EX-10.2

Published on August 14, 2024

Q2 2024 EARNINGS August 14, 2024 Customer Designed, Modern, and Efficient ® NYSE: SOAR

Disclaimer Disclosure Regarding Forward-Looking Statements Some statements in this Presentation may be considered “forward-looking statements” for purposes of the Federal securities laws. Forward-looking statements generally relate to management’s current expectations, hopes, beliefs, intentions, strategies, or projections about future events or future financial or operating performance. For example, statements regarding anticipated growth in the industry in which Volato operates and anticipated growth in the demand for Volato’s services, and projections of Volato’s future financial results or other metrics are forward-looking statements. The words “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intends,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” project,” “should,” “would,” and similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. Forward-looking statements are subject to risks, uncertainties, and other factors which could cause actual results to differ materially from those expressed or implied by the forward-looking statements. You should not rely on these forward-looking statements as predictions of future events. Forward-looking statements are based upon estimates and assumptions that, while considered reasonable by management, are inherently uncertain. Factors that may cause actual result to differ from current expectations include, but are not limited to: changes to existing applicable laws or regulations; the possibility that Volato may be adversely affected by economic, business, or competitive factors; Volato’s estimates of expenses and profitability; the evolution of the markets in which Volato competes and Volato’s ability to enter new markets effectively; the ability of Volato to implement its strategic initiatives and continue to innovate its existing services; the delivery of aircraft by OEMs; the impact of government and other responses to public health crisis such as pandemics on Volato’s business; and other risks and uncertainties set forth in the section entitled “Risk Factors” and Cautionary Note Regarding Forward -Looking Statements in Volato’s most recently filed Form 10-K and subsequent quarterly reports on form 10-Q and those risk factors set forth in subsequent filings Volato may make from time-to-time with the Securities and Exchange Commission (SEC). Volato cautions that the foregoing list of factors is not exclusive. Nothing in this Presentation should be regarded as a representation by any person that the forward-looking statements set forth herein will be achieved or that any of the contemplated results of the forward-looking statements will be achieved. You should not place undue reliance on forward-looking statements, which speak only as of the date they are made. Volato does not undertake any duty to update these forward-looking statements. Financial Information; Non-GAAP Financial Measures The Presentation also includes certain financial measures not presented in accordance with generally accepted accounting principles (“GAAP”) and other metrics derived therefrom. The non-GAAP financial measures are not measures of financial performance in accordance with GAAP and may exclude items that are significant in understanding and assessing Volato’s financial results. Therefore, these measures should not be considered in isolation or as an alternative to net income, cash flows from operations, or other measures of profitability, liquidity, or performance under GAAP. Volato’s presentation of these measures may not be comparable to similarly titled measures used by other companies. Volato believes that the use of these non-GAAP financial measures are subject to inherent limitations as they reflect the exercise of business judgments by management about which items of income and expense are included or excluded in determining these non-GAAP financial measures. This Presentation also includes certain projections of non-GAAP financial measures. Due to the high variability and difficulty in making accurate forecasts and projections of financial information, together with the fact that some information may be excluded because it is not ascertainable or accessible, Volato is unable to quantify certain amounts that would be required to be included in the most directly comparable GAAP financial measures without unreasonable effort. Consequently, no disclosure of estimated comparable GAAP measures is included and no reconciliation of the forward-looking non-GAAP financial measures is included. 2

Disclaimer (Cont’d) Use of Projections This Presentation contains financial forecasts for Volato with respect to certain financial results of Volato. Volato’s independent auditor has not audited, studied, reviewed, compiled, or performed any procedures with respect to the projections for the purpose of their inclusion in this Presentation. Accordingly, they did not express an opinion or provide any other form of assurance with respect thereto for the purpose of this Presentation. These projections are forward-looking statements and should not be relied upon as being necessarily indicative of future results. In this Presentation, certain of the above- mentioned projected information has been provided for purposes of providing comparisons with historical data. The assumptions and estimates underlying the prospective financial information are inherently uncertain and are subject to a wide variety of significant business, economic, and competitive risks and uncertainties that could cause actual results to differ materially from those contained in the prospective financial information. Accordingly, there can be no assurance that the prospective results are indicative of the future performance of Volato or the actual results will not differ materially from those presented in the prospective financial information. Inclusion of the prospective financial information in this Presentation should not be regarded as a representation by any person that the results contained in the prospective financial information will be achieved. Industry and Market Data In this Presentation, Volato relies on and refers to certain information and statistics obtained from third-party sources which it believes to be reliable. Volato has not independently verified the accuracy or completeness of any third-party information. Trademarks This Presentation may contain trademarks, service marks, trade names, and copyrights of other companies, which are the property of their respective owners. Solely for convenience, the trademarks, service marks, trade names, and copyrights referred to in this Presentation may be listed without the trademark, service mark, or copyright symbols, but and Volato will assert the rights of the applicable owners to these trademarks, service marks, trade names, and copyrights to the fullest extent under applicable law. 3

