EXHIBIT 99.2

Published on August 2, 2023

Exhibit 99.2

ENJOY FLYING MORE INVESTOR PRESENTATION AUGUST 2023

Disclaimer About this Presentation This investor presentation (the

“Presentation”) relates to a proposed business combination (the “Business Combination”) between PROOF Acquisition Corp I (“PACI”) and Volato, Inc. (“Volato”). The information contained herein does not purport to be all inclusive and none of

PACI, Volato, or their respective affiliates or representatives makes any representation or warranty, express or implied, as to the accuracy, completeness, or reliability of the information contained in this Presentation. This Presentation

does not constitute (i) a solicitation of a proxy, consent, or authorization with respect to any securities or in respect to the Business Combination or (ii) an offer to sell, a solicitation of an offer to buy, or a recommendation to purchase

any security of PACI, Volato, or any of their respective affiliates. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended, or an exemption

therefrom. Forward Looking Statements Some statements in this Presentation may be considered “forward-looking statements” for purposes of the Federal securities laws. Forward-looking statements generally relate to management’s current

expectations, hopes, beliefs, intentions, strategies, or projections about future events or PACI or Volato’s future financial or operating performance. For example, statements regarding anticipated growth in the industry in which Volato

operates and anticipated growth in the demand for Volato’s services, projections of Volato’s future financial results or other metrics, and ownership of the combined company following the closing of the Business Combination are

forward-looking statements. The words “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intends,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” “pro forma,” project,” “should,” “would,” and similar expressions

may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. Forward-looking statements are subject to risks, uncertainties, and other factors which could cause actual results

to differ materially from those expressed or implied by the forward-looking statements. You should not rely on these forward-looking statements as predictions of future events. Forward-looking statements are based upon estimates and

assumptions that, while considered reasonable by management of PACI and Volato, are inherently uncertain. Factors that may cause actual result to differ from current expectations include, but are not limited to: the occurrence of any event,

change, or other circumstances give rise to the termination of definitive agreements with respect to the Business Combination; the inability to complete the Business Combination due to the failure to obtain approval of the stockholders of

PACI or to satisfy the other conditions of closing; changes to the proposed structure of the Business Combination that may be required or appropriate as a result of applicable laws or regulations or as a condition to obtaining regulatory

approval of the Business Combination; the ability to meet stock exchange listing standards following consummation of the Business Combination; the risk that the Business Combination disrupts current plans and operations of Volato as a result

of the announcement and consummation of the Business Combination; the ability to recognize the anticipated benefits of the Business Combination, which may be affected by, among other things, competition, the ability of the combined company to

grow and manage growth profitably, maintain relationships with customers and suppliers and retain its management and key employees; the costs related to the Business Combination; changes to existing applicable laws or regulations; the

possibility that Volato or the combined company may be adversely affected by economic, business, or competitive factors; Volato’s estimates of expenses and profitability; the evolution of the markets in which Volato competes and Volato’s

ability to enter new markets effectively; the ability of Volato to implement its strategic initiatives and continue to innovate its existing services; the impact of government and other responses to public health crisis such as pandemics on

Volato’s business; and other risks and uncertainties set forth in the section entitled “Risk Factors” and Cautionary Note Regarding Forward-Looking Statements in PACI’s final prospectus dated November 30, 2021 relating to its initial public

offering (the “Prospectus”) and those risk factors relating to Volato’s business identified in the appendix to this Presentation. This Presentation includes financial information, which is subject to further review and adjustment, and may

differ from the financial information in the proxy statement/prospectus of PACI to be delivered to PACI’s stockholders, and the related registration statement on Form S-4 to be filed by PACI (the “Form S-4”) with the Securities and Exchange

Commission (“SEC”). As a result, the historic financial information contained in this Presentation and any estimates or projections relying on this financial information may change and constitutes forward-looking information. PACI and Volato

caution that the foregoing list of factors is not exclusive. Nothing in this Presentation should be regarded as a representation by any person that the forward-looking statements set forth herein will be achieved or that any of the

contemplated results of the forward-looking statements will be achieved. You should not place undue reliance on forward-looking statements, which speak only as of the date they are made. Neither PACI nor Volato undertakes any duty to update

these forward-looking statements. Financial Information; Non-GAAP Financial Measures The financial information and data contained in this Presentation is unaudited and does not conform to Regulation S-X. This information may not be included

in, may be adjusted in, or may be presented differently in the Form S-4 related to the Business Combination and the proxy statement/prospectus contained therein. The Presentation also includes certain financial measures not presented in

accordance with generally accepted accounting principles (“GAAP”) and other metrics derived therefrom. The non-GAAP financial measures are not measures of financial performance in accordance with GAAP and may exclude items that are

significant in understanding and assessing Volato’s financial results. Therefore, these measures should not be considered in isolation or as an alternative to net income, cash flows from operations, or other measures of profitability,

liquidity, or performance under GAAP. Volato’s presentation of these measures may not be comparable to similarly titled measures used by other companies. PACI and Volato believe that the use of these non-GAAP financial measures are subject to

inherent limitations as they reflect the exercise of business judgments by management about which items of income and expense are included or excluded in determining these non-GAAP financial measures. 2

Disclaimer (Cont’d) 3 This Presentation also includes certain projections of

non-GAAP financial measures. Due to the high variability and difficulty in making accurate forecasts and projections of financial information, together with the fact that some information may be excluded because it is not ascertainable or

accessible, PACI and Volato are unable to quantify certain amounts that would be required to be included in the most directly comparable GAAP financial measures without unreasonable effort. Consequently, no disclosure of estimated comparable

GAAP measures is included and no reconciliation of the forward-looking non-GAAP financial measures is included. Use of Projections This Presentation contains financial forecasts for Volato with respect to certain financial results of

Volato. Neither PACI’s nor Volato’s independent auditors have audited, studied, reviewed, compiled, or performed any procedures with respect to the projections for the purpose of their inclusion in this Presentation. Accordingly, they did not

express an opinion or provide any other form of assurance with respect thereto for the purpose of this Presentation. These projections are forward-looking statements and should not be relied upon as being necessarily indicative of future

results. In this Presentation, certain of the above-mentioned projected information has been provided for purposes of providing comparisons with historical data. The assumptions and estimates underlying the prospective financial information

are inherently uncertain and are subject to a wide variety of significant business, economic, and competitive risks and uncertainties that could cause actual results to differ materially from those contained in the prospective financial

information. Accordingly, there can be no assurance that the prospective results are indicative of the future performance of Volato or the actual results will not differ materially from those presented in the prospective financial

information. Inclusion of the prospective financial information in this Presentation should not be regarded as a representation by any person that the results contained in the prospective financial information will be achieved. Industry and

Market Data In this Presentation, PACI and Volato rely on and refer to certain information and statistics obtained from third-party sources which they believe to be reliable. Neither PACI nor Volato has independently verified the accuracy or

completeness of any third-party information. Trademarks This Presentation may contain trademarks, service marks, trade names, and copyrights of other companies, which are the property of their respective owners. Solely for convenience, the

trademarks, service marks, trade names, and copyrights referred to in this Presentation may be listed without the trademark, service mark, or copyright symbols, but PACI and Volato will asset the rights of the applicable owners to these

trademarks, service marks, trade names, and copyrights to the fullest extent under applicable law. Additional Information PACI intends to file a Form S-4, which will include a proxy statement/prospectus, that will be both the proxy

statement to be distributed to holders of PACI’s stockholders in connection with its solicitation of proxies for the vote with respect to the Business Combination and other matters as may be described in the Form S-4, as well as the

prospectus relating to the offer and sale of the securities to be issued in the Business Combination. After the Form S-4 is declared effective, PACI will mail a definitive proxy statement/prospectus and other relevant documents to its

stockholders. This Presentation does not contain all the information that should be considered concerning the proposed Business Combination and is not intended to form the basis of any investment decision or any other decision in respect of

the Business Combination. PACI’s stockholders and other interested persons are advised to read, when available, the preliminary proxy statement/prospectus included in the Form S-4 and the amendments thereto and the definitive proxy

statement/prospectus and other filed in connection with the Business Combination, as this material will contain important information about Volato, PACI, and the Business Combination. When available, the proxy statement/prospectus and other

relevant material will be mailed to stockholders of PACI as of the record date to be established for voting on the Business Combination. Stockholders will also be able to obtain copies of the preliminary proxy statement, the definitive proxy

statement, and other documents filed with the SEC, without charge, one available, at the SEC’s website at www.sec.gov, or by directing a request to PACI’s secretary at 11911 Freedom Drive, Suite 1080, Reston, Virginia 20190 or

571-310-4949. Participants in the Solicitation PACI and its directors and executive officers may be deemed participants in the solicitation of proxies from PACI’s stockholders with respect to the proposed Business Combination. A list of the

names of those directors and executive officers and a description of their interests in PACI is contained in the Prospectus, which was filed with the SEC and is available free of charge at the SEC’s website at www.sec.gov. To the extent

holdings of PACI’s securities may have changed since that time, changes have been or will be reflected on States of Change in Ownership on Form 4 filed with the SEC. Additional information regarding the interests of the participants will be

contained in the proxy statement/prospectus for the Business Combination when available. Certain directors and executive officers of Volato may also be deemed participants in the solicitation of proxies from the stockholders of PACI in

connection with the proposed Business Combination. A list of the names of Volato’s directors and executive officers and information regarding their interests in the Business Combination will be included in the proxy statement/prospectus for

the Business Combination when available.

