10-K: Annual report pursuant to Section 13 and 15(d)

Published on March 26, 2024

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________________

FORM 10-K

_____________________________

For the Fiscal Year Ended December 31 , 2023

OR

For the Transition Period From to

Commission File Number 001-41104

(Exact name of Registrant as specified in its charter)

4522 |

||||||||||||||

|

(State or other jurisdiction of

incorporation or organization)

|

(Primary Standard Industrial

Classification Code Number)

|

(I.R.S. Employer

Identification Number)

|

||||||||||||

Telephone: 844 -399-8998

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol |

Name of exchange on which registered |

||||||

Securities registered pursuant to Section 12(g) of the Act:

None

| Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. | Yes | o | x | |||||||||||

| Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. | Yes | o | x | |||||||||||

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company.

See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large Accelerated Filer | o | Accelerated Filer | o | |||||||||||

| x | Smaller Reporting Company | |||||||||||||

| Emerging Growth Company | ||||||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.o

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. o

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No x

As of June 30, 2023, the aggregate market value of the registrant’s common stock held by non-affiliates of the registrant was $68,103,546 based on the closing sale price as reported on the NYSE American LLC. As of March 20, 2024 there were 29,251,629 shares of common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant’s definitive Proxy Statement to be delivered to shareholders in connection with its 2024 Annual Meeting of Stockholders are incorporated by reference into Part III of this Annual Report on Form 10-K where indicated. Such proxy statement will be filed with the U.S. Securities and Exchange Commission within 120 days after the end of the fiscal year to which this report relates.

VOLATO GROUP, INC.

FORM 10-K

FOR THE YEAR ENDED DECEMBER 31, 2023

INDEX

Page |

||||||||

Note About Forward-Looking Statements

This report includes estimates, projections, statements relating to our business plans, objectives, and expected operating results that are “forward- looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, and Section 21E of the Securities Exchange Act of 1934. Forward- looking statements may appear throughout this report, including the following sections: “Business” (Part I, Item 1 of this Form 10- K), “Risk Factors” (Part I, Item 1A of this Form 10-K), and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” (Part II, Item 7 of this Form 10- K). These forward-looking statements generally are identified by the words “believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,” “strategy,” “future,” “opportunity,” “plan,” “may,” “should,” “will,” “would,” “will be,” “will continue,” “will likely result,” and similar expressions. Forward -looking statements are based on current expectations and assumptions that are subject to risks and uncertainties that may cause actual results to differ materially. We describe certain risks and uncertainties that could cause actual results and events to differ materially in the sections entitled “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and “Quantitative and Qualitative Disclosures about Market Risk” (Part II, Item 7A of this Form 10 -K). Readers are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date they are made. We undertake no obligation to update or revise publicly any forward-looking statements, whether because of new information, future events, or otherwise.

3

PART I

ITEM 1. BUSINESS

Overview

Our mission is to empower people to live their best lives while creating more time for the rest of their lives by providing convenient and high-quality travel services. Through our focus on the development of proprietary technology and evolution of aircraft ownership and use models, combined with our commitment to an exceptional customer experience using the “Right Aircraft for the Mission,” we are able to achieve a more efficient private jet experience, without sacrificing luxury.

Our History

Volato Group, Inc. (“Volato Group” “we” or “us”) is a private aviation company founded in January 2021. That year, we entered the private jet charter and fractional ownership market with our Part 135 HondaJet ownership program, taking delivery of our first jet in August 2021 and completing our first Part 135 charter flight in October of 2021. The HondaJet is manufactured by Honda Aircraft Company (“Honda”). We took delivery of three HondaJets in 2021. In 2022, we continued to build our fleet of HondaJets. In March 2022, we acquired Gulf Coast Aviation, Inc., owner of G C Aviation, Inc., a Texas entity and Part 135 air carrier certificate holder. This acquisition added personnel and facilities to support managed aircraft, sales, maintenance, and other operational functions. Also in March 2022, we placed orders for four Gulfstream G280s for delivery in 2024 and 2025. In August of 2022, we launched the Volato Stretch jet card, a differentiated jet card product that provides flight credits for customer itinerary flexibility. In December of 2022, we signed a letter of intent for a multi-year fleet purchase of HondaJets with Honda. In January 2023, we launched our automated dynamic pricing tool for the general charter market. In March of 2023, we introduced the Insider Program, a deposit program for our charter services featuring HondaJet pricing caps in certain geographical areas. In May 2023, we executed a firm order with Honda for 23 HondaJets to be delivered from 2023 through 2025.

On December 1, 2023, Volato, Inc., a Georgia corporation (“Volato”), PROOF Acquisition Corp I, a Delaware corporation (“PACI”) and PACI Merger Sub, Inc., a Delaware corporation and a direct, wholly-owned subsidiary of PACI (“Merger Sub”), consummated the previously announced Business Combination Agreement, dated August 1, 2023 (the “Business Combination Agreement”). Pursuant to the terms of the Business Combination Agreement, a business combination between PACI and Volato was effected through the merger of Merger Sub with and into Volato, with Volato surviving the merger as a wholly-owned subsidiary of PACI (the “Business Combination,” and together with the other transactions contemplated by the Business Combination Agreement and the other agreements contemplated thereby, the “Transactions”). In connection with the consummation of the Business Combination (the “Closing”), PACI changed its name to “Volato Group, Inc.”.

Our Core Values

We are creating a culture of service, not just limited to interactions with our customers. Our senior leadership team has implemented a structured management training program based on the Scaling Up framework and informed by our core values. Our culture focuses on five core values:

1.Improve yourself and those around you. Embrace opportunities to teach and discover. Lead with encouragement and praise.

2.Listen with intent. Be engaged and curious while seeking to understand others.

3.Have positive interactions. Strengthen relationships by being humble and approachable

4.Be transparent. Foster an environment of trust and lasting relationships.

5.Contribute and commit. Embrace the conflict of ideas. Participate and then fully support the decision.

4

The Private Aviation Industry: Our Opportunity

The private aviation industry is large, resilient and growing. In 2022, private aviation was a $29.0 billion-dollar market globally, and was forecasted to grow to $38.0 billion in 20294. Private aviation has traditionally served high net worth individuals and corporate customers, flying on a combination of owned and chartered aircraft. In the United States, the market for private aircraft sales and charter totaled $25.1 billion in 20215. However, aircraft sales and private charter services are distinct markets, and our programs are designed to address both. We sell aircraft to participants in our aircraft ownership program, and those aircraft are leased back to our air carrier subsidiary for providing charter services to both owners and the general charter market. In this way, we build our fleet, and owners enjoy charter access to that fleet, rather than just the owners’ individual aircraft. These are standard features of a functional aircraft program. Uniquely, our aircraft ownership program provides revenue share and guaranteed availability to owners, coupled with higher utilization and efficiency rates.

1.https://www.fortunebusinessinsights.com/industry-reports/business-jet-market-101585

2.https://www.statista.com/statistics/1171101/charter-market-size-united-states/

5

The following factors are driving growth across the private aviation industry:

•The number of high-net-worth potential customers is growing. This growth has resulted in an increased demand for exclusive and personalized travel experiences. According to the Global Wealth Report conducted by Credit Suisse, as of the end of 2021 there were 24.48 million U.S. millionaires. This number is expected to rise by 13% to 27.66 by 20266. According to Forbes, the number of U.S. billionaires rose from 724 in 20217 to 735 in 20238.

•The market of potential private flyers is under-penetrated. According to the New York Times, referencing a study from McKinsey & Company, there are 100,000 regular private jet fliers in the United States, out of some 1.5 million people who could afford to charter a plane9. The private jet market remains under-penetrated. We believe factors like a superior owner and customer experience will add to the well-recognized benefits of increased productivity and convenience that private flying offers, in drawing new demand.

•Highly regulated industry creates barriers to entry. The private aviation market is complex and highly regulated, presenting barriers to scaling, therefore reducing competition, and decreasing price sensitivity. The industry is also subject to significant regulatory oversight by numerous federal agencies. However, Volato’s business model fits well within this regulatory environment.

•Commercial airline service is declining. North American passenger satisfaction with commercial aviation is in decline across all three segments—first/business, premium economy, and economy/basic economy—down more than 29 points from 2021 to 791 (on a 1,000-point scale)10 11. Passengers are responding negatively to increases in cost, flight crew performance, passenger loads, delays, and communication.

•The COVID-19 pandemic increased exposure to private aviation. This led to more people experimenting with private aviation, increasing engagement with the category. This was fueled by a lack of access to commercial travel, increased passenger sensitivity to traveling with unknown passengers, mask mandates, and general delays. We expect interest in private aviation to continue to grow, with changes in how people work and live in a post-COVID pandemic environment bolstering foundational demand.

