S-1: General form for registration of securities under the Securities Act of 1933

Published on May 7, 2025

As filed with the Securities and Exchange Commission on May 7, 2025.

Registration No. 333-__________

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

Volato Group, Inc.

(Exact name of registrant as specified in its charter.)

| Delaware | 4522 | 86-2707040 | ||

|

(State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(IRS Employer Identification No.) |

1954 Airport Road

Suite 124

Chamblee, Georgia 30341

844-399-8998

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Matthew Liotta

Chief Executive Officer

1954 Airport Road

Suite 124

Chamblee, Georgia 30341

844-399-8998

(Name, address, including zip code and telephone number, including area code, of agent for service)

Copies to:

Kate L. Bechen

Hallie D. Heath

Dykema Gossett PLLC

111 E. Kilbourn Ave., Suite 1050

Milwaukee, WI 53202

(414) 488-7300

Approximate date of commencement of proposed sale to the public: From time to time after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

| Emerging growth company | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Commission, acting pursuant to said section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. The selling stockholder named in this preliminary prospectus may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities, and the selling stockholder named in this preliminary prospectus is not soliciting an offer to buy these securities, in any state where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS | SUBJECT TO COMPLETION | DATED MAY 7, 2025 |

Volato Group, Inc.

4,067,553 Shares of Common Stock

This prospectus relates to the resale from time to time of up to 4,067,553 shares of Class A common stock, par value $0.0001 per share (“Common Stock”), of Volato Group, Inc. (“we”, “us”, “our” or the “Company”) by the selling stockholder identified herein (collectively, with any of such selling stockholder’s transferees, pledgees, assignees, distributees, donees or successors-in-interest, the “Selling Stockholder”) consisting of 4,067,553 shares of Common Stock (the “Conversion Shares”) issuable upon the conversion of (i) a 10% original issue discount senior unsecured convertible promissory note issued to the Selling Stockholder on December 4, 2024 in an aggregate original principal amount of $4,500,000 (the “First Tranche Note”) and (ii) a 10% original issue discount senior unsecured convertible promissory note to be issued to the Selling Stockholder in an aggregate original principal amount of $1,500,000, subject to the satisfaction or waiver of certain conditions, including the Company having an effective registration statement for the resale of the shares of Common Stock issuable pursuant to the Notes (as defined below) and the Company having satisfied its obligations under the previously disclosed Settlement Agreement and Stipulation entered into with Sunpeak Holdings Corporation (“Sunpeak”) that became effective on November 6, 2024 and that relates to the settlement of outstanding claims owed to Sunpeak (the “Second Tranche Note” and together with the First Tranche Note, the “Notes”), in each case, issued or issuable pursuant to the terms of that certain Securities Purchase Agreement, dated as of December 4, 2024, that we entered into with the Selling Stockholder (the “SPA”), plus all accumulated interest until its respective maturity date and redemption premium on the Notes, using the initial note conversion floor price of $1.83, assuming that each Note remains outstanding until its respective maturity date and that the redemption premium and interest on the Notes are paid in shares of Common Stock. The SPA also provides for the issuance of additional 10% original issue discount senior unsecured convertible promissory notes in an aggregate original principal amount of $30,000,000 (together with the Notes, the “SPA Notes”), which shares of Common Stock issuable upon the conversion thereof are not being included in this prospectus. All securities acquired by the Selling Stockholder pursuant to the terms of the SPA will be, and the First Tranche Note was, acquired in private transactions exempt from registration under the Securities Act of 1933, as amended (the “Securities Act”). For additional information regarding the SPA, the SPA Notes and the Conversion Shares, see “Prospectus Summary – The Selling Stockholder Transactions”.

Our registration of the Common Stock covered by this prospectus does not mean that the Selling Stockholder will offer or sell any of the Conversion Shares. We will not receive any proceeds from the resale of the Conversion Shares by the Selling Stockholder in this offering. However, we received $4,050,000 in aggregate gross proceeds in connection with the issuance and sale of the First Tranche Note and we will receive an additional $1,350,000 in aggregate gross proceeds in connection with the issuance and sale of the Second Tranche Note (in each case, after giving effect to the 10% original issue discount for such Notes). We used the net proceeds from the sale of the First Tranche Note and intend to use the net proceeds from the sale of the Second Tranche Note for general corporate and working capital purposes. Our management will have broad discretion in the application of such proceeds. All selling and other expenses incurred by the Selling Stockholder will be paid by the Selling Stockholder, except for certain legal fees and expenses, which will be paid by us. The Selling Stockholder may sell, transfer or otherwise dispose of any or all of the Conversion Shares offered by this prospectus from time to time on the NYSE American LLC (“NYSE American”) or any other stock exchange, market, or trading facility on which the shares of Common Stock are traded, or in private transactions. The Conversion Shares may be offered and sold or otherwise disposed of by the Selling Stockholder at fixed prices, market prices prevailing at the time of sale, prices related to prevailing market prices, or privately negotiated prices. Refer to the section entitled “Plan of Distribution” for more information regarding how the Selling Stockholder may offer, sell, or dispose of its Conversion Shares. We will bear all fees and expenses incident to our obligation to register the Conversion Shares.

Our Common Stock is traded on the NYSE American under the symbol “SOAR”. On May 6, 2025, the last reported sale price of our Common Stock on the NYSE American was $2.41 per share. On February 24, 2025, we effected a 1-for-25 reverse stock split of our Common Stock. Unless otherwise indicated, all share and per-share amounts in this prospectus have been adjusted to give effect to the 1-for-25 reverse stock split.

We may amend or supplement this prospectus from time to time by filing amendments or supplements as required. You should read the entire prospectus and any amendments or supplements carefully before you make your investment decision.

We are an “emerging growth company” as defined under U.S. federal securities laws and, as such, have elected to comply with reduced public company reporting requirements. This prospectus complies with the requirements that apply to an issuer that is an emerging growth company.

Investing in our Common Stock involves risks. Before buying any shares of Common Stock, you should carefully review the risks and uncertainties described under the heading “Risk Factors” beginning on page 9 of this prospectus and in the documents incorporated by reference into this prospectus, including our Annual Report on Form 10-K for the year ending December 31, 2024.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2025

TABLE OF CONTENTS

| i |

This prospectus is part of a Registration Statement on Form S-1 that we filed with the Securities and Exchange Commission (the “SEC”) pursuant to which the Selling Stockholder may, from time to time, offer and sell or otherwise dispose of the shares of our Common Stock covered by this prospectus. We may also file a prospectus supplement or post-effective amendment to the registration statement of which this prospectus forms a part. The prospectus supplement or post-effective amendment may add, update or change information contained in this prospectus. If there is any inconsistency between the information in this prospectus and the applicable prospectus supplement or post-effective amendment, you should rely on the prospectus supplement or post-effective amendment, as applicable. The registration statement we filed with the SEC, of which this prospectus forms a part, includes exhibits that provide more detail of the matters discussed in this prospectus. You should read this prospectus, any post-effective amendment, and any applicable prospectus supplement and the related exhibits filed with the SEC before making your investment decision. The registration statement and the exhibits can be obtained from the SEC, as indicated under the section entitled “Where You Can Find More Information.”