Table of Contents 4 Executive Summary Company Overview Key Investment

Highlights Financials Appendix

Today’s Presenters 5 Matt Liotta Co-Founder & CEO John Backus CEO

EXECUTIVE SUMMARY

Fly Better, Fly Smarter, Fly Volato 7 Volato brings the benefits of whole

aircraft ownership to the fractional customer, providing Volato residual fleet capacity which is filled through a unique suite of products and innovative software.

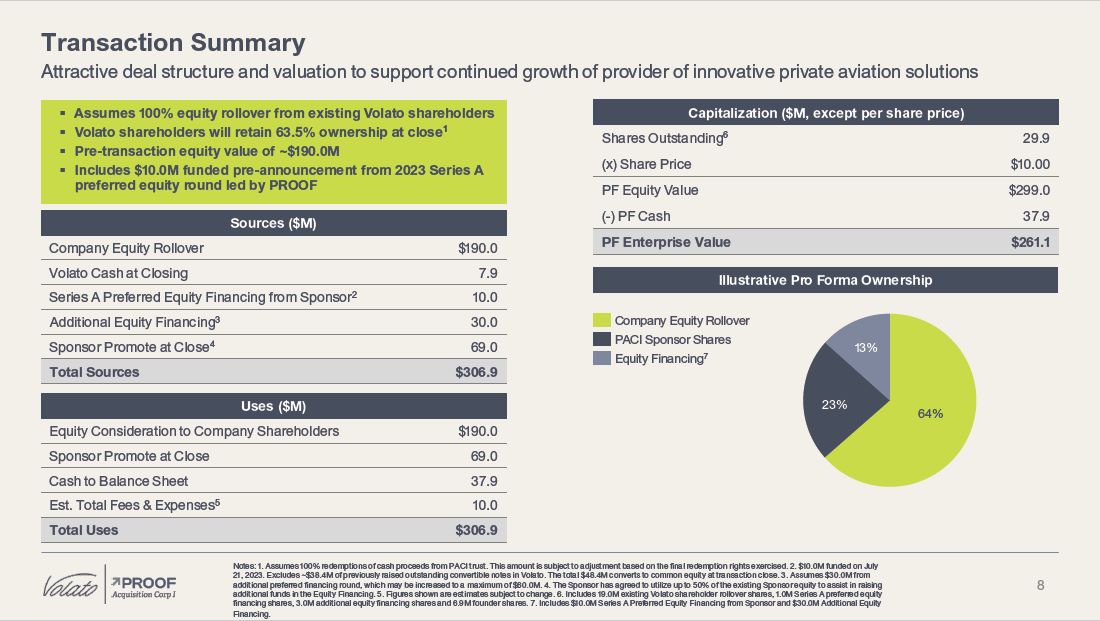

Illustrative Pro Forma Ownership Equity Consideration to Company

Shareholders $190.0 Sponsor Promote at Close 69.0 Cash to Balance Sheet 37.9 Est. Total Fees & Expenses5 10.0 Total Uses $306.9 Uses ($M) Company Equity Rollover $190.0 Volato Cash at Closing 7.9 Series A Preferred Equity

Financing from Sponsor2 10.0 Additional Equity Financing3 30.0 Sponsor Promote at Close4 69.0 Total Sources $306.9 Sources ($M) 64% 23% 13% Company Equity Rollover PACI Sponsor Shares Equity Financing7 8 Notes: 1. Assumes 100%

redemptions of cash proceeds from PACI trust. This amount is subject to adjustment based on the final redemption rights exercised. 2. $10.0M funded on July 21, 2023. Excludes ~$38.4M of previously raised outstanding convertible notes in

Volato. The total $48.4M converts to common equity at transaction close. 3. Assumes $30.0M from additional preferred financing round, which may be increased to a maximum of $60.0M. 4. The Sponsor has agreed to utilize up to 50% of the

existing Sponsor equity to assist in raising additional funds in the Equity Financing. 5. Figures shown are estimates subject to change. 6. Includes 19.0M existing Volato shareholder rollover shares, 1.0M Series A preferred equity financing

shares, 3.0M additional equity financing shares and 6.9M founder shares. 7. Includes $10.0M Series A Preferred Equity Financing from Sponsor and $30.0M Additional Equity Financing. Shares Outstanding6 29.9 (x) Share Price $10.00 PF

Equity Value $299.0 (-) PF Cash 37.9 PF Enterprise Value $261.1 Capitalization ($M, except per share price) Assumes 100% equity rollover from existing Volato shareholders Volato shareholders will retain 63.5% ownership at

close1 Pre-transaction equity value of ~$190.0M Includes $10.0M funded pre-announcement from 2023 Series A preferred equity round led by PROOF Transaction Summary Attractive deal structure and valuation to support continued growth of

provider of innovative private aviation solutions

9 PROOF Acquisition Corp I Experienced team with the ability to provide

strategic advisory strengthened by strong aviation industry knowledge and expertise IPO Date: 12/1/2021 Deadline Date: 12/3/2023 Current Cash Remaining in Trust: $67.7M1 Notes: 1. Estimated Cash in Trust as of July 31, 2023. Proven

Track Record Investing in Late-Stage Companies PROOF.VC’s prior investments include Beyond Meat, Sweetgreen, Roman Health, Carta, Zipline, Epic Games, Carbon Health, Masterclass, EquipmentShare, Varo Money, Arcadia, SmartAsset and Overtime

Sports Ability to Attract and Expand Institutional Following and Ownership PROOF.VC has invested in 80 companies, 27 of which currently have or have exited at a $1B+ market value Well-developed relationships with the largest institutional

players via years of fund raising across venture capital and public company investments Committed to being a Growth & Value Creation Partner Shared vision of not only financing a transaction, but also acting as a trusted partner to

enable further growth & expansion PACI views its ongoing role as an “always-on” resource available to help the company; PROOF.VC does not get involved in current operational strategy, talent or budgets unless invited to do so Backed by

a Team with Deep Aviation Expertise John Backus CEO Coleman Andrews Lead Independent Director Key consultant in turnarounds of Continental Airlines & South African Airways CEO who led successful turnarounds of World Airways &

South African Airways Former executive of Key Airlines and World Airways Katy Arris-Wilson Due Diligence Advisor

COMPANY OVERVIEW

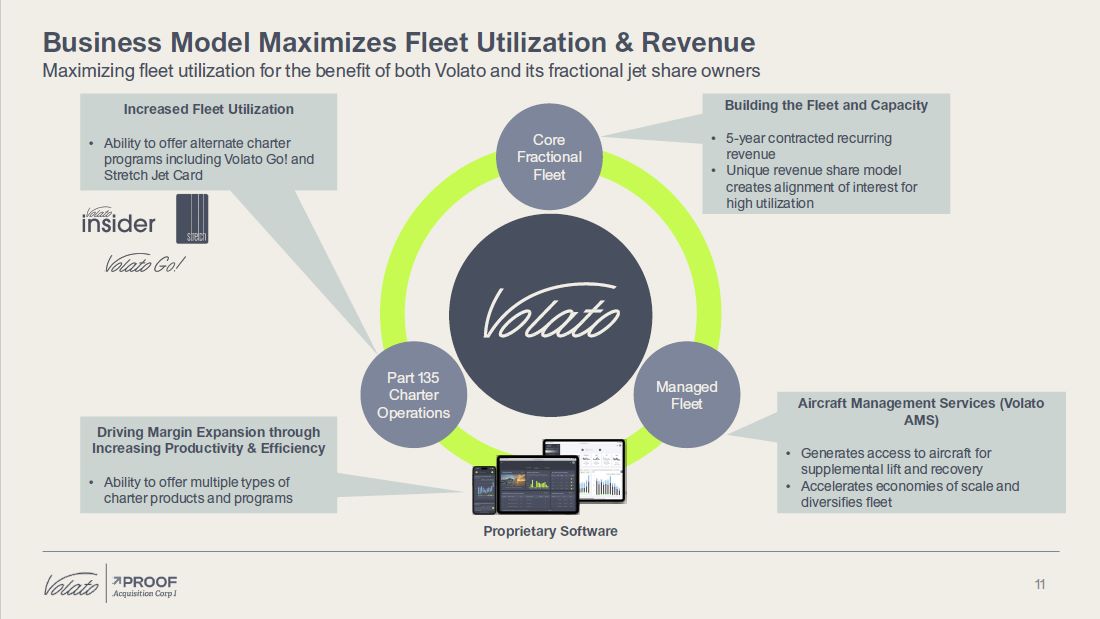

Core Fractional Fleet Part 135 Charter Operations Managed Fleet 11 Building

the Fleet and Capacity 5-year contracted recurring revenue Unique revenue share model creates alignment of interest for high utilization Aircraft Management Services (Volato AMS) Generates access to aircraft for supplemental lift and

recovery Accelerates economies of scale and diversifies fleet Increased Fleet Utilization Ability to offer alternate charter programs including Volato Go! and Stretch Jet Card Proprietary Software Business Model Maximizes Fleet

