EX-99.1

Published on February 21, 2024

INVESTOR PRESENTATION FEBRUARY 2024 ENJOY FLYING MORE ® NYSE:SOAR

Disclaimer Disclosure Regarding Forward-Looking Statements Some statements in this Presentation may be considered “forward-looking statements” for purposes of the Federal securities laws. Forward-looking statements generally relate to management’s current expectations, hopes, beliefs, intentions, strategies, or projections about future events or future financial or operating performance. For example, statements regarding anticipated growth in the industry in which Volato operates and anticipated growth in the demand for Volato’s services, and projections of Volato’s future financial results or other metrics are forward-looking statements. The words “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intends,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” project,” “should,” “would,” and similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. Forward-looking statements are subject to risks, uncertainties, and other factors which could cause actual results to differ materially from those expressed or implied by the forward-looking statements. You should not rely on these forward-looking statements as predictions of future events. Forward-looking statements are based upon estimates and assumptions that, while considered reasonable by management, are inherently uncertain. Factors that may cause actual result to differ from current expectations include, but are not limited to: changes to existing applicable laws or regulations; the possibility that Volato may be adversely affected by economic, business, or competitive factors; Volato’s estimates of expenses and profitability; the evolution of the markets in which Volato competes and Volato’s ability to enter new markets effectively; the ability of Volato to implement its strategic initiatives and continue to innovate its existing services; the impact of government and other responses to public health crisis such as pandemics on Volato’s business; and other risks and uncertainties set forth in the section entitled “Risk Factors” and Cautionary Note Regarding Forward-Looking Statements in Volato’s Form 8-K dated December 7, 2023 and those risk factors set forth in subsequent filings Volato may make from time-to-time with the Securities and Exchange Commission (SEC). Volato cautions that the foregoing list of factors is not exclusive. Nothing in this Presentation should be regarded as a representation by any person that the forward-looking statements set forth herein will be achieved or that any of the contemplated results of the forward-looking statements will be achieved. You should not place undue reliance on forward-looking statements, which speak only as of the date they are made. Volato does not undertake any duty to update these forward-looking statements. Financial Information; Non-GAAP Financial Measures This Presentation includes unaudited financial information, which is subject to further review and adjustment, and may differ from the financial information that will be subsequently filed in a periodic report by Volato with the SEC. As a result, the historic financial information contained in this Presentation and any estimates or projections relying on this financial information may change and constitutes forward-looking information. The Presentation also includes certain financial measures not presented in accordance with generally accepted accounting principles (“GAAP”) and other metrics derived therefrom. The non- GAAP financial measures are not measures of financial performance in accordance with GAAP and may exclude items that are significant in understanding and assessing Volato’s financial results. Therefore, these measures should not be considered in isolation or as an alternative to net income, cash flows from operations, or other measures of profitability, liquidity, or performance under GAAP. Volato’s presentation of these measures may not be comparable to similarly titled measures used by other companies. Volato believes that the use of these non- GAAP financial measures are subject to inherent limitations as they reflect the exercise of business judgments by management about which items of income and expense are included or excluded in determining these non-GAAP financial measures. 2

Disclaimer (Cont’d) This Presentation also includes certain projections of non-GAAP financial measures. Due to the high variability and difficulty in making accurate forecasts and projections of financial information, together with the fact that some information may be excluded because it is not ascertainable or accessible, Volato is unable to quantify certain amounts that would be required to be included in the most directly comparable GAAP financial measures without unreasonable effort. Consequently, no disclosure of estimated comparable GAAP measures is included and no reconciliation of the forward-looking non-GAAP financial measures is included. Use of Projections This Presentation contains financial forecasts for Volato with respect to certain financial results of Volato. Volato’s independent auditor has not audited, studied, reviewed, compiled, or performed any procedures with respect to the projections for the purpose of their inclusion in this Presentation. Accordingly, they did not express an opinion or provide any other form of assurance with respect thereto for the purpose of this Presentation. These projections are forward-looking statements and should not be relied upon as being necessarily indicative of future results. In this Presentation, certain of the above-mentioned projected information has been provided for purposes of providing comparisons with historical data. The assumptions and estimates underlying the prospective financial information are inherently uncertain and are subject to a wide variety of significant business, economic, and competitive risks and uncertainties that could cause actual results to differ materially from those contained in the prospective financial information. Accordingly, there can be no assurance that the prospective results are indicative of the future performance of Volato or the actual results will not differ materially from those presented in the prospective financial information. Inclusion of the prospective financial information in this Presentation should not be regarded as a representation by any person that the results contained in the prospective financial information will be achieved. Industry and Market Data In this Presentation, Volato relies on and refers to certain information and statistics obtained from third-party sources which it believes to be reliable. Volato has not independently verified the accuracy or completeness of any third-party information. Trademarks This Presentation may contain trademarks, service marks, trade names, and copyrights of other companies, which are the property of their respective owners. Solely for convenience, the trademarks, service marks, trade names, and copyrights referred to in this Presentation may be listed without the trademark, service mark, or copyright symbols, but and Volato will assert the rights of the applicable owners to these trademarks, service marks, trade names, and copyrights to the fullest extent under applicable law. 3

4 Table of Contents 1 2 3 Company Overview Business Model Volato Fleet Financials 4

COMPANY OVERVIEW

Fly Better, Fly Smarter, Fly Volato Volato brings the benefits of whole aircraft ownership to the fractional customer, providing Volato residual fleet availability which is filled through a unique suite of products and innovative software. 6

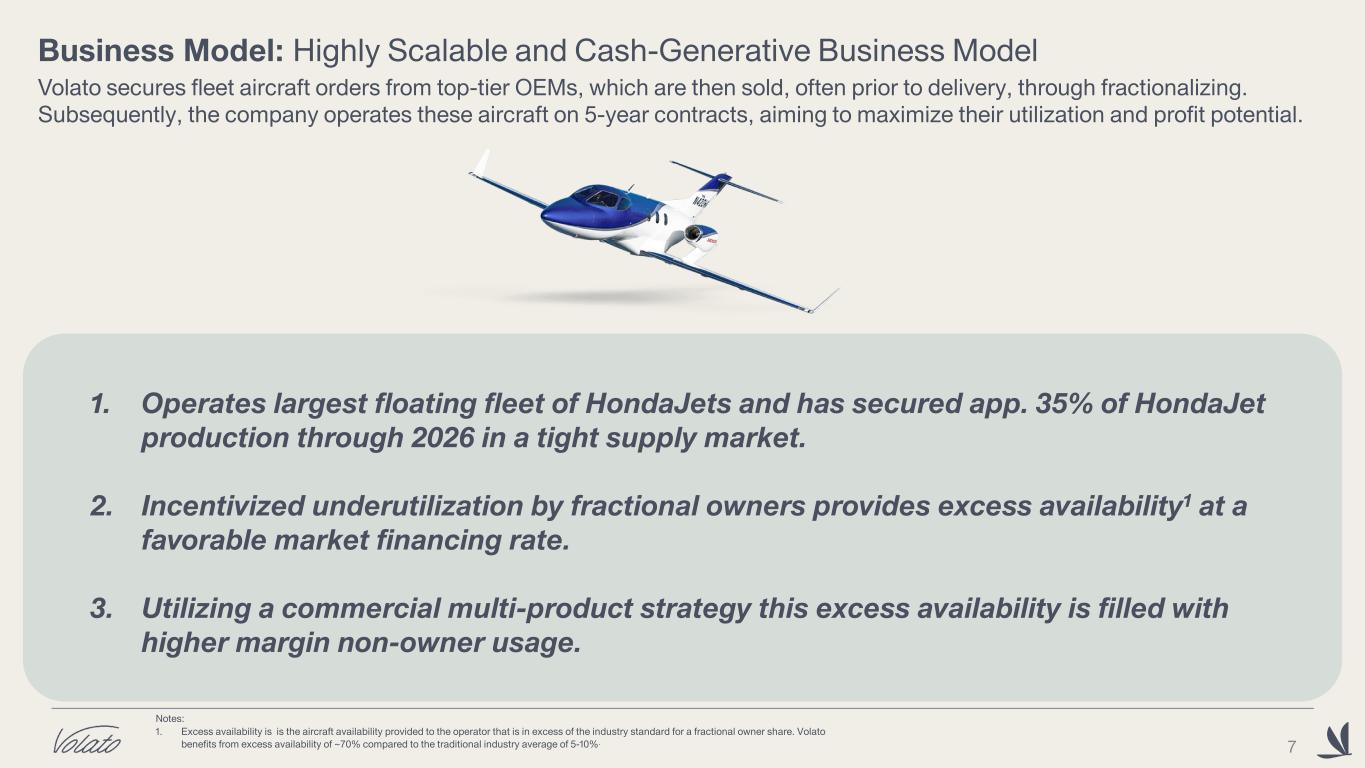

Business Model: Highly Scalable and Cash-Generative Business Model Volato secures fleet aircraft orders from top-tier OEMs, which are then sold, often prior to delivery, through fractionalizing. Subsequently, the company operates these aircraft on 5-year contracts, aiming to maximize their utilization and profit potential. 1. Operates largest floating fleet of HondaJets and has secured app. 35% of HondaJet production through 2026 in a tight supply market. 2. Incentivized underutilization by fractional owners provides excess availability1 at a favorable market financing rate. 3. Utilizing a commercial multi-product strategy this excess availability is filled with higher margin non-owner usage. 7 Notes: 1. Excess availability is is the aircraft availability provided to the operator that is in excess of the industry standard for a fractional owner share. Volato benefits from excess availability of ~70% compared to the traditional industry average of 5-10%.

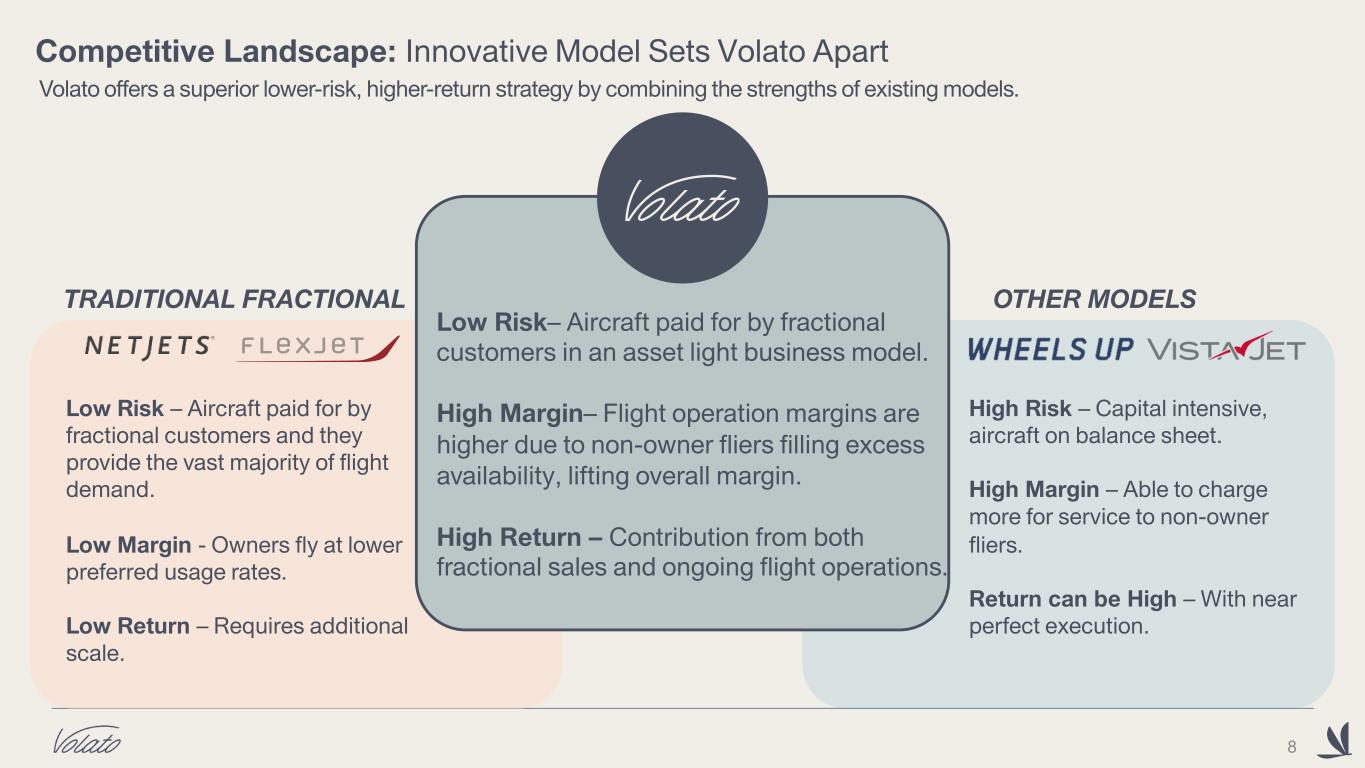

Competitive Landscape: Innovative Model Sets Volato Apart Volato offers a superior lower-risk, higher-return strategy by combining the strengths of existing models. 8 Low Risk – Aircraft paid for by fractional customers and they provide the vast majority of flight demand. Low Margin - Owners fly at lower preferred usage rates. Low Return – Requires additional scale. High Risk – Capital intensive, aircraft on balance sheet. High Margin – Able to charge more for service to non-owner fliers. Return can be High – With near perfect execution. Low Risk– Aircraft paid for by fractional customers in an asset light business model. High Margin– Flight operation margins are higher due to non-owner fliers filling excess availability, lifting overall margin. High Return – Contribution from both fractional sales and ongoing flight operations. TRADITIONAL FRACTIONAL OTHER MODELS

