities Purchase Agreement, the Company is required to hold a meeting of stockholders of the Company (the “Stockholder Meeting”), no later than seventy-five (75) calendar days after the closing of the Initial Tranche (the “Stockholder Meeting Deadline”), seeking approval of the issuance of all of the shares of common stock that may be issuable pursuant to the Notes in compliance with the rules and regulations of the NYSE American LLC. If, despite the Company’s reasonable best efforts, the Stockholder Approval is not obtained by the Stockholder Meeting Deadline, the Company will adjourn and reconvene the Stockholder Meeting at least as often as every thirty (30) calendar days thereafter until such Stockholder Approval is obtained, but in no event later than the one hundred and thirty-fifth (135th) calendar day after the closing date of the Initial Tranche.

The Securities Purchase Agreement also limits the total cumulative number of shares of Common Stock issued to the Investor under the Notes, the Securities Purchase Agreement, and any other transaction documents to 19.99% of the number of shares of Company common stock issued and outstanding (the “Exchange Cap”) pursuant to the requirements of Section 713 of the NYSE American LLC Company Guide or other applicable rules of the principal market on which the Company’s securities are listed, except that such limitation will not apply following the Company’s receipt of Stockholder Approval. The Exchange Cap is calculated based on the number of shares of Company common stock issued and outstanding as of the date of the Securities Purchase Agreement, which number will be reduced, on a share-for-share basis, by the number of shares of Company common stock issued or issuable pursuant to any transaction or series of transactions that may be aggregated with the transactions contemplated by the Securities Purchase Agreement under the applicable rules of the NYSE American LLC.

In connection with the closing of the Initial Tranche, the parties entered into a registration rights agreement (the “Registration Rights Agreement”), pursuant to which the Company agreed to file with the SEC an initial registration statement within 30 days of such closing to register the resale of all of the shares of common stock issuable pursuant to the Notes. The Company is obligated to use its best efforts to have the registration statement declared effective by the SEC as soon as practicable, but in no event later than the 60th calendar day following the closing date (the “Effectiveness Deadline”). However, in the event the Company is notified by SEC that the registration statement will not be reviewed or is no longer subject to further review and comments, the Effectiveness Deadline will be accelerated to the fifth business day following the date on which the Company is so notified if such date precedes the initial Effectiveness Deadline. In the event the registration statement is subject to a full SEC review, or the Company is required to update the financial statements therein, which causes the registration statement not to be declared effective by the Effectiveness Deadline, the Effectiveness Deadline will automatically be deemed to be extended for so long as necessary, provided that the Company is using its best efforts to promptly respond to and satisfy the requests of the SEC. During any such period, the Company will not be in default of satisfying the Effectiveness Deadline.

The Securities Purchase Agreement, Notes, and Registration Rights Agreement contain customary representations, warranties, agreements and conditions to completing future sale transactions, indemnification rights and obligations of the parties. Among other things, the Investor represented to the Company, that it is an “accredited investor” (as such term is defined in Rule 501(a) of Regulation D under the Securities Act of 1933, as amended (the “Securities Act”)). The Company offered and will issue the Notes, and the shares of common stock issuable pursuant to the Notes, in reliance upon the exemptions from registration contained in Section 4(a)(2) of the Securities Act and Regulation D promulgated thereunder.

Reasons for the proposal

Our common stock is listed on the NYSE American LLC and, as such, we are subject to the exchange’s listing rules. We are seeking stockholder approval of the Issuance Proposal in order to comply with the NYSE American LLC Company Guide Section 713(a)(ii).

10

If the Investor wishes to convert the full amount of the Notes issued and issuable pursuant to the Securities Purchase Agreement, the shares of common stock issued upon conversion would be more than 20% of our currently outstanding shares of common stock. The NYSE American LLC Company Guide Section 713(a)(ii) requires that we obtain stockholder approval of the issuance of common stock and/or securities convertible into, or exercisable for, common stock in excess of 20% of our current issued and outstanding shares of common stock.