Utilization & Revenue Maximizing fleet utilization for the benefit of both Volato and its fractional jet share owners Driving Margin Expansion through Increasing Productivity & Efficiency Ability to offer multiple types of charter

products and programs

12 Volato by the Numbers Notes: $96.7M audited 2022 consolidated revenue

under US-GAAP. Includes Pro-forma for partial year of Gulf Coast Aviation, acquired in March 2022. Full fleet, including fractional, managed and leased aircraft under operational control and managed-only fleet. Trailing 6-month Net Promoter

Score as of July 1, 2023. Includes 11 HondaJets and 4 Gulfstream G280s scheduled for delivery in 2024. 27 Aircraft on Firm Order4 $96M 2022 Revenue1 25 Aircraft Currently in Fleet2 88 Net Promoter Score3

KEY INVESTMENT HIGHLIGHTS

Key Investment Highlights 14 Asset Light and Unique Business Model with

Recurring Diversified Revenue Streams 2 Increasing Utilization with Larger, More Efficient Fleet 4 Management Team & Board Members with Decades of Industry Experience 5 Large and Fast-Growing Market with Favorable

Tailwinds 1 Growing Floating Fleet Capacity in a Market with Limited HondaJet Availability 3

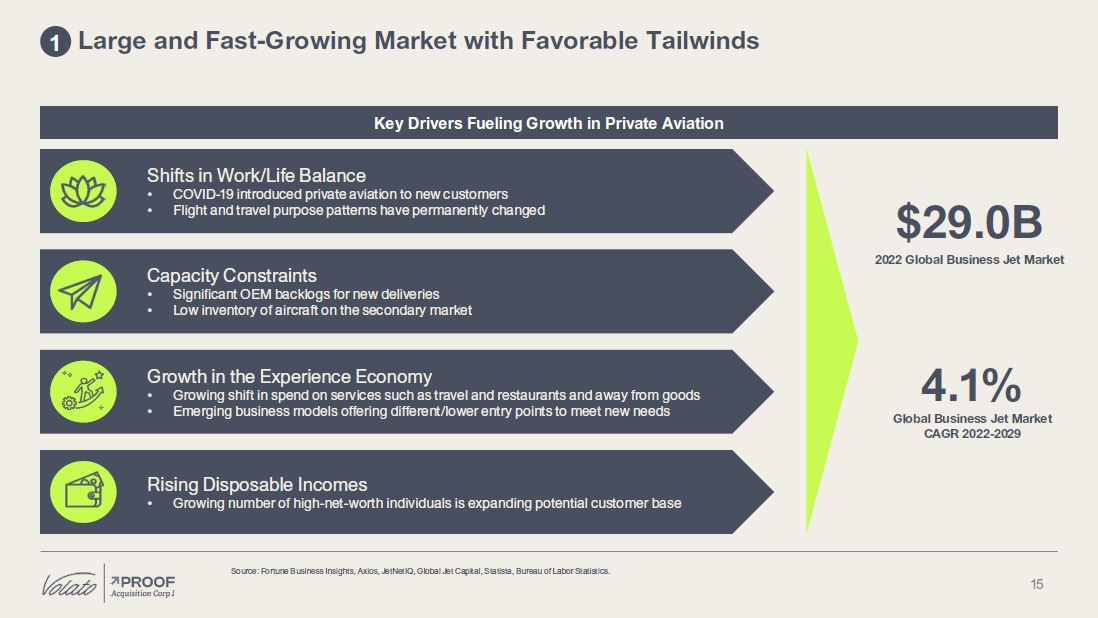

15 Shifts in Work/Life Balance COVID-19 introduced private aviation to new

customers Flight and travel purpose patterns have permanently changed Capacity Constraints Significant OEM backlogs for new deliveries Low inventory of aircraft on the secondary market Growth in the Experience Economy Growing shift in

spend on services such as travel and restaurants and away from goods Emerging business models offering different/lower entry points to meet new needs Large and Fast-Growing Market with Favorable Tailwinds $29.0B 2022 Global Business Jet

Market 4.1% Global Business Jet Market CAGR 2022-2029 1 Key Drivers Fueling Growth in Private Aviation Source: Fortune Business Insights, Axios, JetNetIQ, Global Jet Capital, Statista, Bureau of Labor Statistics. Rising Disposable

Incomes Growing number of high-net-worth individuals is expanding potential customer base

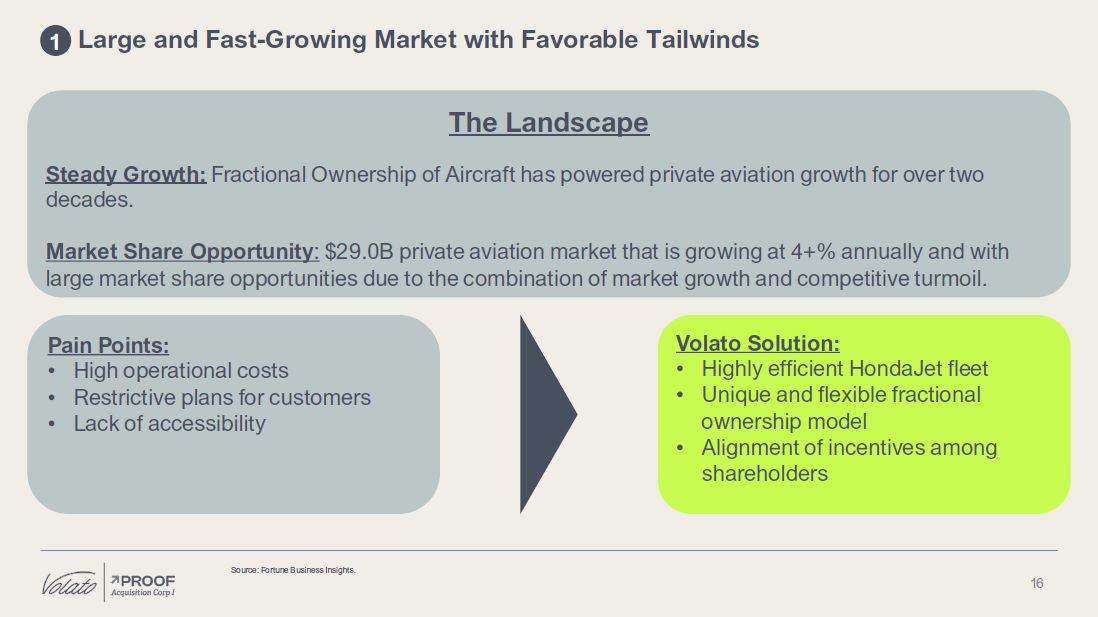

16 Pain Points: High operational costs Restrictive plans for customers Lack

of accessibility Volato Solution: Highly efficient HondaJet fleet Unique and flexible fractional ownership model Alignment of incentives among shareholders The Landscape Steady Growth: Fractional Ownership of Aircraft has powered

private aviation growth for over two decades. Market Share Opportunity: $29.0B private aviation market that is growing at 4+% annually and with large market share opportunities due to the combination of market growth and competitive

turmoil. Source: Fortune Business Insights. Large and Fast-Growing Market with Favorable Tailwinds 1