Key Q2 2024 Highlights ✓ Grew flight hours 5% and blended yield 6% year-over-year in the second quarter of 2024 ✓ Achieved demand mix of 44% owner and 56% program & ad hoc in the second quarter, reflecting strong demand and contributing to blended yield ✓ Subsequent to quarter end, took delivery of one HondaJet and one Gulfstream G280 ✓ Expect delivery of 8-10 HondaJets and two Gulfstream G280s in FY 2024 ✓ Announced that Vaunt, Volato’s subscription platform for connecting travelers to empty leg private flights, reached $1 million in Annual Recurring Revenue ✓ After the quarter end, signed a $4 million term loan to enhance our cash position and support us on our path to profitability while awaiting delivery of additional aircraft

Volato: Highly Scalable and Cash-Generating Business Model Volato secures fleet aircraft orders from top-tier OEMs, which are then sold, often prior to delivery, through fractionalizing. Subsequently, the company operates these aircraft on 5-year contracts, aiming to maximize their utilization and profit potential. 1. Operates largest floating fleet of HondaJets and has secured meaningful amount of HondaJet production through 2025 in a tight supply market. 2. Launched first Gulfstream G280 fractional program in the U.S., expanding fleet to super-midsize category. 3. Incentivized underutilization by fractional owners provides excess availability1 at a favorable market financing rate. 4. Utilizing a commercial multi-product strategy this excess availability is filled with higher margin non-owner usage. 5 Notes: 1. Excess availability is the ai rcraft availability provided to the operator that is in excess of the industry standard for a fractional owner share . Volato benefits from excess availability of ~70% compared to the traditional industry average of 5-10% .