•New business models are introducing more people to the benefits of flying private. Semi-private carriers are introducing a new category of fliers to the benefits of private travel. These carriers provide access to smaller airports, offer reduced travel time, avoid checkpoints, and enable a less stressful customer experience12.

•Static industry with little innovation presents opportunities. A lack of innovation in the industry has contributed to low asset utilization, poor operational and commercial technology, high operational complexity, and antiquated commercial practices, all of which stifle efficiency and scalability. This leads to a lack of downward pressure on prices. Through Volato’s unique business model, Volato believes there are significant opportunities to take advantage of the growth in the market and its current lack of innovation, low customer satisfaction and underutilization. Volato believes it has the understanding, knowledge, experience, and capability to effectively address these market opportunities.

Our Solution

We are committed to prioritizing the satisfaction of our customers in an efficient and sustainable manner. We strive to achieve this by utilizing innovative business models and technology to deliver a service that maximizes fleet utilization and profitability and improves customer satisfaction.

3.Credit Suisse Global Wealth Report 2022, Page 40, Table 1 (https://www.credituisse.com/media/assets/corporate/docs/aboutus/ research/publications/global-wealth-report-2022-en.pdf)

4.Forbes’ 35th Annual World’s Billionaires List: Facts And Figures 2021 (https://www.forbes.com/sites/kerryadolan/2021/04/06/forbes-35thnnual-worlds-billionaires-list-facts-and-f

5.Forbes Billionaires 2023: The Richest People In The World dated August 9, 2023 (https://www.forbes.com/sites/chasewithorn/2023/04/04/ forbes-37th-annual-worlds-billionaires-list-facts-and-figures-2023)

6.www.nytimes.com/2021/10/01/your-money/private-jets-demand.html

7.https://www.jdpower.com/business/press-releases/2021-north-america-airline-satisfaction-study

8.https://www.jdpower.com/business/press-releases/2023-north-america-airline-satisfaction-study

9.https://www.forbes.com/sites/suzannerowankelleher/2022/08/01/amid-airport-chaos-semi-private-jet-travel-emerges-ashegoldilocks- option/?sh=5abb9e8a11c7

6

Our private aviation offerings are designed with the goal of delivering exceptional value to our customers. We achieve this by employing a strategy with objective and measurable performance metrics.

One of our key strategies is the “Right Plane for Right Mission” approach. We have developed a core fleet of HondaJets that covers what management believes is the majority of private aviation missions in the markets in which we serve. These missions generally involve up to four passengers and distances of less than 1,000 nautical miles. We believe the HondaJet provides a best-in-class cabin experience, while also maintaining competitive operating costs. We also place great importance on developing strong, positive relationships with Honda.

The following are certain benefits of the HondaJet that we believe make it the ideal aircraft for our fleet:

•The HondaJet is a revolutionary aircraft that combines superior performance, comfort, and efficiency. Its innovative design features include a unique over-the-wing engine mount, natural laminar flow wing, and advanced flight deck technology.

•The HondaJet’s compact size and superior performance make it ideal for business and personal travel, with a range of up to 1,400 nautical miles and a top speed of 422 knots. Its spacious cabin comfortably seats up to six passengers and offers a range of amenities, including a fully enclosed lavatory and Wi-Fi connectivity.

•The HondaJet’s advanced safety features include an all-glass cockpit with state-of-the-art avionics, automatic stability augmentation system, and enhanced flight vision system, making it one of the safest and most advanced light jets on the market.

We believe in maintaining an alignment of economic interests with our aircraft owners. Through our program’s unique revenue sharing feature, we empower aircraft owners to share in eligible revenue generated from charter flights on their aircraft while maintaining preferred-rate access for their own flights on our fleet. This, together with our proprietary software, allows us the flexibility needed to maximize fleet utilization.

To further maximize fleet utilization, we have developed a suite of products that target underserved market segments. This commercial approach to fleet utilization allows us to offer a more comprehensive range of services to our customers, while also increasing our profitability.

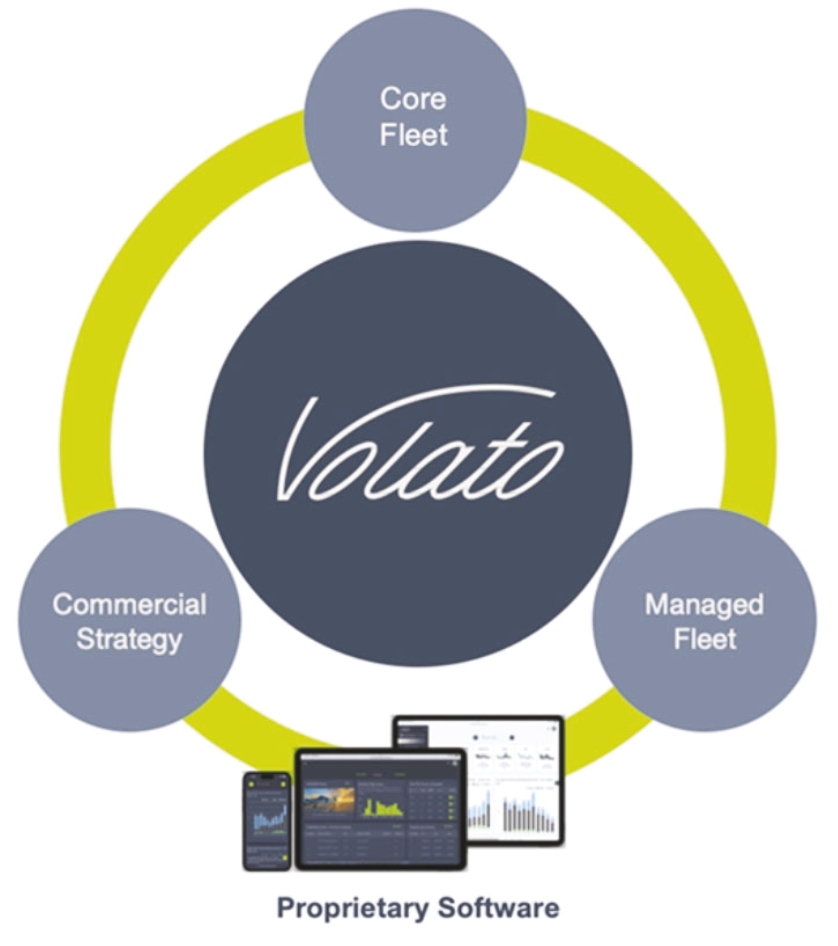

Our business model has three main components: 1) our unique aircraft sales and ownership program, 2) our aircraft management services, and 3) our revenue from charter flights which includes owner flights, deposit product flights, and wholesale/retail charter flights. The aircraft ownership program is an asset-lite model whereby we sell each fleet aircraft to a limited liability company. The LLC, owned by third-party owners, leases the aircraft back to us for management and charter operation on behalf of the LLC under 14 C.F.R. Part 135. Each program participant separately contracts with us for charter on our HondaJet fleet on preferred terms, generally including a set monthly management fee and preferred charter rates. For our second business model component, we provide aircraft management services to existing aircraft owners and help them monetize their aircraft through third-party charter activities. Finally, our commercial services generate demand

7

for both the aircraft ownership program fleet and managed aircraft fleet through the operation of retail deposit programs and retail charter as well as wholesale charter through brokers.

Volato Aircraft Ownership Program – An Innovative Approach to Shared Aircraft Ownership

Traditional fractional private aviation programs have typically been operated under 14 C.F.R. Subpart 91K, where fractional owners receive a block of entitled hours relative to the size of their fractional interest in the aircraft. An industry

8

standard assumes 800 occupied flight hours is equal to a full interest, meaning a 1/8th share would be recommended for an owner looking at 100 hours of annual usage.

We believe there are several disadvantages with this traditional model that can negatively impact the fractional owner:

•Does not provide the primary benefits of full aircraft ownership. Key benefits of owning an aircraft are the same basic “bundle of rights” that come along with ownership of any property, including the rights of possession, control, and enjoyment. In a traditional fractional model, the owner must sacrifice both control over how much it flies as well as enjoyment of revenue generated from the asset.

•Hard for customers to forecast flight usage needs across multi-year programs. Entitled hour programs require fractional owners to commit to an annual usage level for the length of the program. It is challenging for owners to forecast this accurately resulting in either owners overflying and requiring additional hours that may not be available or only available at substantially increased prices, or under flying and the program being more expensive than originally forecast.