Potential Consequences if This Proposal is Not Approved

The failure of our stockholders to approve this proposal will mean that: (i) we cannot permit the full conversion of the Notes, and (ii) we may incur substantial additional costs and expenses. In addition, failure of our stockholders to approve this proposal within seventy-five (75) days after the Initial Closing would result in an Amortization Event that would require the Company to make monthly payments, beginning on the seventh (7th) trading day after the date of the Amortization Event, in an amount equal to the sum of (i) the Amortization Principal Amount; (ii) 20% of such Amortization Principal Amount; and (iii) accrued and unpaid interest as of each payment date. The Company would be required to make these payments on the same day of each successive calendar month until the entire outstanding principal amount of any outstanding Notes is repaid. Further, the approval of this proposal is one of the condition precedents for the Investor to purchase additional Notes under the Securities Purchase Agreement.

Required Vote

The affirmative vote of a majority of the shares of common stock present in person or represented by proxy and entitled to vote on the subject matter is required to approve this proposal. Abstentions and broker non-votes will have no effect on the outcome of this proposal.

THE BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE “FOR”

THE ISSUANCE PROPOSAL.

THE ISSUANCE PROPOSAL.

11

PROPOSAL 3: ADJOURNMENT PROPOSAL

The Board believes that, if the number of votes cast in favor of each of the previous proposals is insufficient to approve such proposals, it is in the best interests of the Company and its stockholders to enable the Company to continue to seek to obtain a sufficient number of additional votes to approve such proposals.

The Board is asking stockholders to authorize the holder of any proxy solicited by the Board to vote in favor of adjourning the Special Meeting or any adjournment or postponement thereof. If our stockholders approve this proposal, we could adjourn the Special Meeting, and any adjourned session of the Special Meeting, to use the additional time to solicit additional proxies in favor of each proposal.

Required Vote

Approval of the adjournment of the Special Meeting requires the affirmative vote of a majority of votes cast (excluding abstentions and broker non-votes) on this proposal. Abstentions and broker non-votes will have no effect on the outcome of this proposal.

THE BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE “FOR”

THE ADJOURNMENT PROPOSAL.

THE ADJOURNMENT PROPOSAL.

12

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information known to Volato Group regarding the beneficial ownership of common stock by:

•each person who is the beneficial owner of more than 5% of the outstanding shares of common stock;

•each of Volato Group’s named executive officers and directors; and

•all of Volato Group’s named executive officers and directors as a group.

Beneficial ownership is determined according to the rules of the SEC, which generally provide that a person has beneficial ownership of a security if he, she or it possesses sole or shared voting or investment power over that security, including options and warrants and rights that are currently exercisable or exercisable within 60 days as well as restricted stock units that vest within 60 days.

The beneficial ownership of common stock is based on 45,900,553 shares of common stock issued and outstanding as of December 23, 2024.

| Name of Beneficial Owner | Number of Shares of Common Stock Beneficially Owned |

Percentage of Shares of Outstanding Common Stock |

||||||

| Greater than 5% | ||||||||

Hoop Capital LLC(1)

|

3,446,153 | 7.51 | % | |||||

Argand Group(2)

|

3,446,153 | 7.51 | % | |||||

Directors and Named Executive Officers(3)

|

||||||||

Matthew Liotta(2)

|

5,132,051 | 11.18 | % | |||||

Nicholas Cooper(4)

|

3,558,168 | 7.75 | % | |||||

Keith Rabin(5)

|

— | * | ||||||

Christopher Burger(6)

|

40,863 | * | ||||||

Michael Nichols(7)

|

81,868 | * | ||||||

Fred Colen (8)

|

— | * | ||||||

All directors and named executive officers as a group (6 individuals) |

8,812,950 | 19.20 | % | |||||

_____________

* Less than 1%.

(1)Hoop Capital LLC shares are by Mr. Nicholas Cooper, former Chief Commercial Officer and named executive officer for the fiscal year ended December 31, 2023. Mr. Cooper resigned from the Company as of November 30, 20024. Mr. Cooper is currently a member of our Board of Directors.

(2)Mr. Liotta beneficially owns (i) 3,466,153 shares of common stock held by Argand Group LLC in which Mr. Liotta holds shared voting and dispositive power, (ii) 1,322,118 shares of common stock held by PDK Capital, LLC in which Mr. Liotta has sole voting power and shares dispositive power with his spouse, Jennifer. Liotta, (iii) 526,203 shares of common stock, and (iv) 17,358 restricted stock units that vest within 60 days.

(3)The business address of each of our officers and directors is 1954 Airport Road, Suite 124, Chamblee, Georgia 30341.

(4)Mr. Cooper, our former beneficially owns 3,446,153 shares of common stock held by Hoop Capital LLC in which Mr. Cooper holds shared voting and investment power, and (ii) 92,015 of common stock.

