S-1/A: General form of registration statement for all companies including face-amount certificate companies

Published on May 23, 2024

As filed with the Securities and Exchange Commission on May 23, 2024

Registration Statement No. 333-278913

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 1

to

FORM S-1

REGISTRATION STATEMENT

Under

The Securities Act of 1933

VOLATO GROUP, INC.

(Exact name of Registrant as specified in its charter)

|

Delaware

|

| |

4522

|

| |

86-2707040

|

|

(State or other jurisdiction of

incorporation or organization)

|

| |

(Primary Standard Industrial

Classification Code Number)

|

| |

(I.R.S. Employer

Identification Number)

|

1954 Airport Road, Suite 124

Chamblee, Georgia 30341

Telephone: 844-399-8998

(Address, including zip code, and telephone number, including area code, of

Registrant’s principal executive offices)

Jennifer Liotta

General Counsel

1954 Airport Road, Suite 124

Chamblee, Georgia 30341

Telephone: 844-399-8998

(Name, address, including zip code, and telephone number, including area code, of

agent for service)

Copies to:

|

Reid Avett

Womble Bond Dickinson (US) LLP

2001 K Street, NW

Suite 400 South

Washington, DC 20006

Telephone: 202-857-4425

|

| |

M. Ali Panjwani, Esq.

Pryor Cashman LLP

7 Times Square

New York, NY 10036

Telephone: 212-421-4100

|

Approximate date of commencement of proposed

sale to the public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be

offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: ☒

If this Form is filed to register additional securities for an

offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to

Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to

Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large,

accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large, accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth

company” in Rule 12b-2 of the Exchange Act.

|

Large, accelerated filer

|

| |

☐

|

| |

Accelerated filer

|

| |

☐

|

|

Non-accelerated filer

|

| |

☒

|

| |

Smaller reporting company

|

| |

☒

|

|

|

| |

|

| |

Emerging growth company

|

| |

☒

|

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The Registrant hereby amends this Registration Statement on such

date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the

Securities Act of 1933, as amended, or until this Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Information contained herein is subject to completion or amendment. A registration statement relating to these securities has been filed with the

SEC. These securities may not be sold nor may offers to buy be accepted prior to the time the registration statement becomes effective. This prospectus shall not constitute an offer to sell or the solicitation of an offer to buy nor shall

there be any sale of these securities in any jurisdiction in which such offer, solicitation or sale would be unlawful.

SUBJECT TO COMPLETION, DATED MAY 23, 2024

PRELIMINARY PROSPECTUS

Up to 6,849,315 Shares of Class A Common Stock

Up to 6,849,315 Pre-Funded Warrants

Up to 6,849,315 Common Warrants

Up to 13,698,630 Shares of Class A Common Stock Underlying Pre-Funded Warrants and

Common Warrants

We are offering (i) 6,849,315 shares of Class A common stock

of Volato Group, Inc. (the “Common Stock”) and (ii) Common Warrants to purchase 6,849,315 shares of common stock (“Common Warrants”), at an exercise price of $1.46 per share (representing 100% of the assumed public offering price per share of

Common Stock to be sold in this offering), on a best-efforts basis. The Common Warrants will expire on the fifth anniversary of the original issuance date. We are offering the Common Stock and Common Warrants at an assumed purchase price of

$1.46 per share, which is equal to the closing price of our common stock on the NYSE American on May 22, 2024.

The actual public offering price will be determined between

us, A.G.P./Alliance Global Partners (“A.G.P.”), Roth Capital Partners, LLC (“Roth” and, together with A.G.P., whom we refer to herein as the “placement agent”) and the investors in the offering, and may be at a discount to the current market

price of our common stock. Therefore, the assumed public offering price used throughout this prospectus may not be indicative of the final offering price.

We are also offering 6,849,315 pre-funded warrants,

(“Pre-Funded Warrants”) to purchase up to 6,849,315 shares of Common Stock. We are offering to certain purchasers whose purchase of Common Stock in this offering would otherwise result in the purchaser, together with its affiliates and

certain related parties, beneficially owning more than 4.99% of our outstanding shares of Common Stock immediately following the consummation of this offering, the opportunity to purchase, if any purchaser so chooses, Pre-Funded Warrants, in

lieu of shares of Common Stock that would otherwise result in such purchaser's beneficial ownership exceeding 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding shares of Common Stock. The purchase price of each Pre-Funded

Warrant is $1.46 (which is equal to the assumed public offering price per share of Common Stock to be sold in this offering minus $0.0001, the exercise price per share of Common Stock of

each Pre-Funded Warrant). The Pre-Funded Warrants are immediately exercisable and may be exercised at any time until all of the Pre-Funded Warrants are exercised in full. For each Pre-Funded Warrant we sell, the number of shares of Common

Stock we are offering will be decreased on a one-for-one basis.

Because we will issue a Common Warrant for each share of

Common Stock and for each Pre-Funded Warrant sold in this offering, the number of Common Warrants sold in this offering will not change as a result of a change in the mix of shares of Common Stock and Pre-Funded Warrants sold.

Each Pre-Funded Warrant may be exercised, immediately in cash and

from time to time thereafter.

Our shares of Common Stock, Pre-Funded Warrants and Common

Warrants can only be purchased together in this offering, but will be issued separately. Up to 13,698,630 shares of Common Stock issuable from time to time upon exercise of the Pre-Funded Warrants and Common Warrants are also being offered by

this prospectus. These securities are being sold in this offering to certain purchasers under a securities purchase agreement dated May , 2024 between us and the purchasers.

Our shares of Common Stock are listed on the NYSE American

under the symbol “SOAR.” On May 23, 2024, the last reported sale price of our shares of Common Stock on the NYSE American was $1.46 per share.

As stated above, the public offering price for our securities

in this offering will be determined at the time of pricing, and may be at a discount to the then current market price. The assumed public offering price used throughout this prospectus may not be indicative of the final offering price. The

final public offering price will be determined through negotiation between us and investors based upon a number of factors, including our history and our prospects, the industry in which we operate, our past and present operating results, the

previous experience of our executive officers and the general condition of the securities markets at the time of this offering. There is no established public trading market for the Common Warrants and we do not expect markets to develop.

Without an active trading market, the liquidity of the warrants will be limited. In addition, we do not intend to list the Pre-Funded Warrants or the Common Warrants on the NYSE American, any other national securities exchange or any other

trading system.

We have retained the placement agent to act as our sole

placement agent in connection with the securities offered by this prospectus. The placement agent is not purchasing or selling any of these securities nor is it required to sell any specific number or dollar amount of securities, but has

agreed to use its reasonable best efforts to sell the securities offered by this prospectus. We may not sell all of the securities in this offering. We have agreed to pay the placement agent the placement agent fees set forth in the table

below.

There is no minimum number of securities or minimum aggregate

amount of proceeds for this offering to close. We expect this offering to be completed not later than two business days following the commencement of this offering and we will deliver all securities to be issued in connection with this

offering delivery versus payment (“DVP”) /receipt versus payment (“RVP”) upon receipt of investor funds received by us. Accordingly, neither we nor the placement agent have made any arrangements to place investor funds in an escrow account or

trust account since the placement agent will not receive investor funds in connection with the sale of the securities offered hereunder.

We are an “emerging growth company,” as that term is defined

under the federal securities laws, and a “smaller reporting company” and, as such, are subject to certain reduced public company reporting requirements. See “Prospectus Summary—Implications of Being an

Emerging Growth Company and a Smaller Reporting Company.”

|

|

| |

Per Share

|

| |

Per Pre-Funded Warrant and

Accompanying Common Warrant

|

| |

Total

|

|

Public offering price(1)

|

| |

$

|

| |

|

| |

|

|

Placement Agent Fees(2)

|

| |

$

|

| |

|

| |

|

|

Proceeds to us, before expenses(3)

|

| |

$

|

| |

|

| |

|

|

(1)

|

The public offering price is $ per share of common stock and $ per pre-funded warrant.

|

|

(2)

|

Represents a cash fee equal to seven percent (7%) of the aggregate purchase price paid by investors in this offering up

to $15,000,000 and, a cash fee equal to six percent (6%) of the aggregate purchase price paid by investors above $15,000,000. Notwithstanding the foregoing, we and the placement agent, have agreed that for certain identified investors

to a cash fee equal to three and a half percent (3.5%) of the aggregate purchase price paid by such investors in this offering up to $15,000,000 and, a cash fee equal to three percent (3%) of the aggregate purchase price paid by such

investors above $15,000,000. We have also agreed to reimburse the placement agent for its accountable offering-related legal expenses in an amount up to $125,000 and pay the placement agent a non-accountable expense allowance of

$25,000. See “Plan of Distribution” beginning on page 102 of this prospectus for a description of the compensation to be received by the placement agent.

|

|

(3)

|

Does not include proceeds from the exercise of the warrants in cash, if any.

|

Investing in our securities involves a high

degree of risk. See the “Risk Factors” section beginning on page 10 of this prospectus.