•Depreciation is only applicable for a percentage of flights deemed business use. Many traditional fractional program owners who use their program for a mix of business and leisure travel are often disappointed to learn they may only be eligible for bonus depreciation on the percentage of their total usage that is deemed business use, and the leisure portion is not eligible. Additionally, if an aircraft owner’s use is primarily personal, no depreciation is available.

•Lack of transparency into aircraft flight operations. In the traditional program, fractional owners are often not provided detail into their aircraft’s flight operations, and it is generally not transparent how the aircraft is used or monetized outside of the fractional owner’s usage or if any of the owners benefit from that associated revenue generation.

•Fractional Owners traditionally accept operational control of their flights and the liability and risk associated with operational control. Traditional fractional ownership programs require their owners to execute an acknowledgment of operational control, where the fractional owner agrees to accept liability and risk associated with their flights operated under 14 C.F.R. Part 91(K).

Our solution provides an innovative and more financially viable model. Our program is a more versatile and operationally efficient version of aircraft ownership that provides key benefits of full aircraft ownership to the program participants. The program was designed to be more financially efficient by focusing on maximizing aircraft flight utilization while better aligning the interests of aircraft owners and us. The program participants are building our fleet, secured on a long-term basis at a lower cost of capital than leasing or acquiring aircraft, with lower risk, as we only pay revenue share based on usage rather than a flat monthly rate. Our revenue share payments to the LLCs that own the aircraft may reduce the pressure fractional owners often feel to fly a certain number of hours in a contract year. As a result, we may generate additional capacity on the fleet for non-owner flights.

•Fractional owners participate in aircraft revenue share. Our program participants enjoy a revenue share from eligible Volato revenue flights. The revenue share is a set contracted amount per eligible occupied revenue-generating flight hour and is calculated and remitted monthly to each aircraft holding SPE, which then distributes on a pro-rata basis to its members, the aircraft owners.

•Unlimited flight hours regardless of fractional size. By decoupling ownership and usage, and removing the concept of entitled hours, our HondaJet fractional owners can fly unlimited hours under the terms of the owner’s individual contracts with our air carrier subsidiary. A 1/16th owner can fly as much or as little as they wish and is not limited by the size of their share.

•Favorable tax treatment for owners. Due to the unique nature of our aircraft ownership structure, our owners may be eligible for depreciation of their aircraft asset through their respective Plane Co LLC interests.

•Our unique program benefits influence purchase decision. Traditional programs with entitled flight hours require customers to factor in anticipated flight hours into their fractional program purchase decisions. In contrast, we believe our owners are basing their purchase decisions based on anticipated flight usage and their personal financial situation. Our owners may buy a larger share based on their individual tax profile and depreciation benefits, or the larger revenue share they wish to receive as owners of larger shares enjoy preferential hourly rates and receive a larger revenue share based on the percentage of the owned aircraft.

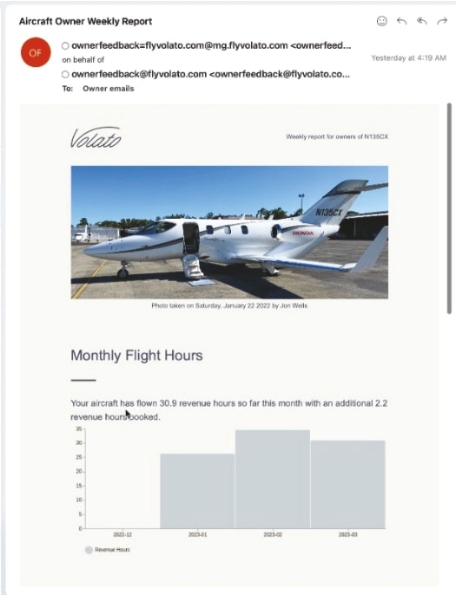

•Transparency into Flight Operations. Our software innovations allow for more transparency into its flight operations by providing program participants detailed information on their aircraft’s commercial activities and maintenance status.

9

•Transfer of Operational Control and Management. Under 14 C.F.R. Part 135, we assume operational control of aircraft we operate by way of a lease, which transfers responsibility for aircraft management and liability arising from the operation of the aircraft by us. In contrast, under Part 91K fractional programs, the owners retain operational control of the aircraft and have potential liability exposure related to the aircraft operations.

Our Current Fleet

Together with the benefits of HondaJets, we are focused on bringing efficiencies to the private aviation market, eliminating unnecessary and expensive unused capacity from private flights.

The traditional route to cost reduction in private aviation has been either single-pilot operations or deploying turboprop aircraft instead of jets. These methods are logical; single-pilot operations save on personnel costs, and turboprop aircraft are cheaper to operate. However, both measures have inherent downsides. Single-pilot operations have safety implications due to increased pilot workload, while turboprops are generally slower and noisier than jet aircraft.

Recognizing the gap in the market for an economically efficient but uncompromised private jet experience, we have not adopted these conventional cost-cutting measures. Instead, we are focusing on building a fleet of jet aircraft that meets the needs of our customers and is properly gauged for the majority of private aviation flights in the markets we serve.

The above concepts were central when considering and selecting aircraft for our fleet and unique business model. Our fleet is primarily composed of the HondaJet HA-420, a jet in the Very Light Jet market segment, that is best suited for flights of four or fewer passengers and under three hours or 1,000 nautical miles. Compared to the Phenom 300, we believe the HondaJet offers multiple advantages:

•Superior Operating Efficiency. The HondaJet’s design and performance profile means it is not just less expensive to operate but also matches the fuel economy of a turboprop, maintaining the speed and quietness of a jet without incurring extra fuel costs. This efficient operation enables us to offer cost savings to customers while preserving the jet experience.

•Superior Cabin Experience. The over-the-wing engine mount design of the HondaJet decreases cabin noise, thus enhancing passenger comfort. Despite its smaller size, it provides a comfortable cabin and a larger luggage compartment compared to other jets in its category.

•No Compromise. While the HondaJet HA-420 is rated for single-pilot operations, all of our HondaJet commercial passenger flights are operated with two pilots. This staffing includes safety and service benefits for our customers, while offering a more cost-effective solution.

Aircraft Ownership Program Revenue Streams

Our Aircraft Ownership Program has 3 revenue streams that are long-term (5-year contract), recurring in nature and predictable, which together provide a high level of revenue visibility for the business.

•Aircraft Sales Revenue. We sell aircraft to the LLCs, and the aircraft are subject to a 5-year leaseback to us. We believe that if we deliver on our brand and product promise then we should see a substantial renewal rate by program participants when the lease expires.

•Monthly Management Fee. Program participants under our traditional pricing structure pay a set monthly management fee, which is subject to an annual increase. Holders of smaller sizes (i.e., 1/8th and 1/16th) pay a premium. Program participants under our low-use pricing structure do not pay a monthly management fee but pay a premium for their usage. This revenue is included in “aircraft management revenue” in our MD&A.

•Charter Flight Revenue. Program participants may book flights on the HondaJet fleet at preferential hourly rates. Repositioning fees are waived for owner flights departing within an estimated two-hour flight time from select our bases. Fuel is separately charged to the owner at our blended cost. The total flight charge is invoiced after the flight is completed and the revenue is included in “charter flight revenue” as in our MD&A.

Commercial Strategy – Optimizing Fleet Utilization

We are developing commercial capabilities in the light jet market segment with our HondaJet fleet through a multi-channel, segmented product and pricing approach.

Under our ownership program, owners have guaranteed availability to our aircraft on an unlimited basis. When owners are not flying, we have an opportunity to sell capacity that would otherwise remain unused as charter flights (“Charter”), which

10

is a non-guaranteed availability offering. At all times, we maintain operational control over our aircraft (i.e., we assign aircraft to and accept flights at our discretion), without requiring any aircraft owner approval. This provides us with the ability to schedule flights efficiently.