You should rely only on the information contained in this prospectus. Neither we nor the Selling Stockholder have authorized anyone to provide you with any information or to make any representations other than those contained in this prospectus, any post-effective amendment, or any applicable prospectus supplement prepared by or on behalf of us or to which we have referred you. We and the Selling Stockholder take no responsibility for and can provide no assurance as to the reliability of any other information that others may give you. If anyone provides you with different or inconsistent information, you should not rely on it. You should assume that the information appearing in this prospectus, any post-effective amendment and any applicable prospectus supplement to this prospectus is accurate only as of the date on its respective cover. Our business, financial condition, results of operations and prospects may have changed since those dates. Neither we nor the Selling Stockholder are making an offer to sell our Common Stock in any jurisdiction where the offer or sale thereof is not permitted. You should not assume that the information appearing in this prospectus any post-effective amendment and any applicable prospectus supplement to this prospectus is accurate as of any date other than their respective dates. Our business, financial condition, results of operations and prospects may have changed since those dates. You should carefully read the entirety of this prospectus before making an investment decision.

We further note that the representations, warranties and covenants made by us in any agreement that is filed as an exhibit to the registration statement of which this prospectus forms a part were made solely for the benefit of the parties to such agreement, including, in some cases, for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation, warranty or covenant to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made. Accordingly, such representations, warranties and covenants should not be relied on as accurately representing the current state of our affairs.

This prospectus contains references to trademarks, trade names and service marks belonging to other entities. Solely for convenience, trademarks, trade names and service marks referred to in this prospectus may appear without the ® or TM symbols, but such references are not intended to indicate, in any way, that the applicable licensor will not assert, to the fullest extent under applicable law, its rights to these trademarks and trade names. We do not intend our use or display of other companies’ trade names, trademarks or service marks to imply a relationship with, or endorsement or sponsorship of us by, any other companies.

| ii |

This summary highlights information contained elsewhere in this prospectus or incorporated by reference herein. This summary does not contain all of the information you should consider before investing in our shares of Common Stock. Before deciding to invest in our shares of Common Stock, you should read this entire prospectus carefully, including the section of this prospectus entitled “Risk Factors” beginning on page 9 and under similar headings in the other documents that are incorporated by reference into this prospectus. As used in this prospectus, unless the context requires otherwise, the terms “Company,” “Volato,” “we,” “our” and “us” refer to Volato Group, Inc. and its consolidated subsidiaries.

Company Overview

The Company initially operated under the name Aerago, Inc., which was formed on January 7, 2021, in the State of Georgia. On August 31, 2021, Aerago, Inc. filed an amendment to its Articles of Incorporation to change its name to Volato, Inc. On December 1, 2023, the Company consummated a business combination transaction (the “Business Combination”) pursuant to a business combination agreement (the “Business Combination Agreement”), dated August 1, 2023 between the Company, PACI Merger Sub, Inc., a Delaware corporation and a direct, wholly-owned subsidiary of the Company (“Merger Sub”), and Volato, Inc. Pursuant to the terms of the Business Combination Agreement, Merger Sub merged with and into Volato, Inc., with Volato, Inc. surviving the merger as a wholly-owned subsidiary of the Company. In connection with the consummation of the Business Combination, the Company changed its name from “PROOF Acquisition Corp I” to “Volato Group, Inc.”