Neither the Securities and Exchange

Commission, or the SEC, nor any state securities commission has approved or disapproved of the securities to be issued under this prospectus or determined if this prospectus is truthful or complete. Any representation to the contrary is a

criminal offense.

Co-Placement Agents

|

A.G.P.

|

| |

Roth Capital Partners

|

The date of this prospectus is , 2024.

i

You should rely only on the information contained in this

prospectus, any amendment or supplement to this prospectus, and any related free writing prospectus prepared by or on behalf of us or to which we have referred you. Neither we nor any of the placement agents have authorized anyone to provide

you with information that is different from, or in addition to, that contained in this prospectus, any amendment or supplement to this prospectus and any related free writing prospectus prepared by or on behalf of us or to which we have

referred you. We and the placement agents take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you.

This prospectus is not an offer to sell, nor is it seeking an

offer to buy, these securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus or any prospectus supplement is accurate only as of the date on the front of those

documents only, regardless of the time of delivery of this prospectus or any applicable prospectus supplement, or any sale of the securities offered hereby. Our business, financial condition, results of operations and prospects may have changed

since those dates.

Neither we nor any of the placement agents have taken any

action that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession

of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of our securities and the distribution of this prospectus outside the United States.

This prospectus contains summaries of certain provisions contained

in some of the documents described herein, but reference is made to the actual documents for complete information. All of the summaries are qualified in their entirety by the actual documents. Copies of some of the documents referred to herein

have been filed, will be filed or will be incorporated by reference as exhibits to the registration statement of which this prospectus is a part, and you may obtain copies of those documents as described below under “Where You Can Find More Information.”

This prospectus contains references to

trademarks, trade names and service marks belonging to other entities. Solely for convenience, trademarks, trade names and service marks referred to in this prospectus may appear without the ® or TM symbols, but such references are not intended

to indicate, in any way, that the applicable licensor will not assert, to the fullest extent under applicable law, its rights to these trademarks and trade names. We do not intend our use or display of other companies’ trade names, trademarks

or service marks to imply a relationship with, or endorsement or sponsorship of us by, any other companies.

Unless the context otherwise requires, references in this

prospectus to the “Company,” “we,” “us” and “our” and any related terms refer to Volato Group, Inc and our consolidated subsidiaries.

ii

This summary highlights information

contained elsewhere in this prospectus. This summary does not contain all of the information that may be important to you. You should read this entire prospectus carefully, including the matters discussed under the sections entitled “Risk

Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” “Business” and the consolidated financial statements and related notes included elsewhere in this prospectus before making an investment

decision.

Our Business

Volato, Group, Inc. was originally formed in the State of

Georgia under the name of Aerago, Inc. on January 7, 2021 (“inception”). On August 31, 2021, the Company filed an amendment to its Articles of Incorporation to change its name from “Aerago, Inc.” to “Volato, Inc.” Following a business

combination consummated on December 1, 2023 between Volato, PROOF Acquisition Corp I, a Delaware corporation (“PACI”) and PACI Merger Sub, Inc., a Delaware corporation and a direct, wholly-owned subsidiary of PACI (“Merger Sub”), Volato

survived as a wholly-owned subsidiary of PACI (“Business Combination”). In connection with the consummation of this transaction, PACI changed its name to “Volato Group, Inc.”.