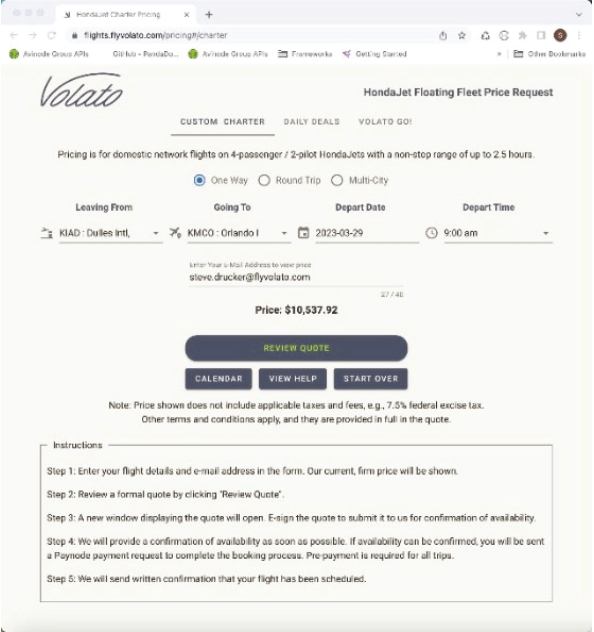

We take advantage of this Charter opportunity with dynamic pricing offered through a variety of options available simultaneously to our flight deposit program and general retail and wholesale customers. We use a proprietary pricing tool to adjust pricing for any given flight based on factors such as forecasted demand, available aircraft, and booking dates. In contrast, it is typical in private aviation for pricing to be set at fixed hourly rates that do not vary.

Through inventory management and pricing practices, we can offer Charter customers access to our fleet, depending upon demand and other criteria we set. While we do not guarantee availability for any Charter customer at any time, we also do not require any long-term commitment or block access to our fleet during peak demand periods.

Revenue Streams from Fleet Optimization

All of the revenue described below in revenue streams from fleet optimization is included in “aircraft usage revenue” in Volato Group’s MD&A.

Deposit Products

We have created a complementary set of products with differentiable attributes beyond price. For the HondaJet floating fleet, our service network for all Charter services is presently focused on domestic operations with limited access to Mexico, Canada, and the Caribbean. Pricing for flight services on all Charter quotes, though determined dynamically, is fixed at the time of quoting.

Volato Insider

We introduced a deposit-based program in March 2023 to reduce the inefficiencies of booking and paying on a trip-by-trip basis while rewarding larger deposit customers with capped rates for HondaJet flights in certain geographical zones. Deposit customers pay the lower of the then-current general charter rate or the capped rate. Larger deposits in the program receive capped pricing in larger geographical zones. Insider deposit customers have preferred access for charter requests over general charter, and the program is fully refundable for any unused balances during the term of the agreement, but are not refundable after the term of the agreement, except any incentive credits customers may have received.

Volato Stretch Jet Card

Launched in 2022, the Volato Stretch jet card is designed for price-conscious customers with high schedule flexibility. We may make changes to itineraries under this program and compensate customers for eligible changes with non-cash credits towards future flights. Unused balances may be refunded during the term of the agreement, but are not refundable after the term of the agreement; incentive credits are not refundable.

Charter

Charter currently comprises approximately 40% of our revenue flight hours. However, our strategy is to build our deposit program customer base, and reduce general Charter. General Charter helps us increase our fleet utilization by filling in capacity remaining after the aircraft ownership program or deposit program customer flights. To improve our general Charter capabilities, we are working on proprietary software to improve our quoting, pricing, and scheduling processes. These capabilities are designed to improve the customer booking experience and increase the speed of transactions.

Volato Aircraft Management Services

Volato Aircraft Management Services (the “Volato AMS”) is a full-service management and charter operator line of business within Volato Group. Under Volato AMS, owner aircraft are managed by and leased to Volato Group for both owner flights and third-party charter flights under our FAA Air Carrier Certificate, or managed by us for the owner’s exclusive use. The benefits to the wider organization of the Volato AMS division include having additional aircraft which can be used by us for occasional charter capacity and for last-minute relief flights when our charter fleet planes become unavailable for scheduled flights. Some aircraft also provide additional capabilities such as larger cabins and range. By increasing the total aircraft available to us for Charter, Volato AMS also helps unlock economies of scale to the benefit of Volato Group and its aircraft ownership program participants.

11

The Volato AMS managed fleet includes a range of different aircraft that were primarily inherited as part of the Gulf Coast Aviation acquisition in March 2022. Going forward the key focus is airframes which are part of our core fleet, currently HondaJets.

Volato AMS currently manages six aircraft on the FAA Air Carrier Certificate and one airplane is managed solely for owner use and is not on the Certificate.

Revenue Streams for Volato AMS

The two sources of revenue are aircraft management fees and Charter revenue sharing. Aircraft management fees which are included in managed aircraft revenue in our MD&A are paid by aircraft owners to Volato AMS and include all operating expenses for the aircraft: maintenance, crew hiring and management, flight operations, dispatch, hangar, fuel, cleaning, insurance, and aircraft Charter marketing. Volato AMS typically receives 15% of the revenue per Charter trip and revenue from these charter trips are included in “charter flight revenue” in our MD&A.

Software Strategy

Following a thorough examination of off-the-shelf flight management systems, we identified that none could fully meet our current and projected needs. Consequently, in September 2022, we made the decision to develop a custom flight management and marketing platform to meet our specific requirements.