(5)Keith Rabin, our former President and one of our named executive officers for the fiscal year ended December 31, 2023, resigned from his position as of July 19, 2024.

(6)Mr. Burger beneficially owns (i) 32,050 shares of common stock held by Mr. Burger, and (ii) 8,813 shares of common stock underlying options exercisable within 60 days.

13

(7)Mr. Nichols beneficially owns (i) 37,799 shares of common stock held by Mr. Nichols and (ii) 44,068 shares of common underlying options exercisable within 60 days.

(8)Mr. Colen resigned from his position on the Board of Director as of June 4, 2024.

WHERE YOU CAN FIND MORE INFORMATION

We file annual, quarterly and current reports, proxy statements and other information with the SEC. Our SEC filings are available to the public from commercial document retrieval services and at the website maintained by the SEC at http://www.sec.gov. You may also access any document we file with the SEC on our website at https://flyvolato.com/ under the “Investor Relations” menu.

You should rely on the information contained in this document to vote your shares at the Special Meeting. We have not authorized anyone to provide you with information that is different from what is contained in this document. This document is dated [●]. You should not assume that the information contained in this document is accurate as of any date other than that date, and the mailing of this document to stockholders at any time after that date does not create an implication to the contrary. This proxy statement does not constitute a solicitation of a proxy in any jurisdiction where, or to or from any person to whom, it is unlawful to make such proxy solicitations in such jurisdiction.

We will provide without charge upon written or oral request, paper copies of our proxy materials, including our 2023 Annual Report. Requests for such copies should be addressed to:

Volato Group, Inc.

1954 Airport Road, Suite 124

Chamblee, Georgia 30341

844-399-8998

Attention: Secretary

1954 Airport Road, Suite 124

Chamblee, Georgia 30341

844-399-8998

Attention: Secretary

IMPORTANT NOTICE REGARDING DELIVERY OF STOCKHOLDER DOCUMENTS

We have adopted a procedure called “householding,” which the SEC has approved. Under this procedure, we deliver a single copy of the Notice of Internet Availability and, if applicable, our proxy materials to multiple stockholders who share the same address, unless we have received contrary instructions from one or more of such stockholders. This procedure reduces our printing costs, mailing costs and fees. Stockholders who participate in householding will continue to be able to access and receive separate proxy cards. Upon written or oral request, we will deliver promptly a separate copy of the Notice of Internet Availability and, if applicable, our proxy materials to any stockholder at a shared address to which we deliver a single copy of any of these materials. This request may be submitted by contacting Volato Group, Inc. at the address listed above. We will deliver those documents to such stockholder promptly upon receiving the request.

OTHER BUSINESS

The Board knows of no business to be brought before the Special Meeting which is not referred to in the accompanying Notice of Special Meeting. Should any such matters be presented, the persons named in the proxy shall have the authority to take such action in regard to such matters as in their judgment seems advisable. If you hold shares through a broker, bank or other nominee as described above, they will not be able to vote your shares on any other business that comes before the Special Meeting unless they receive instructions from you with respect to such matter.

14

Appendix A

FORM OF AMENDMENT TO SECOND AMENDED AND RESTATED CERTIFICATE OF INCORPORATION

Volato Group, Inc., a corporation organized and existing under and by virtue of the General Corporation Law of the State of Delaware (the “Corporation”), does hereby certify as follows:

FIRST: That, at a meeting of the Board of Directors of the Corporation, resolutions were duly adopted recommending and declaring advisable that the Second Amended and Restated Certificate of Incorporation of the Corporation be amended and that such amendments be submitted to the stockholders of the Corporation for their consideration, as follows:

RESOLVED, that Section 4.1 of Article IV of the Second Amended and Restated Certificate

of Incorporation of the Corporation, as amended and/or restated to date, be amended and restated in its entirety to read as follows:

“Section 4.1 Authorized Capital Stock: That, effective as of 5 p.m. Eastern Time on the date this Certificate of Amendment of Second Amended and Restated Certificate of Incorporation is filed with the Office of the Secretary of State of the State of Delaware (the “Effective Time”).