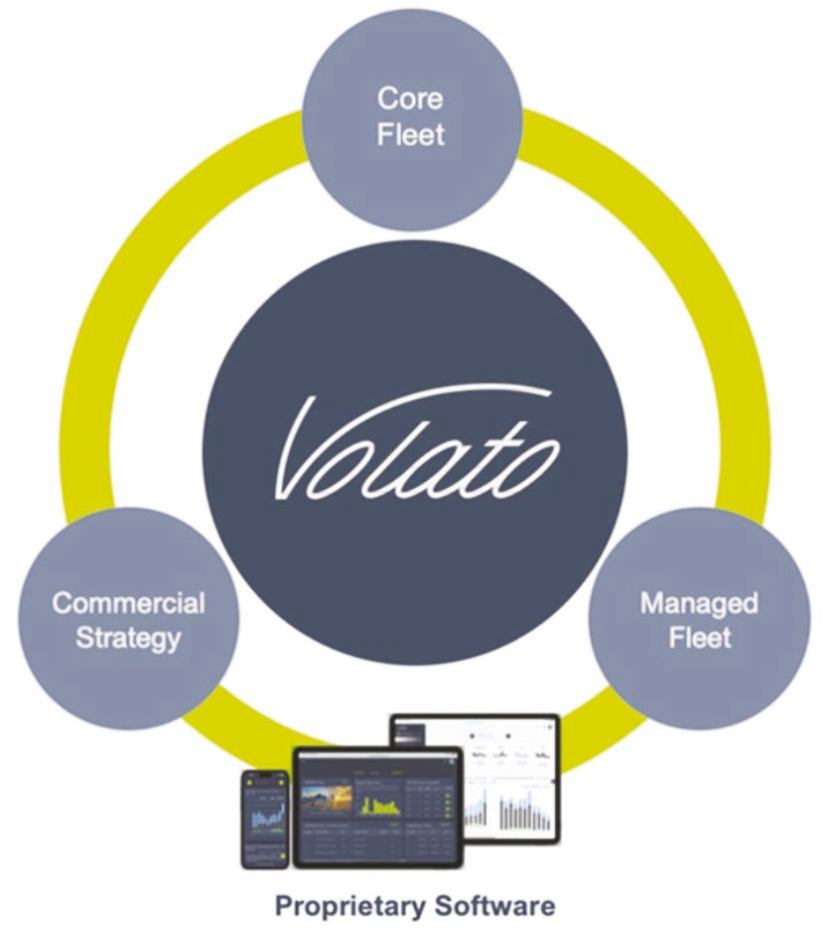

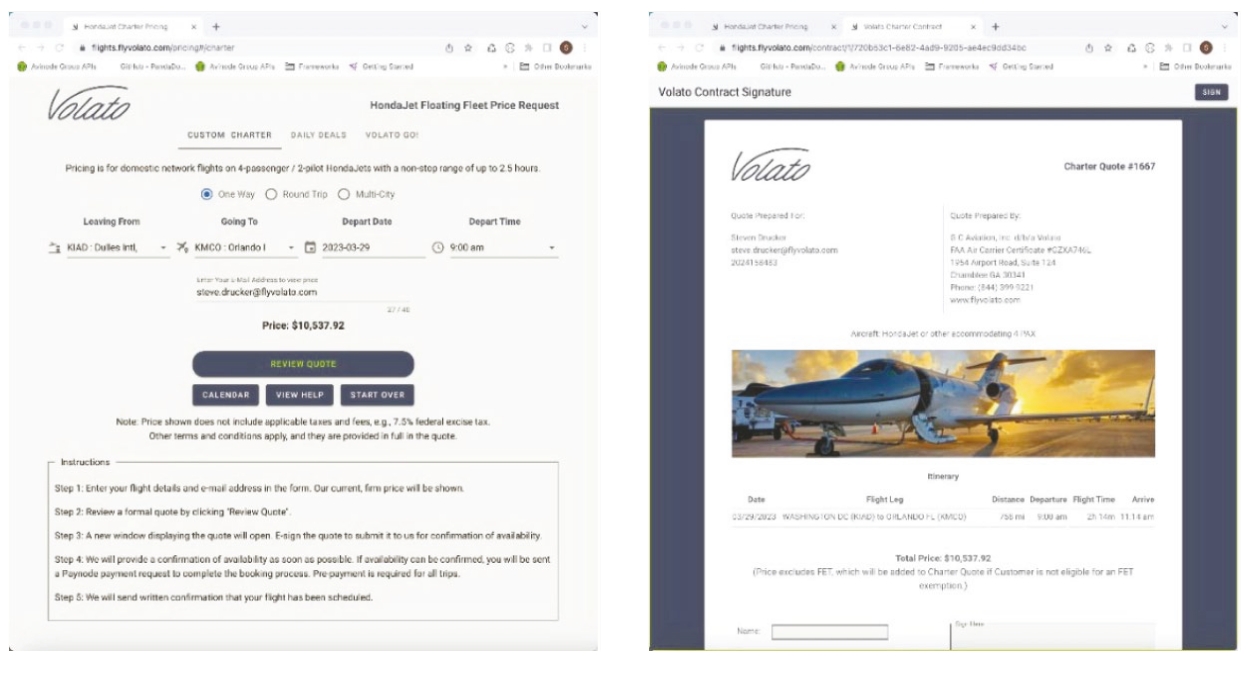

Volato’s mission is to provide our aircraft ownership program

participants, which we refer to as JetShare owners, and other customers more time for the rest of their lives by providing convenient and high-quality travel by using the right aircraft for the mission and by developing proprietary

technology designed to make the travel experience seamless.

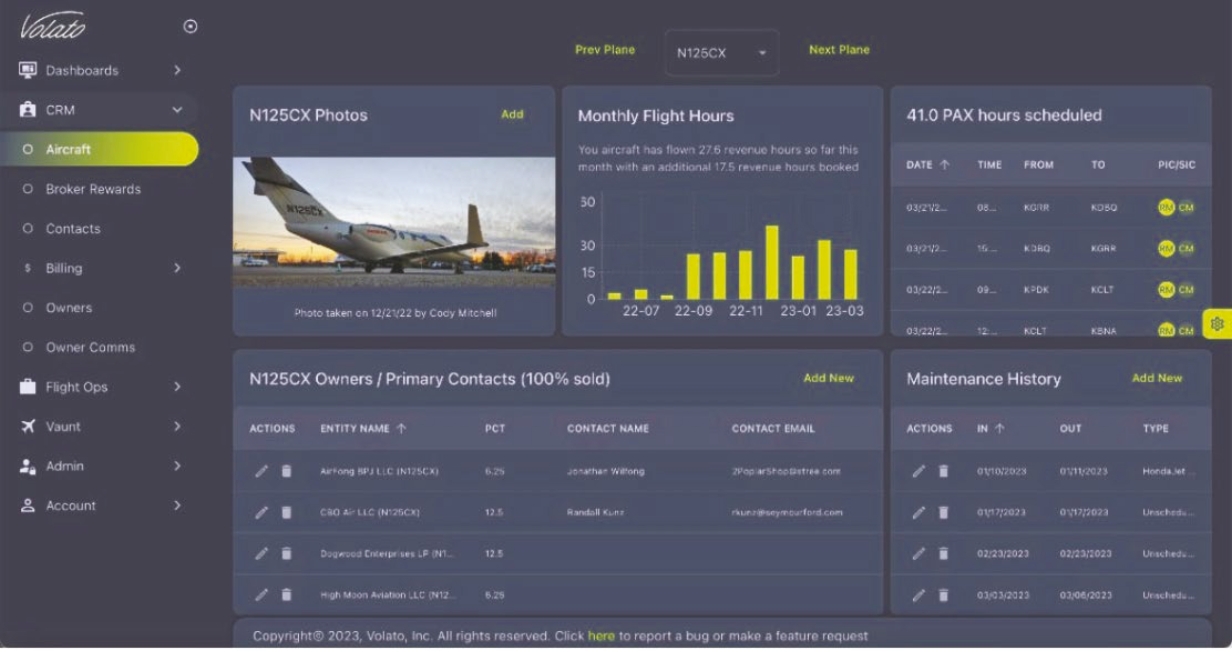

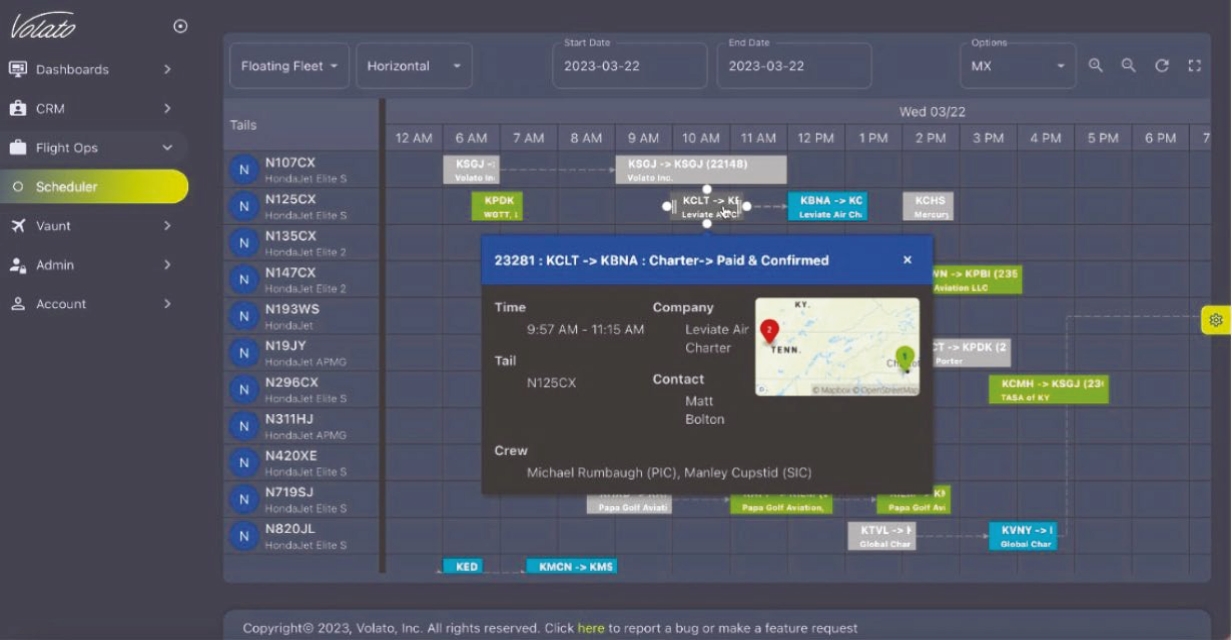

Our revenue is generated through our aircraft ownership

program, a focused commercial strategy which includes deposit products, charter flights and aircraft management services. Our aircraft ownership program is an asset-light model whereby we sell LLC membership interests to third-party owners

and then sell each fleet aircraft to a limited liability company (LLC). The LLC then leases the aircraft back to us for management and charter operation on behalf of the LLC under 14 C.F.R. Part 135. In turn, program participants (JetShare

owners) invest in those special purpose entities to fund the aircraft purchase. We operate the aircraft on behalf of the special purpose entity and enter into charter agreements with the individual JetShare owners to provide preferential

access and charter pricing for our HondaJet fleet.

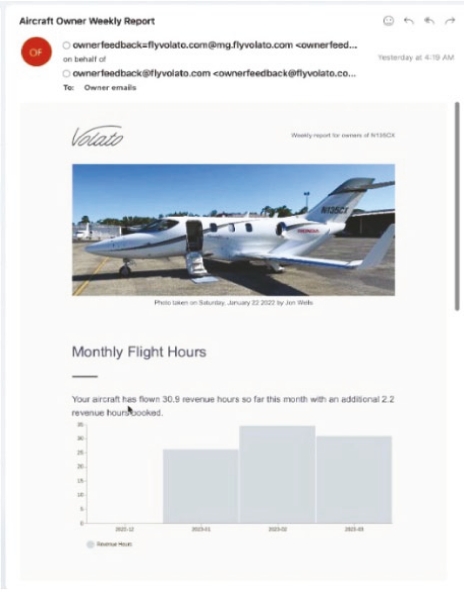

Additionally, our commercial services generate demand for our

fleet through the operation of retail deposit programs and charter as well as wholesale charter through brokers. We offer these programs on a fleet of 24 HondaJets, and a managed fleet of 6 aircraft. Finally, we provide aircraft management

services to existing owners of aircraft and help them monetize their aircraft through charter services.

