EX-19.1

Published on March 31, 2025

VOLATO GROUP, INC. INSIDER TRADING POLICY (Adopted by the Board of Directors on December 1, 2023. Effective at the Merger Effective Time associated with the Company’s business combination.) A. POLICY OVERVIEW Volato Group, Inc. (together, with its subsidiaries, collectively the “Company”) has adopted this Insider Trading Policy (the “Policy”) to enable Company employees and service providers to comply with the federal and state securities laws and regulations that govern trading in securities, thereby minimizing the Company’s legal and reputational risk. It is every employee’s responsibility to understand and comply with this Policy. Insider trading is not only a violation of this Policy, but insider trading is also illegal and can subject violators to civil and criminal penalties. In addition to individual liability for insider trading, the Company, as well as individual directors, officers, and other supervisory personnel could face liability. Even the appearance of insider trading activity can result in government investigations or lawsuits that are time-consuming and expensive. Insider trading can lead to criminal and civil liability, including damages and fines, imprisonment, and prohibitions on serving as an officer or director of a public company. For purposes of this Policy, the Company’s General Counsel serves as the Compliance Officer. The Compliance Officer may designate others from time to time, including outside counsel, to assist with the execution of the Compliance Officer’s duties under this Policy. B. POLICY STATEMENT 1. No Trading on Material Non-public Information. It is illegal for anyone to trade in securities using material non-public information in doing so. If you are in possession of material non-public information about the Company, then you are prohibited from: a. using that information to trade in the securities of the Company; b. disclosing that information to directors, officers, employees, consultants, contractors, agents, or service providers whose roles do not require them to have that information; c. disclosing that information to any person outside of the Company, including family members, friends, business associates, investors, and consulting firms, without prior written authorization from the Compliance Officer; and d. using that information to express an opinion or make a recommendation about trading in the Company’s securities. In addition, material non-public information about another company that you come into possession of through your role at the Company is subject to these same restrictions about disclosure and trading. If you are in possession of material non-public information about a Company’s supplier, customer, or competitor, then you cannot use that information to trade securities. Such actions are a violation of this Policy. 2. No Disclosure of Confidential Information. You may not disclose material non-public information about the Company or about another company that you obtained in connection with your role DocuSign Envelope ID: A2670512-3F06-4B6D-9A12-51A631532078

- 2 - in the Company to friends, family members, or any other person or entity the Company has not authorized to know such information. In addition, you must treat the confidential information of third parties in accordance with related non-disclosure agreements or other obligations the Company has with these third parties and limit your use of the confidential information to the purpose for which it was disclosed. If you receive an inquiry for information from a person outside of the Company, such as a stock analyst, or a request for sensitive information outside the ordinary course of business from a person outside of the Company, such as a business associate, vendor, supplier, or salesperson, then you should refer the inquiry to the Chief Executive Officer. Responding to a request yourself can violate this Policy and, in some circumstances, federal or state law. 3. Definition of Material Non-public Information. “Material information” means information that a reasonable investor would be likely to consider as substantially important in deciding whether to buy, hold, or sell the Company’s traded securities, or consider as significantly altering the total mix of information available in the marketplace about the Company. In general, any information that could reasonably be expected to affect the market price of a traded security is likely to be material. Material information can be either positive or negative about the Company. Although it is not possible to define every category of material information, some examples of information that could be regarded as material include, but are not limited to: a. financial results, key metrics, financial condition, pre-announcements of earnings, and projections or forecasts, particularly if such information is inconsistent with the Company’s projections or forecasts or the expectations of the investment community; b. restatements of financial results, material impairments, write-offs, or restructurings; c. a change in the Company’s independent auditors; d. notification that the Company is no longer relying on an audit report; e. business plans and budgets; f. creation of a significant financial obligation, a default of a significant financial obligation, or acceleration of a significant financial obligation; g. impending bankruptcy or financial liquidity problems; h. a significant development involving a business relationship, including the execution, modification, or termination of a significant agreement or order with a customer, supplier, vendor, distributor, manufacturer, or business partner; i. significant information relating to Company products, such as a new product, a major modification or performance issue, a defect or recall, a significant pricing change, or other announcement of a significant nature; j. a significant development in research and development; k. a significant development relating to the Company’s intellectual property; DocuSign Envelope ID: A2670512-3F06-4B6D-9A12-51A631532078