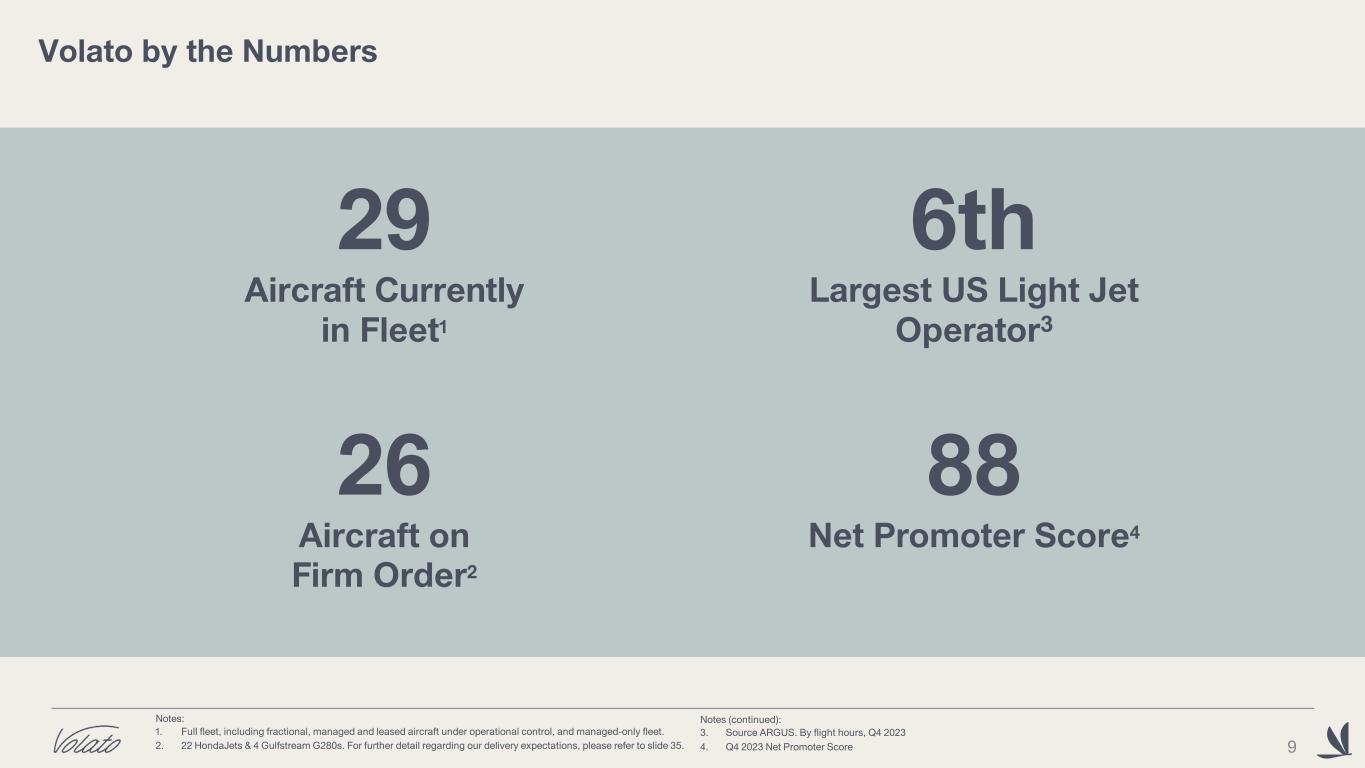

Volato by the Numbers Notes: 1. Full fleet, including fractional, managed and leased aircraft under operational control, and managed-only fleet. 2. 22 HondaJets & 4 Gulfstream G280s. For further detail regarding our delivery expectations, please refer to slide 35. 26 Aircraft on Firm Order2 29 Aircraft Currently in Fleet1 88 Net Promoter Score4 6th Largest US Light Jet Operator3 Notes (continued): 3. Source ARGUS. By flight hours, Q4 2023 4. Q4 2023 Net Promoter Score 9

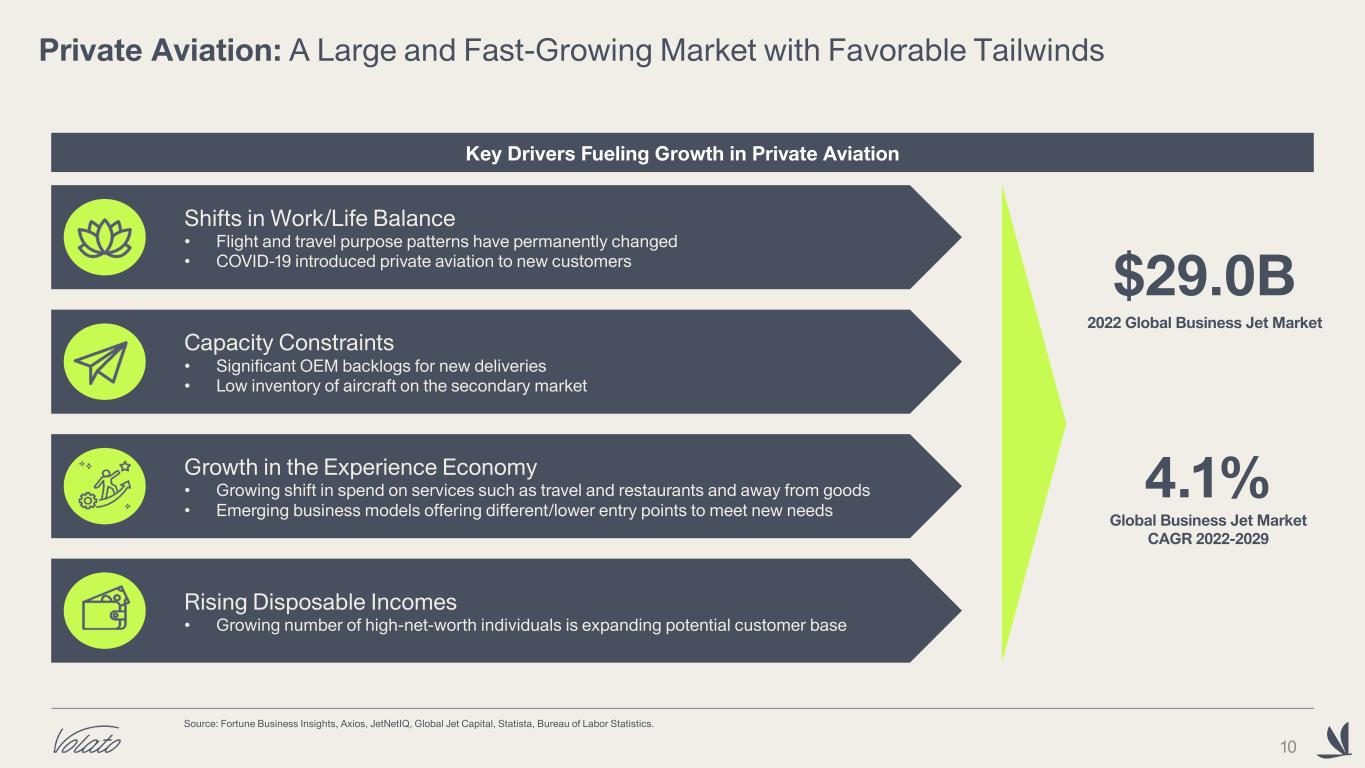

10 Shifts in Work/Life Balance • Flight and travel purpose patterns have permanently changed • COVID-19 introduced private aviation to new customers Capacity Constraints • Significant OEM backlogs for new deliveries • Low inventory of aircraft on the secondary market Growth in the Experience Economy • Growing shift in spend on services such as travel and restaurants and away from goods • Emerging business models offering different/lower entry points to meet new needs Private Aviation: A Large and Fast-Growing Market with Favorable Tailwinds $29.0B 2022 Global Business Jet Market 4.1% Global Business Jet Market CAGR 2022-2029 Key Drivers Fueling Growth in Private Aviation Source: Fortune Business Insights, Axios, JetNetIQ, Global Jet Capital, Statista, Bureau of Labor Statistics. Rising Disposable Incomes • Growing number of high-net-worth individuals is expanding potential customer base

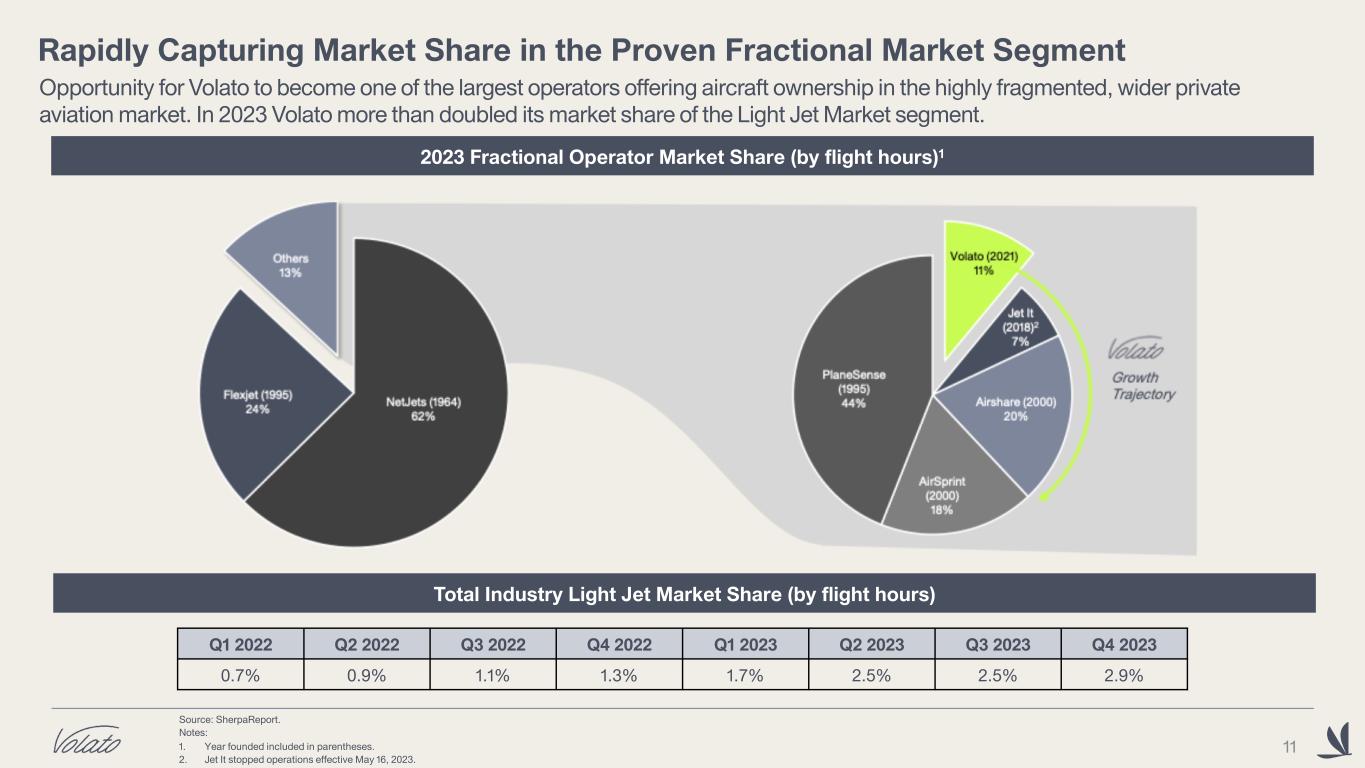

Rapidly Capturing Market Share in the Proven Fractional Market Segment Source: SherpaReport. Notes: 1. Year founded included in parentheses. 2. Jet It stopped operations effective May 16, 2023. 2023 Fractional Operator Market Share (by flight hours)1 Opportunity for Volato to become one of the largest operators offering aircraft ownership in the highly fragmented, wider private aviation market. In 2023 Volato more than doubled its market share of the Light Jet Market segment. Total Industry Light Jet Market Share (by flight hours) Q1 2022 Q2 2022 Q3 2022 Q4 2022 Q1 2023 Q2 2023 Q3 2023 Q4 2023 0.7% 0.9% 1.1% 1.3% 1.7% 2.5% 2.5% 2.9% 11

Operational team of seasoned industry professionals with deep industry experience Led by an entrepreneurial team and a commercial team with prior industry experience KeithRabin President Nicholas Cooper CFA Co-founder &CCO MattLiotta Co-founder&CEO SteveDrucker CTO Gary Waldman EVP, Fleet Performance Leading a diverse team of 240+ full-time employees including a strong pilot cohort with low attrition. Brian Coulter EVP, Operations Mark Heinen CFO Leadership: A Proven Management Team with Complementary Experience 12