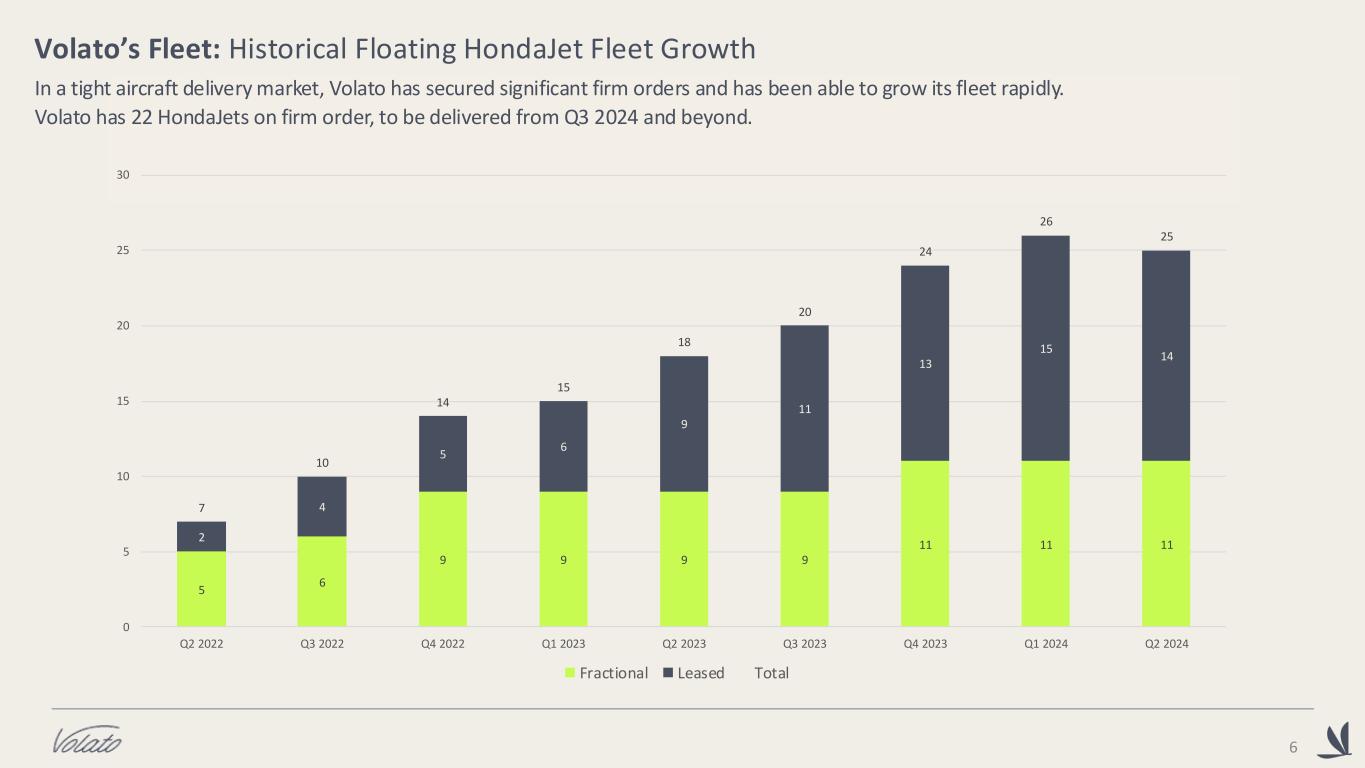

Volato’s Fleet: Historical Floating HondaJet Fleet Growth 6 In a tight aircraft delivery market, Volato has secured significant firm orders and has been able to grow its fleet rapidly. Volato has 22 HondaJets on firm order, to be delivered from Q3 2024 and beyond. 5 6 9 9 9 9 11 11 11 2 4 5 6 9 11 13 15 14 7 10 14 15 18 20 24 26 25 0 5 10 15 20 25 30 Q2 2022 Q3 2022 Q4 2022 Q1 2023 Q2 2023 Q3 2023 Q4 2023 Q1 2024 Q2 2024 Fractional Leased Total