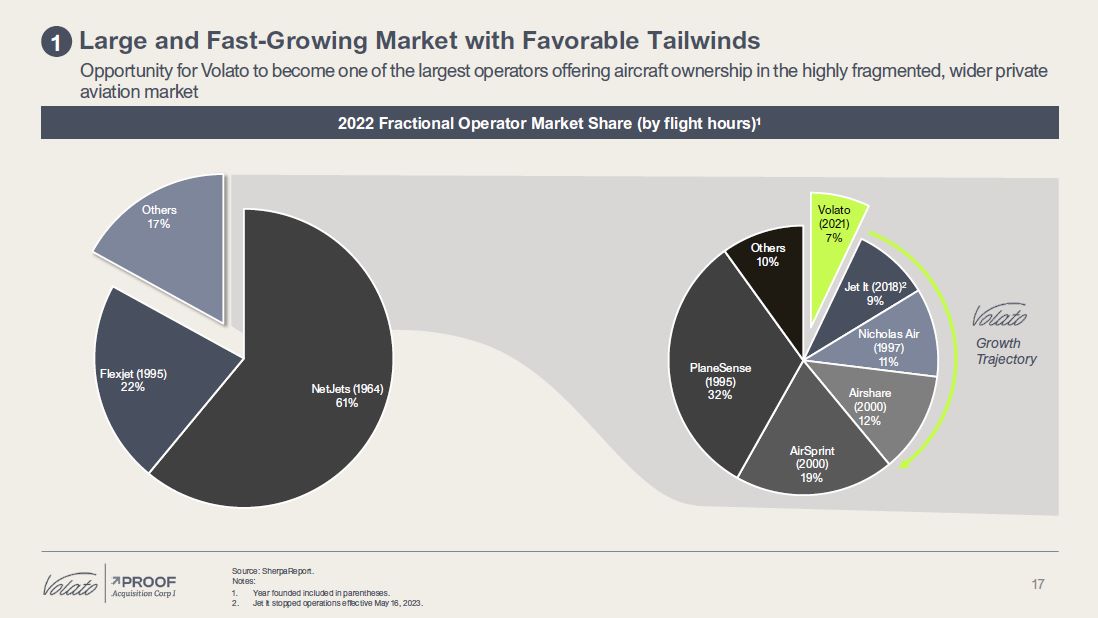

Volato (2021) 7% Nicholas Air (1997) 11% Airshare (2000) 12% AirSprint

(2000) 19% PlaneSense (1995) 32% Others 10% Jet It (2018)2 9% 17 Large and Fast-Growing Market with Favorable Tailwinds 1 Source: SherpaReport. Notes: Year founded included in parentheses. Jet It stopped operations effective May

16, 2023. NetJets (1964) 61% Flexjet (1995) 22% Others 17% 2022 Fractional Operator Market Share (by flight hours)1 Growth Trajectory Opportunity for Volato to become one of the largest operators offering aircraft ownership in the

highly fragmented, wider private aviation market

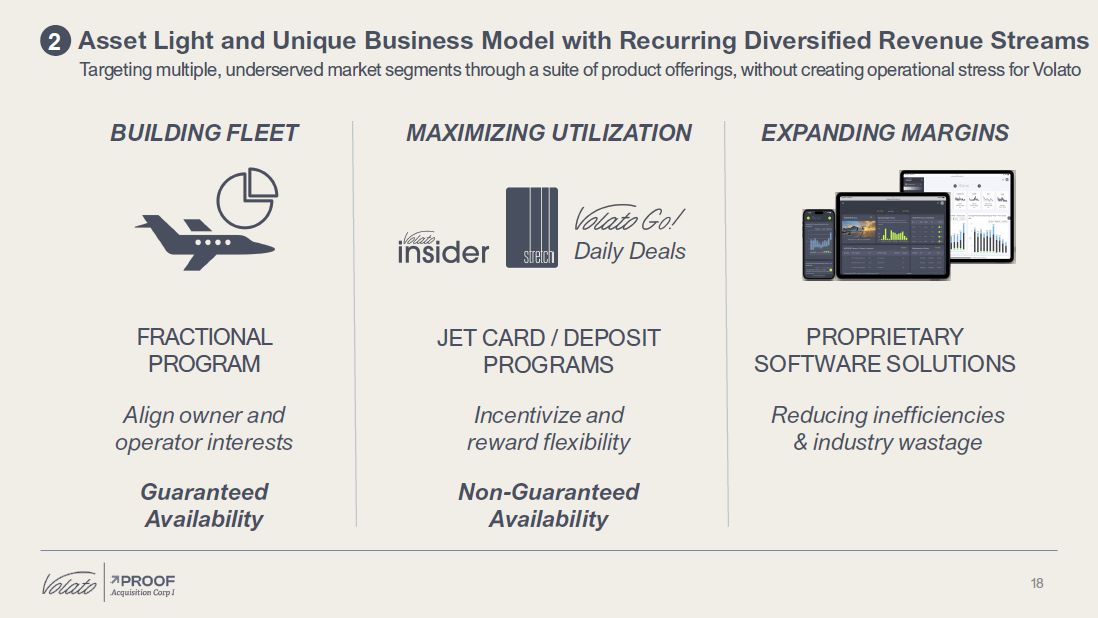

18 Reducing inefficiencies & industry wastage PROPRIETARY SOFTWARE

SOLUTIONS FRACTIONAL PROGRAM Align owner and operator interests Guaranteed Availability BUILDING FLEET MAXIMIZING UTILIZATION EXPANDING MARGINS Daily Deals JET CARD / DEPOSIT PROGRAMS Incentivize and reward flexibility Non-Guaranteed

Availability 2 Asset Light and Unique Business Model with Recurring Diversified Revenue Streams Targeting multiple, underserved market segments through a suite of product offerings, without creating operational stress for Volato

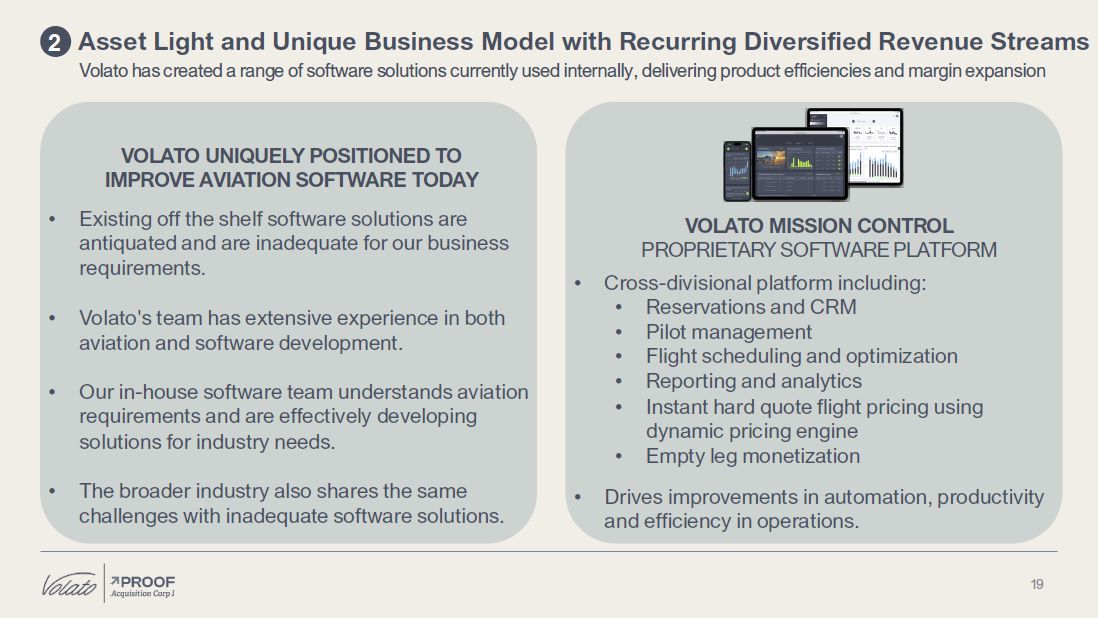

19 2 VOLATO UNIQUELY POSITIONED TO IMPROVE AVIATION SOFTWARE TODAY Existing

off the shelf software solutions are antiquated and are inadequate for our business requirements. Volato's team has extensive experience in both aviation and software development. Our in-house software team understands aviation requirements

and are effectively developing solutions for industry needs. The broader industry also shares the same challenges with inadequate software solutions. VOLATO MISSION CONTROL PROPRIETARY SOFTWARE PLATFORM Cross-divisional platform

including: Reservations and CRM Pilot management Flight scheduling and optimization Reporting and analytics Instant hard quote flight pricing using dynamic pricing engine Empty leg monetization Drives improvements in automation,

productivity and efficiency in operations. Asset Light and Unique Business Model with Recurring Diversified Revenue Streams Volato has created a range of software solutions currently used internally, delivering product efficiencies and