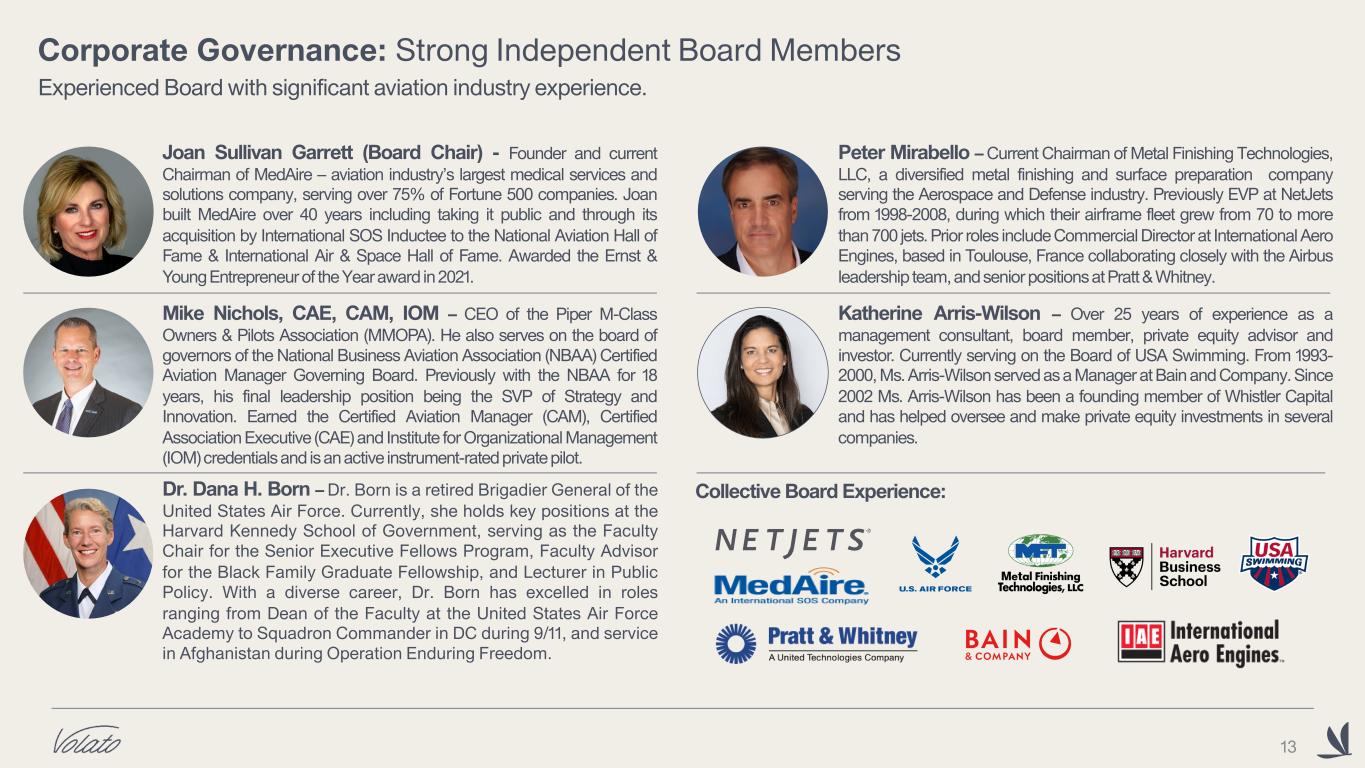

Joan Sullivan Garrett (Board Chair) - Founder and current Chairman of MedAire – aviation industry’s largest medical services and solutions company, serving over 75% of Fortune 500 companies. Joan built MedAire over 40 years including taking it public and through its acquisition by International SOS Inductee to the National Aviation Hall of Fame & International Air & Space Hall of Fame. Awarded the Ernst & Young Entrepreneur of the Year award in 2021. Mike Nichols, CAE, CAM, IOM – CEO of the Piper M-Class Owners & Pilots Association (MMOPA). He also serves on the board of governors of the National Business Aviation Association (NBAA) Certified Aviation Manager Governing Board. Previously with the NBAA for 18 years, his final leadership position being the SVP of Strategy and Innovation. Earned the Certified Aviation Manager (CAM), Certified Association Executive (CAE) and Institute for Organizational Management (IOM) credentials and is an active instrument-rated private pilot. Dr. Dana H. Born – Dr. Born is a retired Brigadier General of the United States Air Force. Currently, she holds key positions at the Harvard Kennedy School of Government, serving as the Faculty Chair for the Senior Executive Fellows Program, Faculty Advisor for the Black Family Graduate Fellowship, and Lecturer in Public Policy. With a diverse career, Dr. Born has excelled in roles ranging from Dean of the Faculty at the United States Air Force Academy to Squadron Commander in DC during 9/11, and service in Afghanistan during Operation Enduring Freedom. Peter Mirabello – Current Chairman of Metal Finishing Technologies, LLC, a diversified metal finishing and surface preparation company serving the Aerospace and Defense industry. Previously EVP at NetJets from 1998-2008, during which their airframe fleet grew from 70 to more than 700 jets. Prior roles include Commercial Director at International Aero Engines, based in Toulouse, France collaborating closely with the Airbus leadership team, and senior positions at Pratt & Whitney. Katherine Arris-Wilson – Over 25 years of experience as a management consultant, board member, private equity advisor and investor. Currently serving on the Board of USA Swimming. From 1993- 2000, Ms. Arris-Wilson served as a Manager at Bain and Company. Since 2002 Ms. Arris-Wilson has been a founding member of Whistler Capital and has helped oversee and make private equity investments in several companies. Collective Board Experience: Corporate Governance: Strong Independent Board Members Experienced Board with significant aviation industry experience. 13

A Focus on Safety and Sustainability Founded in 2021, Volato is unencumbered by legacy baggage and can lead the industry with a modern approach to business. Volato has a longstanding focus on safety and has been awarded the industry's highest safety ratings; IS-BAO Stage 3 and ARGUS Platinum. Operating the most efficient aircraft in its class, Volato is proud that all HondaJet flight operations are also intended to offset emissions through participation in 4Air’s offset program. Volato has a diverse and inclusive team1: • 25 % veteran • 22% female • 18% BIPOC 14 Notes: 1. As at 17 January 2024

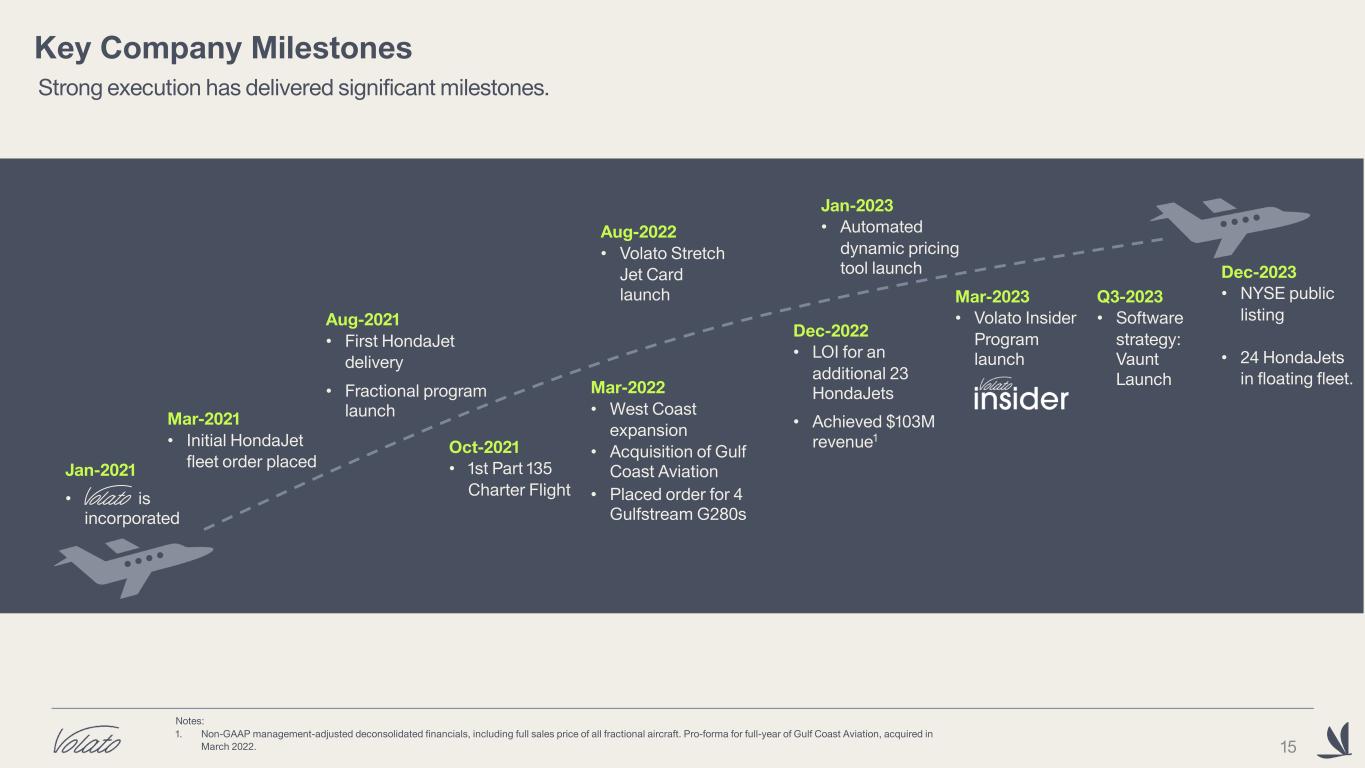

Notes: 1. Non-GAAP management-adjusted deconsolidated financials, including full sales price of all fractional aircraft. Pro-forma for full-year of Gulf Coast Aviation, acquired in March 2022. Jan-2021 • is incorporated Mar-2021 • Initial HondaJet fleet order placed Aug-2021 • First HondaJet delivery • Fractional program launch Mar-2022 • West Coast expansion • Acquisition of Gulf Coast Aviation • Placed order for 4 Gulfstream G280s Oct-2021 • 1st Part 135 Charter Flight Aug-2022 • Volato Stretch Jet Card launch Jan-2023 • Automated dynamic pricing tool launch Dec-2022 • LOI for an additional 23 HondaJets • Achieved $103M revenue1 Mar-2023 • Volato Insider Program launch Key Company Milestones Q3-2023 • Software strategy: Vaunt Launch 15 Dec-2023 • NYSE public listing • 24 HondaJets in floating fleet. Strong execution has delivered significant milestones.

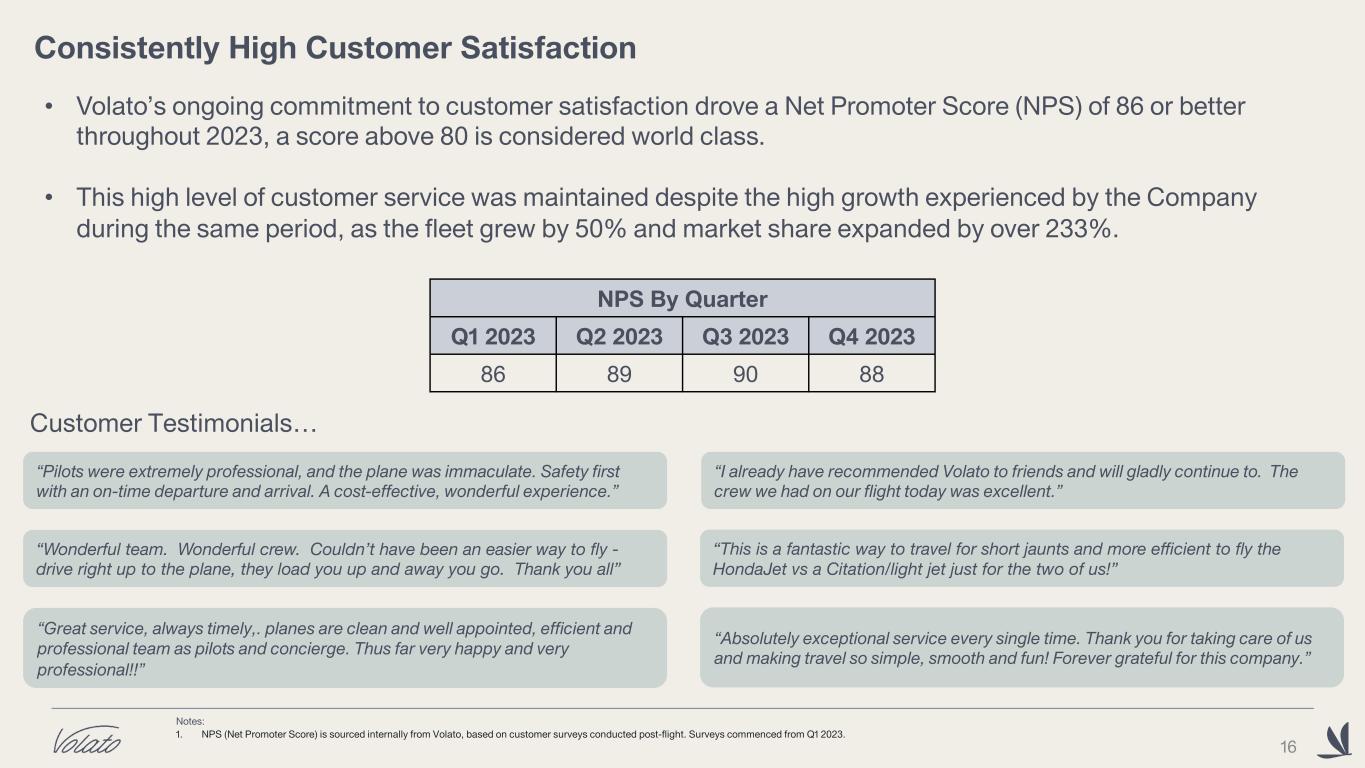

Notes: 1. NPS (Net Promoter Score) is sourced internally from Volato, based on customer surveys conducted post-flight. Surveys commenced from Q1 2023. Consistently High Customer Satisfaction NPS By Quarter Q1 2023 Q2 2023 Q3 2023 Q4 2023 86 89 90 88 • Volato’s ongoing commitment to customer satisfaction drove a Net Promoter Score (NPS) of 86 or better throughout 2023, a score above 80 is considered world class. • This high level of customer service was maintained despite the high growth experienced by the Company during the same period, as the fleet grew by 50% and market share expanded by over 233%. 16 “Wonderful team. Wonderful crew. Couldn’t have been an easier way to fly - drive right up to the plane, they load you up and away you go. Thank you all” “Pilots were extremely professional, and the plane was immaculate. Safety first with an on-time departure and arrival. A cost-effective, wonderful experience.” “I already have recommended Volato to friends and will gladly continue to. The crew we had on our flight today was excellent.” “Great service, always timely,. planes are clean and well appointed, efficient and professional team as pilots and concierge. Thus far very happy and very professional!!” “Absolutely exceptional service every single time. Thank you for taking care of us and making travel so simple, smooth and fun! Forever grateful for this company.” Customer Testimonials… “This is a fantastic way to travel for short jaunts and more efficient to fly the HondaJet vs a Citation/light jet just for the two of us!”

BUSINESS MODEL

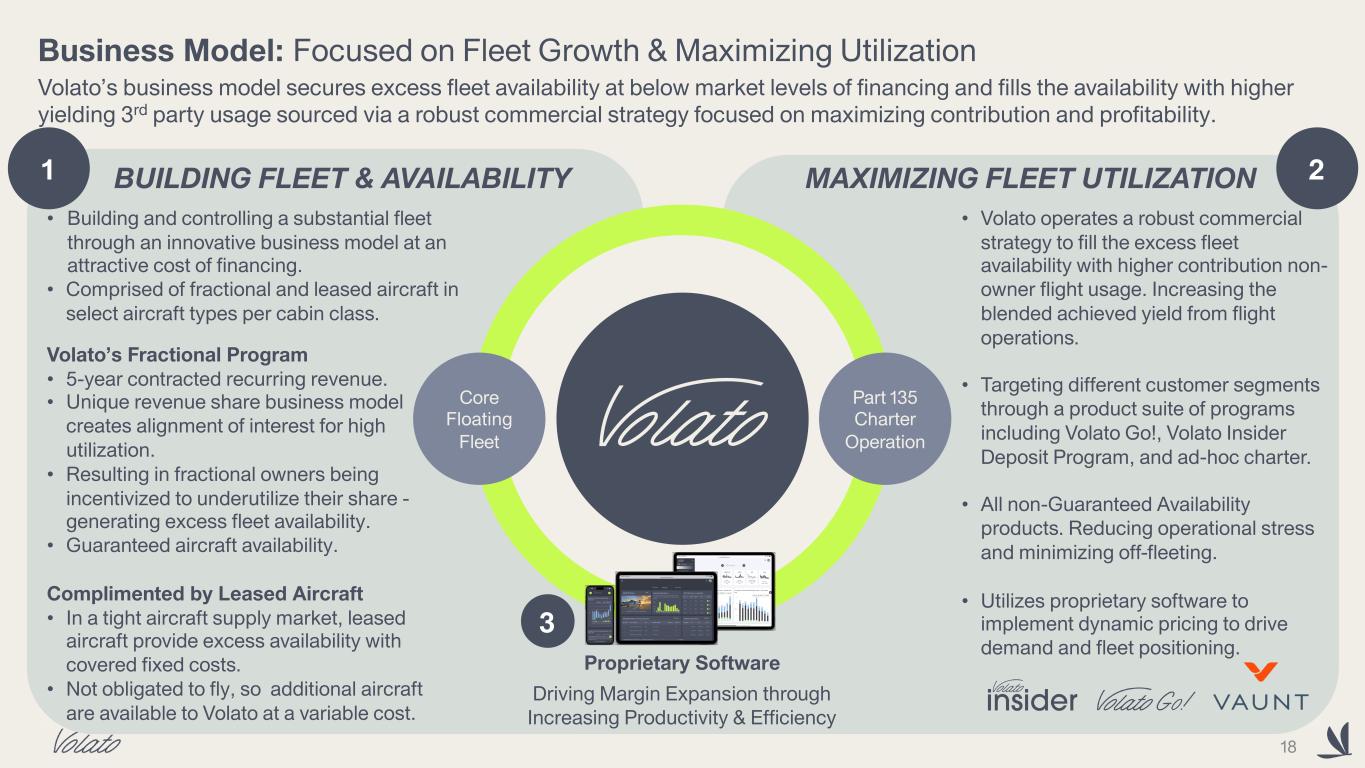

Core Floating Fleet Part 135 Charter Operation Proprietary Software Business Model: Focused on Fleet Growth & Maximizing Utilization Volato’s business model secures excess fleet availability at below market levels of financing and fills the availability with higher yielding 3rd party usage sourced via a robust commercial strategy focused on maximizing contribution and profitability. 1 2BUILDING FLEET & AVAILABILITY MAXIMIZING FLEET UTILIZATION • Building and controlling a substantial fleet through an innovative business model at an attractive cost of financing. • Comprised of fractional and leased aircraft in select aircraft types per cabin class. Volato’s Fractional Program • 5-year contracted recurring revenue. • Unique revenue share business model creates alignment of interest for high utilization. • Resulting in fractional owners being incentivized to underutilize their share - generating excess fleet availability. • Guaranteed aircraft availability. Complimented by Leased Aircraft • In a tight aircraft supply market, leased aircraft provide excess availability with covered fixed costs. • Not obligated to fly, so additional aircraft are available to Volato at a variable cost. • Volato operates a robust commercial strategy to fill the excess fleet availability with higher contribution non- owner flight usage. Increasing the blended achieved yield from flight operations. • Targeting different customer segments through a product suite of programs including Volato Go!, Volato Insider Deposit Program, and ad-hoc charter. • All non-Guaranteed Availability products. Reducing operational stress and minimizing off-fleeting. • Utilizes proprietary software to implement dynamic pricing to drive demand and fleet positioning. Driving Margin Expansion through Increasing Productivity & Efficiency 18 3