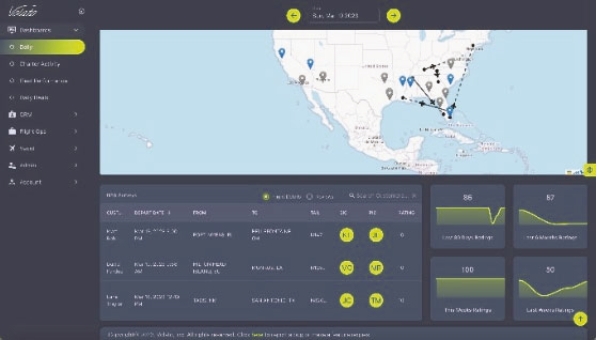

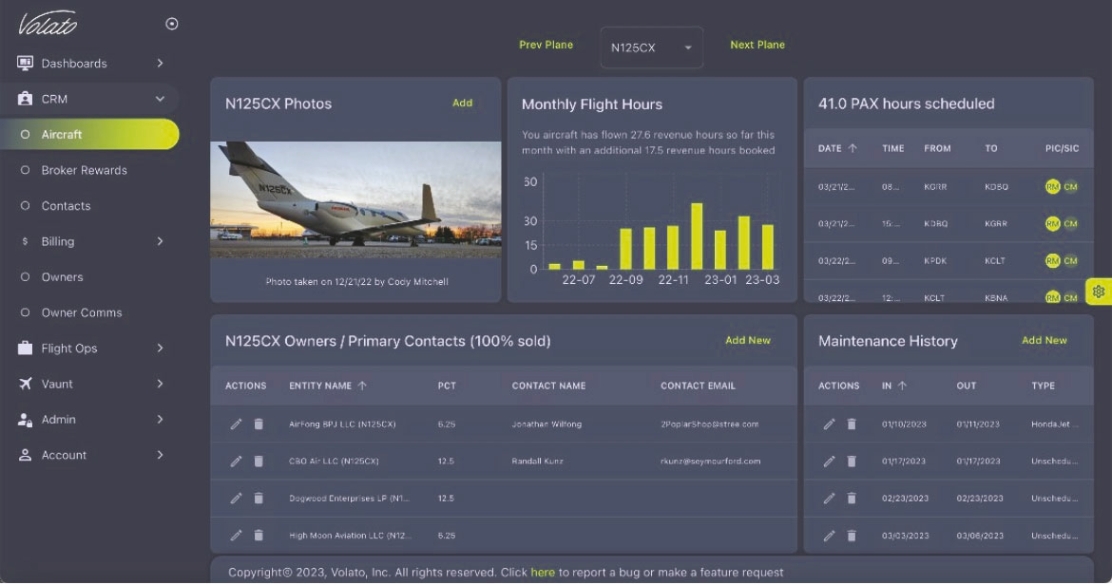

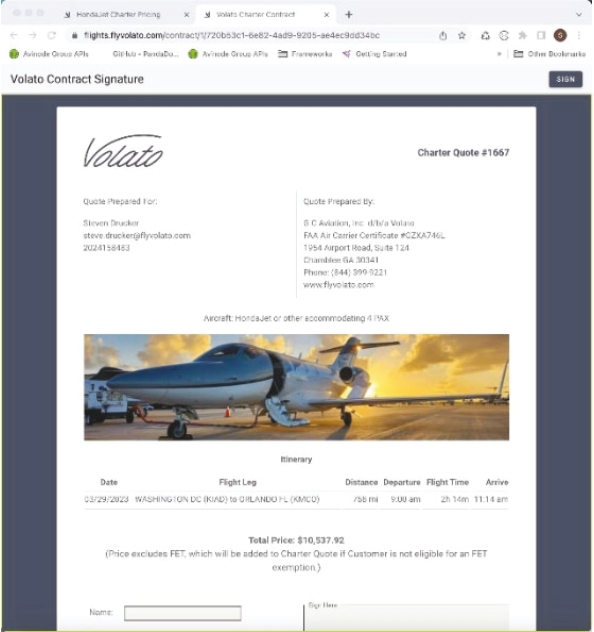

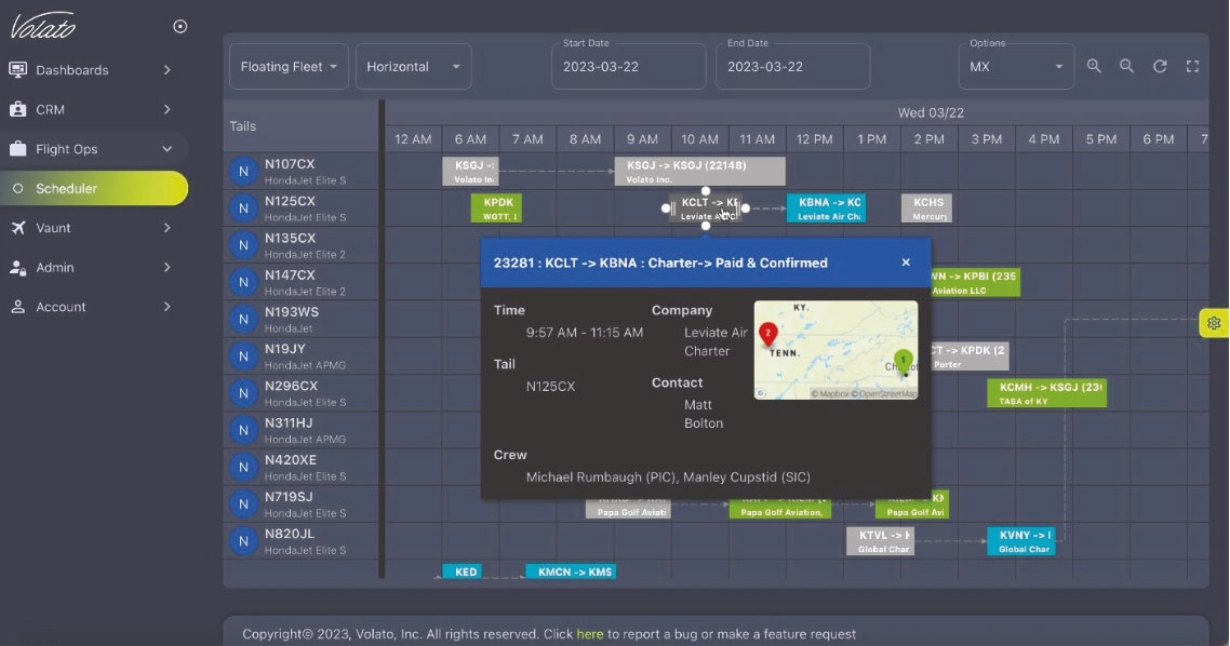

Our cloud-based software, Mission Control, is a modern, API-first solution for the management of our business. Mission Control provides a wide range of features, including Avinode data integration and synchronization, an internal/external-facing Charter pricing tool, and a Broker Rewards program, a voluntary program through which we pay a commission to third-party individual Charter brokers for eligible flights purchased through the brokers. Our software also offers an Empty Leg Marketing module, which provides daily deals to customers, increasing their opportunities to save on Charter flights.

Mission Control's reporting dashboards provide real-time insights into daily Charter sales, fleet performance, and select key performance indicators (“KPIs”). The platform's crew and aircraft scheduling tools enable the management of aircraft ownership, monthly flight hours, and owner flight activity. The fleet map feature provides an interactive display of our entire fleet, allowing us to track aircraft locations in real-time via an ADS-B data provider.

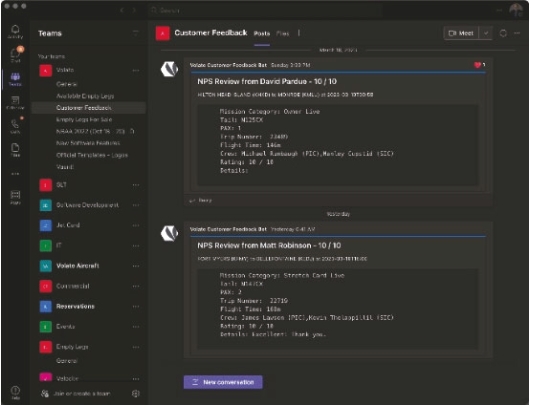

Our Aircraft Owner Database feature includes a customer relations management tool, meet and greet alerts, an auto-generated weekly email newsletter, and automated billing and invoicing functionality. The platform's Customer Flight Reviews feature, which includes Net Promotor Score metrics, allows us to collect valuable feedback from customers and make informed business decisions.

Our software solution improves transparency, operational efficiency, scalability, and customer satisfaction. Additionally, it enhances our financial performance, by streamlining our flight management processes and reducing manual workloads.

Real-time updates to KPI dashboards and alert notifications, delivered over multiple communication channels and through multiple visualizations enable swift decision-making and greater oversight across our operations.

|

|

|||||||

| Figure: Flight reviews are output to a Microsoft Teams channel that is open to the entire company. | Figure: Aggregate NPS scores displayed in our proprietary Volato MissionControl application. | |||||||

12

One of our core aims is to improve customer satisfaction by enabling real-time interactions across our entire enterprise. Our platform enables greater transparency and visibility for our customers with the opportunity to follow their journey and receive updates at every stage. This enables us to reduce customer complaints, boost retention rates, and enhance our reputation in the market.

|

||||||||

Figure: Enhancing transparency by sending an automated weekly email to aircraft ownership program participants about their asset’s performance over time.

Figure: Volato Mission Control Aircraft Dashboard

13

Additionally, our proprietary software solutions enhance marketing capabilities by exposing features of the platform to potential customers, including charter brokers and retail customers which we believe will increase charter sales and create greater brand exposure.

|

|

|||||||

Figure: Our proprietary instant-pricing system and e-signature platform reduces overhead while providing customers with improved service.

Currently, our reservation/flight operation team enters flight reservations, schedules, invoices, and quotes into a third-party system. This data is, in turn, imported into Volato Mission Control in near-real time.

Figure: Mission Control Flight Scheduling

With Mission Control, we have access to a sophisticated tool for managing our business, providing real-time access to essential data, streamlining operations, and enhancing the customer experience. Our software is designed to drive our productivity, resulting in reduced costs, and increased operational efficiency and revenue.

14

Social Impact Initiatives

As a growing company, we have an opportunity to build an aviation company for tomorrow. Our business model, fleet, people, and culture have all been influenced by our awareness of our social impact and place as a good corporate citizen in our community.

We prioritize environmental responsibility and operate a fleet of efficient aircraft. Lower fuel burn and operating costs are key selection criterion in evaluating prospective airframes for our fleet. Aircraft that match these criteria, in addition to being financially efficient, reduce the carbon footprint. We believe that sustainability is a critical aspect of our business and offset 100% of the CO2 generated by our HondaJet core fleet’s flight operations (which excludes any HondaJets that are managed by us) through our participation in the 4AIR offset program by purchasing carbon offsets for all fuel used by the fleet; however, we cannot provide assurance that such 4AIR offset program will achieve its stated goal. Although we do not perform any independent monitoring, 4AIR’s carbon offset program is quantified and verified by several leading carbon offset registries which issue serial numbers to us for each retirement of the carbon offset. Through this offset program, we are actively taking steps to reduce our impact on the environment.

We also strongly believe in creating a diverse, equitable, and inclusive workplace that values and celebrates all employees. We recognize the importance of promoting diversity in the aviation industry, and as of 15 April 2023, we actively support organizations such as Women in Aviation, the Organization of Black Aerospace Professionals, National Gay Pilot Association, Latino Pilots Association, Professional Asian Pilots Association, and the U.S. Military.

We invest in our employees and provide a range of competitive benefits. We offer comprehensive healthcare including dental and vision, a matching 401k program, paid time off, life insurance, and short-term disability. We invest in our team through training and mentorship.

Our commitment to sustainability and diversity is just one aspect of our overall mission to provide the best possible experience for our customers. By prioritizing the needs of our employees, we are able to create a positive and welcoming environment that translates into an exceptional aviation experience for all our clients. We are dedicated to setting high standards and providing our customers with a truly exceptional experience.

Flight Operations

Within our organization, we have a dedicated Flight Operations team that is responsible for the safety and efficiency of our aviation operations. This team is comprised of various sub-teams, including our Safety team, Operations Control Center (OCC), Experience Concierge (EC), maintenance team, aircraft management team, and training team.