Since our inception, we have been focused on making the

necessary investments in people, focused acquisitions, aircraft and technology to build an industry leading aviation company that uses capital efficiently.

Financial highlights for the three months ended March 31, 2024

include:

|

•

|

We generated total revenue of $13.2 million a decrease of $2.5 million, or 16%, compared to the three months ended March

31, 2023. Revenue from aircraft usage increased by $4.8 million, or 72%, while revenue from plane sales decreased by $5.7 million, during the three months ended March 31, 2024, related to lower plane sales;

|

|

•

|

We had 2,926 total flight hours for the three months ended March 31, 2024, representing 39% year-over-year growth;

|

|

•

|

We incurred a net loss of $17.4 million for the three months ended March 31, 2024, representing a $9.9 million increase

in loss over the prior year primarily related to lower plane sales, as described above, and increased advertising and marketing spend as well as increased costs related to being a publicly traded company and a rapidly scaling

business; and

|

|

•

|

Adjusted negative EBITDA1 was $13.1 million for the three months ended March 31, 2024 compared

to adjusted negative EBITDA of $6.7 million for the same period last year.

|

|

1

|

Adjusted EBITDA is a non-GAAP financial measure. Please refer to the tables and related

notes in the section titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” for a reconciliation of Adjusted EBITDA to its most comparable GAAP measure.

|

1

The following are financial highlights for fiscal year ended

December 31, 2023:

|

•

|

We generated total revenue of $73.3 million a decrease of $23.4 million, or 24%, compared to the year ended December 31,

2022. Revenue from aircraft usage increased by $23.4 million, or 162%, while revenue from plane sales decreased by $46.3 million, or 68%, during the year ended December 31, 2023, primarily related to lower plane sales;

|

|

•

|

We had 11,273 total flight hours for the year ended December 31, 2023, representing 124% year-over-year growth;

|

|

•

|

We incurred a net loss of $52.8 million for the year ended December 31, 2023, representing a $43.5 million increase in loss

over the prior year primarily related to lower plane sales, as described above, and increased costs related to being a publicly traded company and a rapidly scaling business; and

|

|

•

|

Adjusted negative EBITDA was $32.1 million for the year ended December 31, 2023 compared to adjusted negative EBITDA of

$9.0 million for the prior year. The change in adjusted EBITDA was the result of increased costs of being a publicly traded company and a rapidly scaling business, as well as lower plane sales.

|

Financial highlights for 2022 include:

|

•

|

We generated revenue of $96.7 million for the year ended December 31, 2022, representing 9,058% year-over-year growth,

including growth from Plane Co membership interest sales and acquisitions consummated during 2022;

|

|

•

|

We had 6,986 total flight hours representing over 1000%, year-over-year growth;

|

|

•

|

We incurred a net loss of $9.4 million for the year ended December 31, 2022, representing a $7.9 million increase in loss

over the prior year; and

|

|

•

|

Adjusted EBITDA decreased by $7.0 million in 2022, to adjusted negative EBITDA of $8.4 million for the year ended

December 31, 2022.

|

Implications of Being an Emerging Growth Company and a Smaller

Reporting Company

We are an “emerging growth company,” as defined in the JOBS Act,

and we may take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not emerging growth companies, including, but not limited to, not being required to comply with the

auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, as amended (the “Sarbanes-Oxley Act”); reduced obligations with respect to financial data, including presenting only two years of audited financial statements

in addition to any required unaudited interim financial statements, with correspondingly reduced “Management’s Discussion and Analysis of Financial Condition and Results of Operations” disclosure; reduced disclosure obligations regarding

executive compensation in our periodic reports, proxy statements and registration statements; exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and stockholder approval of any golden parachute

payments not previously approved; and an exemption from compliance with the requirement of the Public Company Accounting Oversight Board (United States) (“PCAOB”) regarding the communication of critical audit matters in the auditor’s report

on the financial statements.

In addition, pursuant to the JOBS Act, as an emerging growth

company we have elected to take advantage of an extended transition period for complying with new or revised accounting standards. This effectively permits us to delay adoption of certain accounting standards until those standards would

otherwise apply to private companies. As a result, our consolidated financial statements may not be comparable to companies that comply with new or revised accounting pronouncements as of the public company effective dates.

We may take advantage of these provisions until the last day

of our fiscal year following the fifth anniversary of the consummation of our initial public offering, which closed on December 3, 2021. We will cease to be an emerging growth company prior to the end of such five-year period if certain

earlier events occur, including (i) if we become a large accelerated filer under applicable SEC rules; (ii) our annual gross revenue exceeds $1.235 billion; or (iii) we issue more than $1.0 billion of non-convertible debt in any three-year

period.

Additionally, we are a “smaller reporting company” as defined in

the rules promulgated under the Securities Act. Smaller reporting companies may take advantage of certain reduced disclosure obligations, including, among

2

other things, providing only two years of audited financial statements. We will

remain a smaller reporting company only so long as (i) the market value of the Common Stock held by non-affiliates is less than $250 million, calculated as of the end of the most recently completed second financial quarter or (ii) our annual

revenue is less than $100 million in our previous financial year and during such completed financial year and the market value of the Common Stock held by non-affiliates is less than $700 million.

Summary of Risk Factors

Our business is subject to numerous risks and uncertainties,

including those described in the section entitled “Risk Factors,” that represent challenges that we face in connection with the successful implementation of our strategy and growth of our business. The occurrence of one or more of the

events or circumstances described in the section entitled “Risk Factors,” alone or in combination with other events or circumstances, may adversely affect our business, financial condition, and results of operations. Such risks include, but

are not limited to, the following:

Risks Related to Our Business and Industry

|

•

|

We have a limited operating history and history of net losses and may continue to experience net losses in the future.

|

|

•

|

Significant reliance on HondaJet and Gulfstream aircraft and parts poses risks to our business and prospects.

|

|

•

|

We may not be able to successfully implement our growth strategies.

|

|

•

|

If we are not able to successfully enter into new markets and services and enhance our existing products and services, our

business, financial condition, and results of operations could be adversely affected.

|

|

•

|

We are exposed to the risk of a decrease in demand for private aviation services.

|

|

•

|

The private aviation industry is subject to competition.

|

|

•

|

The loss of key personnel upon whom we depend on to operate our business or the inability to attract additional qualified

personnel could adversely affect our business.

|

|

•

|

We may require substantial additional funding to finance our operations, but adequate additional financing may not be

available when we need it, on commercially acceptable terms, or at all.

|

|

•

|

The supply of pilots to the aviation industry is limited and may negatively affect our operations and financial condition.

Increases in our labor costs, which constitute a substantial portion of our total operating costs, may adversely affect our business, results of operations, and financial condition.

|

|

•

|

We may be subject to unionization, work stoppages, slowdowns or increased labor costs, and the unionization of our

employees could result in increased labor costs.

|

|

•

|

We are exposed to operational disruptions due to maintenance.

|

|

•

|

Federal, state, and local tax rules can adversely impact our results of operations and financial position.

|

|

•

|

We may not realize the tax benefits from our aircraft ownership program.

|

|

•

|

Significant increases in fuel costs could have a material adverse effect on our business, financial condition and results

of operations.

|

|

•

|

Some of our business may become dependent on third-party operators to provide flights for our customers. If third-party

operators’ flights, which are required to serve a substantial portion of our business, are not available or do not perform adequately, our costs may increase and our business, financial condition, and results of operations could be

adversely affected.

|

|

•

|

If we face problems with any of our third-party service providers, our operations could be adversely affected.

|

|

•

|

Our insurance may become too difficult or expensive for us to obtain. Increases in insurance costs or reductions in

insurance coverage may materially and adversely impact our results of operations and financial position.

|

|

•

|

If our efforts to continue to build our strong brand identity and achieve high member satisfaction and loyalty are not

successful, we may not be able to attract or retain customers, and our operating results may be adversely affected.