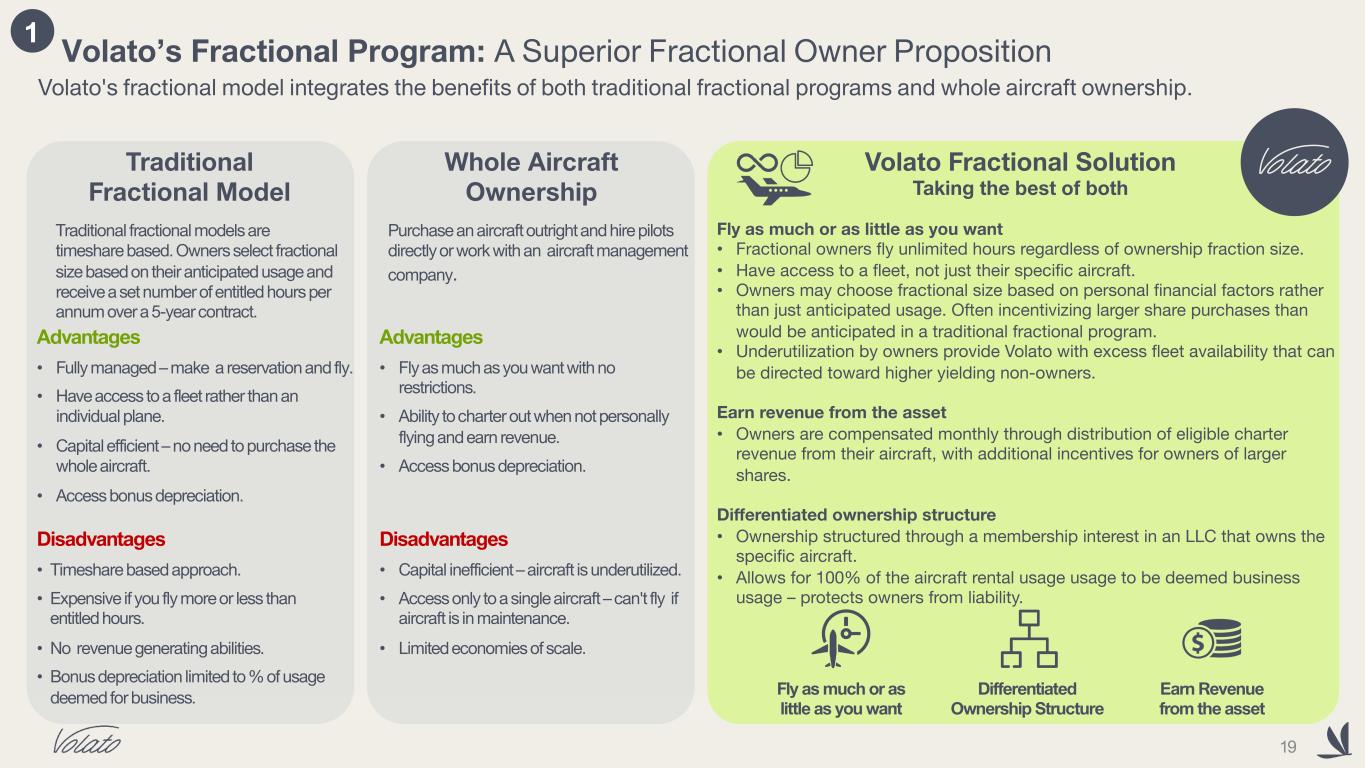

Volato's fractional model integrates the benefits of both traditional fractional programs and whole aircraft ownership. Traditional Fractional Model Whole Aircraft Ownership Traditional fractional models are timeshare based. Owners select fractional size based on their anticipated usage and receive a set number of entitled hours per annum over a 5-year contract. Purchase an aircraft outright and hire pilots directly or work with an aircraft management company. Advantages • Fully managed – make a reservation and fly. • Have access to a fleet rather than an individual plane. • Capital efficient – no need to purchase the whole aircraft. • Access bonus depreciation. Disadvantages • Timeshare based approach. • Expensive if you fly more or less than entitled hours. • No revenue generating abilities. • Bonus depreciation limited to % of usage deemed for business. Advantages • Fly as much as you want with no restrictions. • Ability to charter out when not personally flying and earn revenue. • Access bonus depreciation. Disadvantages • Capital inefficient – aircraft is underutilized. • Access only to a single aircraft – can't fly if aircraft is in maintenance. • Limited economies of scale. Fly as much or as little as you want • Fractional owners fly unlimited hours regardless of ownership fraction size. • Have access to a fleet, not just their specific aircraft. • Owners may choose fractional size based on personal financial factors rather than just anticipated usage. Often incentivizing larger share purchases than would be anticipated in a traditional fractional program. • Underutilization by owners provide Volato with excess fleet availability that can be directed toward higher yielding non-owners. Earn revenue from the asset • Owners are compensated monthly through distribution of eligible charter revenue from their aircraft, with additional incentives for owners of larger shares. Differentiated ownership structure • Ownership structured through a membership interest in an LLC that owns the specific aircraft. • Allows for 100% of the aircraft rental usage usage to be deemed business usage – protects owners from liability. Volato Fractional Solution Taking the best of both Fly as much or as little as you want Earn Revenue from the asset Differentiated Ownership Structure 19 Volato’s Fractional Program: A Superior Fractional Owner Proposition 1

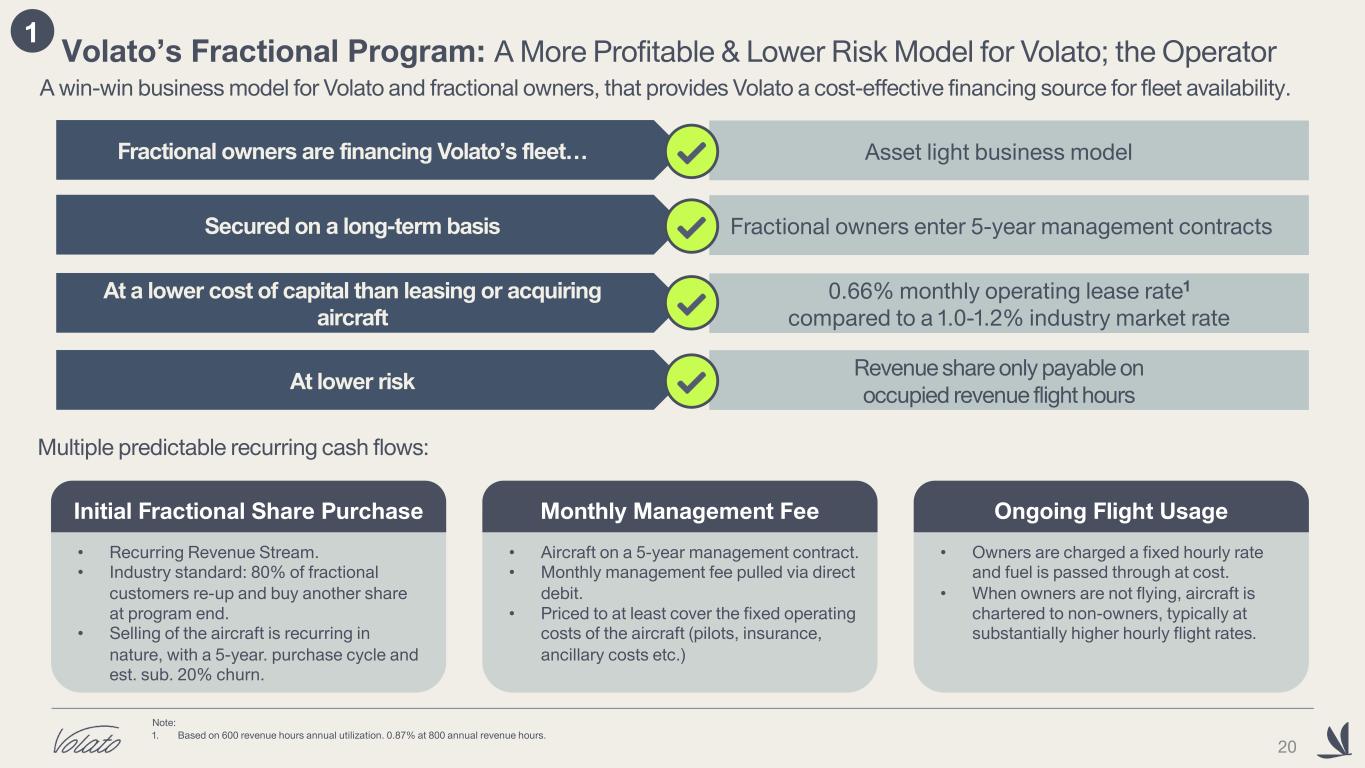

Monthly Management Fee • Aircraft on a 5-year management contract. • Monthly management fee pulled via direct debit. • Priced to at least cover the fixed operating costs of the aircraft (pilots, insurance, ancillary costs etc.) Note: 1. Based on 600 revenue hours annual utilization. 0.87% at 800 annual revenue hours. Fractional owners are financing Volato’s fleet… Secured on a long-term basis At a lower cost of capital than leasing or acquiring aircraft At lower risk Asset light business model Fractional owners enter 5-year management contracts 0.66% monthly operating lease rate1 compared to a 1.0-1.2% industry market rate Revenue share only payable on occupied revenue flight hours A win-win business model for Volato and fractional owners, that provides Volato a cost-effective financing source for fleet availability. Volato’s Fractional Program: A More Profitable & Lower Risk Model for Volato; the Operator 20 Multiple predictable recurring cash flows: Initial Fractional Share Purchase • Recurring Revenue Stream. • Industry standard: 80% of fractional customers re-up and buy another share at program end. • Selling of the aircraft is recurring in nature, with a 5-year. purchase cycle and est. sub. 20% churn. Ongoing Flight Usage • Owners are charged a fixed hourly rate and fuel is passed through at cost. • When owners are not flying, aircraft is chartered to non-owners, typically at substantially higher hourly flight rates. 1

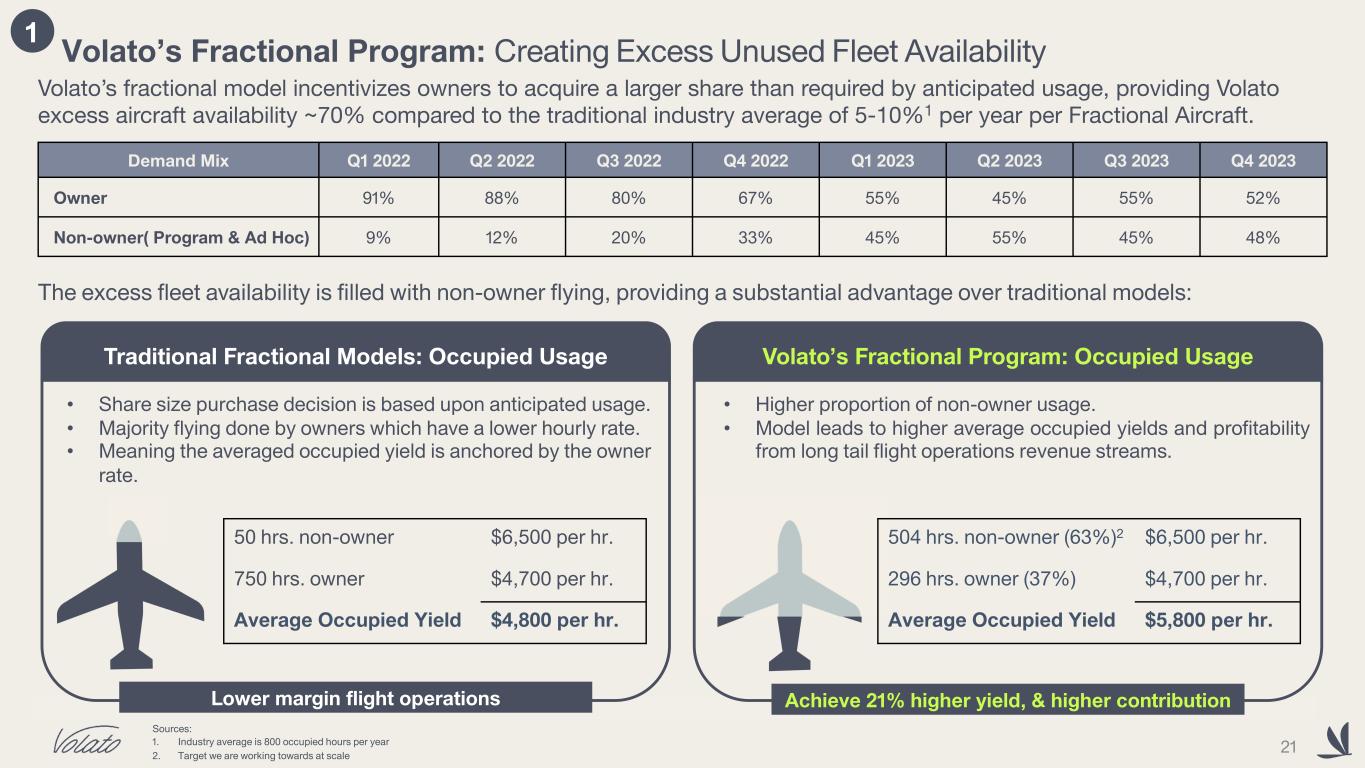

50 hrs. non-owner $6,500 per hr. 750 hrs. owner $4,700 per hr. Average Occupied Yield $4,800 per hr. 504 hrs. non-owner (63%)2 $6,500 per hr. 296 hrs. owner (37%) $4,700 per hr. Average Occupied Yield $5,800 per hr. Volato’s Fractional Program: Creating Excess Unused Fleet Availability 21 • Higher proportion of non-owner usage. • Model leads to higher average occupied yields and profitability from long tail flight operations revenue streams. Volato’s fractional model incentivizes owners to acquire a larger share than required by anticipated usage, providing Volato excess aircraft availability ~70% compared to the traditional industry average of 5-10%1 per year per Fractional Aircraft. • Share size purchase decision is based upon anticipated usage. • Majority flying done by owners which have a lower hourly rate. • Meaning the averaged occupied yield is anchored by the owner rate. Volato’s Fractional Program: Occupied Usage Achieve 21% higher yield, & higher contribution Traditional Fractional Models: Occupied Usage Lower margin flight operations Sources: 1. Industry average is 800 occupied hours per year 2. Target we are working towards at scale The excess fleet availability is filled with non-owner flying, providing a substantial advantage over traditional models: 1 Demand Mix Q1 2022 Q2 2022 Q3 2022 Q4 2022 Q1 2023 Q2 2023 Q3 2023 Q4 2023 Owner 91% 88% 80% 67% 55% 45% 55% 52% Non-owner( Program & Ad Hoc) 9% 12% 20% 33% 45% 55% 45% 48%