margin expansion

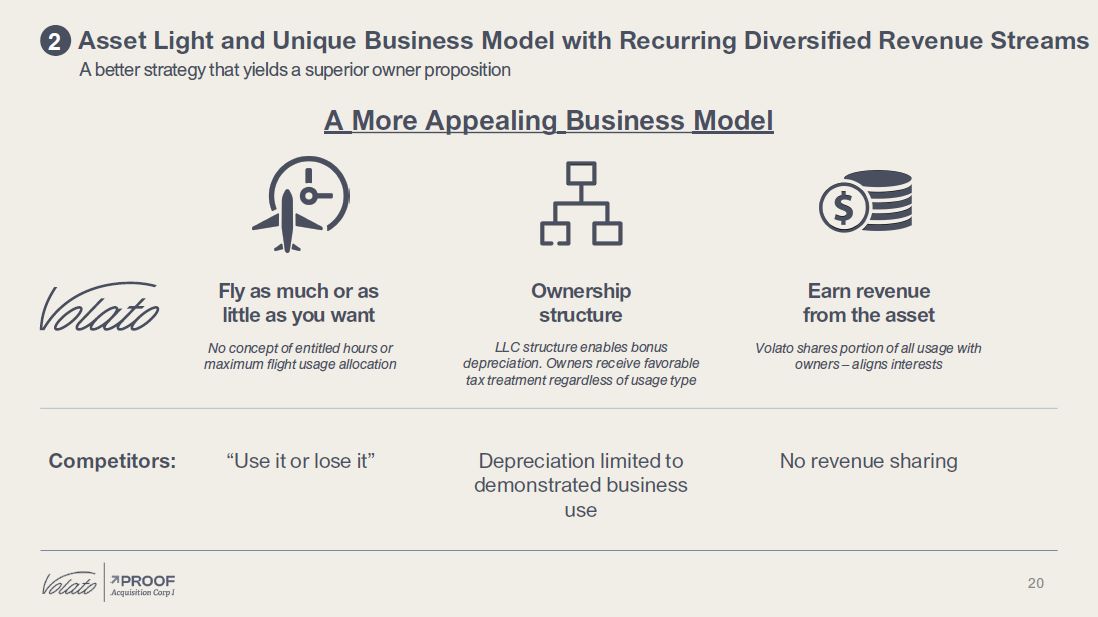

20 A More Appealing Business Model “Use it or lose it” Depreciation limited

to demonstrated business use Competitors: No revenue sharing Fly as much or as little as you want No concept of entitled hours or maximum flight usage allocation Ownership structure LLC structure enables bonus depreciation. Owners

receive favorable tax treatment regardless of usage type Earn revenue from the asset Volato shares portion of all usage with owners – aligns interests 2 Asset Light and Unique Business Model with Recurring Diversified Revenue Streams A

better strategy that yields a superior owner proposition

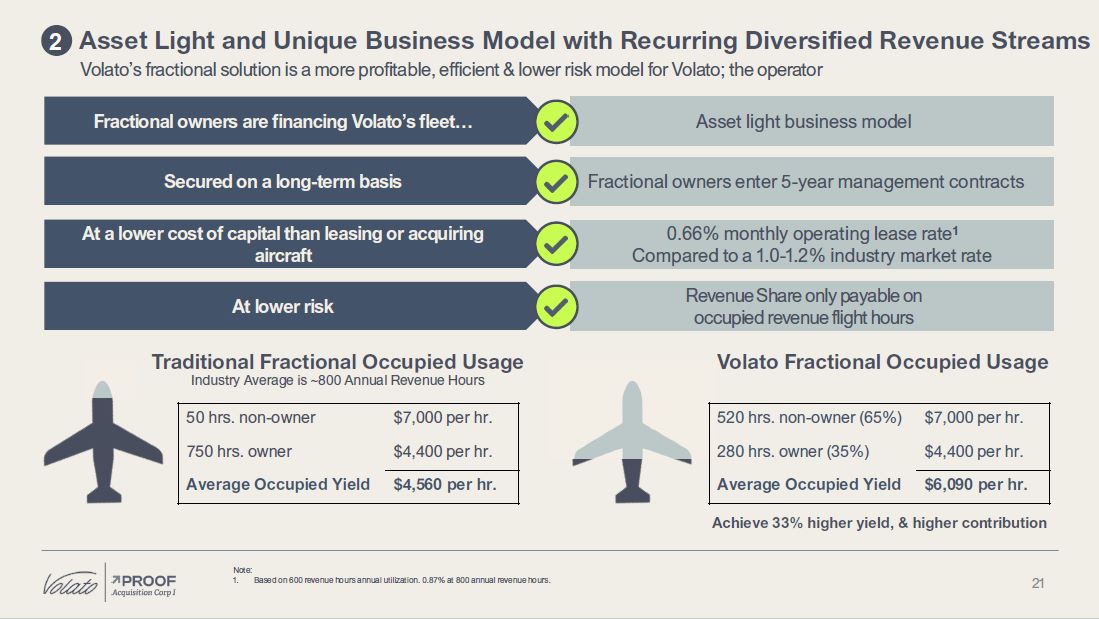

21 Note: 1. Based on 600 revenue hours annual utilization. 0.87% at 800 annual

revenue hours. Achieve 33% higher yield, & higher contribution Secured on a long-term basis At a lower cost of capital than leasing or acquiring aircraft At lower risk Fractional owners are financing Volato’s fleet… Asset light

business model Fractional owners enter 5-year management contracts 0.66% monthly operating lease rate1 Compared to a 1.0-1.2% industry market rate Revenue Share only payable on occupied revenue flight hours $7,000 per hr. $4,400 per

hr. 50 hrs. non-owner 750 hrs. owner Average Occupied Yield $4,560 per hr. $7,000 per hr. $4,400 per hr. 520 hrs. non-owner (65%) 280 hrs. owner (35%) Average Occupied Yield $6,090 per hr. Volato Fractional Occupied Usage 2 Asset

Light and Unique Business Model with Recurring Diversified Revenue Streams Volato’s fractional solution is a more profitable, efficient & lower risk model for Volato; the operator Traditional Fractional Occupied Usage Industry Average

is ~800 Annual Revenue Hours

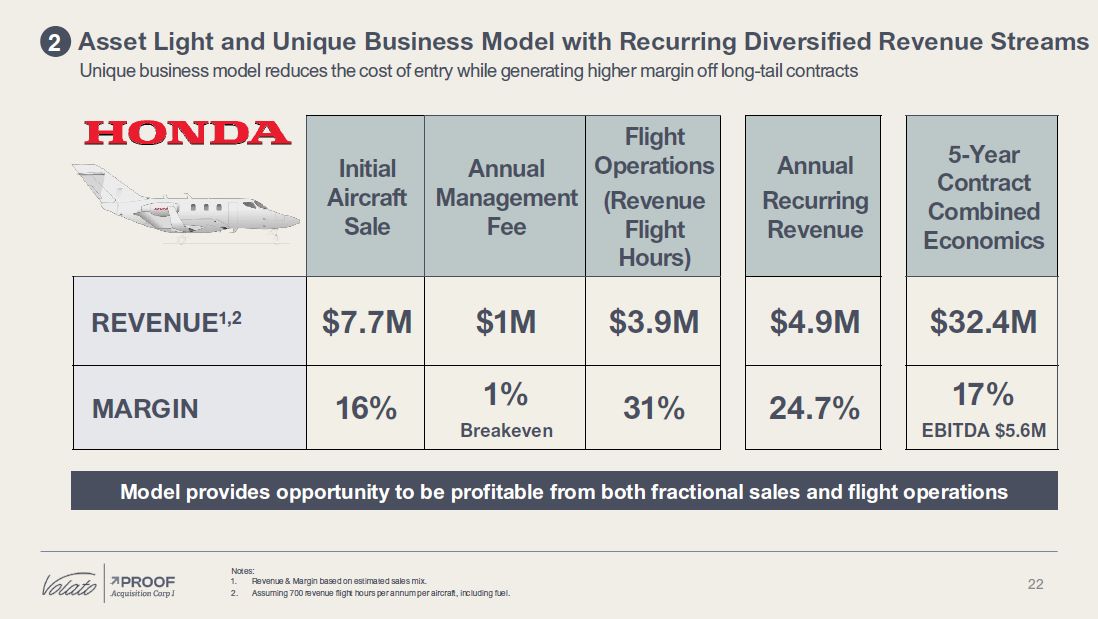

22 Initial Aircraft Sale Annual Management Fee Flight Operations (Revenue

Flight Hours) REVENUE1,2 $7.7M $1M $3.9M MARGIN 16% 1% Breakeven 31% Annual Recurring Revenue $4.9M 24.7% 5-Year Contract Combined Economics $32.4M 17% EBITDA $5.6M 2 Asset Light and Unique Business Model with Recurring

Diversified Revenue Streams Unique business model reduces the cost of entry while generating higher margin off long-tail contracts Model provides opportunity to be profitable from both fractional sales and flight operations Notes: Revenue

& Margin based on estimated sales mix. Assuming 700 revenue flight hours per annum per aircraft, including fuel.