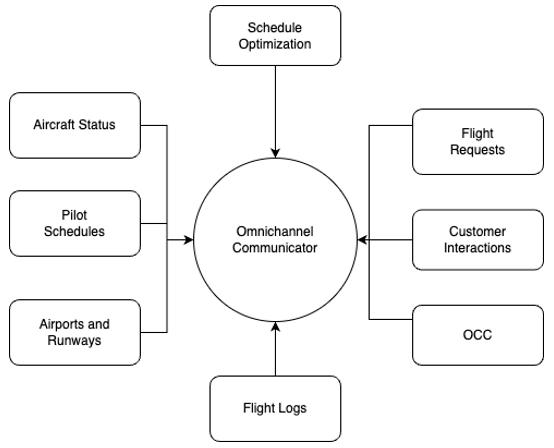

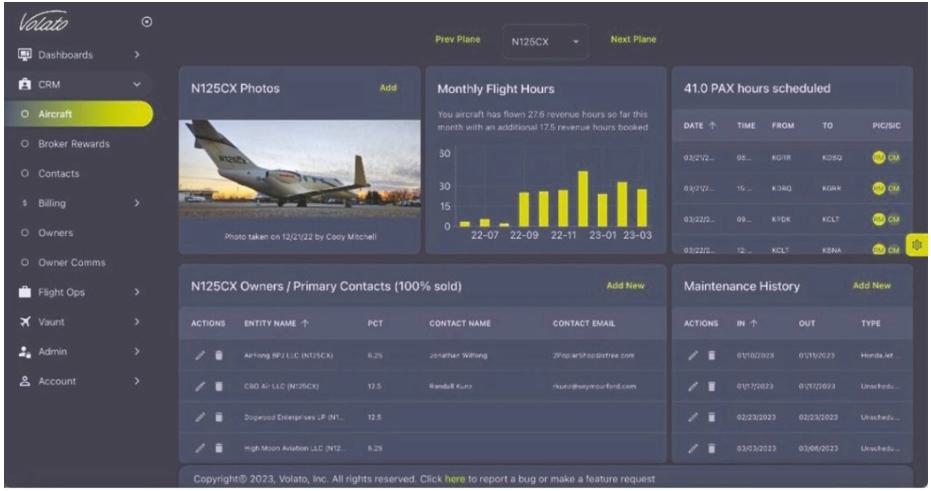

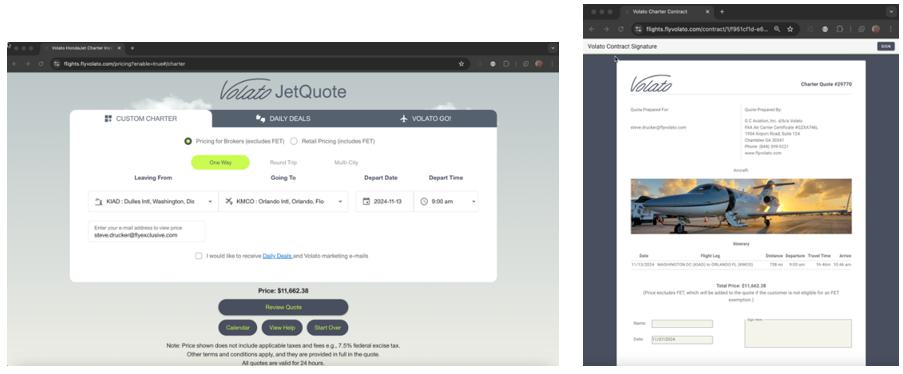

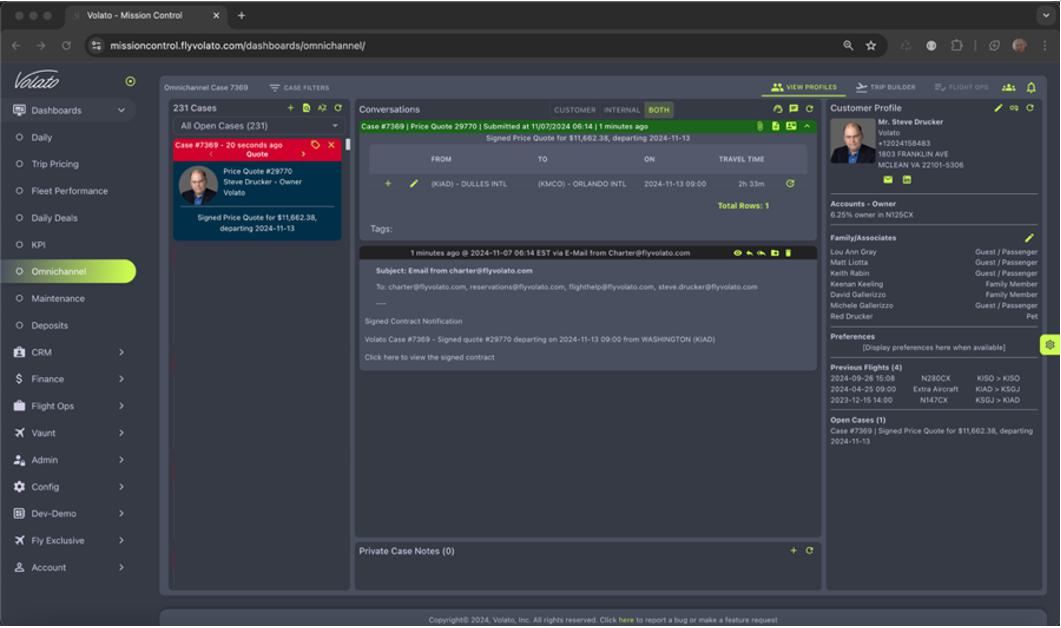

Volato is an aviation company advancing the industry with innovative solutions in aviation software and on-demand flight access. Historically, we generated revenue through our aircraft ownership program. This program was a focused commercial strategy including deposit products, charter flights, and aircraft management services. Our aviation experience led to the development of our proprietary software. Mission Control drives efficiency across operations and supports operators in managing fractional ownership, charter, and other services. We also have a new patent-pending technology that advances how aircraft generate revenue by repurposing underutilized aircraft resources for cryptocurrency mining. With a commitment to advanced technology and customer-focused solutions, we are building scalable tools to elevate service quality and operational effectiveness in private aviation.

In September 2024, we announced an agreement with flyExclusive, Inc. (“flyExclusive”) to transition the management of our aircraft ownership program fleet operations to flyExclusive. Our management expects that this arrangement will provide substantial cost savings to the Company and allow us to focus on high-growth areas, such as aircraft sales and proprietary software. We will continue to take delivery of new aircraft, including three Gulfstream G280s in 2025. This arrangement is intended to allow the Company to benefit from the margins on aircraft sales without the burden of operational costs, while also generating revenue from our proprietary software.

The Selling Stockholder Transactions

On December 4, 2024, we entered into the SPA and certain related transaction documents described below with the Selling Stockholder. In accordance with the SPA, the Company agreed to issue the SPA Notes in an aggregate original principal amount of up to $36,000,000, which SPA Notes will be convertible into shares of Common Stock. On the same day, we issued the First Tranche Note to the Selling Stockholder in an aggregate principal amount of $4,500,000 at the initial closing (the “Initial Closing”) for a purchase price of $4,050,000, representing an original issue discount of ten percent (10%), and which matures on December 4, 2025. Following the Initial Closing, an aggregate principal amount of $31,500,000 of Notes is available to be issued under the SPA. Pursuant to the SPA, the Company has agreed to issue the Second Tranche Note following the satisfaction or waiver of certain conditions, including the registration statement of which this prospectus forms a part being declared effective and the Company having satisfied its obligations under the previously disclosed Settlement Agreement and Stipulation entered into with Sunpeak. The Company intends to satisfy such condition prior to the issuance of the Second Tranche Note. Under the Settlement Agreement and Stipulation, Sunpeak agreed to purchase certain outstanding payables between the Company and designated vendors of the Company totaling approximately $4.7 million (the “Claims”), and to thereafter exchange such Claims for a settlement amount payable in shares of Common Stock. Instead of certain of the Claims being resolved under the Settlement Agreement and Stipulation, the Company satisfied a $1.2 million portion of the Claims directly with the applicable vendor through cash payments made in the first quarter of 2025, in lieu of being satisfied under the terms of the Settlement Agreement and Stipulation. The Company expects that its remaining obligations under the Settlement Agreement and Stipulation will be satisfied in full no later than December 31, 2025.

| 1 |

Any additional SPA Notes will be in aggregate principal amounts agreed to by the Company and the Selling Stockholder; provided, however, that no additional SPA Note will be in an amount in excess of $4,000,000, unless otherwise mutually agreed to by the Company and Selling Stockholder. Further, no additional SPA Notes will be issued at any time when the aggregate principal balance outstanding on all previously issued SPA Notes is greater than $2,000,000. It is also a condition to closing on any additional SPA Notes that during the twenty (20) trading days immediately preceding the most recent additional closing, a minimum of $500,000 in shares of Common Stock has been traded and the daily “VWAP” of the Common Stock is greater than the “Conversion Price” described below. “VWAP” is defined as the daily volume weighted average price of the Common Stock for a trading day on NYSE American (or such other market on which the Company’s Common Stock is listed) during regular trading hours as reported by Bloomberg L.P. Each additional SPA Note will mature twelve (12) months after the issuance date of such additional SPA Note.

The number of shares of Common Stock issuable upon conversion of any SPA Note will be determined by dividing (x) the portion of the principal, interest, or other amounts outstanding under such SPA Note to be converted by (y) the Conversion Price. The Conversion Price of the First Tranche Note was initially $0.3660 per share, which was adjusted to $9.15 pursuant to the 1-for -25 reverse stock split effected by the Company on February 24, 2025 (the “Fixed Price”). Beginning on the three (3) month anniversary of the issuance date of each SPA Note, and on the same day of each third month thereafter (each, a “Fixed Price Reset Date”), the Conversion Price will be reduced to the lower of (i) the then-effective Conversion Price or (ii) 90% of the lowest daily VWAP during the ten (10) consecutive trading days immediately prior to such Fixed Price Reset Date (the “Variable Price”), provided that the Conversion Price cannot be lower than the Floor Price (as defined in the SPA Notes) then in effect. Accordingly, the Conversion Price of the First Tranche Note was reset to $1.91 as of March 4, 2025. Further, subject to the rules of the NYSE American LLC, or any successor thereto, the Company may at any time any Notes remain outstanding, reduce the then current Conversion Price of any such Notes to any amount and for any period of time deemed appropriate by the Board.