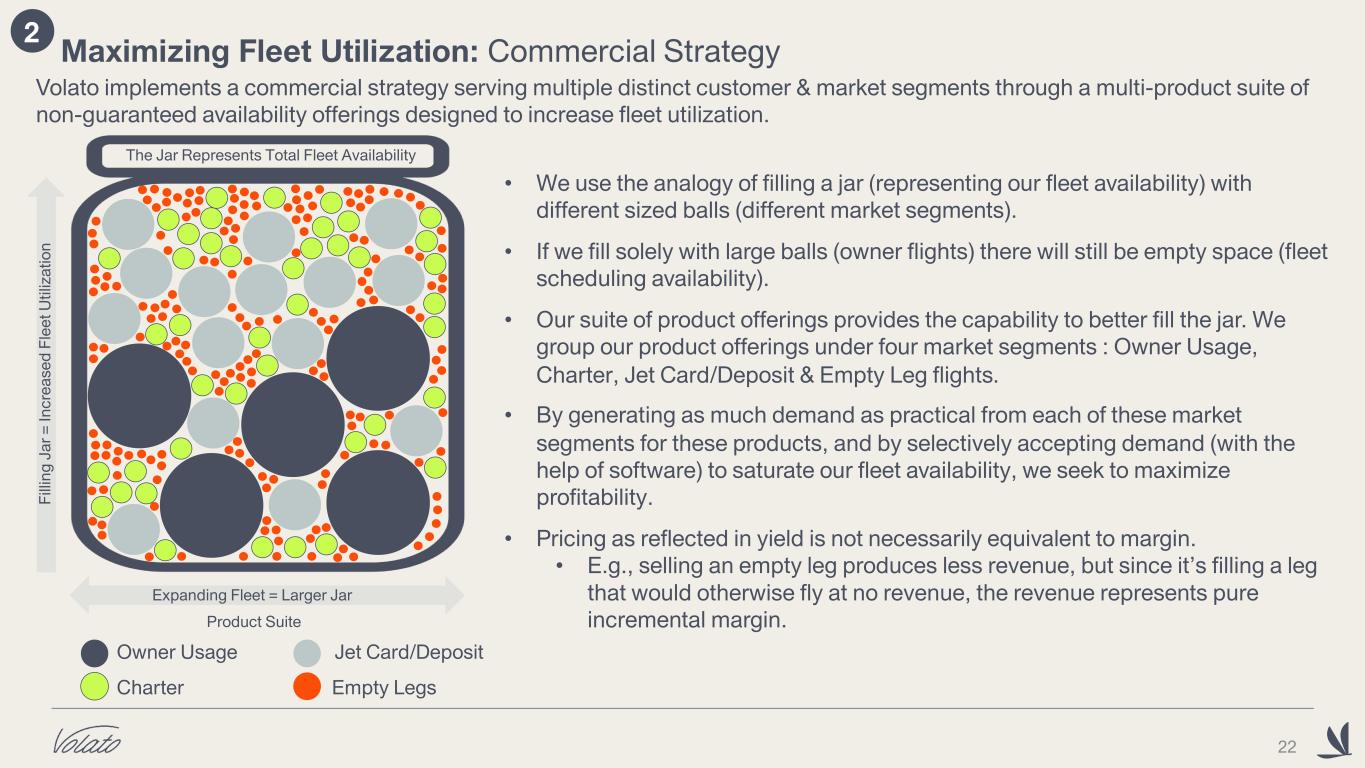

Maximizing Fleet Utilization: Commercial Strategy Volato implements a commercial strategy serving multiple distinct customer & market segments through a multi-product suite of non-guaranteed availability offerings designed to increase fleet utilization. 22 Owner Usage Jet Card/Deposit Charter Empty Legs Product Suite • We use the analogy of filling a jar (representing our fleet availability) with different sized balls (different market segments). • If we fill solely with large balls (owner flights) there will still be empty space (fleet scheduling availability). • Our suite of product offerings provides the capability to better fill the jar. We group our product offerings under four market segments : Owner Usage, Charter, Jet Card/Deposit & Empty Leg flights. • By generating as much demand as practical from each of these market segments for these products, and by selectively accepting demand (with the help of software) to saturate our fleet availability, we seek to maximize profitability. • Pricing as reflected in yield is not necessarily equivalent to margin. • E.g., selling an empty leg produces less revenue, but since it’s filling a leg that would otherwise fly at no revenue, the revenue represents pure incremental margin. 2 The Jar Represents Total Fleet Availability F ill in g Ja r = In cr ea se d F le et U til iz at io n Expanding Fleet = Larger Jar

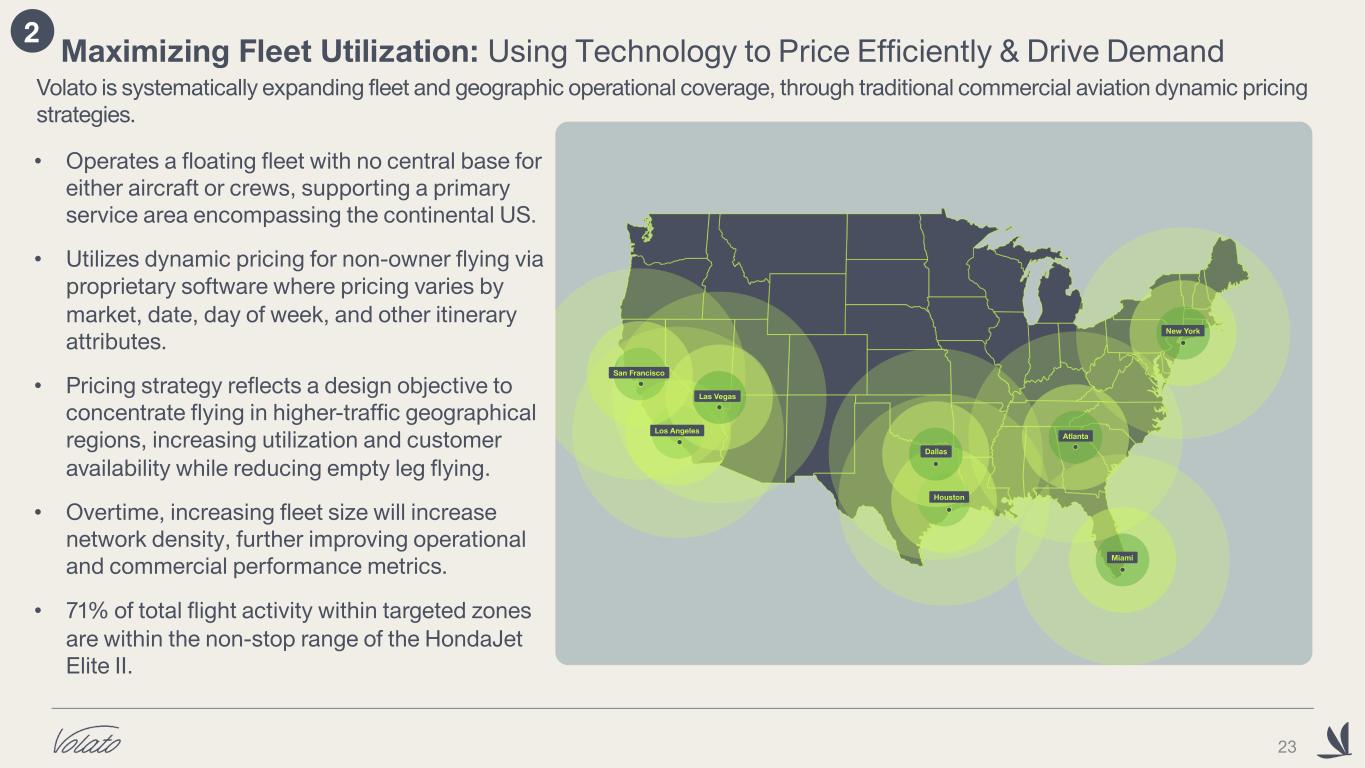

Maximizing Fleet Utilization: Using Technology to Price Efficiently & Drive Demand Volato is systematically expanding fleet and geographic operational coverage, through traditional commercial aviation dynamic pricing strategies. 23 • Operates a floating fleet with no central base for either aircraft or crews, supporting a primary service area encompassing the continental US. • Utilizes dynamic pricing for non-owner flying via proprietary software where pricing varies by market, date, day of week, and other itinerary attributes. • Pricing strategy reflects a design objective to concentrate flying in higher-traffic geographical regions, increasing utilization and customer availability while reducing empty leg flying. • Overtime, increasing fleet size will increase network density, further improving operational and commercial performance metrics. • 71% of total flight activity within targeted zones are within the non-stop range of the HondaJet Elite II. 2

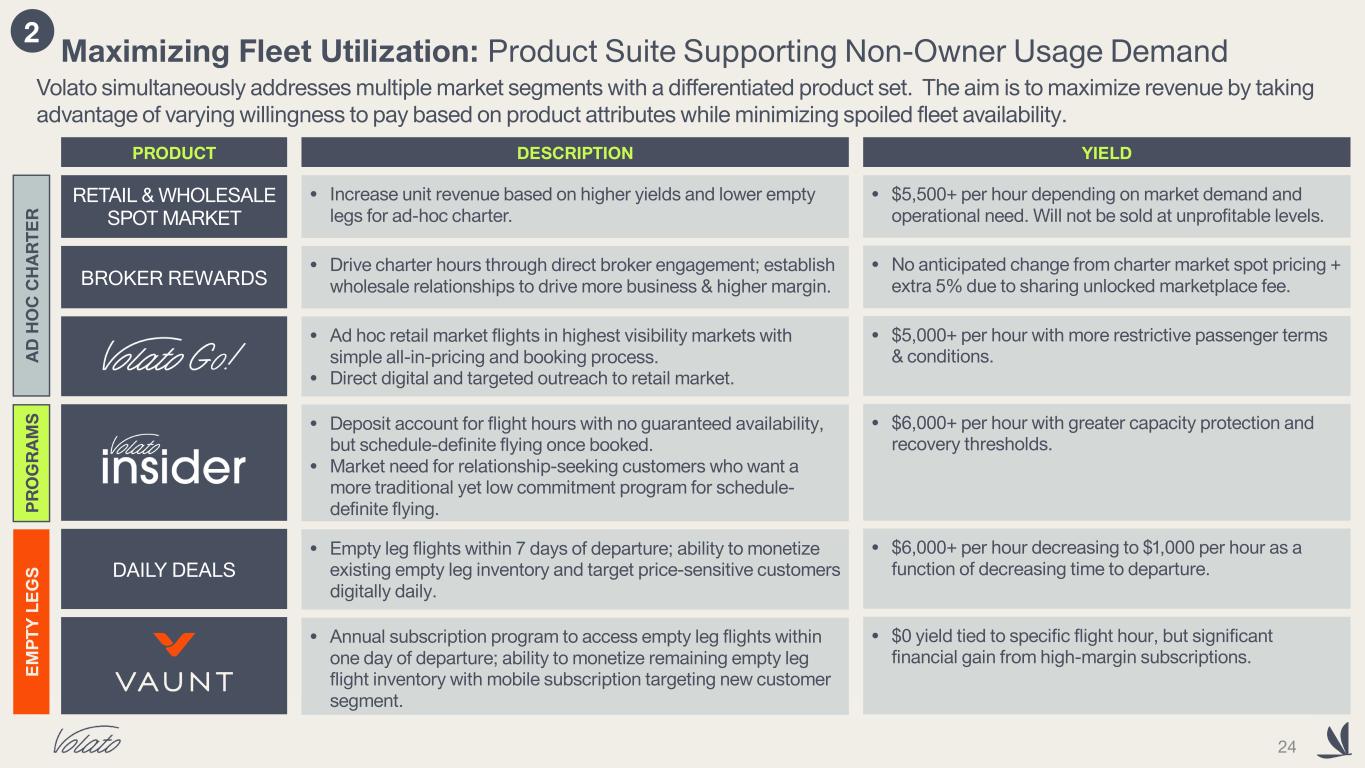

Maximizing Fleet Utilization: Product Suite Supporting Non-Owner Usage Demand Volato simultaneously addresses multiple market segments with a differentiated product set. The aim is to maximize revenue by taking advantage of varying willingness to pay based on product attributes while minimizing spoiled fleet availability. RETAIL & WHOLESALE SPOT MARKET • Increase unit revenue based on higher yields and lower empty legs for ad-hoc charter. DAILY DEALS P R O G R A M S BROKER REWARDS E M P T Y L E G S A D H O C C H A R T E R 2 24 • $5,500+ per hour depending on market demand and operational need. Will not be sold at unprofitable levels. • Drive charter hours through direct broker engagement; establish wholesale relationships to drive more business & higher margin. • No anticipated change from charter market spot pricing + extra 5% due to sharing unlocked marketplace fee. • Ad hoc retail market flights in highest visibility markets with simple all-in-pricing and booking process. • Direct digital and targeted outreach to retail market. • $5,000+ per hour with more restrictive passenger terms & conditions. • Deposit account for flight hours with no guaranteed availability, but schedule-definite flying once booked. • Market need for relationship-seeking customers who want a more traditional yet low commitment program for schedule- definite flying. • $6,000+ per hour with greater capacity protection and recovery thresholds. • Empty leg flights within 7 days of departure; ability to monetize existing empty leg inventory and target price-sensitive customers digitally daily. • $6,000+ per hour decreasing to $1,000 per hour as a function of decreasing time to departure. • Annual subscription program to access empty leg flights within one day of departure; ability to monetize remaining empty leg flight inventory with mobile subscription targeting new customer segment. • $0 yield tied to specific flight hour, but significant financial gain from high-margin subscriptions. PRODUCT DESCRIPTION YIELD