FINANCIAL INFORMATION

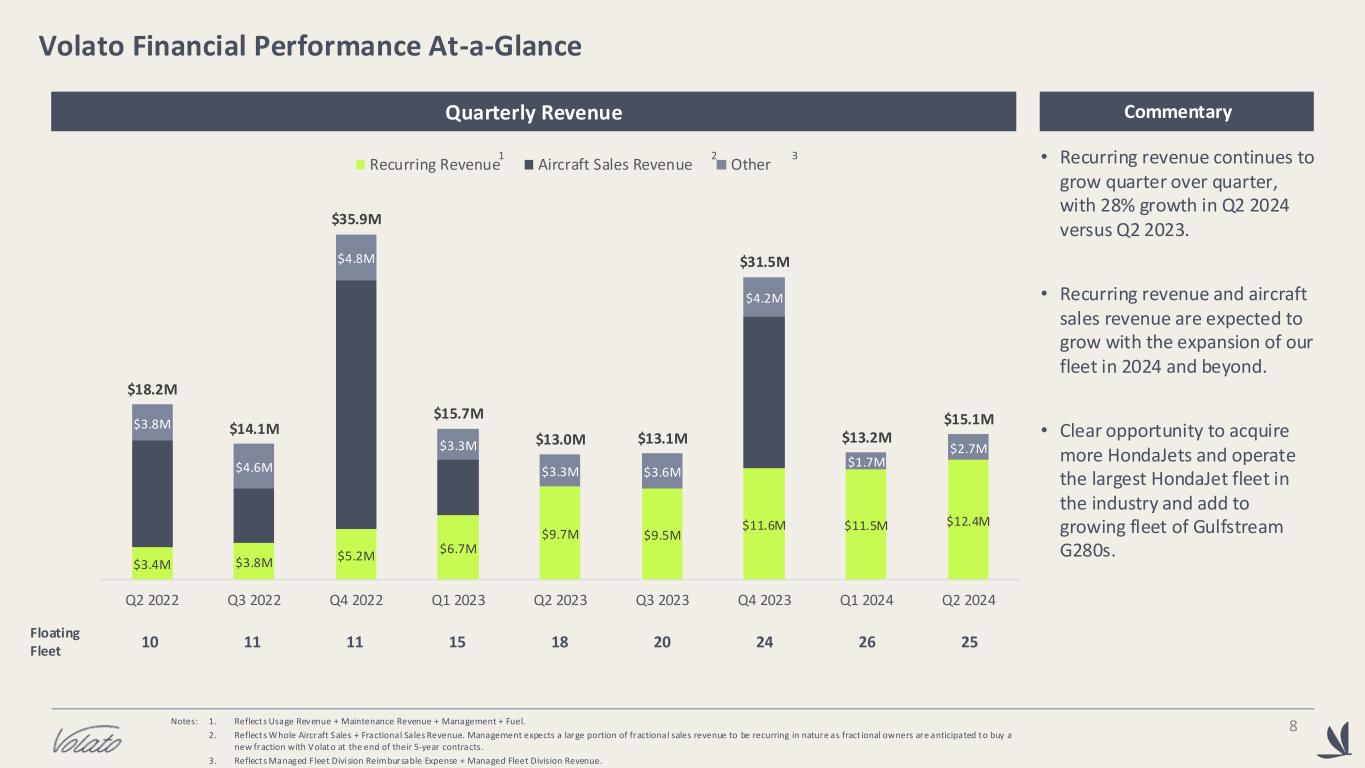

Volato Financial Performance At-a-Glance 8 Quarterly Revenue Commentary 1. Reflects Usage Revenue + Maintenance Revenue + Management + Fuel. 2. Reflects Whole Aircraft Sales + Fractional Sales Revenue. Management expects a large portion of fractional sales revenue to be recurring in nature as fract ional owners are anticipated to buy a new fraction with Volato at the end of their 5-year contracts. 3. Reflects Managed F leet Division Reimbursable Expense + Managed Fleet Division Revenue. • Recurring revenue continues to grow quarter over quarter, with 28% growth in Q2 2024 versus Q2 2023. • Recurring revenue and aircraft sales revenue are expected to grow with the expansion of our fleet in 2024 and beyond. • Clear opportunity to acquire more HondaJets and operate the largest HondaJet fleet in the industry and add to growing fleet of Gulfstream G280s. Floating Fleet 10 11 11 15 18 20 24 26 25 Notes: $3.4M $3.8M $5.2M $6.7M $9.7M $9.5M $11.6M $11.5M $12.4M $3.8M $4.6M $4.8M $3.3M $3.3M $3.6M $4.2M $1.7M $2.7M $18.2M $14.1M $35.9M $15.7M $13.0M $13.1M $31.5M $13.2M $15.1M Q2 2022 Q3 2022 Q4 2022 Q1 2023 Q2 2023 Q3 2023 Q4 2023 Q1 2024 Q2 2024 Recurring Revenue Aircraft Sales Revenue Other 1 2 3