|

|

•

|

Any failure to offer high-quality customer support may harm our relationships with our customers and could adversely affect

our reputation, brand, business, financial condition, and results of operations.

|

|

•

|

Our business is affected by factors beyond our control including: air traffic congestion at airports; airport slot

restrictions; air traffic control inefficiencies; natural disasters; adverse weather conditions, such as

|

3

hurricanes or blizzards; increased and changing security measures; changing

regulatory and governmental requirements; new or changing travel-related taxes; or the outbreak of disease; any of which could have a material adverse effect on our business, results of operations, and financial condition.

|

•

|

Our business is primarily focused on certain targeted geographic markets, making us vulnerable to risks associated with

having geographically concentrated operations.

|

|

•

|

The operation of aircraft is subject to various risks, and failure to maintain an acceptable safety record may have an

adverse impact on our ability to obtain and retain customers.

|

|

•

|

We could suffer losses and adverse publicity stemming from any accident involving aircraft models operated by third

parties.

|

|

•

|

A delay or failure to identify and devise, invest in, and implement certain important technology, business, and other

initiatives could have a material impact on our business, financial condition and results of operations.

|

|

•

|

We rely on our information technology systems to manage numerous aspects of our business. A cyber-based attack of these

systems could disrupt our ability to deliver services to our customers and could lead to increased overhead costs, decreased revenues, and harm to our reputation.

|

|

•

|

System failures, defects, errors, or vulnerabilities in our website, applications, backend systems, or other technology

systems or those of third-party technology providers could harm our reputation and brand and adversely impact our business, financial condition, and results of operations.

|

|

•

|

We will rely on third parties maintaining open marketplaces to distribute our mobile and web applications and we currently

rely on third parties to provide the software we use in certain of our products and services, including the provision of our flight management system. If these third parties interfere with the distribution of our products or services,

with our use of the software, or with the interoperability of our platform with the software, our business would be adversely affected.

|

|

•

|

If we are unable to adequately protect our intellectual property interests or are found to be infringing on the

intellectual property interests of others, we may incur significant expense and our business may be adversely affected.

|

|

•

|

Any damage to our reputation or brand image could adversely affect our business or financial results.

|

|

•

|

As part of our growth strategy, we may engage in future acquisitions that could disrupt our business and have an adverse

impact on our financial condition.

|

|

•

|

We are subject to risks associated with climate change, including the potential increased impacts of severe weather events

on our operations and infrastructure.

|

|

•

|

Terrorist activities or warnings have dramatically impacted the aviation industry and will likely continue to do so.

|

|

•

|

Our operations in the private aviation sector may be subject to risks associated with protests targeting private aviation

services.

|

Risks Related to Legal and Regulatory Matters

|

•

|

We are subject to significant governmental regulation.

|

|

•

|

Because our software could be used to collect and store personal information, privacy concerns in the territories in which

we operate could result in additional costs and liabilities to us or inhibit sales of our software.

|

|

•

|

We may become involved in litigation that may materially adversely affect us.

|

|

•

|

We are subject to various environmental and noise laws and regulations, which could have a material adverse effect on our

business, results of operations, and financial condition.

|

|

•

|

We may incur substantial maintenance costs as part of our leased aircraft return obligations.

|

|

•

|

Environmental regulation and liabilities, including new or developing laws and regulations, or our initiatives in response

to pressure from our stakeholders may increase our costs of operations and adversely affect us.

|

|

•

|

The issuance of operating restrictions applicable to one of the fleet types we operate could have a material adverse effect

on our business, results of operations, and financial condition.

|

Risks Related to Our Contractual Obligations

|

•

|

Our obligations in connection with our contractual obligations, including long-term leases and debt financing obligations,

could impair our liquidity and thereby harm our business, results of operations, and financial condition.

|

|

•

|

Agreements governing our debt obligations include financial and other covenants that provide limitations on our business

and operations under certain circumstances, and failure to comply with any of the covenants in such agreements could adversely impact us.

|

4

Risks Related to Ownership of Our Securities

and Being a Public Company

|

•

|

If we fail to maintain an effective system of disclosure controls and internal control over financial reporting, our

ability to produce timely and accurate financial statements or comply with applicable regulations could be impaired, which may adversely affect investor confidence in us and, as a result, the market price of the Common Stock.

|

|

•

|

Sales of Common Stock, or the perception of such sales, by us pursuant to this prospectus in the public market or

otherwise, could cause the market price for our Common Stock to decline.

|

|

•

|

Our Certificate of Incorporation designates specific courts as the exclusive forum for substantially all stockholder

litigation matters, which could limit the ability of our Stockholders to obtain a favorable forum for disputes with us or our directors, officers or employees.

|

|

•

|

Our management team has limited experience managing a public company.

|

|

•

|

The requirements of being a public company may strain our resources, divert our management’s attention, and affect our

ability to attract and retain qualified board members.

|

|

•

|

We may never realize the full value of our intangible assets or our long-lived assets, causing us to record impairments

that may materially adversely affect our financial conditions and results of operations.

|

|

•

|

We may be subject to securities litigation, which is expensive and could divert our management’s attention.

|

|

•

|

Because we became a publicly traded company by means other than a traditional underwritten initial public offering, our

stockholders may face additional risks and uncertainties.

|

|

•

|

An active market for our securities may not develop, which would adversely affect the liquidity and price of our

securities.

|

|

•

|

If securities or industry analysts do not publish research or reports about our business, if they change their

recommendations regarding our Common Stock, or if our operating results do not meet their expectations, our Common Stock price and trading volume could decline.

|

Risks Related to Ownership of Our Securities

and Being a Public Company

|

•

|

If you purchase shares of our common stock in this offering, you will incur immediate and substantial dilution.

|

|

•

|

We have broad discretion in the use of the net proceeds from this offering and may invest or spend the proceeds in ways

with which you do not agree and in ways that may not yield a return on your investment.

|

|

•

|

Because there are no current plans to pay cash dividends on the Common Stock for the foreseeable future, you may not

receive any return on investment unless you sell the Common Stock at a price greater than what you paid for it.

|

|

•

|

The market price of the Common Stock may be volatile, which could cause the value of your investment to decline.

|

Corporate Information

Our business mailing address is 1954 Airport Rd., Suite 124,

Chamblee, Georgia 30341 and our telephone number is 844-399-8998. We also maintain a website at flyvolato.com. The information contained in or accessible from our website is not incorporated into this prospectus, and you should not consider

it part of this prospectus. We have included our website address in this prospectus solely as an inactive textual reference. You should not rely on any such information in making the decision of whether to purchase our securities.

5

THE OFFERING

The following summary of the offering

contains basic information about the offering and the securities being offered and is not intended to be complete. It does not contain all the information that may be important to you. For a more complete understanding of our securities,

please refer to the section titled “Description of Securities That We Are Offering.”

Issuer

Volato Group, Inc.

Securities being offered by us

Up to 6,849,315 shares of Common Stock or Pre-Funded Warrants to purchase up

to 6,849,315 shares of Common Stock (sales of Pre-Funded Warrants, if sold, would reduce the number of shares of Common Stock that we are offering on a one-for-one basis), and (ii) Common Warrants to purchase up to 6,849,315 shares of

Common Stock. Each share of Common Stock and/or Pre-funded Warrant will be sold together with one Common Warrant.

Pre-funded warrant offered by us

We are offering to certain purchasers whose purchase of shares of Common

Stock in this offering would otherwise result in the purchaser, together with its affiliates and certain related parties, beneficially owning more than 4.99% of our outstanding shares of Common Stock immediately following the closing of

this offering, the opportunity to purchase, if such purchasers so choose, Pre-Funded Warrants, in lieu of shares of Common Stock that would otherwise result in any such purchaser's beneficial ownership, together with its affiliates and

certain related parties, exceeding 4.99% (or, at the election of such purchaser, 9.99%) of our outstanding shares of Common Stock immediately following the consummation of this offering. The purchase price of each Pre-Funded Warrant is

equal to the purchase price of the shares of Common Stock in this offering minus $0.0001, the exercise price of each Pre-Funded Warrant. Each Pre-Funded Warrant is immediately exercisable and may be exercised at any time until it has been

exercised in full. For each Pre-Funded Warrant we sell, the number of shares of Common Stock we are offering will be decreased on a one-for-one basis. This offering also relates to the shares of Common Stock issuable upon exercise of any

Pre-Funded Warrants sold in this offering.