VOLATO UNIQUELY POSITIONED TO IMPROVE AVIATION SOFTWARE TODAY • Existing off-the-shelf software solutions are antiquated and are inadequate. • Volato's team has extensive experience in both aviation and software development. • Our in-house software team understands aviation requirements and are effectively developing solutions for industry needs. • The broader industry also shares the same challenges with inadequate software solutions. VOLATO MISSION CONTROL PROPRIETARY SOFTWARE PLATFORM • Cross-divisional platform including: • Reservations and CRM • Pilot management • Flight scheduling and optimization • Reporting and analytics • Instant hard quote flight pricing using dynamic pricing engine • Empty leg monetization • Drives improvements in automation, productivity and efficiency in operations. Proprietary Technology: Driving Margin Expansion and Productivity In-house developed software solutions deliver product efficiencies and margin expansion. 25 3

VAUNT: A Unique Approach to Monetizing Empty Legs Vaunt, a subsidiary of Volato, is a consumer mobile-app that monetizes existing operational empty leg flights, making private aviation experiences accessible to a new market segment. 26 • Over 30% of private aviation flights are empty leg repositing flights, indicating significant wastage and lost revenue opportunities. • Rather than market to existing private aviation participants at a discount, Vaunt is aimed towards people who aspire to fly private but do not have the capability. • Vaunt subscribers pay $1,000 per year, with no additional cost to fly each awarded flight. • Delivered under a different brand than Volato because we are targeting a different consumer segment. • High margin software business, potentially delivering Volato significant margin expansion. • Strategy includes ultimately working with 3rd party operators and capturing the wider industry's empty legs rather than just those generated by Volato’s fleet. 3 www.flyvaunt.com

VOLATO FLEET

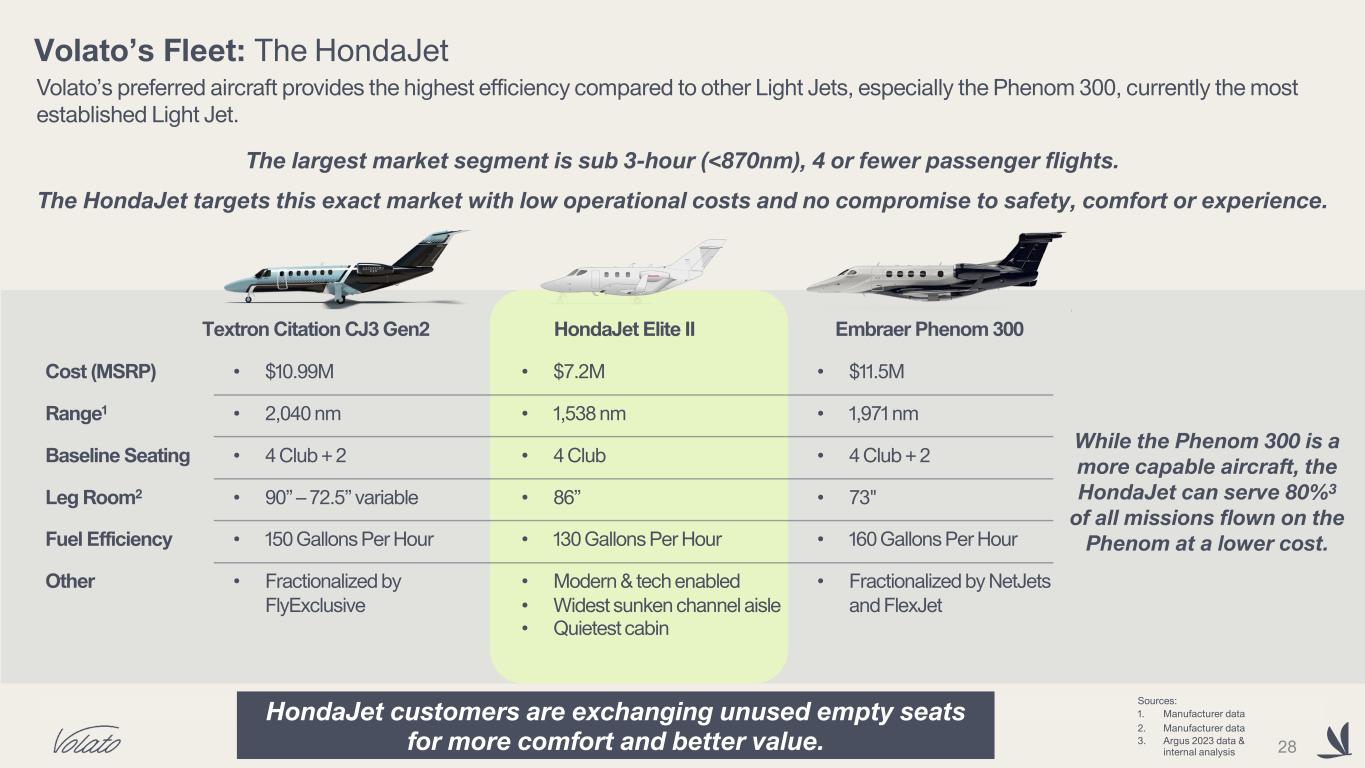

Volato’s Fleet: The HondaJet Volato’s preferred aircraft provides the highest efficiency compared to other Light Jets, especially the Phenom 300, currently the most established Light Jet. 28 HondaJet Elite II Embraer Phenom 300 Sources: 1. Manufacturer data 2. Manufacturer data 3. Argus 2023 data & internal analysis The largest market segment is sub 3-hour (<870nm), 4 or fewer passenger flights. The HondaJet targets this exact market with low operational costs and no compromise to safety, comfort or experience. Textron Citation CJ3 Gen2 While the Phenom 300 is a more capable aircraft, the HondaJet can serve 80%3 of all missions flown on the Phenom at a lower cost. Cost (MSRP) • $10.99M • $7.2M • $11.5M Range1 • 2,040 nm • 1,538 nm • 1,971 nm Baseline Seating • 4 Club + 2 • 4 Club • 4 Club + 2 Leg Room2 • 90” – 72.5” variable • 86” • 73" Fuel Efficiency • 150 Gallons Per Hour • 130 Gallons Per Hour • 160 Gallons Per Hour Other • Fractionalized by FlyExclusive • Modern & tech enabled • Widest sunken channel aisle • Quietest cabin • Fractionalized by NetJets and FlexJet HondaJet customers are exchanging unused empty seats for more comfort and better value.

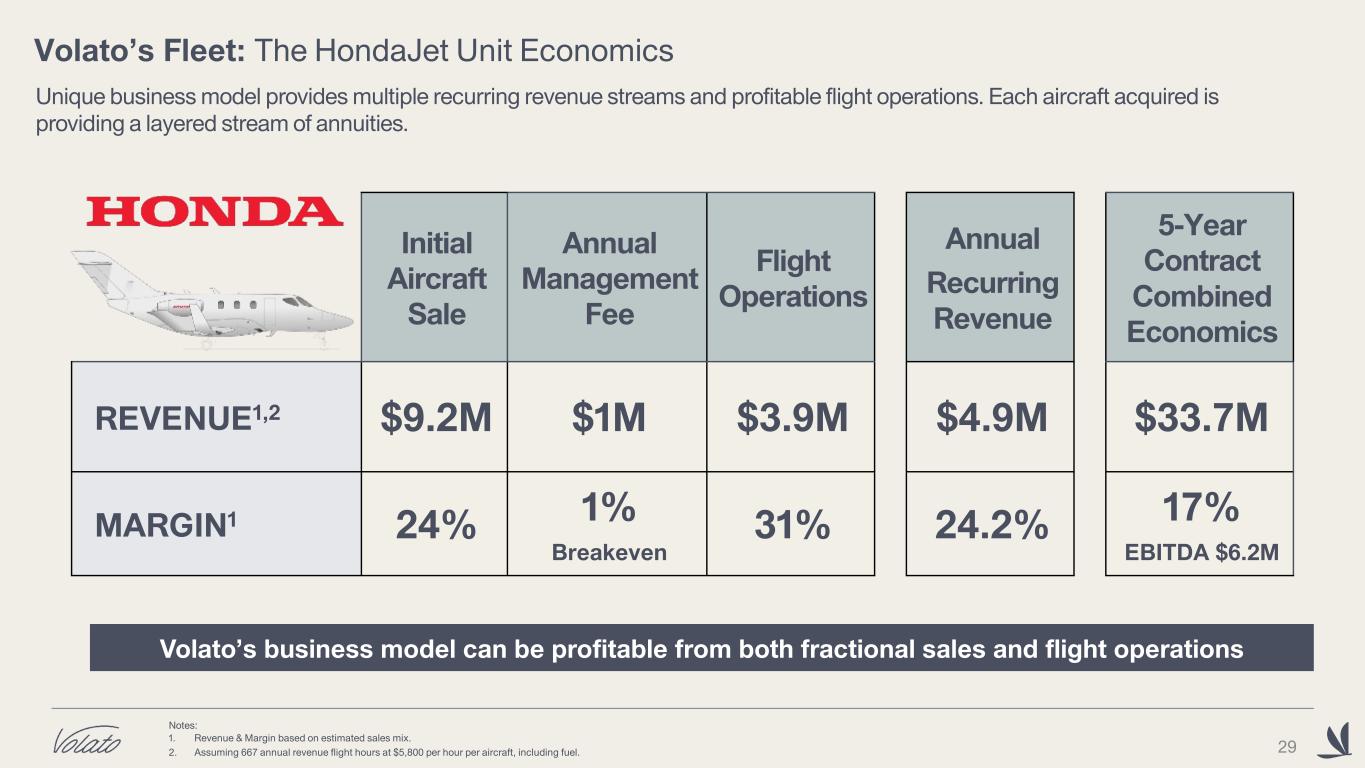

Unique business model provides multiple recurring revenue streams and profitable flight operations. Each aircraft acquired is providing a layered stream of annuities. Volato’s business model can be profitable from both fractional sales and flight operations Notes: 1. Revenue & Margin based on estimated sales mix. 2. Assuming 667 annual revenue flight hours at $5,800 per hour per aircraft, including fuel. 29 Volato’s Fleet: The HondaJet Unit Economics Initial Aircraft Sale Annual Management Fee Flight Operations Annual Recurring Revenue 5-Year Contract Combined Economics REVENUE1,2 $9.2M $1M $3.9M $4.9M $33.7M MARGIN1 24% 1% Breakeven 31% 24.2% 17% EBITDA $6.2M

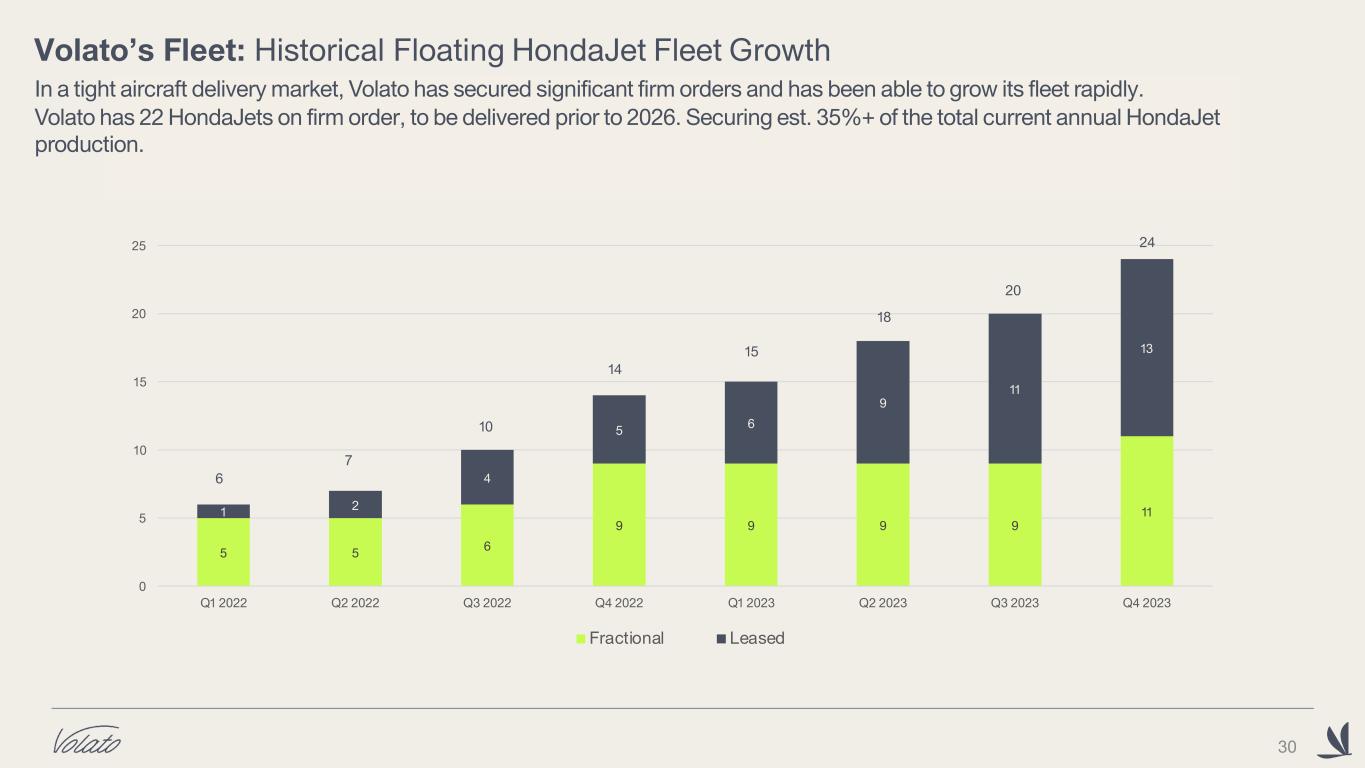

Volato’s Fleet: Historical Floating HondaJet Fleet Growth 30 5 5 6 9 9 9 9 111 2 4 5 6 9 11 13 6 7 10 14 15 18 20 24 0 5 10 15 20 25 30 35 Q1 2022 Q2 2022 Q3 2022 Q4 2022 Q1 2023 Q2 2023 Q3 2023 Q4 2023 Fractional Leased In a tight aircraft delivery market, Volato has secured significant firm orders and has been able to grow its fleet rapidly. Volato has 22 HondaJets on firm order, to be delivered prior to 2026. Securing est. 35%+ of the total current annual HondaJet production.