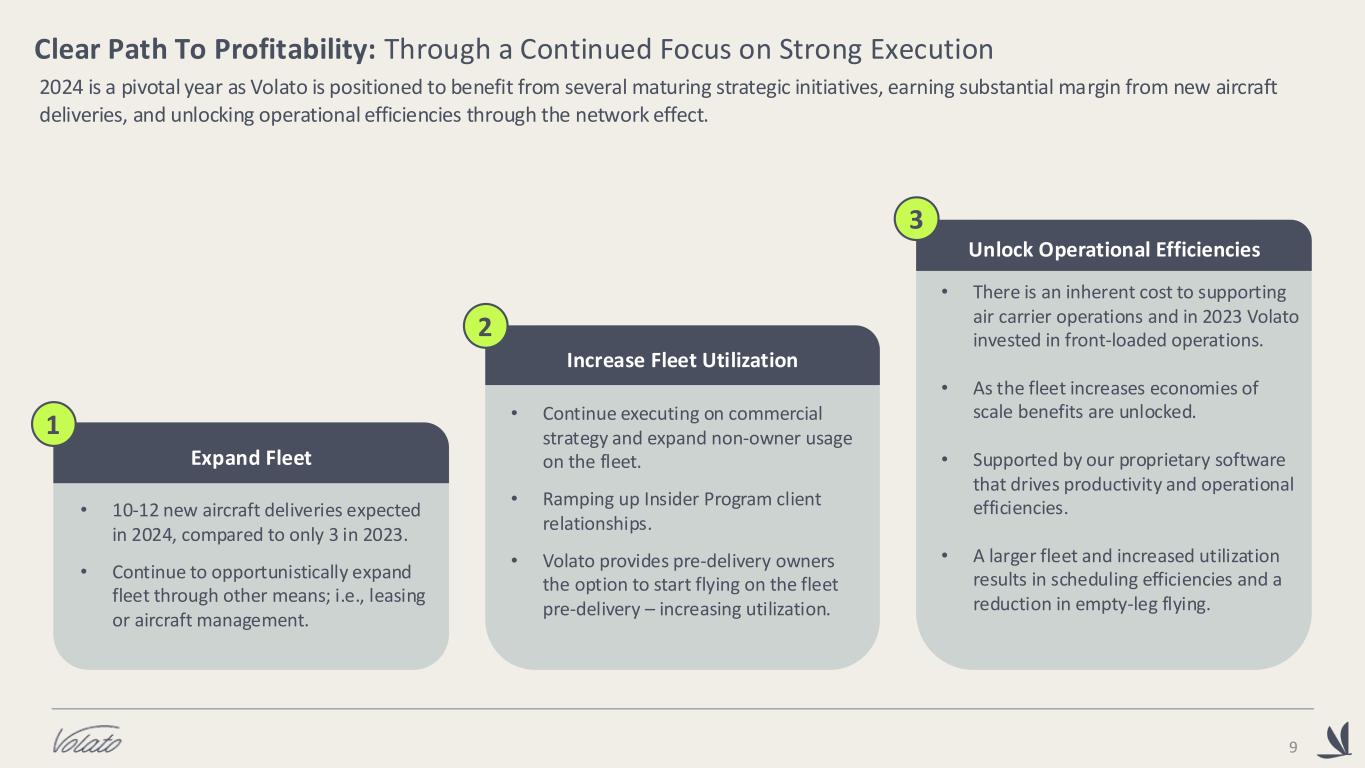

9 2024 is a pivotal year as Volato is positioned to benefit from several maturing strategic initiatives, earning substantial margin from new aircraft deliveries, and unlocking operational efficiencies through the network effect. Clear Path To Profitability: Through a Continued Focus on Strong Execution Increase Fleet Utilization • Continue executing on commercial strategy and expand non-owner usage on the fleet. • Ramping up Insider Program client relationships. • Volato provides pre-delivery owners the option to start flying on the fleet pre-delivery – increasing utilization. Expand Fleet • 10-12 new aircraft deliveries expected in 2024, compared to only 3 in 2023. • Continue to opportunistically expand fleet through other means; i.e., leasing or aircraft management. Unlock Operational Efficiencies • There is an inherent cost to supporting air carrier operations and in 2023 Volato invested in front-loaded operations. • As the fleet increases economies of scale benefits are unlocked. • Supported by our proprietary software that drives productivity and operational efficiencies. • A larger fleet and increased utilization results in scheduling efficiencies and a reduction in empty-leg flying. 1 2 3