Additionally, on any trading day on which the aggregate trading value of the Common Stock (as reported on Bloomberg) is equal to or greater than $250,000 between 4:30 a.m. and 11:00 a.m. eastern time, the Conversion Price on such trading day (and only for such trading day) will be reduced to the lowest of (i) the Variable Price, (ii) the lowest price traded on such trading day until 11:00 a.m. eastern time, subject to the Floor Price then in effect or (iii) the then-effective Conversion Price. Upon the occurrence of an Event of Default (as defined in the SPA Notes), with respect to any Event of Default, the Event of Default Conversion Price (as defined in the SPA Notes) will be the lower of (i) the then effective Conversion Price or (ii) 85% of the lowest daily VWAP during the ten (10) consecutive trading days immediately prior to the date that the Selling Stockholder delivers a conversion notice any time after the occurrence of an Event of Default or an Event of Default Redemption Notice (as defined in the SPA Notes), as applicable, subject to the Floor Price.

The initial Floor Price for the First Tranche Note was $0.073 per share, which was adjusted to $1.83 pursuant to the 1-for-25 reverse stock split effected by the Company on February 24, 2025. However, beginning on the six (6) month anniversary of a SPA Note’s issuance, and on the same day of every six (6) months thereafter (each, a “Floor Price Reset Date”), the Floor Price will be reduced to 20% of the average VWAP during the five (5) trading days immediately prior to such Floor Price Reset Date. Additionally, the Company may reduce the Floor Price to any amount set forth in a written notice to the SPA Note holder, provided that any such reduction will be irrevocable and will not be subject to increase thereafter.

Interest on the outstanding principal balance of each SPA Note will accrue at an annual rate equal to 4.0% (the “Interest Rate”) and interest may be paid in cash or shares of Common Stock. Each SPA Note will contain customary events of default and the Interest Rate will increase to an annual rate of 18.0% upon the occurrence of an Event of Default.

Aggregate sales pursuant to the SPA would result in significant dilution to existing stockholders, reducing their collective ownership percentage from 100% to approximately 7% of the outstanding shares of Common Stock assuming no other changes in the capital structure. As of April 29, 2025, the maximum number of shares of Common Stock issuable upon conversion of all the SPA Notes issued or issuable pursuant to the SPA is 24,405,324 shares, assuming that all the SPA Notes remain outstanding until their respective maturity date and that the Payment Premium (as defined in the SPA Notes) and interest on the SPA Notes are paid in shares of Common Stock, using the Floor Price, subject to adjustments. However, a SPA Note holder will not have the right to convert any portion of a SPA Note (including the First Tranche Note and Second Tranche Note), to the extent that, after giving effect to such conversion, the holder (together with certain of its affiliates and other related parties) would beneficially own in excess of 4.99% of the shares of Common Stock outstanding immediately after giving effect to such conversion (the “Beneficial Ownership Limitation”) and such maximum number of shares may increase or decrease due to, including but not limited to, (i) changes in the amount of principal, interest, or other amounts outstanding under the SPA Notes; (ii) a reduction of the Conversion Price on a Fixed Price Reset Date; (iii) a reduction of the Conversion Price on a trading day on which the aggregate trading value of the shares of Common Stock (as reported by Bloomberg) is equal to or greater than $250,000; (iv) a reduction of the Conversion Price as a result of an Event of Default; (v) a reduction of the Conversion Price as a result of a Dilutive Issuance (as defined below); or (vi) a reduction of the Floor Price on a Floor Price Reset Date. Furthermore, in no case will the Company issue shares of Common Stock in excess of the then-authorized number of shares of Common Stock that the Company is authorized to issue pursuant to its Certificate of Incorporation. In this regard, the SPA only requires that the Company have authorized and reserved a sufficient number of shares of Common Stock that would be issuable upon the conversion of any SPA Notes then outstanding. If necessary, the Company will seek separate stockholder approval of an additional increase to the number of authorized shares of Common Stock that the Company may issue prior to closing on additional SPA Notes that would be convertible into a number of shares of Common Stock in excess of the amount of shares that the Company is then authorized to issue.

A SPA Note holder, upon notice to the Company, may increase or decrease the Beneficial Ownership Limitation, provided that the Beneficial Ownership Limitation in no event exceeds 9.99% of the shares of Common Stock outstanding immediately after giving effect to such conversion. Any increase in the Beneficial Ownership Limitation will not be effective until the sixty-first (61st) day after such notice is delivered to the Company. A SPA Note holder may waive any beneficial ownership limitation, only as to itself, upon at least sixty-one (61) days prior notice.

If, any time after the issuance date of a SPA Note, and from time to time thereafter, an “Amortization Event” occurs, then the Company will be required to make monthly payments beginning on the seventh (7th) trading day after the Amortization Event Date (as defined in the Notes) and continuing on the same day of each successive calendar month until the entire outstanding principal amount of any outstanding SPA Notes is repaid. Each such monthly payment will be in an amount equal to the sum of (i) one sixth of the aggregate principal amount outstanding for all SPA Notes (the “Amortization Principal Amount”), plus (ii) 20% of such Amortization Principal Amount, and (iii) accrued and unpaid interest as of each payment date. An “Amortization Event” is defined in the SPA Notes as (i) the daily VWAP being less than the Floor Price then in effect for three (3) trading days during a period of five (5) consecutive trading days, (ii) the Company’s failure to obtain stockholder approval within seventy-five (75) days after the date of the First Tranche Note, or (iii) the Company being in material breach of the Registration Rights Agreement (described below), and such breach remains uncured for a period of twenty (20) trading days, or the occurrence of certain events set forth in the Registration Rights Agreement. The obligation of the Company to make monthly payments related to an Amortization Event will cease upon cure of the Amortization Event, pursuant to the terms of the SPA Notes.

| 2 |

At any time any SPA Notes remain outstanding, the Company is prohibited from effecting, entering into an agreement to effect, or announcing, any issuance, offer, sale, grant of any option or right to purchase, or other disposal of any equity security or any equity-linked or related security, any stock or securities directly or indirectly convertible into or exercisable or exchangeable for shares of Common Stock (“Convertible Securities”), preferred stock or repurchase rights involving a “Variable Rate Transaction” without the written consent of the Selling Stockholder in its sole discretion. “Variable Rate Transaction” means a transaction in which the Company or any subsidiary of the Company (i) issues or sells any Convertible Securities either (A) at a conversion, exercise or exchange rate or other price that is based upon and/or varies with the trading prices of or quotations for the shares of Common Stock at any time after the initial issuance of such Convertible Securities, or (B) with a conversion, exercise or exchange price that is subject to being reset at some future date after the initial issuance of such Convertible Securities or upon the occurrence of specified or contingent events directly or indirectly related to the business of the Company or the market for the Common Stock, other than pursuant to a customary “weighted average” anti-dilution provision or (ii) enters into any agreement (including, without limitation, an equity line of credit or an “at-the-market” offering) whereby the Company or any subsidiary of the Company may sell securities at a future determined price (other than standard and customary “preemptive” or “participation” rights). The Selling Stockholder is entitled to obtain injunctive relief against the Company and its Subsidiaries to preclude any such issuances, which remedy shall be in addition to any right to collect damages. The restrictions contemplated in this paragraph shall not apply to any issuance of securities pursuant to any equity lines of credit or similar arrangement or transactions between the Company and the Selling Stockholder.