Shares of our common stock

outstanding prior to this offering

29,258,087 shares of Common Stock as of May 23, 2024

Shares of our common stock to be

outstanding immediately after this offering

36,107,402 shares of Common Stock, assuming 100% of the maximum amount

offered is issued and no sales of Pre-Funded Warrants which, if sold, would reduce the number of shares of Common Stock that we are offering on a one-for-one basis.

Common Warrants

Each share of Common Stock will be sold together with one Common Warrant.

Each Common Warrant has an exercise price per share equal to 100% of the public offering price of shares in this offering; the Common Warrant expires on the anniversary of the original

6

issuance date. Because we will issue Common Warrant for each share of

Common Stock and for each Pre-Funded Warrant sold in this offering, the number of Common Warrants sold in this offering will not change as a result of a change in the mix of shares of Common Stock and Pre-Funded Warrants sold. This offering

also relates to the shares of Common Warrants sold in this offering, and the shares of Common Stock issuable upon exercise of any Common Warrants sold in this offering.

Reasonable Best Efforts

We have agreed to issue and sell the securities offered hereby to the

purchasers through the placement agent. The placement agent is not required to buy or sell any specific number or dollar amount of the securities offered hereby, but it will use its reasonable best efforts to solicit offers to purchase the

securities offered by this prospectus. See “Plan of Distribution” on page 102 of this prospectus.

Use of proceeds

We intend to use the net proceeds of this offering, together with our

existing cash and cash equivalents for working capital and general corporate purposes, which may include advancing our aircraft sales and ownership program, our aircraft management services, and our charter flights. However, this is a

reasonable best efforts offering with no minimum number of securities or amount of proceeds as a condition to closing, and we may not sell all or any of the securities offered pursuant to this prospectus; and, as a result, we may receive

significantly less in net proceeds in this offering. For example, if we sell only 10%, 25%, 50% or 75% of the maximum amount offered, our gross proceeds will be approximately $1.0 million, $2.5 million, $5.0 million or $7.5 million,

respectively. See “Use of Proceeds.”

Market for our common stock

Our common stock is listed on the NYSE American under the symbol “SOAR.”

Risk factors

Any investment in the common stock offered hereby is speculative and involves a

high degree of risk. You should carefully consider the information set forth under “Risk Factors” elsewhere in this prospectus.

Unless we specifically state otherwise or the context otherwise

requires, the number of shares of Common Stock outstanding does not include:

|

•

|

2,369,169 shares of common stock issuable upon exercise of options issued under the Company’s 2021 Plan outstanding as of

December 31, 2023, with a weighted-average exercise price of $1.43 per share;

|

|

•

|

5,608,690 shares of common stock available for future issuance as of December 31, 2023 under the Company's 2023 Plan;

|

|

•

|

13,800,000 shares of common stock issuable upon the exercise of public warrants as of December 31, 2023; and

|

|

•

|

15,226,000 shares of common stock issuable upon the exercise of private warrants as of December 31, 2023.

|

7

This prospectus contains forward-looking statements. All

statements contained in this prospectus other than statements of historical fact, including statements regarding our future results of operations, financial position, market size and opportunity, our business strategy and plans, the factors

affecting our performance and our objectives for future operations, are forward-looking statements. The words “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “could,” “would,” “expect,” “objective,” “plan,”

“potential,” “seek,” “grow,” “target,” “if” and similar expressions are intended to identify forward-looking statements. We have based these forward-looking statements largely on our current expectations and projections about future events and

trends that we believe may affect our financial condition, results of operations, business strategy, short-term and long-term business operations and objectives and financial needs. These forward-looking statements are subject to a number of

risks, uncertainties and assumptions, including those described in the “Risk Factors.” Moreover, we operate in a very competitive and rapidly changing environment. New risks emerge from time to time. It is not possible for our management to

predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we

may make. In light of these risks, uncertainties and assumptions, the future events and trends discussed in this prospectus may not occur and actual results could differ materially and adversely from those anticipated or implied in the

forward-looking statements. Forward-looking statements contained in this prospectus include, but are not limited to, statements about:

|

•

|

our ability to successfully implement our growth strategies;

|

|

•

|

our ability to expand existing products and service offerings or launch new products and service offerings;

|

|

•

|

our ability to achieve or maintain profitability in the future;

|

|

•

|

geopolitical events and general economic conditions;

|

|

•

|

our ability to grow complementary products and service offerings;

|

|

•

|

our ability to adequately integrate past and future acquisitions into our business;

|

|

•

|

our ability to respond to decreases in demand for private aviation services and changes in customer preferences;

|

|

•

|

our ability to operate in a competitive market;

|

|

•

|

our ability to retain or attract key employees or other highly qualified personnel;

|

|

•

|

our ability to obtain or maintain adequate insurance coverage;

|

|

•

|

our ability to build and maintain strong brand identity for our products and services and expand our customer base;

|

|

•

|

our ability to respond to a failure in our technology to operate our business;

|

|

•

|

our ability to obtain financing or access capital markets in the future;

|

|

•

|

our ability to respond to regional downturns or severe weather or catastrophic occurrences or other disruptions or events;

|

|

•

|

our ability to respond to losses and adverse publicity stemming from accidents involving our aircraft;

|

|

•

|

our ability to respond to existing or new adverse regulations or interpretations thereof;

|

|

•

|

our ability to successfully defend litigation or investigations;

|

|

•

|

the impact of changes in U.S. tax laws;

|

|

•

|

our public securities’ potential liquidity and trading; and

|

|

•

|

other factors detailed under the section entitled “Risk Factors”.

|

We caution you that the foregoing list may not contain all of the

forward-looking statements made in this prospectus. You should not rely upon forward-looking statements as predictions of future events. The events and circumstances reflected in the forward-looking statements may not be achieved or occur.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels

8

of activity, performance or achievements. Except as required by law, we do not

intend to update any of these forward-looking statements after the date of this prospectus or to conform these statements to actual results or revised expectations.

You should read this prospectus and the documents that we

reference in this prospectus and have filed with the SEC as exhibits to the registration statement of which this prospectus is a part with the understanding that our actual future results, levels of activity, performance and events and

circumstances may be materially different from what we expect.

We obtained the industry and market data used throughout this

prospectus from our own internal estimates and research, as well as from independent market research, industry and general publications and surveys, governmental agencies, publicly available information and research, surveys and studies

conducted by third parties. Internal estimates are derived from publicly available information released by industry analysts and third- party sources, our internal research and our industry experience, and are based on assumptions made by us

based on such data and our knowledge of our industry and market, which we believe to be reliable and reasonable. In some cases, we do not expressly refer to the sources from which this data is derived. In addition, while we believe the

industry and market data included in this prospectus is reliable and based on reasonable assumptions, such data involve material risks and other uncertainties and are subject to change based on various factors, including those discussed in

the section entitled “Risk Factors” and “Cautionary Note Regarding Forward Looking Statements.” These and other factors could cause

results to differ materially from those expressed in the estimates made by the independent parties or by us.

9

Investing in our common stock involves a

high degree of risk. You should consider and read carefully all of the risks and uncertainties described below, as well as other information included in this prospectus, including our consolidated financial statements and related notes

appearing at the end of this prospectus, before making an investment decision. The occurrence of any of the following risks or additional risks and uncertainties not presently known to us or that we currently believe to be immaterial could

materially and adversely affect our business, financial condition, results of operations and prospects. If any of these risks actually occur, the trading price of our common stock could decline, and you may lose all or part of your original

investment. This prospectus also contains forward-looking statements and estimates that involve risks and uncertainties. Our actual results could differ materially from those anticipated in the forward-looking statements as a result of

specific factors, including the risks and uncertainties described below.

Risks Related to Our Business and Industry

We have a limited operating history and

history of net losses, and may continue to experience net losses in the future.

You should consider our business and prospects in light of the

risks, expenses, and difficulties encountered by companies in their early stage of development. We launched our business on January 7, 2021. Accordingly, we have limited operating history upon which to base an evaluation of our business and

prospects.