FINANCIAL INFORMATION

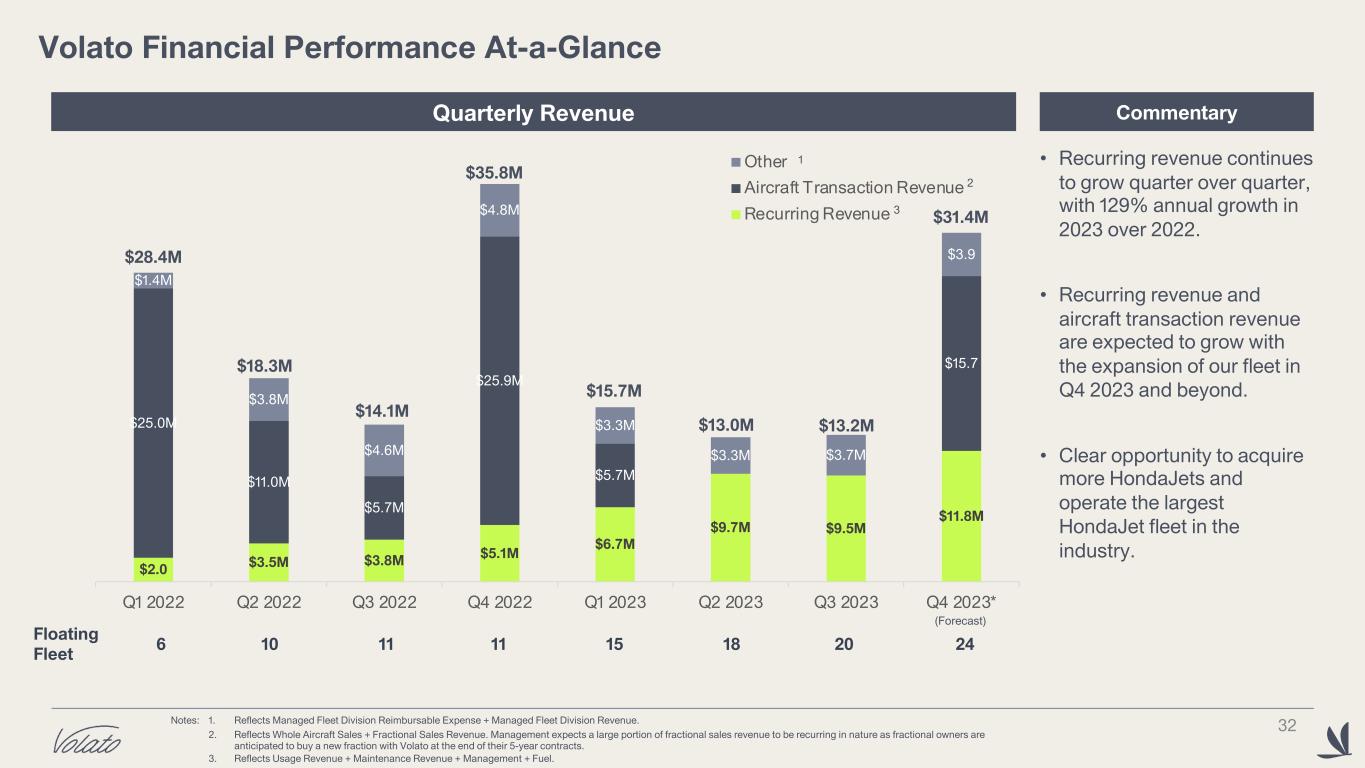

$2.0 $3.5M $3.8M $5.1M $6.7M $9.7M $9.5M $11.8M $25.0M $11.0M $5.7M $25.9M $5.7M $15.7 $1.4M $3.8M $4.6M $4.8M $3.3M $3.3M $3.7M $3.9 Q1 2022 Q2 2022 Q3 2022 Q4 2022 Q1 2023 Q2 2023 Q3 2023 Q4 2023* Other Aircraft Transaction Revenue Recurring Revenue Volato Financial Performance At-a-Glance 32 Quarterly Revenue Commentary 1 2 1. Reflects Managed Fleet Division Reimbursable Expense + Managed Fleet Division Revenue. 2. Reflects Whole Aircraft Sales + Fractional Sales Revenue. Management expects a large portion of fractional sales revenue to be recurring in nature as fractional owners are anticipated to buy a new fraction with Volato at the end of their 5-year contracts. 3. Reflects Usage Revenue + Maintenance Revenue + Management + Fuel. 3 $28.4M $14.1M $35.8M $15.7M $13.2M $18.3M • Recurring revenue continues to grow quarter over quarter, with 129% annual growth in 2023 over 2022. • Recurring revenue and aircraft transaction revenue are expected to grow with the expansion of our fleet in Q4 2023 and beyond. • Clear opportunity to acquire more HondaJets and operate the largest HondaJet fleet in the industry. $13.0M (Forecast) $31.4M Floating Fleet 6 10 11 11 15 18 20 24 Notes:

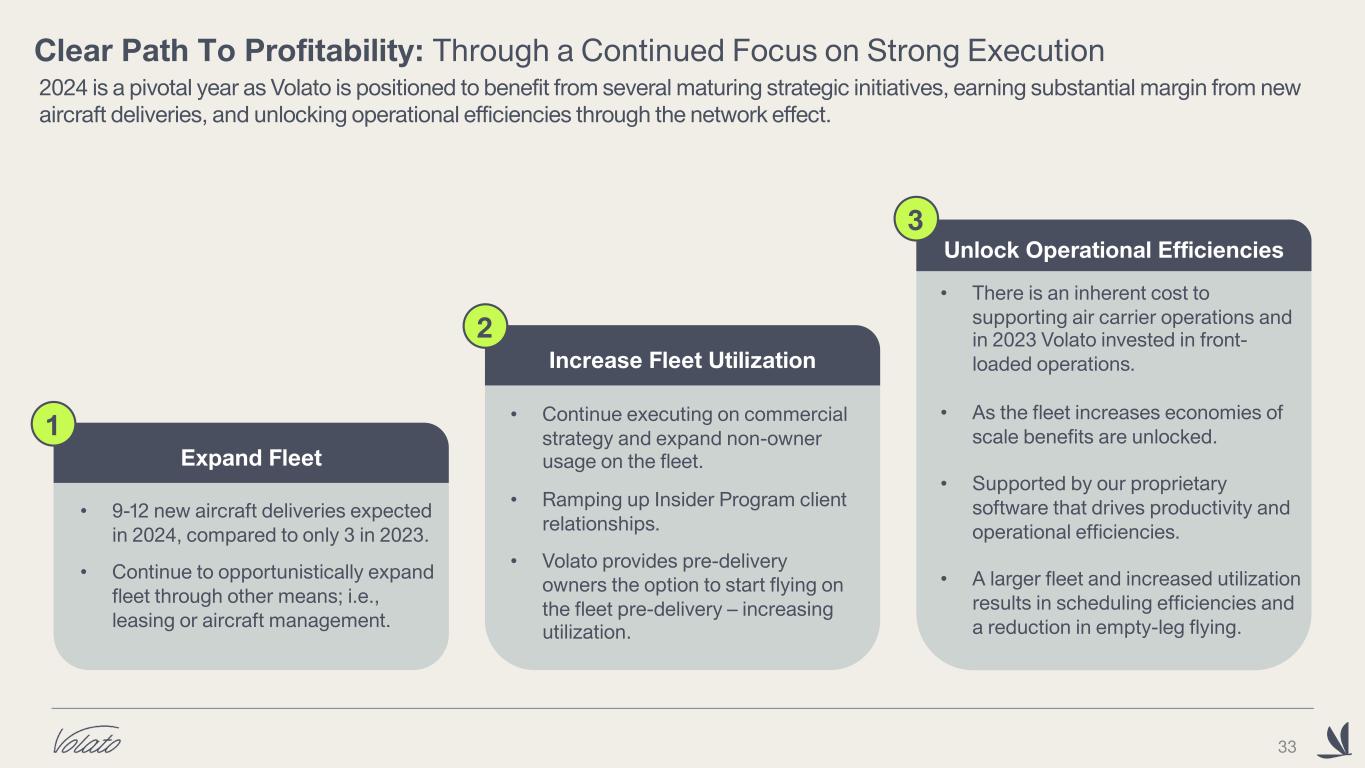

33 2024 is a pivotal year as Volato is positioned to benefit from several maturing strategic initiatives, earning substantial margin from new aircraft deliveries, and unlocking operational efficiencies through the network effect. Clear Path To Profitability: Through a Continued Focus on Strong Execution Increase Fleet Utilization • Continue executing on commercial strategy and expand non-owner usage on the fleet. • Ramping up Insider Program client relationships. • Volato provides pre-delivery owners the option to start flying on the fleet pre-delivery – increasing utilization. Expand Fleet • 9-12 new aircraft deliveries expected in 2024, compared to only 3 in 2023. • Continue to opportunistically expand fleet through other means; i.e., leasing or aircraft management. Unlock Operational Efficiencies • There is an inherent cost to supporting air carrier operations and in 2023 Volato invested in front- loaded operations. • As the fleet increases economies of scale benefits are unlocked. • Supported by our proprietary software that drives productivity and operational efficiencies. • A larger fleet and increased utilization results in scheduling efficiencies and a reduction in empty-leg flying. 1 2 3

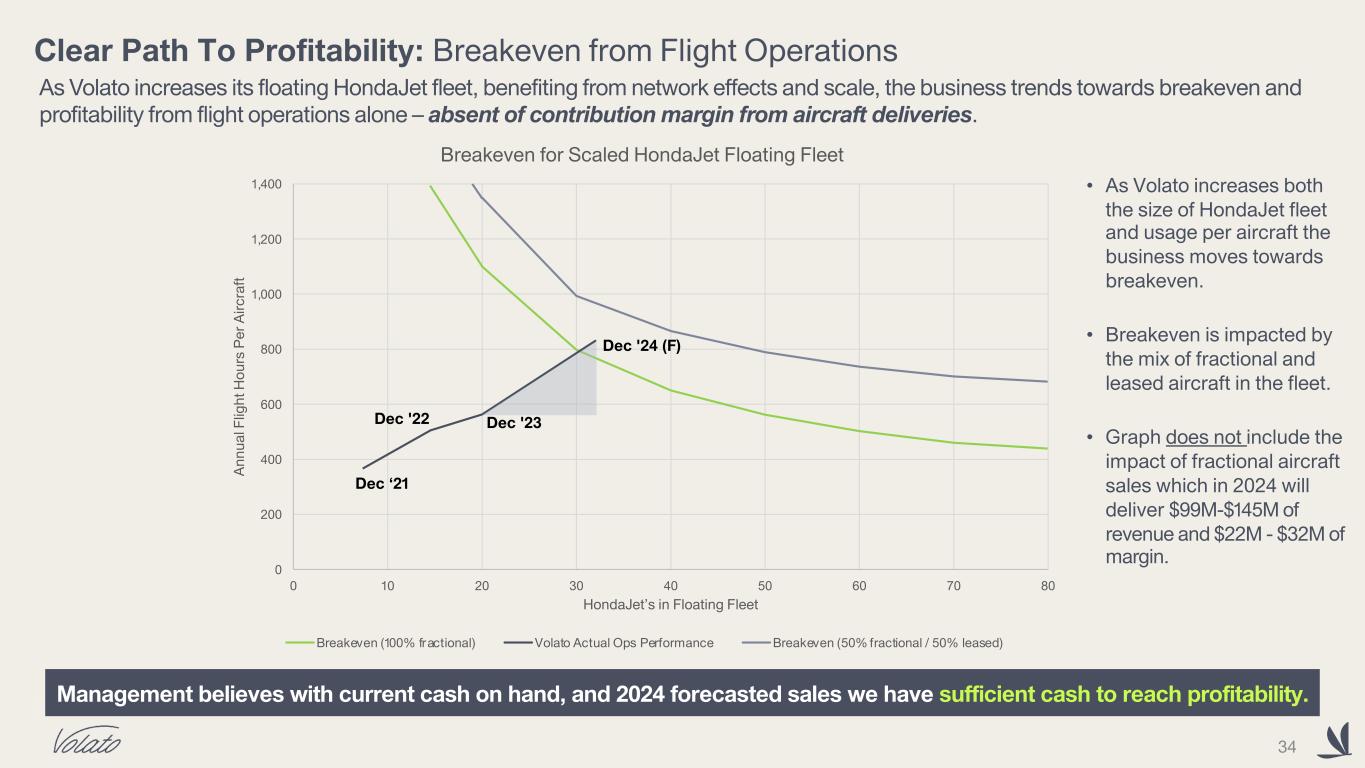

34 0 200 400 600 800 1,000 1,200 1,400 0 10 20 30 40 50 60 70 80 A nn ua l F lig ht H ou rs P er A irc ra ft HondaJet’s in Floating Fleet Breakeven for Scaled HondaJet Floating Fleet Breakeven (100% fractional) Volato Actual Ops Performance Breakeven (50% fractional / 50% leased) Dec '22 Dec '23 Dec ‘21 Dec '24 (F) As Volato increases its floating HondaJet fleet, benefiting from network effects and scale, the business trends towards breakeven and profitability from flight operations alone – absent of contribution margin from aircraft deliveries. Clear Path To Profitability: Breakeven from Flight Operations • As Volato increases both the size of HondaJet fleet and usage per aircraft the business moves towards breakeven. • Breakeven is impacted by the mix of fractional and leased aircraft in the fleet. • Graph does not include the impact of fractional aircraft sales which in 2024 will deliver $99M-$145M of revenue and $22M - $32M of margin. Management believes with current cash on hand, and 2024 forecasted sales we have sufficient cash to reach profitability.