- 3 - l. a significant legal or regulatory development, whether positive or negative, actual or threatened, including new, pending, or settled litigation; m. a major event involving the Company’s securities, including calls of securities for redemption, adoption of a stock repurchase program, option re-pricings, stock splits, changes in dividend policy, public or private securities offerings, a modification to the rights of security holders, or a notice of delisting; n. a significant corporate event, such as a pending or proposed merger, joint venture, or tender offer; o. a significant investment in the Company; p. the acquisition or disposition of a significant asset; q. a change in control of the Company; r. a significant personnel change, such as a change in senior management or an employee lay-off; s. a data breach or other cybersecurity event; t. an update regarding a prior material disclosure that has materially changed; and u. the existence of a special blackout period. “Material non-public information” means material information not generally known or made available to the public. Even when information is widely known throughout the Company, the information can still be non-public. Generally, for information to be considered public, it must be made generally available through news media outlets or through a filing with a state or federal agency. After the disclosure of information, a reasonable period of time must elapse to provide the general public an opportunity to obtain and evaluate the information disclosed. Company policy is that two full trading days must pass after the disclosure of information before the information is considered public. For the sake of caution, however, if you believe information might be material non-public information, then you should treat it as such. Furthermore, you can always consult with the Compliance Officer if you have a question about the status of Company information. C. PERSONS COVERED BY THIS POLICY This Policy applies to directors, officers, employees, consultants, contractors, agents, or service providers (for example, auditors and attorneys), both inside and outside of the United States. To the extent this Policy is applicable to you, it also covers: (a) your immediate family members; (b) persons with whom you share a household; (c) persons who are your economic dependents; and (d) an entity whose trading in securities you influence, direct, or control. You are legally responsible for making sure these individuals and entities comply with this Policy. This Policy continues to apply after you leave the Company or are no longer affiliated with or providing services to the Company, for as long as you remain in possession of material non-public information. In addition, if you are subject to a trading blackout under this Policy at the time you leave the DocuSign Envelope ID: A2670512-3F06-4B6D-9A12-51A631532078

- 4 - Company, then you must abide by the applicable trading restrictions until the end of the relevant blackout period. D. TRADING COVERED BY THIS POLICY Except as discussed in Section H, below (Exceptions to Trading Restrictions), this Policy applies to transactions involving the Company’s securities or the securities of other companies for which you possess material non-public information obtained in connection with your service with the Company. This Policy therefore applies to: 1. the purchase, sale, loan, or other transfer or disposition of equity securities (including common stock, options, restricted stock units, warrants, and preferred stock) and debt securities (including debentures, bonds, and notes) of the Company and such other companies, whether direct or indirect (including transactions made on your behalf by money managers); 2. arrangements that generate gains or losses from or based on changes in the prices of such securities, including derivative securities (for example, exchange-traded put or call options, swaps, caps, and collars), hedging and pledging transactions, short sales, and certain arrangements regarding participation in benefit plans; and 3. an offer to engage in the transactions described above. There are no exceptions to insider trading laws or to this Policy based on the size of the transaction or the type of consideration received. E. TRADING RESTRICTIONS Subject to the exceptions set forth below, this Policy restricts trading during certain periods and by certain individual as follows: 1. Quarterly Blackout Periods. Except as discussed in Section H, below (Exceptions to Trading Restrictions), directors, officers, and employees must refrain from conducting transactions involving the Company’s securities during quarterly blackout periods. Individuals subject to quarterly blackout periods are listed on Schedule I, which is maintained and updated by the Compliance Officer. To the extent applicable to you, quarterly blackout periods also apply to your immediate family members, persons with whom you share a household, persons who are your economic dependents, and an entity whose trading in securities you influence, direct, or control. Even if you are not specifically identified as being subject to a quarterly blackout period, you should exercise caution when engaging in trading during a quarterly blackout period because of the heightened risk of insider trading exposure. A quarterly blackout period begins on the last day of the third month of each fiscal quarter and will end at the beginning of the third full trading day following the Company’s quarterly earnings release. The prohibition against trading during a quarterly blackout period also means that brokers cannot fulfill open orders on your behalf or on behalf of your immediate family members, persons with whom you share a household, persons who are your economic dependents, or an entity whose trading in securities you influence, direct, or control, during the blackout period, including “limit orders” to buy or sell stock at a specified price or better and “stop orders” to buy or sell stock after the price of the stock reaches a specified price. If you are subject to a quarterly blackout period or pre-clearance requirements, then you should so inform any broker with whom such an open order is placed at the time it is placed. DocuSign Envelope ID: A2670512-3F06-4B6D-9A12-51A631532078