Further, at any time any SPA Notes remain outstanding, the Company is prohibited from effecting or entering into an agreement to effect an issuance or sale of shares of Common Stock (other than in connection with the SPA or a standby equity purchase agreement that may be entered into by and between the Company and the Selling Stockholder), or Convertible Securities, for a consideration per share less than a price equal to the Fixed Price in effect immediately prior to such issue or sale (a “Dilutive Issuance”), if the effect of such Dilutive Issuance is to cause the Company to be required to issue, upon conversion of any SPA Notes, any shares of Common Stock in excess of the number of shares of Common Stock which the Company may issue upon conversion of the SPA Notes without breaching the Company’s obligations under the rules or regulations of the NYSE American.

| 3 |

Pursuant to the terms of the SPA, the Company is required to hold a meeting of stockholders of the Company (the “Stockholder Meeting”) seeking approval of the issuance of all of the shares of Common Stock that may be issuable pursuant to the SPA Notes in compliance with the rules and regulations of the NYSE American (the “Stockholder Approval”). The Company has provided each stockholder entitled to vote at a meeting of stockholders of the Company a proxy statement, in each case, in a form reasonably acceptable to the Selling Stockholder and its counsel, at the expense of the Company, with the Company obligated to reimburse the expenses of Selling Stockholder’s counsel incurred in connection therewith. On April 15, 2025, the Company convened its Stockholder Meeting. A total of 502,595 shares of Common Stock, representing approximately 26.44% of the shares outstanding and entitled to vote, were represented in person or by valid proxies at the Stockholder Meeting. As a result, the Company did not achieve a quorum and no business was conducted at the Stockholder Meeting. On May 6, 2025, the Company reconvened the Special Meeting and did not achieve a quorum. Since, despite the Company’s reasonable best efforts, Stockholder Approval was not obtained at the reconvened Stockholder Meeting, the Company has further adjourned and will reconvene the Stockholder Meeting. The Company must adjourn and reconvene the Stockholder Meeting at least as often as every thirty (30) calendar days until the Stockholder Approval is obtained.

The SPA also limits the total cumulative number of shares of Common Stock that may be issued to the Selling Stockholder under the SPA Notes (inclusive of the First Tranche Note and Second Tranche Note), the SPA, and any other transaction documents to 19.99% of the number of shares of Company Common Stock issued and outstanding (the “Exchange Cap”) pursuant to the requirements of Section 713 of the NYSE American Company Guide or other applicable rules of the principal market on which the Company’s securities are listed, except that such limitation will not apply following the Company’s receipt of Stockholder Approval. The Exchange Cap is calculated based on the number of shares of Company Common Stock issued and outstanding as of the date of the SPA, which number will be reduced, on a share-for-share basis, by the number of shares of Company Common Stock issued or issuable pursuant to any transaction or series of transactions that may be aggregated with the transactions contemplated by the SPA under the applicable rules of NYSE American. Prior to the Company’s receipt of Stockholder Approval of the issuance of shares of Common Stock issuable in excess of the Exchange Cap, the Selling Stockholder may not convert any SPA Note into shares of Common Stock to the extent that as a result of such conversion, the number of shares of Common Stock to be issued would exceed 19.99% of the total number of shares of Common Stock outstanding. The Company filed a definitive proxy statement with the SEC to seek the Stockholder Approval at a special meeting of stockholders, which is currently scheduled to be held on April 15, 2025.

In connection with the Initial Closing, the parties entered into a registration rights agreement (the “Registration Rights Agreement”), pursuant to which the Company agreed to file the registration statement of which this prospectus forms a part within 30 days of such closing. The Company agreed to use its best efforts to have this registration statement declared effective by the SEC as soon as practicable, but in no event later than the 60th calendar day following the date of the Initial Closing (the “Effectiveness Deadline”). However, in the event the Company is notified by SEC that the registration statement will not be reviewed or is no longer subject to further review and comments, the Effectiveness Deadline will be accelerated to the fifth business day following the date on which the Company is so notified if such date precedes the initial Effectiveness Deadline. In the event the registration statement is subject to a full SEC review, or the Company is required to update the financial statements therein, which causes the registration statement not to be declared effective by the Effectiveness Deadline, the Effectiveness Deadline will automatically be deemed to be extended for so long as necessary, provided that the Company is using its best efforts to promptly respond to and satisfy the requests of the SEC. During any such period, the Company will not be in default of satisfying the Effectiveness Deadline.

| 4 |

The SPA, Notes, and Registration Rights Agreement contain customary representations, warranties, agreements and conditions to completing future sale transactions, indemnification rights and obligations of the parties. Among other things, the Selling Stockholder represented to the Company that it is an “accredited investor” (as such term is defined in Rule 501(a) of Regulation D under the Securities Act). The Company offered and issued the First Tranche Note and offered and will issue any additional SPA Notes, and the shares of Common Stock issuable pursuant to the First Tranche Note and additional SPA Notes, in reliance upon the exemptions from registration contained in Section 4(a)(2) of the Securities Act and Regulation D promulgated thereunder.

NYSE American Compliance

Our Common Stock is currently listed on the NYSE American under the symbol “SOAR”. On June 18, 2024, the Company received a notice from the NYSE American (the “Deficiency Letter”) advising the Company that it was not in compliance with the NYSE American continued listing standards set forth in (i) Section 1003(a)(i) of the NYSE American Company Guide (the “Company Guide”) requiring a company to have stockholders’ equity of at least $2.0 million if it has reported losses from continuing operations and/or net losses in two of its three most recent fiscal years and (ii) Section 1003(a)(ii) of the Company Guide requiring a company to have stockholders’ equity of at least $4.0 million if it has reported losses from continuing operations and/or net losses in three of its four most recent fiscal years (collectively, the “Minimum Stockholders’ Equity Requirements”). On July 18, 2024, the Company submitted a plan (the “Compliance Plan”) to the NYSE American outlining certain actions the Company has taken and will take to regain compliance with the Minimum Stockholders’ Equity Requirements by December 18, 2025. These actions include, among others, implementing certain cost savings measures that the Company initiated during the second quarter of 2024 and entering into the SPA.