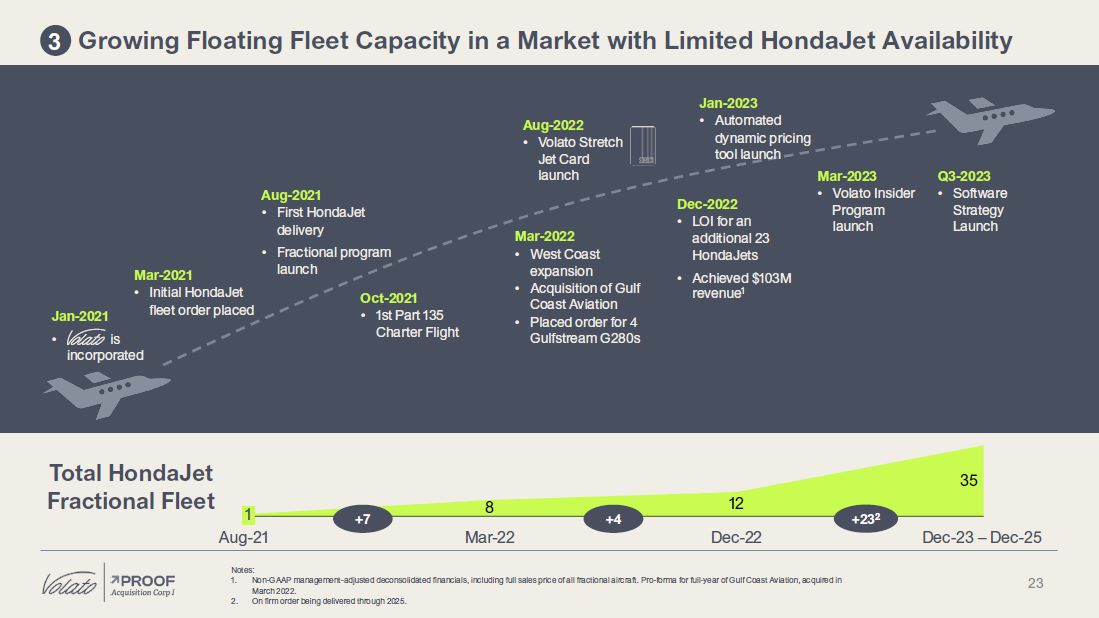

23 Notes: Non-GAAP management-adjusted deconsolidated financials, including

full sales price of all fractional aircraft. Pro-forma for full-year of Gulf Coast Aviation, acquired in March 2022. On firm order being delivered through 2025. Jan-2021 • is incorporated Mar-2021 Initial HondaJet fleet order

placed Aug-2021 Mar-2022 West Coast expansion Acquisition of Gulf Coast Aviation Placed order for 4 Gulfstream G280s First HondaJet delivery Fractional program launch Oct-2021 1st Part 135 Charter Flight Aug-2022 Volato Stretch Jet

Card launch Jan-2023 Automated dynamic pricing tool launch Dec-2022 LOI for an additional 23 HondaJets Achieved $103M revenue1 Mar-2023 Volato Insider Program launch Total HondaJet Fractional Fleet 8 12 35 Dec-23 – Dec-25 Aug-21

Mar-22 Dec-22 1 +4 +232 +7 3 Growing Floating Fleet Capacity in a Market with Limited HondaJet Availability Q3-2023 Software Strategy Launch

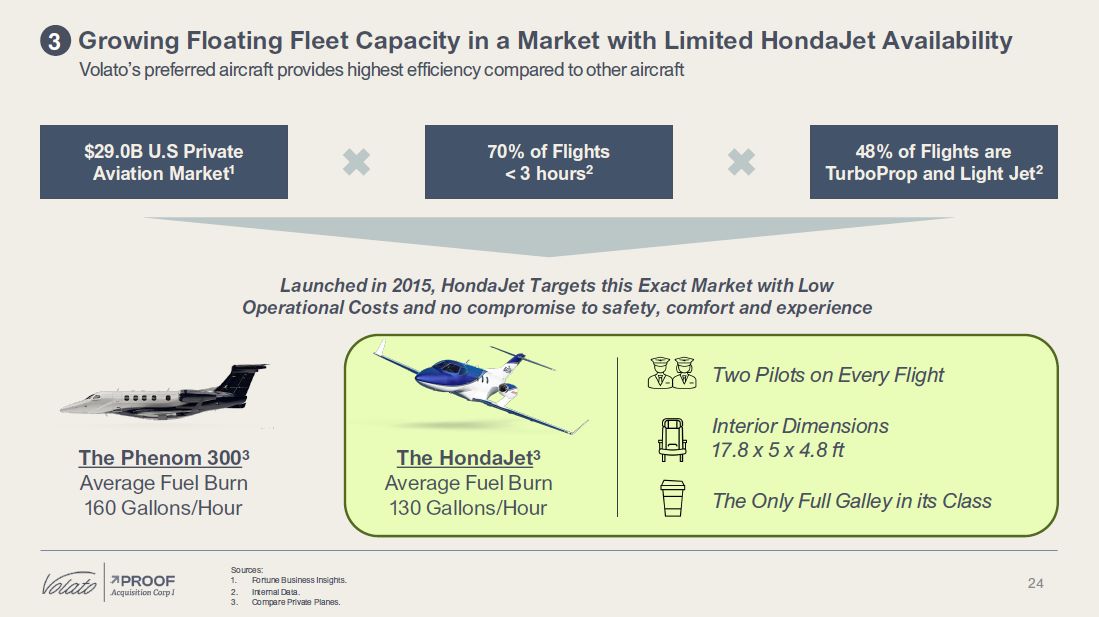

24 3 $29.0B U.S Private Aviation Market1 70% of Flights < 3 hours2 48%

of Flights are TurboProp and Light Jet2 The Phenom 3003 Average Fuel Burn 160 Gallons/Hour The HondaJet3 Average Fuel Burn 130 Gallons/Hour Launched in 2015, HondaJet Targets this Exact Market with Low Operational Costs and no compromise

to safety, comfort and experience Two Pilots on Every Flight Interior Dimensions 17.8 x 5 x 4.8 ft The Only Full Galley in its Class Sources: Fortune Business Insights. Internal Data. Compare Private Planes. Growing Floating Fleet

Capacity in a Market with Limited HondaJet Availability Volato’s preferred aircraft provides highest efficiency compared to other aircraft

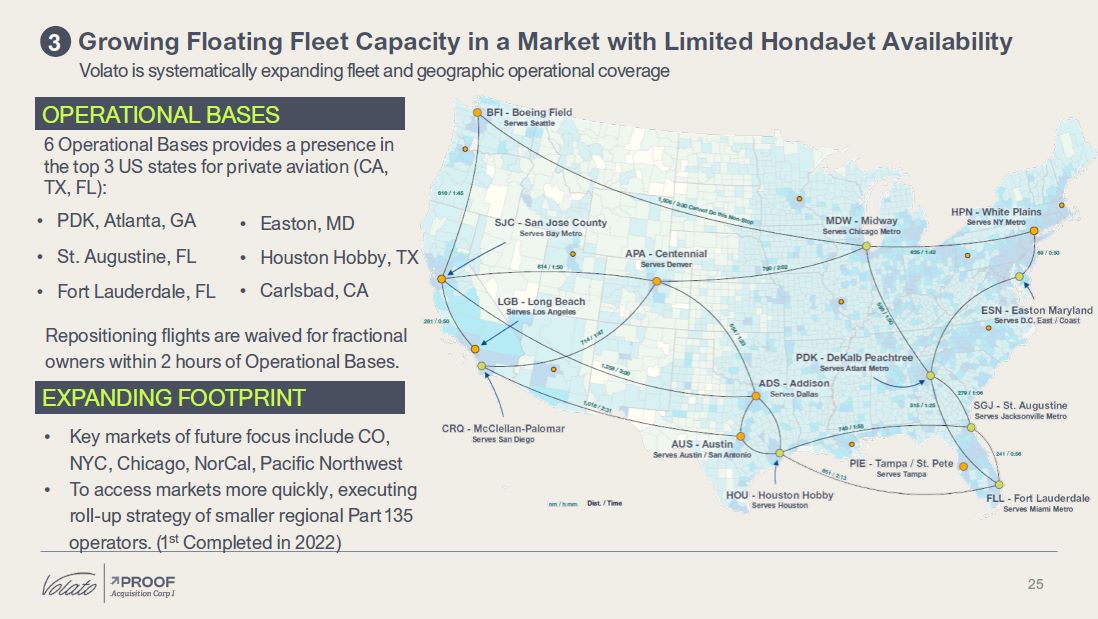

25 OPERATIONAL BASES EXPANDING FOOTPRINT Repositioning flights are waived for

fractional owners within 2 hours of Operational Bases. 6 Operational Bases provides a presence in the top 3 US states for private aviation (CA, TX, FL): Key markets of future focus include CO, NYC, Chicago, NorCal, Pacific Northwest To

access markets more quickly, executing roll-up strategy of smaller regional Part 135 operators. (1st Completed in 2022) 3 Growing Floating Fleet Capacity in a Market with Limited HondaJet Availability Volato is systematically expanding

fleet and geographic operational coverage PDK, Atlanta, GA St. Augustine, FL Fort Lauderdale, FL Easton, MD Houston Hobby, TX Carlsbad, CA