Our safety team is tasked with implementing and maintaining our safety standards in all aspects of our operations. They continuously monitor and evaluate our safety protocols, with an emphasis on applying industry best practices and regulatory compliance.

The Operations Control Center (OCC) team is responsible for overseeing and managing our daily operations. They monitor flights, manage schedules, and make real-time decisions to support flight operations.

Our Experience Concierge (EC) team focuses on providing our aircraft ownership program, jet card, and charter deposit program customers with a first-class travel experience. They work closely with these customers to understand their needs and preferences, and EC’s goal is to deliver seamless and enjoyable travel experiences. Volato’s hospitality-oriented Experience Concierge account management team is central to our focus on Customer Experience (CX). This is the reason why our HondaJet fleet aircraft have the tail signifier of “CX”.

The maintenance team is responsible for maintaining the airworthiness of our aircraft. They conduct regular inspections, repairs, and maintenance to keep our aircraft in condition and meeting required safety standards. They also work with our maintenance program vendors to schedule third-party maintenance.

Our aircraft management team is responsible for overseeing the overall management and operations of our aircraft fleet. They work closely with our maintenance team to keep our aircraft ready to operate on schedule.

Finally, our training team is responsible for training our pilots and other staff members. They also continuously monitor and evaluate our training programs.

Our Flight Operations staff is located in numerous states in the U.S., including locations in all continental time zones. While many of our employees work remote-first, we have concentrated groups of personnel in the Houston, Texas and

15

Saint Augustine, Florida areas. Our pilots are not “home-based” like traditional airlines/fractional jet operators, allowing them to work from any U.S. state and travel to their assigned aircraft at the start of their scheduled work rotation. This approach provides significant advantages over legacy physical operations centers, as it allows us to operate more efficiently and effectively and increase recruiting opportunities, while also reducing our environmental footprint.

Air Carrier Operations

We provide our passenger air carrier services through G C Aviation, Inc. d/b/a Volato, a wholly-owned subsidiary and Part 135 certificate entity. G C Aviation is our exclusive Part 135 operator and provides flight services, aircraft management, private aircraft charter services, and maintenance support.

Safety

At Volato Group, we pride ourselves on our commitment to safety. We believe that safety is not only a fundamental aspect of our organizational culture, but also a cornerstone of the aviation industry. As such, we view compliance with the Federal Aviation Administration (FAA) regulations as merely the baseline for our safety commitment.

To further reinforce our dedication to safety, we have gone above and beyond the minimum FAA requirements by establishing higher safety standards across a range of critical areas such as pilot experience, certification, training, and safety programs. We have implemented Safety Management Systems (SMS) for our air carrier subsidiary that surpasses the FAA regulatory requirements.

Our SMS is a valuable tool for identifying potential hazards, assessing and mitigating risks associated with those hazards, collecting safety data and, most importantly, acting on that data to improve operations. The SMS is managed by our Director of Safety.

One of the key components of our SMS is the Flight Risk Assessment Tool (FRAT), which is used on every flight operated by Volato Group to quantify the flight’s level of risk. Every flight has some level of risk, so the FRAT is important to help distinguish, in advance, between a lower-risk flight and a higher-risk flight. Once identified, higher-risk flights can be assessed for potential mitigation.

Aside from our internal safety management efforts, we are also proud voluntary participants in audits from various third-party safety organizations, including ARGUS and IS-BAO. These audits provide us with an opportunity to have external experts review and enhance the continuous improvement of our SMS.

We believe that our commitment to safety is the cornerstone of our organizational culture. Through our Safety Management Systems and voluntary participation in third-party safety audits, we remain committed to all aspects of safety across our operation.

Volato’s Pilots

All of our commercial passenger flights are operated with two trained and qualified pilots. Our pilot requirements exceed the Federal Aviation Administration's (“FAA”) requirements and training criteria outlined in the Federal Aviation Regulations. Each of our pilots is required to hold an appropriate FAA-required FAA pilot certificate and FAA medical certificate, as well as the necessary type rating for the aircraft they will be flying.

In addition to meeting these essential requirements, our pilot selection process also includes a comprehensive screening process that considers a candidate's professional background, customer service skills, and safety record. This process includes both technical and customer service interviews, allowing us to identify candidates who possess the necessary skills and traits to provide our customers with a superior travel experience.

Once selected, our pilots undergo mandatory advanced aircraft ground and flight training in a full-motion simulator, as well as recurrent training on the relevant aircraft. Through this comprehensive training regimen, our pilots are prepared to handle a challenging situation that may arise during a flight.

Aircraft Maintenance and Repairs

As an aviation company, safety is our utmost priority. We have established a maintenance program that covers all types of maintenance and repairs that occur on different schedules. This includes line maintenance, which involves scheduled maintenance inspections, routine repairs, and unscheduled items as needed. Additionally, we perform scheduled airframe maintenance inspections and engine overhauls at appropriate intervals for any given airframe or engine. Our fleet

16

maintenance is scheduled to prioritize the least disruption and downtime, ending mission proximity to a service center, and compliance with maintenance program requirements. We also conduct unscheduled and “airplane on ground” (“AOG”) repairs as necessary, and as soon as possible, to return the aircraft to service in a timely fashion.

We have two maintenance facilities, one located in St. Augustine, FL and one in Houston, TX. We use third-party maintenance providers to perform substantially all scheduled maintenance work.

Key Vendors

We have contracts with airframe manufacturers to provide parts and maintenance labor for our aircraft at pre-negotiated pricing and rates. Additionally, we have agreements with select airframe and engine manufacturers whereby they provide maintenance services for various aircraft on our certificate. These services are primarily focused on scheduled airframe maintenance inspections, engine inspections, and engine overhauls, in exchange for an hourly rate per flight hour or engine cycle charge.

Furthermore, we have pricing agreements with various fuel providers across the United States, which provide us with pre-negotiated pricing for fuel, as well as handling and facility fees at each location.

We have entered into agreements with a well-known third-party supplier for factory-authorized pilot training, which includes fixed price training slots throughout the year for both initial and recurrent pilot training.

Government Regulation

Primary Domestic Regulators

The subsequent paragraphs provide a brief overview of the roles of some of the most notable domestic regulators relevant to our business operations. It is important to note that this summary is not intended to be comprehensive, as it does not encompass every regulator or rule governed by these regulators.

The Department of Transportation (“DOT”) serves as the primary regulator of economic matters within the aviation industry. Specifically, with respect to our business operations, DOT oversees our subsidiary that operates as an air taxi under Part 298 (14 C.F.R. Part 298, referred to herein as “Part 298”). This includes the economic authority to conduct business as a type of air carrier, as well as consumer protection and insurance requirements applicable to such business.

Furthermore, DOT regulates our advertising and service offering under Part 295 (14 C.F.R. Part 295, referred to herein as “Part 295”). As a statutorily-defined “ticket agent” and “air charter broker” under Part 295, we are subject to DOT jurisdiction in offering and selling our charter programs and in arranging flights on behalf of our customers. In all aspects of our business operations that fall under DOT's purview, we are obligated to comply with its statutory and regulatory authorities to prevent and redress “unfair” or “deceptive” practices. We are also subject to DOT's consumer protection regulations, which cover various areas, such as data reporting, recordkeeping, advertising, ticket sales, and ensuring equal access to air transportation for disabled passengers.

Additionally, DOT enforces U.S. laws governing the citizenship of air carriers. This includes requirements that air carriers be under the actual control of U.S. citizens and satisfy certain other criteria, including having a U.S. citizen as our president/chief executive officer and at least two-thirds of our Board, and other managing officers must be U.S. citizens, and that at least seventy-five percent of our voting stock must be owned and controlled, directly and indirectly, by U.S. citizens. The amount of non-voting stock that may be owned or controlled by non-U.S. citizens is limited as well.

The Federal Aviation Administration (“FAA”) is the primary governing body responsible for overseeing safety matters in the aviation industry. Its regulatory framework encompasses various facets of civil aviation, including the design and manufacture of aircraft and their components, inspection, maintenance, repair and registration of aircraft, as well as the training, licensing, and performance of duties by pilots, flight attendants, and maintenance technicians. The FAA also regulates safety-sensitive personnel for prohibited drug use or alcohol consumption, and oversees the design, construction, and maintenance of runways and airport facilities. Furthermore, the FAA is tasked with managing air traffic control systems and the complex air traffic at busy airport facilities. It certifies and monitors air carriers, establishes Safety Management Systems, promotes voluntary data disclosure systems that aid in enhancing safety, and oversees and controls the operations of air carriers by their accountable managers, directors of operations, and directors of maintenance, among other key personnel.