The total number of shares of all classes of capital stock, each with a par value of $0.0001 per share, which the Corporation is authorized to issue is 601,000,000, consisting of two classes as follows:

1)600,000,000 shares of Class A common stock (the “Class A Common Stock”)

2)1,000,000 shares of preferred stock (the “preferred stock’)

The number of authorized shares of Class A Common Stock or Preferred Stock may be increased or decreased (but not below the number of shares of such class or series thereof then outstanding) by the affirmative vote of the holders of capital stock representing a majority of the voting power of all the then-outstanding shares of capital stock of the Corporation entitled to vote thereon, irrespective of the provisions of Section 242(b)(2) of the DGCL, and no vote of the holders of Class A Common Stock or Preferred Stock voting separately as a class shall be required therefor, unless a vote of any such holder is required pursuant to this certificate of incorporation (as heretofore amended, this “Certificate of Incorporation”) or any Preferred Stock Designation (as defined below) designating a series of Preferred Stock.

SECOND: That, at a special meeting of stockholders of the Corporation, the aforesaid amendment was duly adopted by the stockholders of the Corporation.

THIRD: That, the aforesaid amendment was duly adopted in accordance with the applicable provisions of Section 242 of the General Corporation Law of the State of Delaware.

***

IN WITNESS WHEREOF, the Corporation has caused this Certificate of Amendment to be signed by its Chief Executive Officer on this [•] day of [•], 2024.

VOLATO GROUP, INC.

By:

Matthew Liotta

Chief Executive Officer

15

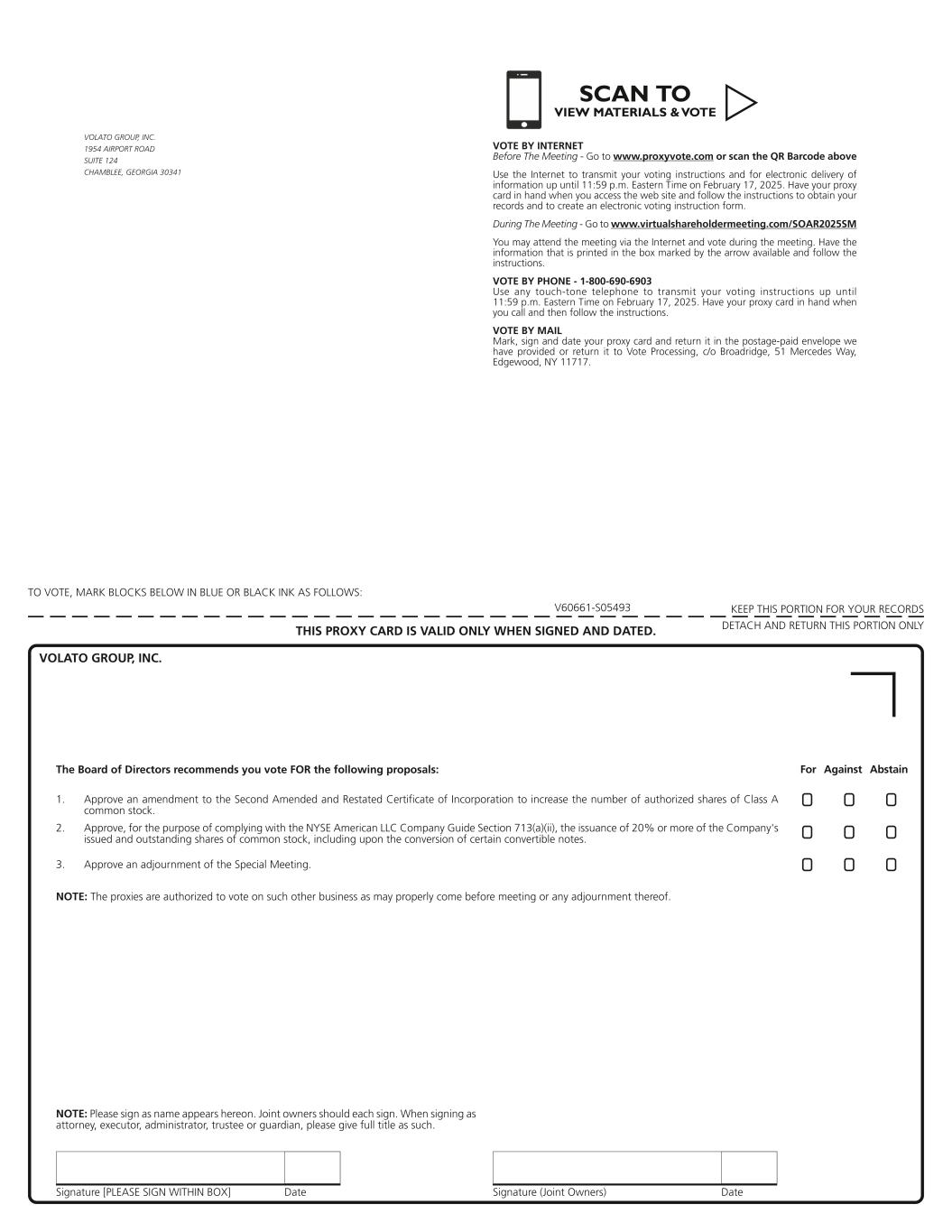

Signature [PLEASE SIGN WITHIN BOX] Date Signature (Joint Owners) Date TO VOTE, MARK BLOCKS BELOW IN BLUE OR BLACK INK AS FOLLOWS: KEEP THIS PORTION FOR YOUR RECORDS DETACH AND RETURN THIS PORTION ONLYTHIS PROXY CARD IS VALID ONLY WHEN SIGNED AND DATED. V60661-S05493 For Against Abstain ! !! ! !! ! !! VOLATO GROUP, INC. 1954 AIRPORT ROAD SUITE 124 CHAMBLEE, GEORGIA 30341 VOLATO GROUP, INC. NOTE: Please sign as name appears hereon. Joint owners should each sign. When signing as attorney, executor, administrator, trustee or guardian, please give full title as such. VOTE BY INTERNET Before The Meeting - Go to www.proxyvote.com or scan the QR Barcode above Use the Internet to transmit your voting instructions and for electronic delivery of information up until 11:59 p.m. Eastern Time on February 17, 2025. Have your proxy card in hand when you access the web site and follow the instructions to obtain your records and to create an electronic voting instruction form. During The Meeting - Go to www.virtualshareholdermeeting.com/SOAR2025SM You may attend the meeting via the Internet and vote during the meeting. Have the information that is printed in the box marked by the arrow available and follow the instructions. VOTE BY PHONE - 1-800-690-6903 Use any touch-tone telephone to transmit your voting instructions up until 11:59 p.m. Eastern Time on February 17, 2025. Have your proxy card in hand when you call and then follow the instructions. VOTE BY MAIL Mark, sign and date your proxy card and return it in the postage-paid envelope we have provided or return it to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717. 2. Approve, for the purpose of complying with the NYSE American LLC Company Guide Section 713(a)(ii), the issuance of 20% or more of the Company's issued and outstanding shares of common stock, including upon the conversion of certain convertible notes. 1. Approve an amendment to the Second Amended and Restated Certificate of Incorporation to increase the number of authorized shares of Class A common stock. 3. Approve an adjournment of the Special Meeting. NOTE: The proxies are authorized to vote on such other business as may properly come before meeting or any adjournment thereof. The Board of Directors recommends you vote FOR the following proposals: SCAN TO VIEW MATERIALS & VOTEw

V60662-S05493 Important Notice Regarding the Availability of Proxy Materials for the Special Meeting: The Proxy Statement is available at www.proxyvote.com. PROXY THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS OF VOLATO GROUP, INC. The stockholder hereby appoints Matthew Liotta and Mark Heinen, or either of them, as proxies, each with the power to appoint his substitute, and hereby authorizes them to represent and to vote, as designated on the reverse side of this ballot, all of the shares of Class A Common Stock of Volato Group, Inc. that the stockholder is entitled to vote and, in his discretion, to vote upon such other business as may properly come before the Special Meeting of Stockholders to be held virtually at www.virtualshareholdermeeting.com/SOAR2025SM at 9:00 a.m., Eastern Time, on Tuesday, February 18, 2025 or any adjournment or postponement thereof, with all powers which the stockholder would possess if present at the Special Meeting. THIS PROXY CARD, WHEN PROPERLY EXECUTED, WILL BE VOTED IN THE MANNER DIRECTED HEREIN BY THE UNDERSIGNED. IF NO DIRECTION IS MADE BUT THE CARD IS SIGNED, THIS PROXY CARD WILL BE VOTED FOR PROPOSAL 1, FOR PROPOSAL 2, AND FOR PROPOSAL 3 AS WELL AS IN THE DISCRETION OF THE PROXIES WITH RESPECT TO SUCH OTHER BUSINESS AS MAY PROPERLY COME BEFORE THE MEETING. (Continued and to be marked, dated and signed, on the other side)