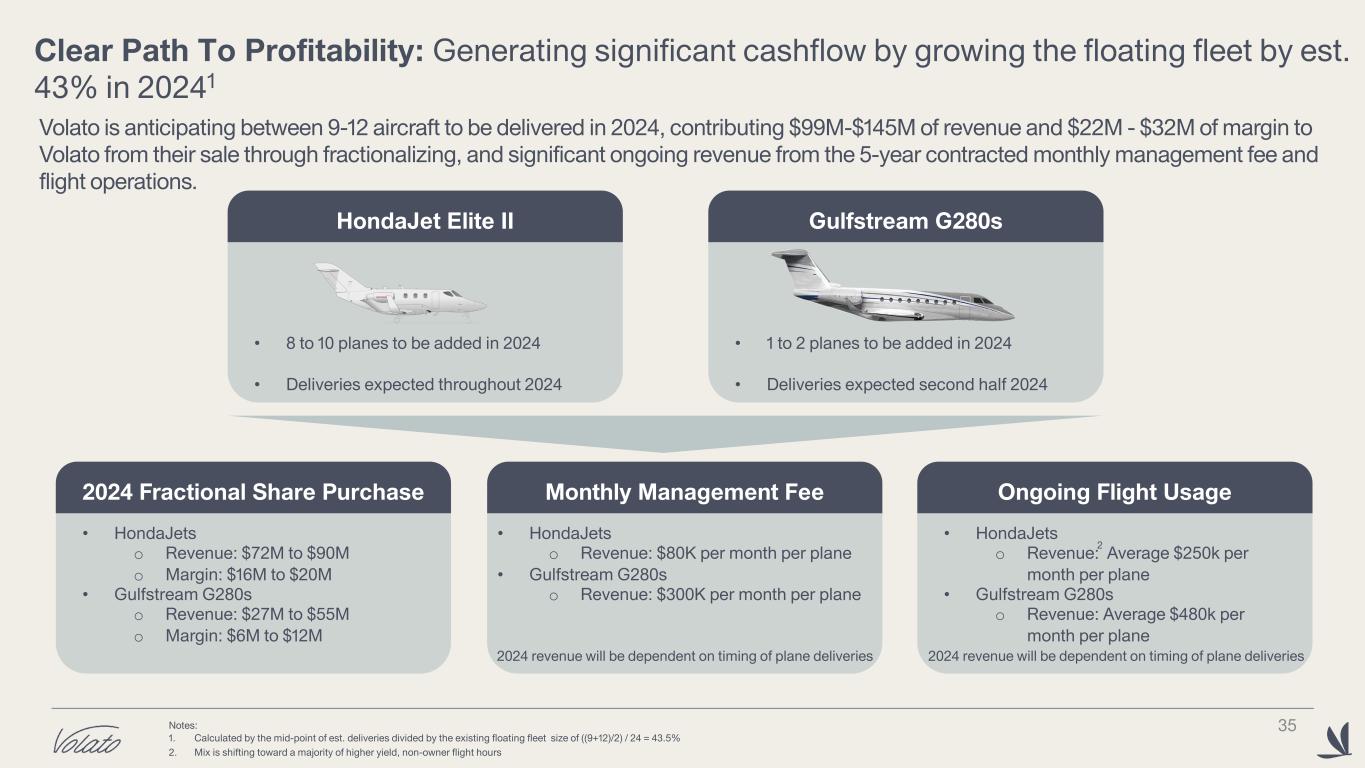

Clear Path To Profitability: Generating significant cashflow by growing the floating fleet by est. 43% in 20241 35 Monthly Management Fee • HondaJets o Revenue: $80K per month per plane • Gulfstream G280s o Revenue: $300K per month per plane 2024 Fractional Share Purchase • HondaJets o Revenue: $72M to $90M o Margin: $16M to $20M • Gulfstream G280s o Revenue: $27M to $55M o Margin: $6M to $12M Ongoing Flight Usage • HondaJets o Revenue: Average $250k per month per plane • Gulfstream G280s o Revenue: Average $480k per month per plane HondaJet Elite II • 8 to 10 planes to be added in 2024 • Deliveries expected throughout 2024 Gulfstream G280s • 1 to 2 planes to be added in 2024 • Deliveries expected second half 2024 Volato is anticipating between 9-12 aircraft to be delivered in 2024, contributing $99M-$145M of revenue and $22M - $32M of margin to Volato from their sale through fractionalizing, and significant ongoing revenue from the 5-year contracted monthly management fee and flight operations. Notes: 1. Calculated by the mid-point of est. deliveries divided by the existing floating fleet size of ((9+12)/2) / 24 = 43.5% 2. Mix is shifting toward a majority of higher yield, non-owner flight hours 2024 revenue will be dependent on timing of plane deliveries 2024 revenue will be dependent on timing of plane deliveries 2

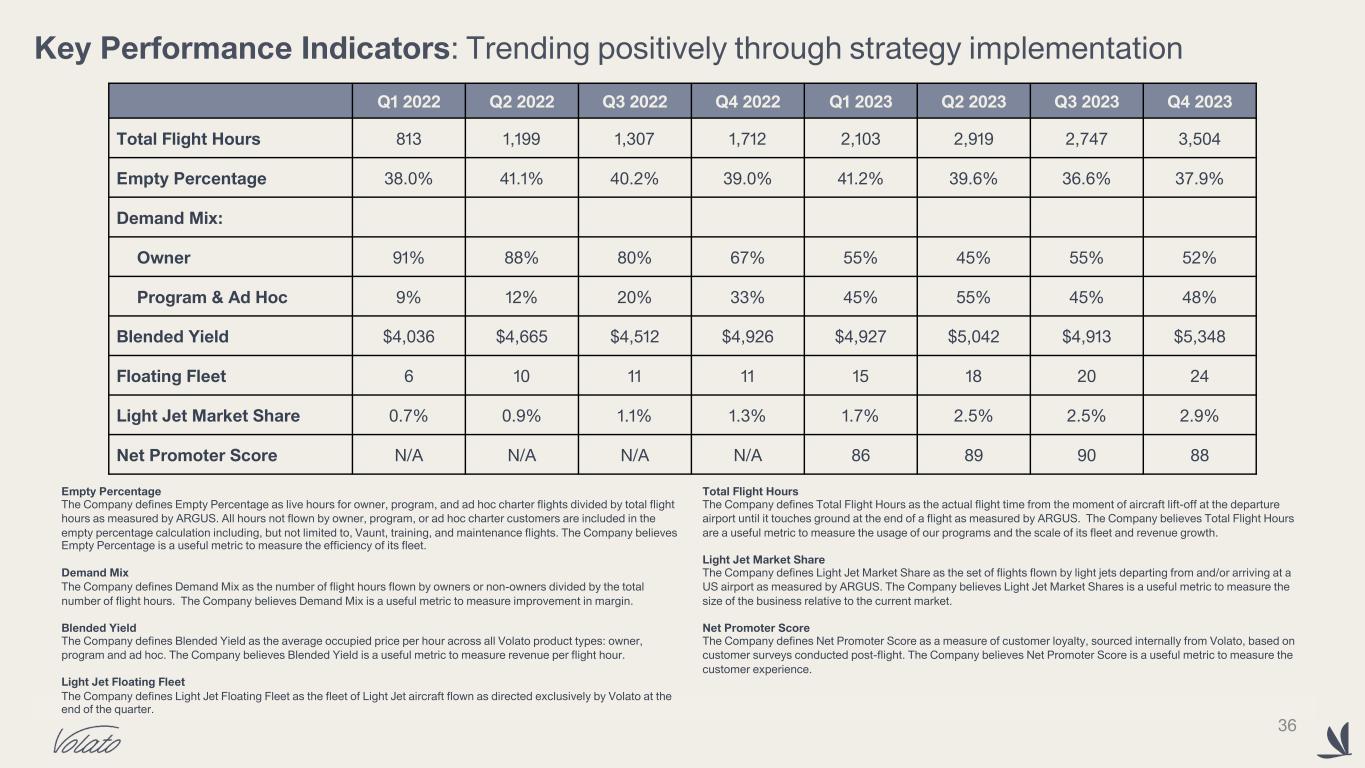

Key Performance Indicators: Trending positively through strategy implementation 36 Q1 2022 Q2 2022 Q3 2022 Q4 2022 Q1 2023 Q2 2023 Q3 2023 Q4 2023 Total Flight Hours 813 1,199 1,307 1,712 2,103 2,919 2,747 3,504 Empty Percentage 38.0% 41.1% 40.2% 39.0% 41.2% 39.6% 36.6% 37.9% Demand Mix: Owner 91% 88% 80% 67% 55% 45% 55% 52% Program & Ad Hoc 9% 12% 20% 33% 45% 55% 45% 48% Blended Yield $4,036 $4,665 $4,512 $4,926 $4,927 $5,042 $4,913 $5,348 Floating Fleet 6 10 11 11 15 18 20 24 Light Jet Market Share 0.7% 0.9% 1.1% 1.3% 1.7% 2.5% 2.5% 2.9% Net Promoter Score N/A N/A N/A N/A 86 89 90 88 Empty Percentage The Company defines Empty Percentage as live hours for owner, program, and ad hoc charter flights divided by total flight hours as measured by ARGUS. All hours not flown by owner, program, or ad hoc charter customers are included in the empty percentage calculation including, but not limited to, Vaunt, training, and maintenance flights. The Company believes Empty Percentage is a useful metric to measure the efficiency of its fleet. Demand Mix The Company defines Demand Mix as the number of flight hours flown by owners or non-owners divided by the total number of flight hours. The Company believes Demand Mix is a useful metric to measure improvement in margin. Blended Yield The Company defines Blended Yield as the average occupied price per hour across all Volato product types: owner, program and ad hoc. The Company believes Blended Yield is a useful metric to measure revenue per flight hour. Light Jet Floating Fleet The Company defines Light Jet Floating Fleet as the fleet of Light Jet aircraft flown as directed exclusively by Volato at the end of the quarter. Total Flight Hours The Company defines Total Flight Hours as the actual flight time from the moment of aircraft lift-off at the departure airport until it touches ground at the end of a flight as measured by ARGUS. The Company believes Total Flight Hours are a useful metric to measure the usage of our programs and the scale of its fleet and revenue growth. Light Jet Market Share The Company defines Light Jet Market Share as the set of flights flown by light jets departing from and/or arriving at a US airport as measured by ARGUS. The Company believes Light Jet Market Shares is a useful metric to measure the size of the business relative to the current market. Net Promoter Score The Company defines Net Promoter Score as a measure of customer loyalty, sourced internally from Volato, based on customer surveys conducted post-flight. The Company believes Net Promoter Score is a useful metric to measure the customer experience.

KEY INVESTMENT HIGHLIGHTS

Volato is Positioned Well for Accelerated Growth Expansion of software offering Focused entry into corporate travel market Expansion of fleet size and offering Expansion of geographic footprint and operational coverage 38

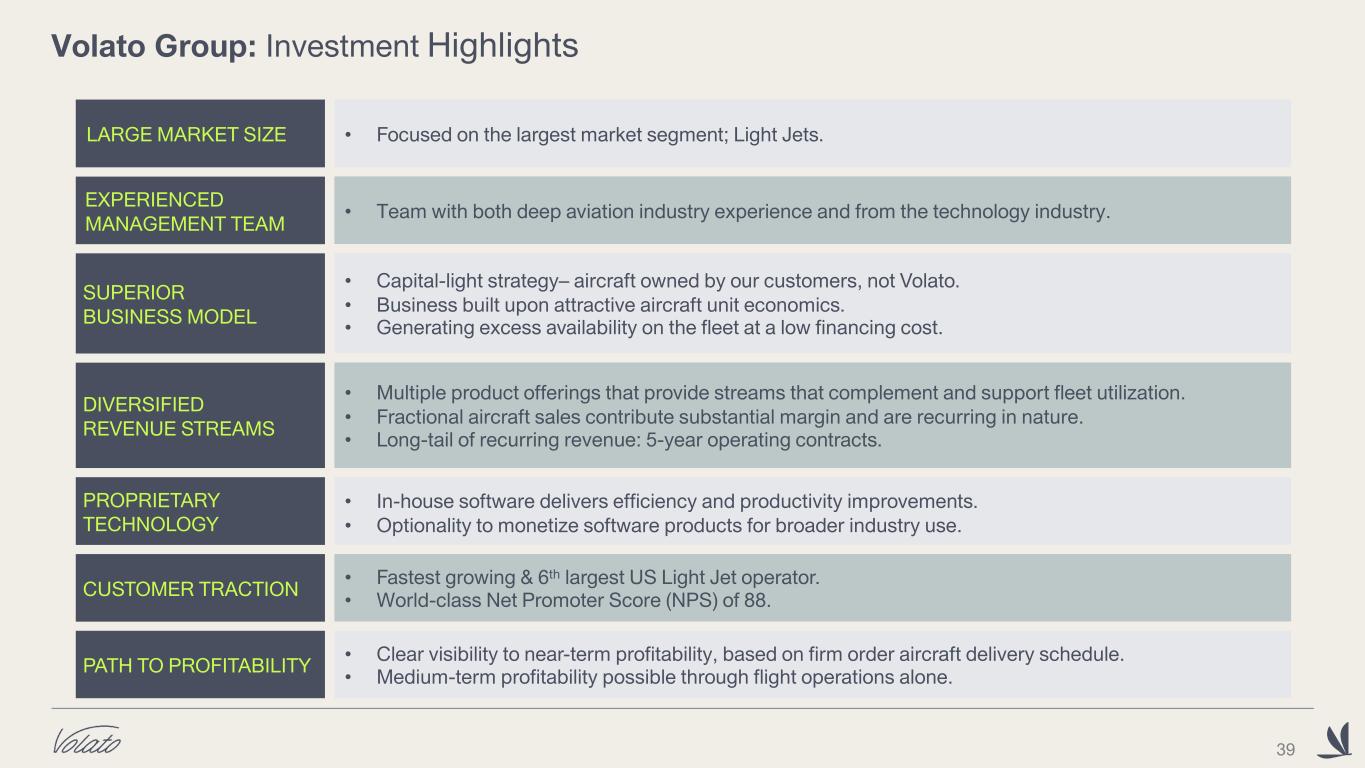

EXPERIENCED MANAGEMENT TEAM SUPERIOR BUSINESS MODEL PROPRIETARY TECHNOLOGY DIVERSIFIED REVENUE STREAMS PATH TO PROFITABILITY LARGE MARKET SIZE • Team with both deep aviation industry experience and from the technology industry. • In-house software delivers efficiency and productivity improvements. • Optionality to monetize software products for broader industry use. • Multiple product offerings that provide streams that complement and support fleet utilization. • Fractional aircraft sales contribute substantial margin and are recurring in nature. • Long-tail of recurring revenue: 5-year operating contracts. • Clear visibility to near-term profitability, based on firm order aircraft delivery schedule. • Medium-term profitability possible through flight operations alone. • Focused on the largest market segment; Light Jets. • Capital-light strategy– aircraft owned by our customers, not Volato. • Business built upon attractive aircraft unit economics. • Generating excess availability on the fleet at a low financing cost. 39 Volato Group: Investment Highlights CUSTOMER TRACTION • Fastest growing & 6th largest US Light Jet operator. • World-class Net Promoter Score (NPS) of 88.

ENJOY FLYING MORE