- 5 - From time to time, the Company may identify other persons who should be subject to quarterly blackout periods and the Compliance Officer will update and revise Schedule I accordingly. 2. Special Blackout Periods. The Company retains the right to impose additional or longer trading blackout periods at any time on its directors, officers, employees, consultants, advisors, contractors, agents, and service providers. The Compliance Officer will notify you if you are subject to a special blackout period by providing to you a notice substantially in the form of Exhibit B. If you are notified that you are subject to a special blackout period, then you cannot engage in a transaction of the Company’s securities until the special blackout period has ended other than the transactions covered by the exceptions below. You also cannot disclose to anyone else that the Company has imposed a special blackout period. To the extent it is applicable to you, a special blackout period also covers your immediate family members, persons with whom you share a household, persons who are your economic dependents, and an entity whose trading in securities you influence, direct, or control. 3. Regulation BTR Blackouts. Directors and officers also can be subject to trading blackouts pursuant to Regulation Blackout Trading Restriction (or Regulation BTR), under the U.S. securities laws. In general, Regulation BTR prohibits a director or officer from engaging in certain transactions involving Company securities during periods when 401(k) plan participants are prevented from purchasing, selling, or otherwise acquiring or transferring an interest in certain securities held in individual account plans. Profits from a transaction in violation of Regulation BTR are recoverable by the Company, regardless of the intentions of the director or officer who initiated the transaction. In addition, an individual who engages in such a transaction is subject to sanctions by the SEC, as well as potential criminal liability. The Company will notify directors and officers when they are subject to a blackout trading restriction. Failure to comply with a trading blackout in accordance with Regulation BTR is a violation of law and this Policy. F. PROHIBITED TRANSACTIONS You may not engage in any of the following types of transactions, other than as noted below, regardless of whether you are in possession of material non-public information or not. 1. Short Sales. You may not engage in short sales (meaning the sale of a security that must be borrowed to make delivery) or “sell short against the box” (meaning the sale of a security with a delayed delivery) if such sales involve the Company’s securities. 2. Derivative Securities and Hedging Transactions. You may not, directly or indirectly: (a) trade in publicly-traded options, such as puts and calls, and other derivative securities with respect to the Company’s securities (other than stock options, restricted stock units, and other compensatory awards issued to you by the Company); or (b) purchase financial instruments (including prepaid variable forward contracts, equity swaps, collars, and exchange funds), or otherwise engage in transactions, that hedge or offset, or are designed to hedge or offset, any decrease in the market value of equity securities either granted to you by the Company as part of your compensation or held, directly or indirectly, by you. 3. Pledging Transactions. You may not pledge the Company’s securities as collateral for any loan or as part of any other pledging transaction. 4. Margin Accounts. You may not hold the Company’s common stock in margin accounts. G. PRE-CLEARANCE OF TRADES The Company’s directors, officers, and individuals identified on Schedule I as being subject to pre- clearance requirements must obtain pre-clearance prior to trading in the Company’s securities. If you are DocuSign Envelope ID: A2670512-3F06-4B6D-9A12-51A631532078