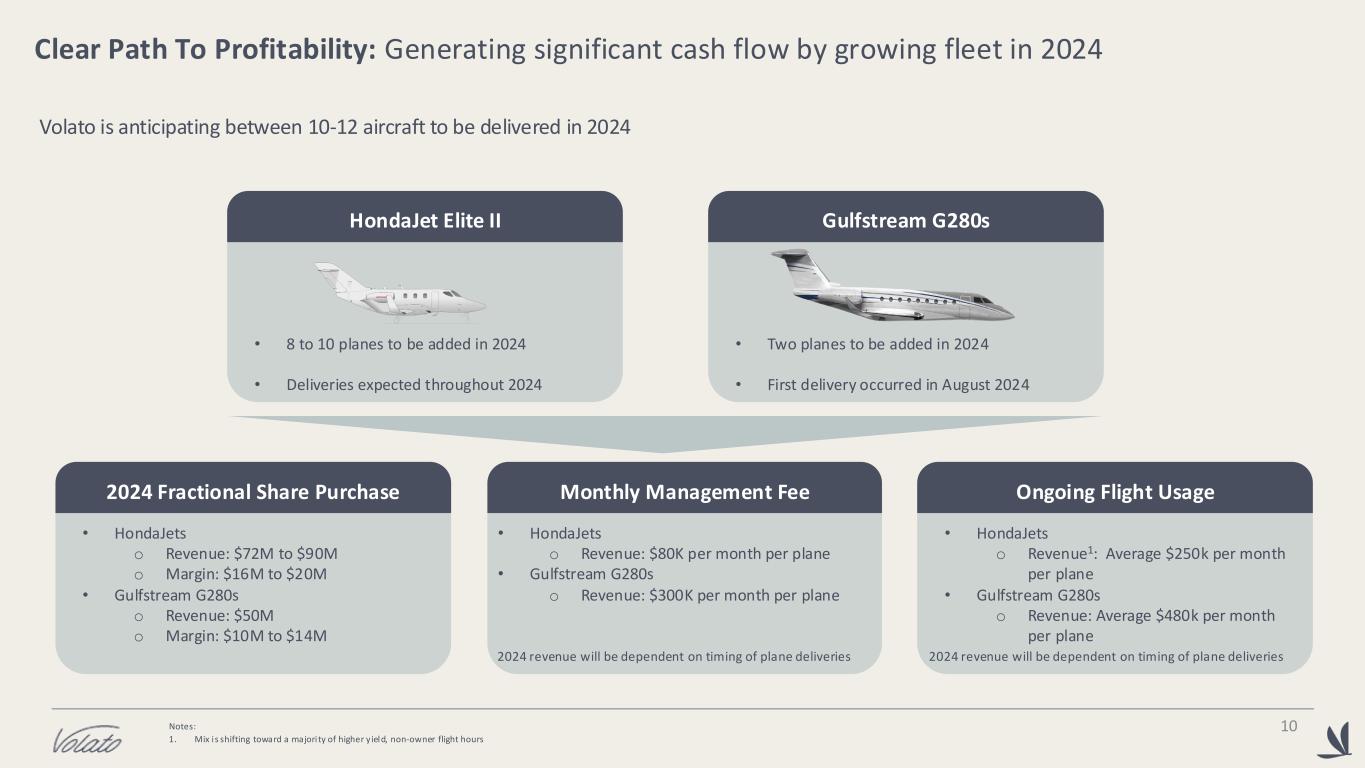

Clear Path To Profitability: Generating significant cash flow by growing fleet in 2024 10 Monthly Management Fee • HondaJets o Revenue: $80K per month per plane • Gulfstream G280s o Revenue: $300K per month per plane 2024 Fractional Share Purchase • HondaJets o Revenue: $72M to $90M o Margin: $16M to $20M • Gulfstream G280s o Revenue: $50M o Margin: $10M to $14M Ongoing Flight Usage • HondaJets o Revenue1: Average $250k per month per plane • Gulfstream G280s o Revenue: Average $480k per month per plane HondaJet Elite II • 8 to 10 planes to be added in 2024 • Deliveries expected throughout 2024 Gulfstream G280s • Two planes to be added in 2024 • First delivery occurred in August 2024 Volato is anticipating between 10-12 aircraft to be delivered in 2024 Notes: 1. Mix i s shifting toward a majori ty of higher y ield, non-owner flight hours 2024 revenue will be dependent on timing of plane deliveries 2024 revenue will be dependent on timing of plane deliveries