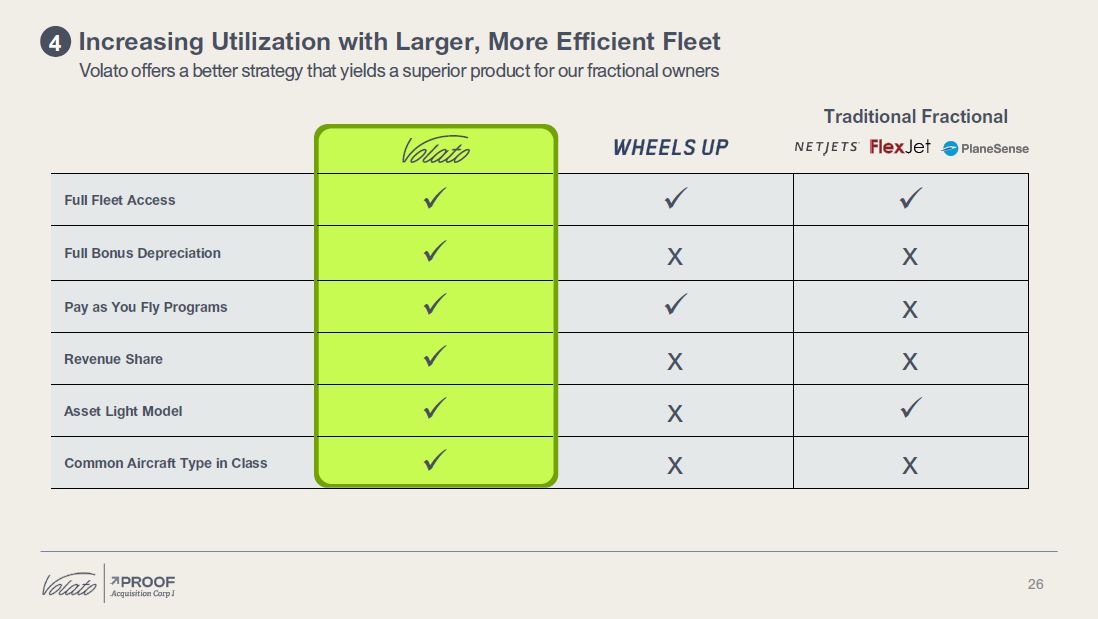

26 4 jds Full Fleet Access Full Bonus Depreciation x x Pay as You

Fly Programs x Revenue Share x x Asset Light Model x Common Aircraft Type in Class x x Traditional Fractional Increasing Utilization with Larger, More Efficient Fleet Volato offers a better strategy that yields a superior

product for our fractional owners

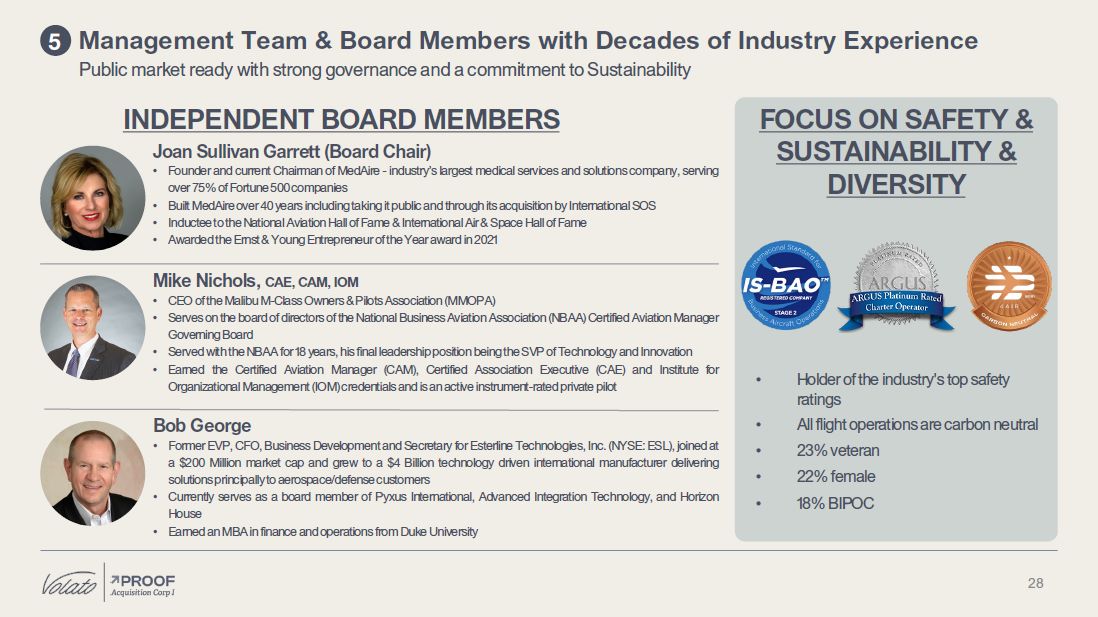

Operational team of seasoned industry professionals with over 30 years of

industry experience across: Led by an entrepreneurial team with a track record of successful exits 27 5 And a commercial team with prior industry experience KeithRabin President & CFO Nicholas Cooper CFA Co-founder &CCO Matt

Liotta Co-founder& CEO SteveDrucker CTO Gary Waldman EVP, Fleet Performance Norm Katz EVP, Sales Management Team & Board Members with Decades of Industry Experience Leading a team of 240+ full-time employees

28 5 FOCUS ON SAFETY & SUSTAINABILITY & DIVERSITY • • • • Holder

of the industry's top safety ratings All flight operations are carbon neutral 23% veteran 22% female 18% BIPOC Bob George Former EVP, CFO, Business Development and Secretary for Esterline Technologies, Inc. (NYSE: ESL), joined at a $200

Million market cap and grew to a $4 Billion technology driven international manufacturer delivering solutions principally to aerospace/defense customers Currently serves as a board member of Pyxus International, Advanced Integration

Technology, and Horizon House Earned an MBA in finance and operations from Duke University INDEPENDENT BOARD MEMBERS Joan Sullivan Garrett (Board Chair) Founder and current Chairman of MedAire - industry’s largest medical services and

solutions company, serving over 75% of Fortune 500 companies Built MedAire over 40 years including taking it public and through its acquisition by International SOS Inductee to the National Aviation Hall of Fame & International Air

& Space Hall of Fame Awarded the Ernst & Young Entrepreneur of the Year award in 2021 Mike Nichols, CAE, CAM, IOM CEO of the Malibu M-Class Owners & Pilots Association (MMOPA) Serves on the board of directors of the National

Business Aviation Association (NBAA) Certified Aviation Manager Governing Board Served with the NBAA for 18 years, his final leadership position being the SVP of Technology and Innovation Earned the Certified Aviation Manager (CAM),

Certified Association Executive (CAE) and Institute for Organizational Management (IOM) credentials and is an active instrument-rated private pilot Management Team & Board Members with Decades of Industry Experience Public market ready

with strong governance and a commitment to Sustainability

Volato is Positioned Well for Accelerated Growth 29 Expansion of software

offering Focused entry into corporate travel market Expansion of fleet size and offering Expansion of geographic footprint and operational coverage