While we seek to differentiate our private aviation services by

using a cost-effective fleet and offering different products to meet customers’ individual needs, including (i) our ownership program, (ii) our potential jet card customers’ ability to purchase a block of flight hours, and (iii) deposit

program products, we may not be successful in attracting or retaining customers. Our JetShare customers’ ability to earn charter income on unused hours may not be realized by our customers to the extent anticipated, or at all. Even if these

benefits are realized as anticipated, our competitors may offer directly competing services or other features that customers find more attractive.

We have experienced significant net losses since our inception

and, given our limited operating history and the significant operating and capital expenditures associated with our business plan, it may experience continuing net losses in the future and may never become profitable (as determined by U.S.

Generally Accepted Accounting Principles or otherwise). If we achieve profitability, we cannot be certain that it will be able to sustain or increase profitability. To achieve and sustain profitability, we must accomplish numerous objectives,

including broadening and stabilizing our sources of revenue and increasing the number of customers that utilize our service. Accomplishing these objectives may require significant capital investments. We cannot assure you that we will be able

to achieve these objectives.

Significant reliance on HondaJet and Gulfstream

aircraft and parts poses risks to our business and prospects.

As part of our business strategy, we have historically flown

HondaJet aircraft and are expanding to fly Gulfstream aircraft. If either Honda Aircraft Company or Gulfstream fails to adequately fulfill our obligations towards us or experiences interruptions or disruptions in production or provision of

services due to, for example, bankruptcy, natural disasters, labor strikes, or disruption of their supply chain, we may experience a significant delay in the delivery of or fail to receive previously ordered aircraft and parts, which would

adversely affect our revenue and results of operations and could jeopardize our ability to meet the demands of our customers. Although we could choose to operate aircraft of other manufacturers, such a change would involve substantial expense

to us and could disrupt our business activities. Additionally, the issuance of the Federal Aviation Administration (“FAA”) or manufacturer directives restricting or prohibiting the use of either HondaJet or Gulfstream aircraft would have a

material adverse effect on our business, results of operations, and financial condition.

We may not be able to successfully implement

our growth strategies.

Our growth strategies include, among other things, attracting new

customers and retaining existing customers, expanding our addressable market by opening up private aviation to customers that have not historically used private aviation services, expanding into new markets and developing adjacent businesses.

We face numerous challenges in implementing our growth strategies, including our ability to execute on market, business, product/service and geographic expansions. For example, our continued growth could increase the strain on our resources,

and we could experience operating difficulties, including difficulties in hiring, training, and managing an increasing number of pilots and other employees. These difficulties may result in the erosion of our brand image, divert the attention

of our management and key employees, and impact our financial and operational results.

10

Our strategies for growth are dependent on, among other things,

our ability to expand existing products and services and launch new products and services. Although we may devote significant financial and other resources to the expansion of our products and service offerings, our efforts may not be

commercially successful or achieve the desired results. Our financial results and our ability to maintain or improve our competitive position will depend on our ability to effectively gauge the direction of our key marketplaces and successfully

identify, develop, market, and sell new or improved products and services in these changing marketplaces. Our inability to successfully implement our growth strategies could have a material adverse effect on our business, financial condition,

and results of operations and any assumptions underlying estimates of expected cost savings or expected revenues may be inaccurate.

If we are not able to successfully enter

into new markets and services and enhance our existing products and services, our business, financial condition, and results of operations could be adversely affected.

Our growth will depend in part on our ability to successfully

enter new markets and offer new services and products. Significant changes to our existing geographic coverage or the introduction of new and unproven markets may require us to obtain and maintain applicable permits, authorizations, or other

regulatory approvals. Developing and launching new or expanded locations involves significant risks and uncertainties, including risks related to the reception of such locations by existing and potential future customers, increases in

operational complexity, unanticipated delays or challenges in implementing such new locations or enhancements, increased strain on our operational and internal resources (including an impairment of our ability to accurately forecast customer

demand), and negative publicity in the event such new or enhanced locations are perceived to be unsuccessful. We have scaled our business rapidly, and significant new initiatives may result in operational challenges affecting our business. In

addition, developing and launching new or expanded locations may involve significant upfront investment, such as additional marketing and terminal build out, and such expenditures may not generate a return on investment. Any of the foregoing

risks and challenges could negatively impact our ability to attract and retain customers. If these new or expanded locations are unsuccessful or fail to attract a sufficient number of customers to be profitable, or we are unable to bring new or

expanded locations to market efficiently, our business, financial condition, and results of operations could be adversely affected.

We are exposed to the risk of a decrease in

demand for private aviation services.

Our business is concentrated on private aviation services, which

are vulnerable to changes in consumer preferences, discretionary spending, and other market changes impacting luxury goods and discretionary purchases. The occurrence of geopolitical events such as war, including the current conflicts in Israel

and Ukraine and Israel, terrorism, civil unrest, political instability, environmental or climatic factors, natural disaster, pandemic or epidemic outbreak, public health crisis and general economic conditions may have a significant adverse

effect on our business. The global economy has in the past, and will in the future, experience recessionary periods and periods of economic instability such as the business disruption and related financial impact resulting from the global

COVID-19 health crisis. During such periods, our current and future users may choose not to make discretionary purchases or may reduce overall spending on discretionary purchases. These changes could result in reduced consumer demand for air

transportation, including our private aviation services, or could shift demand from our private aviation services to other methods of air or ground transportation for which we do not offer a competing service. If we are unable to generate

demand or there is a future shift in consumer spending away from private aviation services, our business, financial condition, and results of operations could be adversely affected.

The private aviation industry is subject to

competition.

Many of the markets in which we operate are competitive as a

result of, among other things, the expansion of existing private aircraft operators, expanding private aircraft ownership, and alternatives such as luxury commercial airline service as well as commercial carriers. We compete against several

private aviation operators with different business models, and local and regional private charter operators. Although our business model significantly differs from commercial air carriers, we also compete with commercial air carriers who have

larger operations and service areas and fixed routes, as well as access to financial resources not available to us. Factors that affect competition in the private aviation industry include price, reliability, safety, regulations, professional

reputation, aircraft availability, equipment and quality, consistency, and ease of service, willingness and ability to serve specific airports or regions, and investment requirements. There can be no assurance that our competitors will not be

successful in capturing a share of our present or potential customer base. The materialization of any of these risks could adversely affect our business, financial condition, and results of operations.

11

We may require substantial additional

funding to finance our operations, but adequate additional financing may not be available when we need it, on commercially acceptable terms, or at all.

Our operations are capital intensive, and we require sufficient

liquidity levels for our operations and strategic growth plans. We have financed our operations and capital expenditures primarily through private financing rounds, and through financing of aircraft pre-delivery payment obligations. In the

future, we could be required to raise capital through public or private financing or other arrangements. This financing may not be available on acceptable terms, or at all, and our failure to raise capital when needed could harm our business.

Numerous factors may affect our ability to obtain financing or access the capital markets in the future on terms attractive to us, including our liquidity, operating cash flows, and the timing of capital requirements, credit status and any

credit ratings assigned to us, market conditions in the private aviation industry, U.S. and global economic conditions, and conditions in the capital markets generally, and the availability of our assets as collateral for future financings. We

may sell equity securities or debt securities in one or more transactions at prices and in a manner as we may determine from time to time. If we sell any such securities in subsequent transactions, our current investors may be materially

diluted. Any debt financing, if available, may involve restrictive covenants and could reduce our operational flexibility or profitability. If we cannot raise funds on commercially acceptable terms, we may not be able to grow our business or

respond to competitive pressures and our business, results of operations, and financial condition could be materially adversely affected.

The loss of key personnel upon whom we

depend on to operate our business or the inability to attract additional qualified personnel could adversely affect our business.

We believe that the future success of Volato Group will depend in

large part on our ability to retain or attract highly qualified management, and technical and other personnel, particularly pilots and mechanics. We compete against commercial and private aviation operators, including the major U.S. airlines

for pilots, mechanics and other skilled labor and some of the airlines may offer wage and benefit packages which exceed ours. As we grow our fleet and/or more pilots approach retirement age, we may be affected by a pilot shortage. We may not be

successful in retaining key personnel or in attracting other highly qualified personnel. Any inability to retain or attract significant numbers of qualified management and other personnel would have a material adverse effect on our business,

results of operations, and financial condition.