On September 5, 2024, NYSE American notified the Company that NYSE American accepted the Compliance Plan and granted the Company through December 18, 2025, to regain compliance with the Minimum Stockholders’ Equity Requirements (the “Compliance Period”). During the Compliance Period, the Company is subject to quarterly review by NYSE American to determine if the Company is making progress consistent with the Compliance Plan. If the Company does not regain compliance with the Minimum Stockholders’ Equity Requirements by December 18, 2025, or if the Company does not make sufficient progress consistent with its Compliance Plan, then the NYSE American may initiate delisting proceedings to delist the Company’s Common Stock from the NYSE American.

The Company is committed to regaining compliance with the Minimum Stockholders’ Equity Requirements. Although the Company believes it will be able to achieve compliance with the Minimum Stockholders’ Equity Requirements, there can be no assurance that the Company will be able to regain compliance with such requirements or maintain compliance with any other listing requirements within the time frame required by NYSE American or at all. If NYSE American determines that the Company fails to meet the continued listing standards of NYSE American, the Company’s Common Stock may be delisted from NYSE American.

Summary of Risk Factors

Our business is subject to numerous risks and uncertainties, including those described in the section entitled “Risk Factors,” that represent challenges that we face in connection with the successful implementation of our strategy and growth of our business. The occurrence of one or more of the events or circumstances described in the section entitled “Risk Factors,” alone or in combination with other events or circumstances, may adversely affect our business, financial condition, and results of operations. Such risks include, but are not limited to, the following:

| 5 |

Risks Related to Our Business and Industry

| ● | We have a limited operating history and history of net losses and may continue to experience net losses in the future. |

| ● | Significant reliance on HondaJet and Gulfstream aircraft and parts poses risks to our business and prospects. |

| ● | If we are not able to successfully enter into new markets and services and enhance our existing products and services, our business, financial condition, and results of operations could be adversely affected. |

| ● | We are exposed to the risk of a decrease in demand for private aviation services. |

| ● | We may require substantial additional funding to finance our operations, but adequate additional financing may not be available when we need it, on commercially acceptable terms, or at all. |

| ● | The supply of pilots to the aviation industry is limited and may negatively affect our operations and financial condition. |

| ● | Some of our business may become dependent on third-party operators to provide flights for our customers. If third-party operators’ flights, which are required to serve a substantial portion of our business, are not available or do not perform adequately, our costs may increase and our business, financial condition, and results of operations could be adversely affected. |

| ● | Our business is affected by factors beyond our control including: air traffic congestion at airports; airport slot restrictions; air traffic control inefficiencies; natural disasters; adverse weather conditions, such as hurricanes or blizzards; increased and changing security measures; changing regulatory and governmental requirements; new or changing travel-related taxes; or the outbreak of disease; any of which could have a material adverse effect on our business, results of operations, and financial condition. | |

| ● | Our business is primarily focused on certain targeted geographic markets, making us vulnerable to risks associated with having geographically concentrated operations. |

| ● | The operation of aircraft is subject to various risks, and failure to maintain an acceptable safety record may have an adverse impact on our ability to obtain and retain customers. |

| ● | We rely on our information technology systems to manage numerous aspects of our business. A cyber-based attack of these systems could disrupt our ability to deliver services to our customers and could lead to increased overhead costs, decreased revenues, and harm to our reputation. |

| ● | We will rely on third parties maintaining open marketplaces to distribute our mobile and web applications and we currently rely on third parties to provide the software we use in certain of our products and services, including the provision of our flight management system. If these third parties interfere with the distribution of our products or services, with our use of the software, or with the interoperability of our platform with the software, our business would be adversely affected. |

Risks Related to Legal and Regulatory Matters

| ● | We are subject to significant governmental regulation. |

| ● | We may become involved in litigation that may materially adversely affect us. |

| ● | The issuance of operating restrictions applicable to one of the fleet types we operate could have a material adverse effect on our business, results of operations, and financial condition. |

| 6 |

Risks Related to Our Contractual Obligations

| ● | Our obligations in connection with our contractual obligations, including long-term leases and debt financing obligations, could impair our liquidity and thereby harm our business, results of operations, and financial condition. |

| ● | Agreements governing our debt obligations include financial and other covenants that provide limitations on our business and operations under certain circumstances, and failure to comply with any of the covenants in such agreements could adversely impact us. |

Risks Related to Ownership of Our Securities and Being a Public Company

| ● | If we fail to maintain an effective system of disclosure controls and internal control over financial reporting, our ability to produce timely and accurate financial statements or comply with applicable regulations could be impaired, which may adversely affect investor confidence in us and, as a result, the market price of the Common Stock. |

| ● | Sales of Common Stock, or the perception of such sales, by us pursuant to this prospectus in the public market or otherwise, could cause the market price for our Common Stock to decline. |

| ● | If we are unable to comply with the continued listing requirements of the NYSE American, including satisfying the obligations set forth in the Deficiency Letter with respect to our stockholders’ equity being below the NYSE American’s minimum level, then our common stock will be delisted from the NYSE American. |

| ● | If you purchase shares of our common stock in this offering, you will incur immediate and substantial dilution. You may also experience future dilution as a result of any future equity offerings. | |

| ● | We have broad discretion in the use of the net proceeds from this offering and may invest or spend the proceeds in ways with which you do not agree and in ways that may not yield a return on your investment. |

Risks Related to This Offering

| ● | Unless we obtain the Stockholder Approval, the Notes cannot be converted into shares of Common Stock in excess of the Exchange Cap. | |

| ● | The Selling Stockholder may choose to sell the Conversion Shares at prices below the current market price of our Common Stock. | |

| ● | Investors who buy shares at different times may pay different prices. | |

| ● | Resales of our shares of Common Stock in the public market by our stockholders as a result of this offering may cause the market price of our Common Stock to fall. | |

| ● | Stockholders may experience dilution of their ownership interest due to the issuance of additional shares of Common Stock upon the conversion of the Notes, especially since the Notes have fluctuating conversion rates that are set at a discount to market prices of our shares of Common Stock during the period immediately following conversion. | |

| ● | We will have broad discretion as to the proceeds that we receive from the sale of the Notes under the SPA, and we may not use the proceeds effectively. | |

| ● | Neither we nor the Selling Stockholder have authorized any other party to provide you with information concerning us or this offering. |

Corporate Information

Our business mailing address is 1954 Airport Rd., Suite 124, Chamblee, Georgia 30341 and our telephone number is 844-399-8998. We also maintain a website at flyvolato.com. The information contained in or accessible from our website is not incorporated into this prospectus, and you should not consider it part of this prospectus. We have included our website address in this prospectus solely as an inactive textual reference. You should not rely on any such information in making the decision of whether to purchase our securities.

| 7 |

|

Terms of the offering |

The Selling Stockholder and any of its pledgees, assignees and successors-in-interest will determine when and how it sells the Conversion Shares offered in this prospectus and may, from time to time, sell any or all of its shares covered hereby on the NYSE American or any other stock exchange, market or trading facility on which the shares are traded or in privately negotiated transactions. These sales may be at fixed or negotiated prices. See “Plan of Distribution.” | |

| Common Stock offered by Selling Stockholder | Up to 4,067,553 shares of Common Stock. | |

| Common Stock outstanding prior to this offering | 1,900,893 shares of Common Stock (as of April 29, 2025). | |

| Common Stock to be outstanding after this offering | 5,968,446 shares of Common Stock, assuming the sale of all of the Conversion Shares. | |

| Use of proceeds |

The Selling Stockholder will receive all of the proceeds from the sale of the Conversion Shares offered for sale by it under this prospectus. We will not receive any proceeds from the sale of the Conversion Shares offered by the Selling Stockholder.