17

The FAA's regulatory framework is comprised of several parts found in Title 14 of the U.S. Code of Federal Regulations. For instance, Part 91 contains the general rules for flight safety, while Part 135 contains additional rules that apply to commercial on-demand operations. In the event of a security threat, environmental risk, or other emergency, the FAA holds the power to shut down segments of airspace or even the entire U.S. airspace to civilian use, as demonstrated on September 11, 2001.

As an agency of the Department of Homeland Security (“DHS”), the U.S. Transportation Security Administration (“TSA”) is the primary regulatory body responsible for security matters in the aviation industry. The TSA's oversight extends to standard security programs in use by U.S. airports and air carriers, which cover areas such as flight crew training, passenger identity and screening, security watchlists, and cooperation in threat assessments and responses.

U.S. Customs and Border Protection (“CBP”), also an agency of DHS, plays a crucial role as the primary regulator of customs, immigration, and public health matters affecting the aviation industry. Whenever our air carrier operations involve international flight segments, we are required to provide CBP with advanced disclosure of passenger information, facilitate the inspection of baggage, including prohibited substances or invasive species of plants or animals, and ensure proper disposal of any foreign-originating refuse on the aircraft.

The Environmental Protection Agency (“EPA”) is the primary federal environmental regulator, responsible for promulgating new rules relating to greenhouse emissions from carbon fuels used in aircraft engines in January 2021. These rules are expected to bring about changes in future aircraft engine designs and approvals, leading to a turnover in which engines may remain in use in the coming years. However, this area of regulation remains subject to change based on domestic and international pressures to address the perceived needs of our global environment, making it difficult to predict how these developments might impact our business in the future.

The vast majority of airports where we operate are owned and operated by state and local government entities, which have the right to impose safety, security, and other regulations as long as they do not conflict with federal law.

Airport authorities also have extensive property rights, enabling them to impose conditions on leasing and using airport facilities. The terms on which an airport authority might lease or allow use of its property may be less favorable than customary for real estate transactions outside of an airport environment.

These regulatory authorities possess the power to suspend or revoke our certifications or authorizations, impose monetary fines and other civil penalties, and refer cases for criminal prosecution, which could halt our business and flight operations. These actions may occur with or without an opportunity for us to present our defense before action is taken by the regulator. Even if our position is potentially reasonable, we may not prevail in an appeal because of the regulators' significant discretion and the deference given to their interpretation of the facts and law during the appeal process.

The National Transportation Safety Board (“NTSB”) is an independent agency that is responsible for oversight of aircraft accident investigations. NTSB regulations that govern accident notification are contained in 14 CFR Part 830. NTSB has the authority to issue subpoenas in conjunction with accident investigations. NTSB may elect to delegate accident investigation duties to the FAA.

Privacy and Data Protection

Compliance with laws governing the collection, use, transfer, security, storage, destruction, and other processing of personally identifiable information and other data relating to individuals is important for our business. As our technology platform is an integral part of our operations, adherence to federal, state, local, municipal, and foreign laws and regulations, as well as industry standards, is necessary to enhance the user experience of our mobile application and marketing site relevant to our business.

We receive, collect, store, process, transmit, share, and use personal information, and other customer data, including health information. We also rely on third parties to manage certain aspects of these operations and to receive, collect, store, process, transmit, share, and use such personal information, including payment information. The collection, storage, processing, sharing, use, retention, and security of this information are governed by various laws and regulations.

The California Consumer Privacy Act (“CCPA”) establishes a privacy framework for covered businesses regarding data privacy rights for California residents. Compliance with the CCPA is necessary for businesses to provide certain disclosures to California residents, respond to their requests for disclosures regarding their personal information, and offer them the right to opt out of sales of personal information. The CCPA also provides for severe statutory damages for noncompliance and private rights of action for certain breaches of personal information resulting from a covered business's

18

failure to implement reasonable security procedures and practices. Furthermore, the California Privacy Rights Act, which took effect on January 1, 2023, expands California residents' rights under the CCPA.

Given that we collect personal information from California residents through the air transportation services we have offered in California in the past and direct marketing to California residents for those services, as well as our plans to offer future services in California, we believe that we are subject to compliance with California's privacy laws.

Employees

Our employees are central to our and our customers’ success. As of December 31, 2023, we have 229 employees, including 116 pilots and no part-time employees. In addition, we engage a number of contractors and consultants to supplement our workforce. All full-time employees are located within the United States and fulfill a range of roles, including non-exempt and exempt positions in corporate functions, pilots, and maintenance personnel.

To date, Volato Group and our affiliates have not experienced any work stoppages. Furthermore, none of our employees are currently represented by a labor organization or subject to collective bargaining agreements. Our human capital objectives include, as applicable, identifying, recruiting, retaining, incentivizing and integrating our existing and new employees. The principal purposes of our incentive plans are to attract, retain and motivate selected employees and consultants through the granting of stock-based compensation awards.

Facilities

We are a remote-first company, founded during the COVID-19 crisis. Our physical operations are located primarily at three locations: St. Augustine, Florida; Houston, Texas; and Atlanta, Georgia. All our facilities are located on land that is leased from third parties. We believe that these facilities meet our current and future anticipated needs. In addition, primarily for aircraft ownership program participants’ flight pricing, we designate a few other physical locations as operational bases, which may or may not have personnel or facilities, but which our owners are not charged repositioning fees to fly from.

Due to operating a floating fleet, our core fleet of charter aircraft do not return to our facilities or a designated airport each night, but over-night throughout the country based on their flight schedule. Our managed aircraft, which are operated primarily for the benefit of the aircraft owners, typically return to a single, “home” airport, but will occasionally overnight at other airports.

Intellectual Property

Safeguarding our proprietary technology and other intellectual property is important for our business. We employ a combination of strategies, including trademarks, contractual commitments and security procedures to protect our intellectual property. We require our employees and relevant consultants to sign confidentiality agreements and certain third parties to sign nondisclosure agreements. We routinely evaluate our technology development initiatives and branding strategy to identify potential new intellectual property. We have pending U.S. and certain foreign trademark applications, including the “Volato” word mark and Dragonfly design mark.

Presently, we own the Internet domain “flyvolato.com.” The regulation of domain names in the United States is subject to change, and regulatory authorities may create additional top-level domains, appoint additional domain name registrars, or change the prerequisites for holding domain names. As a result, we may not be able to acquire or maintain all domain names that incorporate the name “Volato” or are otherwise relevant to or descriptive of our business.

Although software can be protected by copyright law, we have chosen to rely primarily on trade secret law to protect our proprietary software and have chosen not to register any copyrights in these works. In the United States, copyright law requires registration to bring a claim for infringement and to obtain certain types of remedies. However, even if we decide to register a copyright in our software to bring an infringement action, the remedies and damages available to us for unauthorized use of our software may be limited.

It is important to note that intellectual property laws, contractual commitments, and security procedures provide only limited protection, and our intellectual property rights may be challenged, invalidated, circumvented, infringed upon, or misappropriated. Furthermore, trade secrets, know-how, and other proprietary materials may be independently developed by our competitors or revealed to the public or our competitors, and may no longer provide protection for the related intellectual property.

19

Additionally, intellectual property laws vary from country to country, and we have not sought trademark registrations in every foreign jurisdiction in which we have or may operate. As a result, we may be unable to protect certain aspects of our brands or other intellectual property in other jurisdictions.

AVAILABLE INFORMATION

Our Internet address is www.flyvolato.com. At our Investor Relations website, www.ir.flyvolato.com, we make available free of charge a variety of information for investors. Our goal is to maintain the Investor Relations website as a portal through which investors can easily find or navigate to pertinent information about us, including:

•Our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and any amendments to those reports, as soon as reasonably practicable after we electronically file that material with or furnish it to the Securities and Exchange Commission (“SEC”) at www.sec.gov.

•Information on our business strategies, financial results, and metrics for investors.

•Announcements of investor conferences, speeches, and events at which our executives talk about our product, service, and competitive strategies. Archives of these events are also available.

•Press releases on quarterly earnings, product and service announcements, legal developments, and international news.

•Corporate governance information including our governance guidelines, committee charters, codes of conduct and ethics, and other governance-related policies.

•Other news and announcements that we may post from time to time that investors might find useful or interesting.

•Opportunities to sign up for email alerts to have information pushed in real time.