The supply of pilots to the aviation

industry is limited and may negatively affect our operations and financial condition. Increases in our labor costs, which constitute a substantial portion of our total operating costs, may adversely affect our business, results of operations,

and financial condition.

Our pilots are subject to stringent pilot qualification, including

minimum flight time hour requirements, and training standards (“FAA Qualification Standards”). The existence of these requirements effectively limits the supply of qualified pilot candidates and increases pilot salaries and related labor costs.

Additionally, our pilots are subject to strict rest and duty rules to minimize pilot fatigue. This limits the number of types of operations that our pilots can fly. If our attrition rates are higher than our ability to hire and retain

replacement pilots, our operations and financial results could be materially and adversely affected. A shortage of pilots would require us to further increase our labor costs, which would result in a material reduction in our results of

operations. These requirements also impact pilot scheduling, work hours, and the number of pilots required to be employed for our operations.

In addition, our operations and financial condition may be

negatively impacted if we are unable to train pilots in a timely manner. Due to an industry-wide shortage of qualified pilots, driven by the flight hours requirements under the FAA Qualification Standards and attrition resulting from the hiring

needs of other industry participants, pilot training timelines have significantly increased and stressed the availability of flight simulators, instructors, and related training equipment. As a result, the training of our pilots may not be

accomplished in a cost-efficient manner or in a manner timely enough to support our operational needs.

We may be subject to unionization, work

stoppages, slowdowns or increased labor costs, and the unionization of our employees could result in increased labor costs.

Our business is labor-intensive and while our employees are not

currently represented by labor unions, we may, in the future, experience union organizing activities by our employees. These union organization activities could lead to work slowdowns or stoppages, which could result in loss of business. In

addition, union activity could result in demands that may increase our operating expenses and adversely affect our business, financial condition, results of operations, and competitive position. Any of the different crafts or classes of our

crewmembers could unionize at any

12

time, which would require us to negotiate in good faith with the crewmember

group’s certified representative concerning a collective bargaining agreement. In addition, we may be subject to disruptions by unions protesting the non-union status of our other crewmembers. Any of these events would be disruptive to our

operations and could harm our business.

We are exposed to operational disruptions due

to maintenance.

Our fleet requires regular maintenance work, which may cause

operational disruption. Our inability to perform timely maintenance and repairs can result in our aircraft being underutilized, which could have an adverse impact on our business, financial condition, and results of operations. On occasion,

airframe manufacturers or regulatory authorities require mandatory or recommended modifications to be made across a particular fleet which may mean having to ground a particular type of aircraft. This may cause operational disruption to and

impose significant costs on us. Furthermore, delivery of components and parts could take a significant period of time, which could result in delays in our ability to maintain and repair our aircraft. Any delays may pose a risk to our business,

financial condition, and results of operations. These risks include the potential need to fly our customers on other operators’ equipment at our expense, which can result in additional costs that may be unpredictable.

Federal, state, and local tax rules can

adversely impact our results of operations and financial position.

We are subject to federal, state, and local taxes in the United

States. Significant judgment is required in sourcing revenue among various jurisdictions, and in determining the provision for income taxes. We believe our income tax estimates are reasonable, but such estimates assume no changes in current tax

rates. In addition, if the Internal Revenue Service or other taxing authority disagrees with a tax position we have taken, as to sourcing, tax rates, or otherwise, and upon final adjudication, we are required to change our position, we could

incur additional tax liability, including interest and penalties. These costs and expenses could have a material adverse impact on our financial condition, results of operations, and cash flows. Additionally, the taxability of our offerings is

subject to various interpretations within the taxing jurisdictions in which we operate. Consequently, in the ordinary course of business, a jurisdiction may contest our reporting positions with respect to the application of our tax code to our

offerings. A conflicting position taken by a state or local taxation authority on the taxability of our offerings could result in additional tax liabilities and could negatively impact our competitive position in that jurisdiction. If we fail

to comply with applicable tax laws and regulations, we could suffer civil or criminal penalties in addition to the delinquent tax assessment. To the extent our offerings are or may be determined to be taxable in a given jurisdiction, the

jurisdiction may still increase the tax rate assessed on such offerings. The property and gross receipts taxation of a mobile asset business such as aviation also varies widely among U.S. jurisdictions. Volato Group seeks to directly or

indirectly pass-through such taxes to our customers. In the event we are not able to pass-through any such taxes, our results of operations, financial condition, and cash flows could be adversely impacted.

We may not realize the tax benefits from our

aircraft ownership program.

We offer a Part 135 aircraft ownership program in which owners,

through an LLC treated as a partnership for U.S. federal income tax purposes, can receive a revenue share of income from charter flights made by the aircraft as well as deductions for depreciation, including bonus depreciation under

Section 168(k) of the IRC. If the aircraft is “listed property” within the meaning of Section 280F of the IRC, the LLC must maintain records to establish that the aircraft is predominantly used in a qualified business use to be eligible for

bonus depreciation. We and the LLCs believe our position, that the aircraft is not listed property, is reasonable. However, the Internal Revenue Service may disagree with this position. If so, the LLC owners will not be able to claim a

deduction for bonus depreciation unless the LLC is able to provide adequate substantiation demonstrating that the aircraft is predominantly used in a qualified business use.

In addition, the bonus depreciation deduction provided by

Section 168(k) of the IRC for aircraft placed in service after September 27, 2017, and before December 31, 2022 (December 31, 2023, with respect to certain long production property, including certain transportation property) is equal to 100% of

the aircraft’s adjusted basis. With respect to aircraft placed in service thereafter, the bonus depreciation deduction phases down 20% per year, thus reducing the tax benefits of participating in our aircraft ownership program. This could

result in lower participation in our aircraft ownership programs. Further, Congress could enact legislation that would more quickly eliminate bonus depreciation and the associated tax benefits.

13

Significant increases in fuel costs could

have a material adverse effect on our business, financial condition and results of operations.

Fuel is essential to the operation of our aircraft and to our

ability to carry out our transport services. Fuel costs are a key component of the pricing of our charter services. We pass on fuel costs to our customers either directly or indirectly, and so we do not maintain hedging arrangements for the

price of fuel. However, increased fuel costs may affect the demand for our charter service. Increases in fuel costs, including as a result of the current conflict in Ukraine and the measures governments and private organizations worldwide have

implemented in response thereto, may have a material adverse effect on our business, financial condition, and results of operations.

Some of our business may become dependent on

third-party operators to provide flights for our customers. If third-party operators’ flights, which are required to serve a substantial portion of our business, are not available or do not perform adequately, our costs may increase and our

business, financial condition, and results of operations could be adversely affected.

While we operate a significant portion of the flights for our

customers, we are subject to the risk of not being able to support the charter demand from our customers. We offer unlimited guaranteed charter hour booking, with certain conditions, to those customers who are “owners”, meaning those customers

are members of entities that own and lease HondaJet fleet aircraft to us. We are subject to variable and potentially surging demand from owners under these agreements, which could require us to find third-party operators to perform an unknown

percentage of these flights. We face the risk of paying high prices for third-party operator flights, as we do not have third-party operator contracts in place. We face the risk that we may not be able to find third-party operators to perform

services as needed. Our potential inability to meet customer charter demand could have a material adverse effect on our business. To the extent that we cannot find a third-party operator to provide a flight at the same rate we were charging the

owner, we may actually lose money on these third-party flights.

For the year ended December 31, 2022, approximately 1.0% of our

flights were fulfilled by third-party aircraft operators on our behalf. We face the risk that this percentage may increase at any time. In addition, where we do rely on third-party operators due to our reliance on third-parties to supplement

our capabilities, we are subject to the risk of disruptions to their operations, which has in the past and may in the future result from many of the same risk factors disclosed herein, such as the impact of adverse economic conditions and the

inability of third-parties to hire or retain skilled personnel, including pilots and mechanics. As the private aviation market grows, we expect competition for third-party aircraft operators to increase. Further, we expect that as competition