We received $4,050,000 in aggregate gross proceeds in connection with the issuance and sale of the First Tranche Note and we will receive an additional $1,350,000 in aggregate gross proceeds in connection with the issuance and sale of the Second Tranche Note (in each case, after giving effect to the 10% original issue discount for such Notes). We used the net proceeds from the sale of the First Tranche Note and intend to use the net proceeds from the sale of the Second Tranche Note for general corporate and working capital purposes. Our management will have broad discretion in the application of such proceeds.

For more information, see “Use of Proceeds.” |

|

| Risk factors | Investing in our securities involves a high degree of risk. You should read the “Risk Factors” section of this prospectus for a discussion of factors to consider carefully before deciding to invest in shares of our Common Stock. | |

| Market for the Common Stock | Our Common Stock is traded on the NYSE American under the symbol “SOAR”. |

The number of shares of our Common Stock to be outstanding upon completion of this offering is based on 1,900,893 shares of our Common Stock outstanding as of April 29, 2025 and excludes:

| ● | 20,500 shares of Common Stock issuable upon exercise of options outstanding as of April 29, 2025; |

| ● | 235,628 shares of Common Stock available for future issuance under the Company’s 2023 Stock Incentive Plan as of April 29, 2025; |

| ● | 552,000 shares of Common Stock issuable upon the exercise of public warrants as of April 29, 2025; and |

| ● | 609,040 shares of Common Stock issuable upon the exercise of private placement warrants as of April 29, 2025. |

| 8 |

Investing in our Common Stock involves a high degree of risk. You should carefully consider the risks described under the heading “Risk Factors” in this prospectus before making an investment decision. Our business, financial condition, or results of operations could be harmed by any of these risks. As a result, you could lose some or all of your investment in our Common Stock. The risks and uncertainties described in this prospectus are not the only ones we face. Additional risks not currently known to us or that we do not presently consider significant may also impair our business operations. Certain statements in this prospectus are forward-looking statements. You should read the explanation of the qualifications and limitations on such forward-looking statements discussed under “Cautionary Note Regarding Forward-Looking Statements” in this prospectus. For additional information, see “Where You Can Find More Information.”

Risks Related to Our Limited Operating History, Business and Industry

We have a limited operating history and history of net losses, and may continue to experience net losses in the future.

You should consider our business and prospects in light of the risks, expenses, and difficulties encountered by companies in their early stage of development. We launched our business through Volato, Inc. on January 7, 2021. Accordingly, we have limited operating history upon which to base an evaluation of our business and prospects. The Company’s current and proposed operations are subject to all business risks associated with newer enterprises. These include likely fluctuations in operating results as the Company reacts to developments in its markets, difficulty in managing its growth and the entry of competitors into the market.

We have experienced significant net losses since our inception and, given our limited operating history, we may experience continuing net losses for the foreseeable future and may never become profitable (as determined by U.S. Generally Accepted Accounting Principles (“GAAP”) or otherwise). We may not accurately anticipate how quickly we might use our funds and whether such funds are sufficient to bring the business to profitability and pay our liabilities. Even if we achieve profitability, we cannot be certain that we will be able to sustain or increase profitability. To achieve and sustain profitability, we must accomplish numerous objectives, including broadening and stabilizing our sources of revenue and increasing the number of customers that utilize our service. Accomplishing these objectives may require significant capital investments. We cannot assure you that we will be able to achieve these objectives.

| 9 |

The Company may not be able to continue to operate its business if it is not successful in securing additional sources of capital and, as a result, may not be able to continue as a going concern.

The Company is dependent on funds from its operations, proceeds from its financing arrangements and additional fundraising in order to sustain its ongoing operations. The Company has suffered recurring losses from operations and has a significant accumulated deficit. As a result of these recurring losses from operations, negative cash flows from operating activities and the need for additional capital there is substantial doubt of the Company’s ability to continue as a going concern. Therefore, our independent registered public accounting firm included an explanatory paragraph expressing substantial doubt about the Company’s ability to continue as a going concern in its report on the Company’s audited financial statements for the year ended December 31, 2024. The financial statements have been prepared in accordance with GAAP, which contemplate that the Company will continue to operate as a going concern. The Company’s financial statements do not contain any adjustments that might result if it is unable to continue as a going concern. There are no assurances that management will be able to raise capital on terms acceptable to the Company. If the Company is unable to obtain sufficient amounts of additional capital, the Company may be required to reduce the near-term scope of its planned development and operations, which could delay implementation of the Company’s business plan and harm its business, financial condition and operating results. In such circumstances, the Company may have to significantly reduce its operations or delay, scale back or discontinue the development of one or more of its products, seek alternative financing arrangements, declare bankruptcy or terminate its operations entirely.

Significant reliance on Gulfstream aircraft and parts poses risks to our business and prospects.

As part of our business strategy, we have historically flown HondaJet aircraft, manufactured by Honda Aircraft Company (“Honda”). The purchase agreement between the Company and Honda was terminated on September 10, 2024. We expect to take delivery of and sell Gulfstream aircraft, manufactured by Gulfstream Aerospace, LP (“Gulfstream”). If Gulfstream experiences interruptions or disruptions in production or provision of services due to, for example, bankruptcy, natural disasters, labor strikes, or disruption of their supply chain, we may experience a significant delay in the delivery of or fail to receive previously ordered aircraft and parts, which would adversely affect our revenue and results of operations and could jeopardize our ability to meet the demands of our customers.

If we cannot internally or externally finance our aircraft or generate sufficient funds to make payments to external financing sources, we may not succeed.

As is customary in the aviation industry, we are reliant on external financing for the acquisition of aircraft and we are likely to need additional financing in the future in order to acquire aircraft. If we are unable to generate sufficient revenue or other funding to make payments on these financing arrangements, the lender may default us under the financing arrangement, which would have a material adverse effect on our business and reputation. Furthermore, if we do not have access to external financing for future aircraft, for whatever reason, including reasons relating to our business or prospects or the broader economy, we may not be in a position to grow and/or operate as a going concern.

We may not be able to successfully implement our growth strategies.