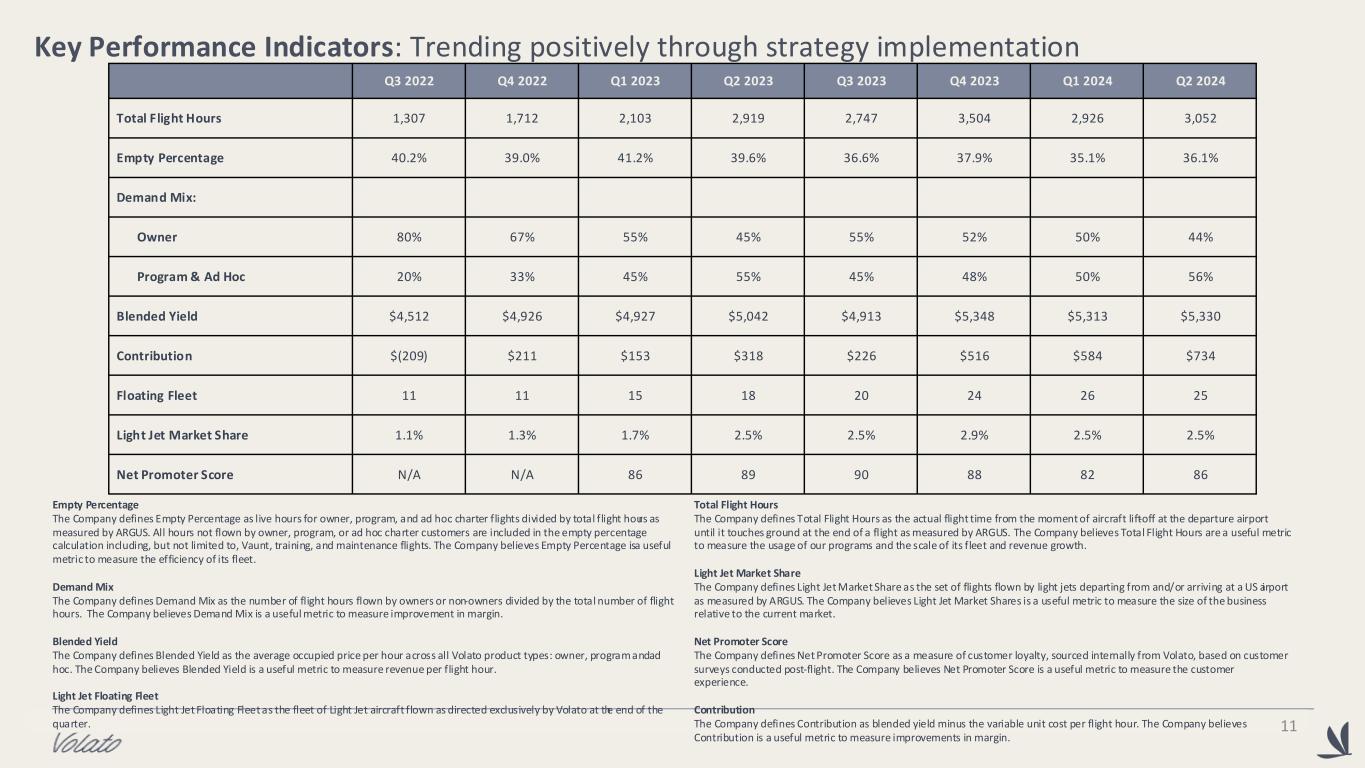

Key Performance Indicators: Trending positively through strategy implementation 11 Q3 2022 Q4 2022 Q1 2023 Q2 2023 Q3 2023 Q4 2023 Q1 2024 Q2 2024 Total Flight Hours 1,307 1,712 2,103 2,919 2,747 3,504 2,926 3,052 Empty Percentage 40.2% 39.0% 41.2% 39.6% 36.6% 37.9% 35.1% 36.1% Demand Mix: Owner 80% 67% 55% 45% 55% 52% 50% 44% Program & Ad Hoc 20% 33% 45% 55% 45% 48% 50% 56% Blended Yield $4,512 $4,926 $4,927 $5,042 $4,913 $5,348 $5,313 $5,330 Contribution $(209) $211 $153 $318 $226 $516 $584 $734 Floating Fleet 11 11 15 18 20 24 26 25 Light Jet Market Share 1.1% 1.3% 1.7% 2.5% 2.5% 2.9% 2.5% 2.5% Net Promoter Score N/A N/A 86 89 90 88 82 86 Empty Percentage The Company defines Empty Percentage as live hours for owner, program, and ad hoc charter flights divided by total flight hours as measured by ARGUS. All hours not flown by owner, program, or ad hoc charter customers are included in the empty percentage calculation including, but not limited to, Vaunt, training, and maintenance flights. The Company believes Empty Percentage is a useful metric to measure the efficiency of its fleet. Demand Mix The Company defines Demand Mix as the number of flight hours flown by owners or non-owners divided by the total number of flight hours. The Company believes Demand Mix is a useful metric to measure improvement in margin. Blended Yield The Company defines Blended Yield as the average occupied price per hour across all Volato product types: owner, program and ad hoc. The Company believes Blended Yield is a useful metric to measure revenue per flight hour. Light Jet Floating Fleet The Company defines Light Jet Floating Fleet as the fleet of Light Jet aircraft flown as directed exclusively by Volato at the end of the quarter. Total Flight Hours The Company defines Total Flight Hours as the actual flight time from the moment of aircraft lift-off at the departure airport until it touches ground at the end of a flight as measured by ARGUS. The Company believes Total Flight Hours are a useful metric to measure the usage of our programs and the scale of its fleet and revenue growth. Light Jet Market Share The Company defines Light Jet Market Share as the set of flights flown by light jets departing from and/or arriving at a US airport as measured by ARGUS. The Company believes Light Jet Market Shares is a useful metric to measure the size of the business relative to the current market. Net Promoter Score The Company defines Net Promoter Score as a measure of customer loyalty, sourced internally from Volato, based on customer surveys conducted post-flight. The Company believes Net Promoter Score is a useful metric to measure the customer experience. Contribution The Company defines Contribution as blended yield minus the variable unit cost per flight hour. The Company believes Contribution is a useful metric to measure improvements in margin.