- 6 - subject to pre-clearance requirements, then you should submit a pre-clearance request in the form attached as Exhibit A to the Compliance Officer at least two trading days prior to your desired trade date. The individual requesting pre-clearance will be asked to certify that he or she is not in possession of material non-public information. The Compliance Officer is not obligated to approve a transaction submitted for pre-clearance and may determine to not permit the transaction. If the Compliance Officer is the requester, then the Company’s Chief Executive Officer, Chief Financial Officer, or their delegate, must pre-clear or deny any trade. Trades must be executed within two trading days of receiving a pre-clearance. Even after receiving a pre-clearance, the Company’s securities may not be traded if they become subject to a blackout period or the recipient of the pre-clearance becomes aware of material non-public information prior to the trade being executed. From time to time, the Company may identify other individuals who should be subject to these pre- clearance requirements, and the Compliance Officer will update and revise Schedule I accordingly. H. EXCEPTIONS TO TRADING RESTRICTIONS There are no unconditional “safe harbors” for trades made at particular times, and persons subject to this Policy should exercise good judgment at all times. Even when a quarterly blackout period is not in effect, you may be prohibited from engaging in a transaction involving the Company’s securities because you possess material non-public information, are subject to a special blackout period, or are otherwise restricted under this Policy. The following are certain limited exceptions to the blackout period restrictions imposed by the Company: 1. stock option exercises where the purchase of stock options is paid in cash and shares continue to be held by the option holder after the exercise is finalized; 2. receipt and vesting of stock options, RSUs, restricted stock, or other equity compensation awards; 3. purchases from the employee stock purchase plan; however, this exception does not apply to subsequent sales of the shares; 4. net share withholding of equity awards where shares are withheld by the Company to satisfy tax withholding requirements, as long as the election is irrevocable and made in writing at a time when a trading blackout is not in place and you are not in possession of material non-public information; 5. sell-to-cover transactions, to the extent approved and implemented by the Company, where shares are withheld by the Company on vesting of equity awards and sold in order to satisfy tax withholding requirements; however, this exception does not apply to any other market sale for the purposes of paying required withholding; 6. trades made pursuant to a Company-approved 10b5-1 trading plan (see below); 7. purchases of Company stock in its 401(k) plan resulting from periodic contributions to the plan based on payroll contribution election; provided, however, trading restrictions do apply to elections made under the 401(k) plan to: (a) increase or decrease the percentage of contributions that will be allocated to a DocuSign Envelope ID: A2670512-3F06-4B6D-9A12-51A631532078

- 7 - Company stock fund; (b) move balances into or out of a Company stock fund; (c) borrow money against a 401(k) plan account if the loan will result in liquidation of some or all of Company stock fund balance; and (d) prepay a plan loan if the pre-payment will result in the allocation of loan proceeds to a Company stock fund; 8. changes in form of ownership; for example, a transfer from individual ownership to a trust for which you are the trustee; 9. bona fide gifts of the Company’s securities or transfers by will or by the laws of descent and distribution; however, the trading restrictions do apply to subsequent trading of such securities if the donee is a related party of the donor; and 10. changes in the number of the Company’s securities held due to a stock split or a stock dividend that applies equally to all securities of a class. Even if a transaction is subject to an exception to this Policy, you will need to separately assess whether the transaction complies with applicable law. In addition, the limited exceptions in this Section H are not exceptions to the pre-clearance requirements of this Policy; therefore, if you are subject to the pre- clearance requirements of this Policy, then you must pre-clear these transactions with the Compliance Officer. Other Policy exceptions must be approved by the Compliance Officer, in consultation with the Company’s Audit Committee. I. 10B5-1 TRADING PLANS The Company permits its directors, officers, and employees to adopt a written 10b5-1 trading plan to mitigate the risk of trading on material non-public information. This plan allows for individuals to enter a prearranged trading plan as long as the plan is not established, modified, or terminated during a blackout period or when the individual is otherwise in possession of material non-public information. To be approved by the Company and qualify for the exception to this Policy, a 10b5-1 trading plan adopted by a director, officer, or employee must comply with the requirements set forth in the Requirements for Trading Plans attached as Exhibit C. J. SECTION 16 COMPLIANCE The Company’s officers and directors and certain other individuals are required to comply with Section 16 of the Securities and Exchange Act of 1934, as amended, and related rules and regulations that set forth reporting obligations, limitations on “short swing” transactions, that are certain matching purchases and sales of the Company’s securities within a six-month period, and limitations on short sales. To ensure a transaction subject to Section 16 requirements is reported on time, each individual subject to these requirements must provide the Company with detailed information (for example, trade date, number of shares, price) about the transaction involving the Company’s securities. Although the Company will assist in filing a Section 16 report, the obligation to comply with Section 16 is personal; therefore, if you have questions, then you should consult the Compliance Officer. K. VIOLATIONS OF THIS POLICY Directors, officers, employees, consultants, advisors, contractors, agents, and service providers who violate this Policy will be subject to disciplinary action, including ineligibility for future Company equity or incentive programs or termination of employment or an ongoing relationship with the Company. The Company has discretion to determine whether this Policy is violated based on available information. DocuSign Envelope ID: A2670512-3F06-4B6D-9A12-51A631532078