In addition to our website, the public may read or copy any document we file with the SEC at the SEC’s website, http://www.sec.gov (File No. 001-41104). The information found on our websites is not part of, or incorporated by reference into, this or any other report we file with, or furnish to, the SEC. In addition to these channels, we use social media to communicate to the public. It is possible that the information we post on social media could be deemed to be material to investors. We encourage investors, the media, and others interested in Volato to review the information we post on the social media channels listed on our Investor Relations website.

20

ITEM 1A. RISK FACTORS

Unless the context otherwise requires, all references in this subsection to “we” and “our” refers to the business the business of Volato Group and our consolidated subsidiaries. The occurrence of one or more of the events or circumstances described in these risk factors, alone or in combination with other events or circumstances, may have a material adverse effect on the business, financial condition, results of operations, cash flows and future prospects of Volato, in which event the market price of the Common Stock of Volato Group could decline, and you could lose part or all of your investment.

Risks Related to Our Business and Industry

We have a limited operating history and history of net losses, and may continue to experience net losses in the future.

You should consider our business and prospects in light of the risks, expenses, and difficulties encountered by companies in their early stage of development. We launched our business on January 7, 2021. Accordingly, we have limited operating history upon which to base an evaluation of our business and prospects.

While we seek to differentiate our private aviation services by using a cost-effective fleet and offering different products to meet customers’ individual needs, including (i) our ownership program, (ii) our potential jet card customers’ ability to purchase a block of flight hours, and (iii) deposit program products, we may not be successful in attracting or retaining customers. Ours Jet Share customers’ ability to earn charter income on unused hours may not be realized by our customers to the extent anticipated, or at all. Even if these benefits are realized as anticipated, our competitors may offer directly competing services or other features that customers find more attractive.

We have experienced significant net losses since our inception and, given our limited operating history and the significant operating and capital expenditures associated with our business plan, it may experience continuing net losses in the future and may never become profitable (as determined by U.S. Generally Accepted Accounting Principles or otherwise). If we achieve profitability, we cannot be certain that it will be able to sustain or increase profitability. To achieve and sustain profitability, we must accomplish numerous objectives, including broadening and stabilizing our sources of revenue and increasing the number of customers that utilize our service. Accomplishing these objectives may require significant capital investments. We cannot assure you that we will be able to achieve these objectives.

Significant reliance on HondaJet and Gulfstream aircraft and parts poses risks to our business and prospects.

As part of our business strategy, we have historically flown HondaJet aircraft and are expanding to fly Gulfstream aircraft. If either Honda Aircraft Company or Gulfstream fails to adequately fulfill our obligations towards us or experiences interruptions or disruptions in production or provision of services due to, for example, bankruptcy, natural disasters, labor strikes, or disruption of their supply chain, we may experience a significant delay in the delivery of or fail to receive previously ordered aircraft and parts, which would adversely affect our revenue and results of operations and could jeopardize our ability to meet the demands of our customers. Although we could choose to operate aircraft of other manufacturers, such a change would involve substantial expense to us and could disrupt our business activities. Additionally, the issuance of FAA or manufacturer directives restricting or prohibiting the use of either HondaJet or Gulfstream aircraft would have a material adverse effect on our business, results of operations, and financial condition.

We may not be able to successfully implement our growth strategies.

Our growth strategies include, among other things, attracting new customers and retaining existing customers, expanding our addressable market by opening up private aviation to customers that have not historically used private aviation services, expanding into new markets and developing adjacent businesses. We face numerous challenges in implementing our growth strategies, including our ability to execute on market, business, product/service and geographic expansions. For example, our continued growth could increase the strain on our resources, and we could experience operating difficulties, including difficulties in hiring, training, and managing an increasing number of pilots and other employees. These difficulties may result in the erosion of our brand image, divert the attention of our management and key employees, and impact our financial and operational results.

Our strategies for growth are dependent on, among other things, our ability to expand existing products and services and launch new products and services. Although we may devote significant financial and other resources to the expansion of our products and service offerings, our efforts may not be commercially successful or achieve the desired results. Our financial results and our ability to maintain or improve our competitive position will depend on our ability to effectively gauge the direction of our key marketplaces and successfully identify, develop, market, and sell new or improved products and services in these changing marketplaces. Our inability to successfully implement our growth strategies could have a

21

material adverse effect on our business, financial condition, and results of operations and any assumptions underlying estimates of expected cost savings or expected revenues may be inaccurate.

If we are not able to successfully enter into new markets and services and enhance our existing products and services, our business, financial condition, and results of operations could be adversely affected.

Our growth will depend in part on our ability to successfully enter new markets and offer new services and products. Significant changes to our existing geographic coverage or the introduction of new and unproven markets may require us to obtain and maintain applicable permits, authorizations, or other regulatory approvals. Developing and launching new or expanded locations involves significant risks and uncertainties, including risks related to the reception of such locations by existing and potential future customers, increases in operational complexity, unanticipated delays or challenges in implementing such new locations or enhancements, increased strain on our operational and internal resources (including an impairment of our ability to accurately forecast customer demand), and negative publicity in the event such new or enhanced locations are perceived to be unsuccessful. We have scaled our business rapidly, and significant new initiatives may result in operational challenges affecting our business. In addition, developing and launching new or expanded locations may involve significant upfront investment, such as additional marketing and terminal build out, and such expenditures may not generate a return on investment. Any of the foregoing risks and challenges could negatively impact our ability to attract and retain customers. If these new or expanded locations are unsuccessful or fail to attract a sufficient number of customers to be profitable, or we are unable to bring new or expanded locations to market efficiently, our business, financial condition, and results of operations could be adversely affected.

We are exposed to the risk of a decrease in demand for private aviation services.

Our business is concentrated on private aviation services, which are vulnerable to changes in consumer preferences, discretionary spending, and other market changes impacting luxury goods and discretionary purchases. The occurrence of geopolitical events such as war, including the current conflicts in Israel and Ukraine and Israel, terrorism, civil unrest, political instability, environmental or climatic factors, natural disaster, pandemic or epidemic outbreak, public health crisis and general economic conditions may have a significant adverse effect on our business. The global economy has in the past, and will in the future, experience recessionary periods and periods of economic instability such as the business disruption and related financial impact resulting from the global COVID-19 health crisis. During such periods, our current and future users may choose not to make discretionary purchases or may reduce overall spending on discretionary purchases. These changes could result in reduced consumer demand for air transportation, including our private aviation services, or could shift demand from our private aviation services to other methods of air or ground transportation for which we do not offer a competing service. If we are unable to generate demand or there is a future shift in consumer spending away from private aviation services, our business, financial condition, and results of operations could be adversely affected.

The private aviation industry is subject to competition.

Many of the markets in which we operate are competitive as a result of, among other things, the expansion of existing private aircraft operators, expanding private aircraft ownership, and alternatives such as luxury commercial airline service as well as commercial carriers. We compete against several private aviation operators with different business models, and local and regional private charter operators. Although our business model significantly differs from commercial air carriers, we also compete with commercial air carriers who have larger operations and service areas and fixed routes, as well as access to financial resources not available to us. Factors that affect competition in the private aviation industry include price, reliability, safety, regulations, professional reputation, aircraft availability, equipment and quality, consistency, and ease of service, willingness and ability to serve specific airports or regions, and investment requirements. There can be no assurance that our competitors will not be successful in capturing a share of our present or potential customer base. The materialization of any of these risks could adversely affect our business, financial condition, and results of operations.

We may require substantial additional funding to finance our operations, but adequate additional financing may not be available when we need it, on commercially acceptable terms, or at all.

Our operations are capital intensive, and we require sufficient liquidity levels for our operations and strategic growth plans. We have financed our operations and capital expenditures primarily through private financing rounds, and through financing of aircraft pre-delivery payment obligations. In the future, we could be required to raise capital through public or private financing or other arrangements. This financing may not be available on acceptable terms, or at all, and our failure to raise capital when needed could harm our business. Numerous factors may affect our ability to obtain financing or access the capital markets in the future on terms attractive to us, including our liquidity, operating cash flows, and the timing of

22

capital requirements, credit status and any credit ratings assigned to us, market conditions in the private aviation industry, U.S. and global economic conditions, and conditions in the capital markets generally, and the availability of our assets as collateral for future financings. We may sell equity securities or debt securities in one or more transactions at prices and in a manner as we may determine from time to time. If we sell any such securities in subsequent transactions, our current investors may be materially diluted. Any debt financing, if available, may involve restrictive covenants and could reduce our operational flexibility or profitability. If we cannot raise funds on commercially acceptable terms, we may not be able to grow our business or respond to competitive pressures and our business, results of operations, and financial condition could be materially adversely affected.

The loss of key personnel upon whom we depend on to operate our business or the inability to attract additional qualified personnel could adversely affect our business.