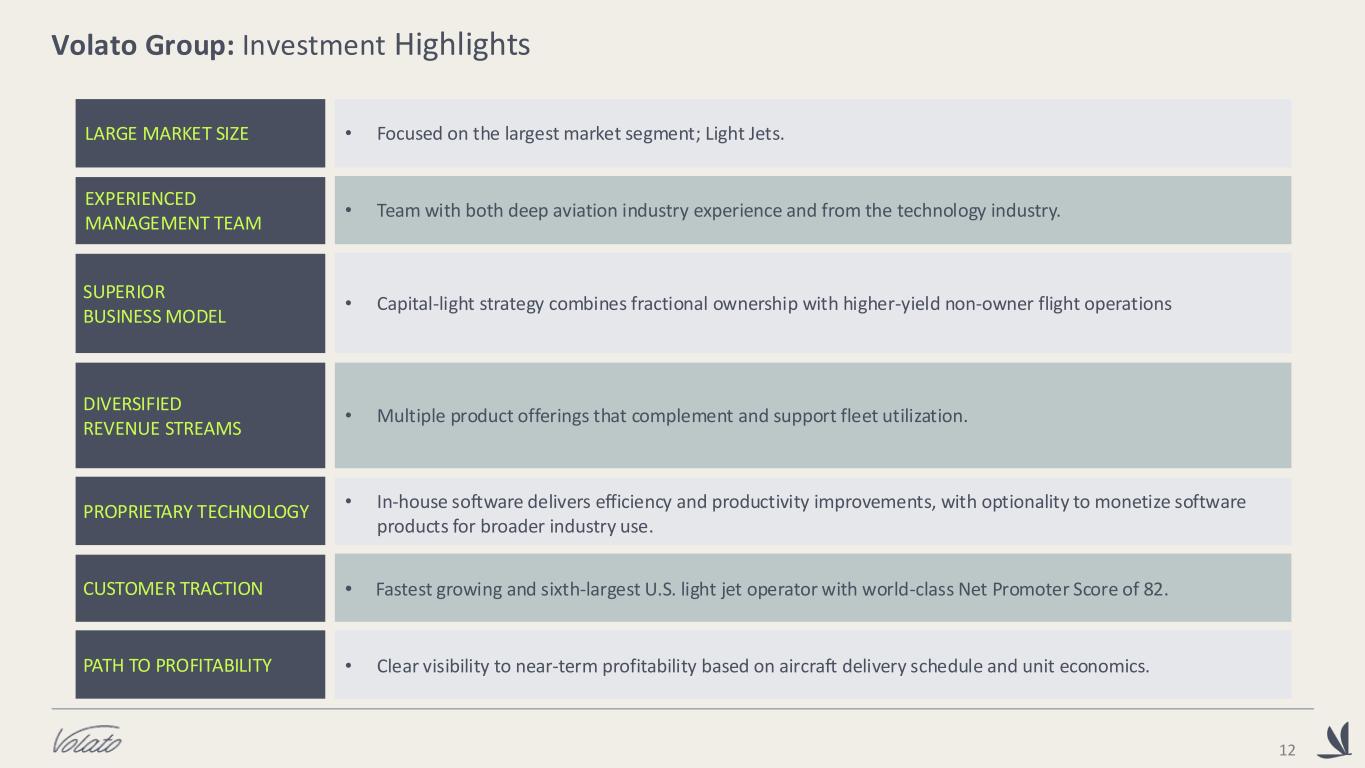

EXPERIENCED MANAGEMENT TEAM SUPERIOR BUSINESS MODEL PROPRIETARY TECHNOLOGY DIVERSIFIED REVENUE STREAMS PATH TO PROFITABILITY LARGE MARKET SIZE • Team with both deep aviation industry experience and from the technology industry. • In-house software delivers efficiency and productivity improvements, with optionality to monetize software products for broader industry use. • Multiple product offerings that complement and support fleet utilization. • Clear visibility to near-term profitability based on aircraft delivery schedule and unit economics. • Focused on the largest market segment; Light Jets. • Capital-light strategy combines fractional ownership with higher-yield non-owner flight operations 12 Volato Group: Investment Highlights CUSTOMER TRACTION • Fastest growing and sixth-largest U.S. light jet operator with world-class Net Promoter Score of 82.

Customer Designed, Modern, and Efficient