- 8 - There are serious legal consequences for individuals who violate insider trading laws, including civil fines, criminal penalties such as imprisonment, and disgorgement of profits made or losses avoided. You can also be liable for improper securities trading by an individual to whom you disclose material non- public information that you learn through your role at the Company or made recommendations or expressed opinions about securities trading on the basis of such information. Consult with your personal legal and financial advisors as needed. Note that the Company’s General Counsel represents the Company and not you personally. There can be instances where you suffer financial harm or other hardship or are otherwise required to forego a planned transaction because of the restrictions imposed by this Policy or securities laws. If you were aware of the material non-public information at the time of the trade, then it is not a defense that you did not “use” the information for the trade. Personal financial emergency or other personal circumstances are not mitigating factors under securities laws and will not excuse your failure to comply with this Policy. In addition, a blackout or trading-restricted period will not extend the term of your options. As a consequence, you can be prevented from exercising your options or as a result of a blackout or other restriction on your trading, and as a result your options might expire by their term. It is your responsibility to manage your economic interests and to consider potential trading restrictions when determining whether to exercise your options. In such instances, the Company cannot extend the term of your options and has no obligation or liability to replace the economic value or lost benefit to you. L. PROTECTED ACTIVITY NOT PROHIBITED Nothing in this Policy or any related guidelines or other documents or information provided in connection with this Policy will in any way limit or prohibit you from engaging in the protected activities set forth in the Company’s Whistleblower Policy, as amended from time to time. M. REPORTING If you believe another individual is violating this Policy or is otherwise using material non-public information they learned through their role at the Company to trade securities, then you should report it to the Compliance Officer. N. AMENDMENTS The Company reserves the right to amend this Policy at any time, for any reason, subject to applicable laws, rules, and regulations, and with or without notice, although the Company will attempt to provide notice in advance of an amendment. Unless otherwise permitted by this Policy, an amendment must be approved by the Company’s Board of Directors. Effective Date: December 1, 2023 DocuSign Envelope ID: A2670512-3F06-4B6D-9A12-51A631532078

Exhibit A SCHEDULE I INDIVIDUALS SUBJECT TO QUARTERLY BLACKOUT PERIODS, PRE-CLEARANCE REQUIREMENTS, AND SECTION 16 REPORTING AND LIABILITY PROVISIONS 1. CURRENT DIRECTORS Subject to Quarterly Blackout? Yes Subject to Pre-Clearance Requirements? Yes Subject to Section 16? Yes 2. CURRENT OFFICERS (including officers who are also directors) Subject to Quarterly Blackout? Yes Subject to Pre-Clearance Requirements? Yes Subject to Section 16? Yes 3. OTHERS (Company employees) Subject to Quarterly Blackout? Yes DocuSign Envelope ID: A2670512-3F06-4B6D-9A12-51A631532078