FINANCIALS

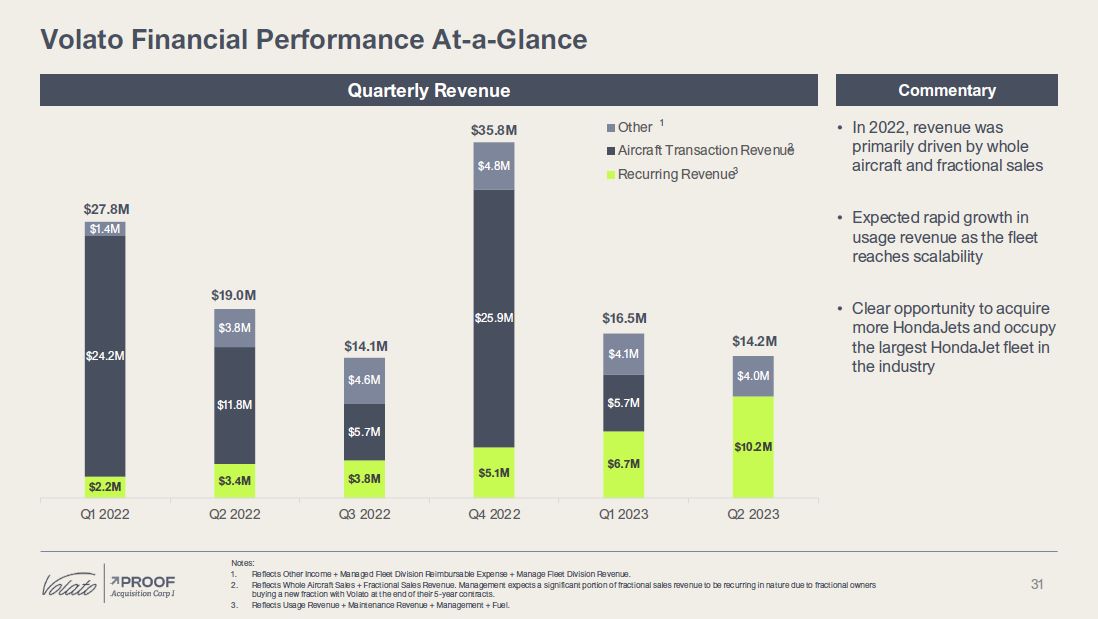

$2.2M $3.4M $3.8M $5.1M $6.7M $10.2M $24.2M $11.8M $5.7M $25.9M $5.7M $1.4M $3.8M $4.6M $4.8M $4.1M $4.0M Q1

2022 Q2 2022 Q3 2022 Q4 2022 Q1 2023 Q2 2023 Volato Financial Performance At-a-Glance 31 Quarterly Revenue Commentary Other 1 Notes: Reflects Other Income + Managed Fleet Division Reimbursable Expense + Manage Fleet Division

Revenue. Reflects Whole Aircraft Sales + Fractional Sales Revenue. Management expects a significant portion of fractional sales revenue to be recurring in nature due to fractional owners buying a new fraction with Volato at the end of their

5-year contracts. Reflects Usage Revenue + Maintenance Revenue + Management + Fuel. Aircraft Transaction Revenue2 Recurring Revenue3 $27.8M $14.1M $35.8M $16.5M $14.2M $19.0M In 2022, revenue was primarily driven by whole aircraft

and fractional sales Expected rapid growth in usage revenue as the fleet reaches scalability Clear opportunity to acquire more HondaJets and occupy the largest HondaJet fleet in the industry

APPENDIX

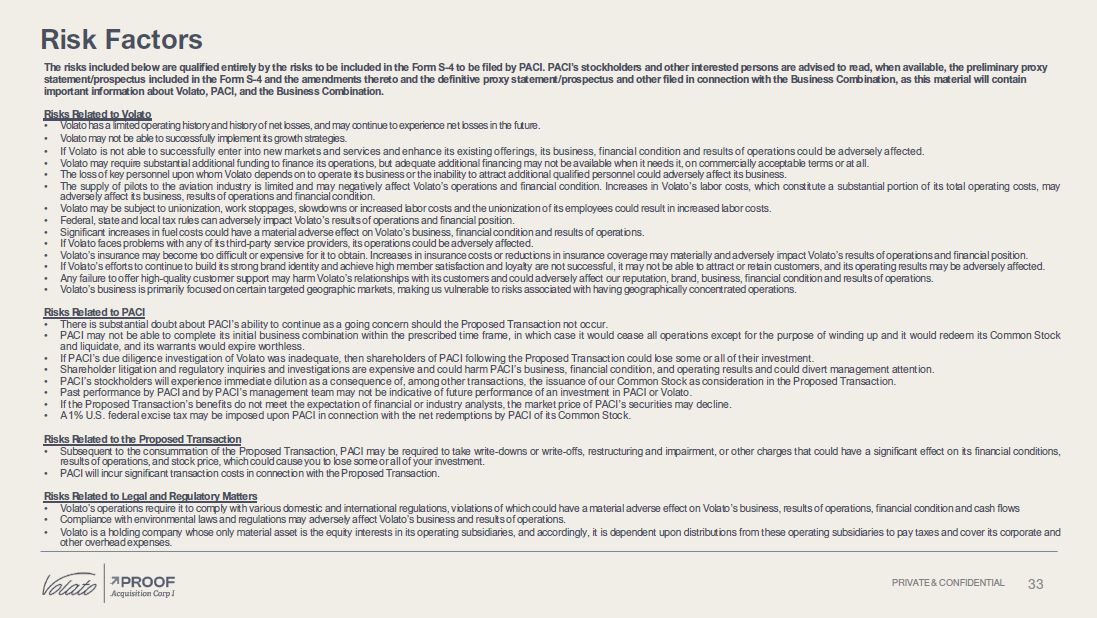

Risk Factors 33 PRIVATE & CONFIDENTIAL The risks included below are

qualified entirely by the risks to be included in the Form S-4 to be filed by PACI. PACI’s stockholders and other interested persons are advised to read, when available, the preliminary proxy statement/prospectus included in the Form S-4 and

the amendments thereto and the definitive proxy statement/prospectus and other filed in connection with the Business Combination, as this material will contain important information about Volato, PACI, and the Business Combination. Risks

Related to Volato Volato has a limited operating history and history of net losses, and may continue to experience net losses in the future. Volato may not be able to successfully implement its growth strategies. If Volato is not able to

successfully enter into new markets and services and enhance its existing offerings, its business, financial condition and results of operations could be adversely affected. Volato may require substantial additional funding to finance its

operations, but adequate additional financing may not be available when it needs it, on commercially acceptable terms or at all. The loss of key personnel upon whom Volato depends on to operate its business or the inability to attract

additional qualified personnel could adversely affect its business. The supply of pilots to the aviation industry is limited and may negatively affect Volato’s operations and financial condition. Increases in Volato’s labor costs, which

constitute a substantial portion of its total operating costs, may adversely affect its business, results of operations and financial condition. Volato may be subject to unionization, work stoppages, slowdowns or increased labor costs and

the unionization of its employees could result in increased labor costs. Federal, state and local tax rules can adversely impact Volato’s results of operations and financial position. Significant increases in fuel costs could have a

material adverse effect on Volato’s business, financial condition and results of operations. If Volato faces problems with any of its third-party service providers, its operations could be adversely affected. Volato’s insurance may become

too difficult or expensive for it to obtain. Increases in insurance costs or reductions in insurance coverage may materially and adversely impact Volato’s results of operations and financial position. If Volato’s efforts to continue to build

its strong brand identity and achieve high member satisfaction and loyalty are not successful, it may not be able to attract or retain customers, and its operating results may be adversely affected. Any failure to offer high-quality customer

support may harm Volato’s relationships with its customers and could adversely affect our reputation, brand, business, financial condition and results of operations. Volato’s business is primarily focused on certain targeted geographic

markets, making us vulnerable to risks associated with having geographically concentrated operations. Risks Related to PACI There is substantial doubt about PACI’s ability to continue as a going concern should the Proposed Transaction not

occur. PACI may not be able to complete its initial business combination within the prescribed time frame, in which case it would cease all operations except for the purpose of winding up and it would redeem its Common Stock and liquidate,

and its warrants would expire worthless. If PACI’s due diligence investigation of Volato was inadequate, then shareholders of PACI following the Proposed Transaction could lose some or all of their investment. Shareholder litigation and

regulatory inquiries and investigations are expensive and could harm PACI’s business, financial condition, and operating results and could divert management attention. PACI’s stockholders will experience immediate dilution as a consequence

of, among other transactions, the issuance of our Common Stock as consideration in the Proposed Transaction. Past performance by PACI and by PACI’s management team may not be indicative of future performance of an investment in PACI or

Volato. If the Proposed Transaction’s benefits do not meet the expectation of financial or industry analysts, the market price of PACI’s securities may decline. A 1% U.S. federal excise tax may be imposed upon PACI in connection with the

net redemptions by PACI of its Common Stock. Risks Related to the Proposed Transaction Subsequent to the consummation of the Proposed Transaction, PACI may be required to take write-downs or write-offs, restructuring and impairment, or

other charges that could have a significant effect on its financial conditions, results of operations, and stock price, which could cause you to lose some or all of your investment. PACI will incur significant transaction costs in connection

with the Proposed Transaction. Risks Related to Legal and Regulatory Matters Volato’s operations require it to comply with various domestic and international regulations, violations of which could have a material adverse effect on Volato’s

business, results of operations, financial condition and cash flows Compliance with environmental laws and regulations may adversely affect Volato’s business and results of operations. Volato is a holding company whose only material asset

is the equity interests in its operating subsidiaries, and accordingly, it is dependent upon distributions from these operating subsidiaries to pay taxes and cover its corporate and other overhead expenses.

ENJOY FLYING MORE