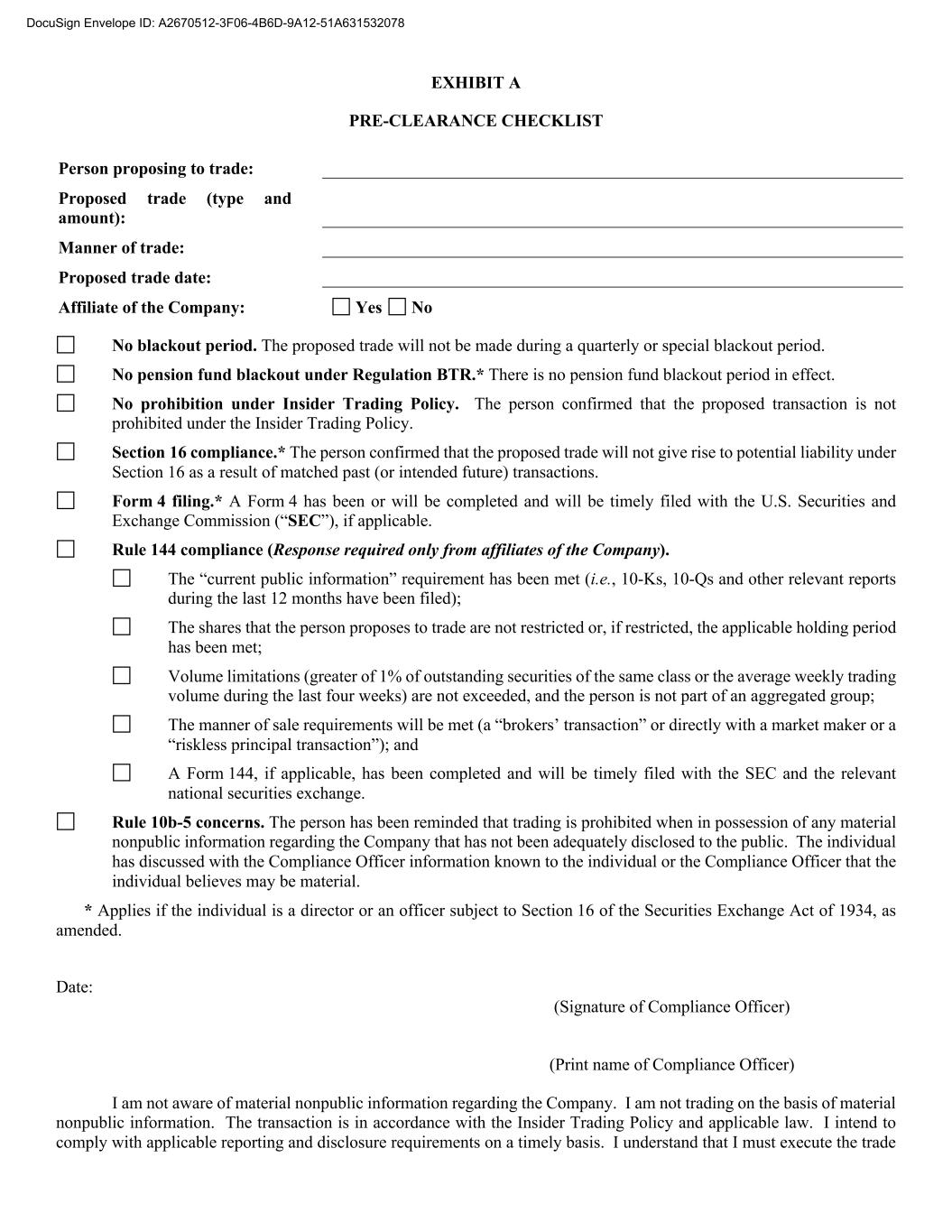

EXHIBIT A PRE-CLEARANCE CHECKLIST Person proposing to trade: Proposed trade (type and amount): Manner of trade: Proposed trade date: Affiliate of the Company: Yes No No blackout period. The proposed trade will not be made during a quarterly or special blackout period. No pension fund blackout under Regulation BTR.* There is no pension fund blackout period in effect. No prohibition under Insider Trading Policy. The person confirmed that the proposed transaction is not prohibited under the Insider Trading Policy. Section 16 compliance.* The person confirmed that the proposed trade will not give rise to potential liability under Section 16 as a result of matched past (or intended future) transactions. Form 4 filing.* A Form 4 has been or will be completed and will be timely filed with the U.S. Securities and Exchange Commission (“SEC”), if applicable. Rule 144 compliance (Response required only from affiliates of the Company). The “current public information” requirement has been met (i.e., 10-Ks, 10-Qs and other relevant reports during the last 12 months have been filed); The shares that the person proposes to trade are not restricted or, if restricted, the applicable holding period has been met; Volume limitations (greater of 1% of outstanding securities of the same class or the average weekly trading volume during the last four weeks) are not exceeded, and the person is not part of an aggregated group; The manner of sale requirements will be met (a “brokers’ transaction” or directly with a market maker or a “riskless principal transaction”); and A Form 144, if applicable, has been completed and will be timely filed with the SEC and the relevant national securities exchange. Rule 10b-5 concerns. The person has been reminded that trading is prohibited when in possession of any material nonpublic information regarding the Company that has not been adequately disclosed to the public. The individual has discussed with the Compliance Officer information known to the individual or the Compliance Officer that the individual believes may be material. * Applies if the individual is a director or an officer subject to Section 16 of the Securities Exchange Act of 1934, as amended. Date: (Signature of Compliance Officer) (Print name of Compliance Officer) I am not aware of material nonpublic information regarding the Company. I am not trading on the basis of material nonpublic information. The transaction is in accordance with the Insider Trading Policy and applicable law. I intend to comply with applicable reporting and disclosure requirements on a timely basis. I understand that I must execute the trade DocuSign Envelope ID: A2670512-3F06-4B6D-9A12-51A631532078

by the end of the second trading day after the date on which the trade is cleared by the Compliance Officer. I understand that by signing below, I am not obligated to execute the trade. (Signature of person proposing to trade) DocuSign Envelope ID: A2670512-3F06-4B6D-9A12-51A631532078

Exhibit B EXHIBIT B FORM OF SPECIAL BLACKOUT NOTICE [ON VOLATO GROUP, INC., LETTERHEAD] [Date] CONFIDENTIAL COMMUNICATION Dear [Insert Name]: Volato Group, Inc. (the “Company”), has imposed a special blackout period in accordance with the terms of the Company’s Insider Trading Policy (the “Policy”). Pursuant to the Policy, and subject to the exceptions stated in the Policy, you may not engage in any transaction involving the securities of the Company until you receive official notice that the special blackout period is no longer in effect. You may not disclose to others the fact that a special blackout period has been imposed. In addition, you should take care to handle any confidential information in your possession in accordance with the Company’s policies. If you have questions, then please contact me, Jennifer Liotta, General Counsel, at jennifer.liotta@flyvolato.com. Sincerely, Compliance Officer DocuSign Envelope ID: A2670512-3F06-4B6D-9A12-51A631532078

EXHIBIT C REQUIREMENTS FOR TRADING PLANS For transactions under a trading plan to be exempt from the prohibitions in the Insider Trading Policy (the “Policy”) of Volato Group, Inc. (together with any subsidiaries, collectively the “Company”) with respect to transactions made while aware of material non-public information and the pre-clearance procedures and blackout periods established under the Policy, the trading plan must comply with the affirmative defense set forth in Exchange Act Rule 10b5-1 and must meet the following requirements: 1. The trading plan must be in writing and signed by the person adopting the trading plan. 2. The trading plan must be adopted at a time when: a. the person adopting the trading plan is not aware of any material nonpublic information; and b. there is no quarterly, special or other trading blackout in effect with respect to the person adopting the plan. 3. The trading plan (i) specifies the amount of securities to be purchased or sold and the price at which and the date on which the securities are to be purchased or sold; (ii) includes a written formula or algorithm, or computer program, for determining the amount of securities to be purchased or sold and the price at which and the date on which the securities are to be purchased or sold; or (iii) does not permit the person to exercise any subsequent influence over how, when, or whether to effect purchases or sales; provided, in addition, that any other person who, pursuant to the contract, instruction, or plan, did exercise such influence must not have been aware of the material nonpublic information when doing so. 4. The trading plan must be entered in good faith and not as part of a plan or scheme to evade the prohibitions of Rule 10b5-1, and the individual entering into the trading plan acts in good faith with respect to the trading plan (e.g., efforts to direct the activities of others). 5. The individual adopting the trading plan may not have entered or altered a corresponding or hedging transaction or position with respect to the securities subject to the trading plan and must agree not to enter into such transaction while the trading plan is in effect. 6. If the individual entering into a trading plan is a director or Section 16 officer (as defined in Section 16 of the Securities and Exchange Act of 1934, as amended), then no purchases or sales may occur until expiration of a cooling-off period consisting of the later of (i) ninety (90) days after the adoption of the trading plan or (ii) two (2) business days following the disclosure of the Company’s financial results in a Form 10-Q or Form 10-K for the completed fiscal quarter in which the trading plan was adopted; provided, however, that, in no event shall the cooling-off period exceed one-hundred and twenty (120) days. If the individual entering into a trading plan is not a director or Section 16 officer, no purchases or sales may occur until the expiration of a cooling-off period that is thirty (30) days after the adoption of the trading plan. 7. If the individual entering into a trading plan is a director or Section 16 officer, such director or officer must include a representation in the trading plan certifying that, on the date of adoption of the plan: (i) the individual director or officer is not aware of any material nonpublic information about the security or Company; and (ii) the individual director or officer is adopting the plan in good faith and not as part of a plan or scheme to evade the prohibitions of Rule 10b5-1. 8. The individual entering into the trading plan may not have any other outstanding trading plans that qualify for the affirmative defense under Rule 10b5-1. Notwithstanding the preceding sentence, the individual entering into a trading plan may (i) have multiple outstanding trading plans with multiple DocuSign Envelope ID: A2670512-3F06-4B6D-9A12-51A631532078

brokers, so long as the contracts with each broker-dealer (taken together as a whole) meet all of the applicable conditions of Rule 10b5-1; (ii) maintain two trading plans simultaneously so long as trading under the later commencing plan cannot begin until all trades under the earlier plan are completed or expire without execution (subject to the cooling-off periods described above); (iii) have multiple trading plans if one of the plans, as noted in such plan, provides for an eligible sell-to-cover transaction. If the trading plan does not provide for an eligible sell-to-cover transaction, then each outstanding plan must qualify for the affirmative defense under Rule 10b5-1. 9. The trading plan must have a minimum term of one year (starting from when trades may first occur in accordance with these requirements). 10. Transactions during the term of the trading plan (except for the “Exceptions to Trading Restrictions” identified in the Policy) must be conducted through the trading plan. 11. Regarding modifications: a. The trading plan may only be modified when the person modifying the trading plan is not aware of material nonpublic information. b. The trading plan may only be modified when there is no quarterly, special or other blackout in effect with respect to the person modifying the plan. c. The modified trading plan must have a minimum duration of one year from the time when trades may first occur under the modified plan in accordance with these requirements. d. Any modification or change to the amount, price or timing of the purchase or sale of the securities underlying the trading plan is treated as a termination of such trading plan. 12. Within the one year preceding the modification or adoption of a trading plan, a person may not have otherwise modified or adopted a plan more than once. 13. If the person that adopted the trading plan terminates the plan prior to its stated duration, he or she may not trade in the Company’s securities until after the later of (a) the completion of the next quarterly blackout period after termination (or, if the plan is terminated during a quarterly blackout period, the end of that blackout period) and (b) 30 calendar days after termination. 14. The Company must be promptly notified of a modification or termination of the trading plan, including any suspension of trading under the plan. 15. The Company must have authority to require the suspension or cancellation of the trading plan at any time. 16. If the trading plan grants discretion to a stockbroker or other person with respect to the execution of trades under the plan: a. trades made under the trading plan must be executed by someone other than the stockbroker or other person that executes trades in other securities for the person adopting the trading plan; b. the person adopting the trading plan may not confer with the person administering the trading plan regarding the Company or its securities; and DocuSign Envelope ID: A2670512-3F06-4B6D-9A12-51A631532078

c. the person administering the trading plan must provide prompt notice to the Company of the execution of a transaction pursuant to the plan. 17. Transactions under the trading plan must be in accordance with applicable law. 18. The trading plan (including a modified trading plan) must meet such other requirements as the Compliance Officer may determine. 19. The trading plan must be submitted to the Company’s Compliance Officer for approval [five days] prior to the entry into the trading plan with an executed certificate stating that the trading plan complies with Rule 10b5-1 and the criteria set forth above. DocuSign Envelope ID: A2670512-3F06-4B6D-9A12-51A631532078