Our growth strategies include, among other things, attracting new customers and retaining existing customers, expanding our addressable market by opening up private aviation to customers that have not historically used private aviation services, expanding into new markets and developing adjacent businesses. We face numerous challenges in implementing our growth strategies, including our ability to execute on market, business, product/service and geographic expansions. For example, our continued growth could increase the strain on our resources, and we could experience operating difficulties, including difficulties in hiring, training, and managing an increasing number of employees. These difficulties may result in the erosion of our brand image, divert the attention of our management and key employees, and impact our financial and operational results

| 10 |

Our strategies for growth are dependent on, among other things, our ability to expand existing products and services and launch new products and services. Although we may devote significant financial and other resources to the expansion of our products and service offerings, our efforts may not be commercially successful or achieve the desired results. Our financial results and our ability to maintain or improve our competitive position will depend on our ability to effectively gauge the direction of our key marketplaces and successfully identify, develop, market, and sell new or improved products and services in these changing marketplaces. Our inability to successfully implement our growth strategies could have a material adverse effect on our business, financial condition, and results of operations and any assumptions underlying estimates of expected cost savings or expected revenues may be inaccurate.

Our growth also depends in part on our ability to successfully enter new markets and offer new services and products. Significant changes to our existing geographic coverage or the introduction of new and unproven markets may require us to obtain and maintain applicable permits, authorizations, or other regulatory approvals. Developing and launching new or expanded locations involves significant risks and uncertainties, including risks related to the reception of such locations by existing and potential future customers, increases in operational complexity, unanticipated delays or challenges in implementing such new locations or enhancements, increased strain on our operational and internal resources (including an impairment of our ability to accurately forecast customer demand), and negative publicity in the event such new or enhanced locations are perceived to be unsuccessful. Significant new initiatives may result in operational challenges affecting our business. In addition, developing and launching new or expanded service offerings may involve significant upfront investment, such as additional marketing, and such expenditures may not generate a return on investment. Any of the foregoing risks and challenges could negatively impact our ability to attract and retain customers. If these new or expanded service offerings are unsuccessful or fail to attract a sufficient number of customers to be profitable, our business, financial condition, and results of operations could be adversely affected.

We are exposed to the risk of a decrease in demand for private aviation services.

Our business is concentrated on private aviation services, which are vulnerable to changes in consumer preferences, discretionary spending, and other market changes impacting luxury goods and discretionary purchases. In addition, demand for private aviation services may be significantly and adversely impacted by factors affecting air travel generally, such as adverse weather changes, the occurrence of geopolitical events such as war, such as the current conflicts in Ukraine, terrorism, civil unrest, political instability, market volatility, environmental or climatic factors, natural disaster, pandemic or epidemic outbreak, public health crisis and general economic conditions. The global economy has in the past, and may in the future, experience recessionary periods and periods of economic instability such as the business disruption and related financial impact resulting from the global COVID-19 health crisis. During such periods, our current and future users may choose not to make discretionary purchases or may reduce overall spending on discretionary purchases. These changes could result in reduced consumer demand for air transportation, including our private aviation services, or could shift demand from our private aviation services to other methods of air or ground transportation for which we do not offer a competing service.

Any of these factors that cause the demand for private aviation services to decline may also result in delays that could reduce the attractiveness of private air charter travel versus other means of transportation, particularly for shorter distance travel. Delays could frustrate passengers, affecting our reputation and potentially reducing demand for our services as a result of flight cancellations and increased costs. We may also experience decreased demand, as well as a loss of reputation, in the event of an accident involving one of its aircraft or an aircraft booked through our platform or any actual or alleged misuse of its platform or aircraft by customers in violation of law. Any of the foregoing circumstances or events which reduced the demand for private jet charters could negatively impact the Company’s ability to establish its business and achieve profitability. If we are unable to generate demand or there is a future shift in consumer spending away from private aviation services, our business, financial condition, and results of operations could be adversely affected.

| 11 |

We may require substantial additional funding to finance our operations, but adequate additional financing may not be available when we need it, on commercially acceptable terms, or at all.

Our operations are capital intensive, and we require sufficient liquidity levels for our operations and strategic growth plans. We have financed our operations and capital expenditures primarily through private financing rounds, credit agreements, convertible debt, and through financing of aircraft pre-delivery payment obligations. In the future, we expect to need to raise additional capital through public or private financing or other arrangements. This financing may not be available on acceptable terms, or at all, and our failure to raise capital when needed could harm our business. Numerous factors may affect our ability to obtain financing or access the capital markets in the future on terms attractive to us, including our liquidity, operating cash flows, and the timing of capital requirements, credit status and any credit ratings assigned to us, market conditions in the private aviation industry, U.S. and global economic conditions, and conditions in the capital markets generally, and the availability of our assets as collateral for future financings. We may sell equity securities or debt securities in one or more transactions at prices and in a manner as we may determine from time to time. If we sell any such securities in subsequent transactions, our current investors may be materially diluted. Any debt financing, if available, may involve restrictive covenants and could reduce our operational flexibility or profitability. If we cannot raise funds on commercially acceptable terms, we may not be able to grow our business or respond to competitive pressures and our business, results of operations, and financial condition could be materially adversely affected.

The loss of key personnel upon whom we depend on to operate our business or the inability to attract additional qualified personnel could adversely affect our business.

We believe that our future success will depend in large part on our ability to retain or attract highly qualified management, and technical and other personnel. We may not be successful in retaining key personnel or in attracting other highly qualified personnel. Any inability to retain or attract significant numbers of qualified management and other personnel would have a material adverse effect on our business, results of operations, and financial condition.

| 12 |

Federal, state, and local tax rules can adversely impact our results of operations and financial position.

We are subject to federal, state, and local taxes in the United States. Significant judgment is required in sourcing revenue among various jurisdictions, and in determining the provision for income taxes. We believe our income tax estimates are reasonable, but such estimates assume no changes in current tax rates. In addition, if the Internal Revenue Service or other taxing authority disagrees with a tax position we have taken, as to sourcing, tax rates, or otherwise, and upon final adjudication, we are required to change our position, we could incur additional tax liability, including interest and penalties. These costs and expenses could have a material adverse impact on our financial condition, results of operations, and cash flows. Additionally, the taxability of our offerings is subject to various interpretations within the taxing jurisdictions in which we operate. Consequently, in the ordinary course of business, a jurisdiction may contest our reporting positions with respect to the application of our tax code to our offerings. A conflicting position taken by a state or local taxation authority on the taxability of our offerings could result in additional tax liabilities and could negatively impact our competitive position in that jurisdiction. If we fail to comply with applicable tax laws and regulations, we could suffer civil or criminal penalties in addition to the delinquent tax assessment. To the extent our offerings are or may be determined to be taxable in a given jurisdiction, the jurisdiction may still increase the tax rate assessed on such offerings. The property and gross receipts taxation of a mobile asset business such as aviation also varies widely among U.S. jurisdictions. The Company seeks to directly or indirectly pass-through such taxes to our customers. In the event we are not able to pass-through any such taxes, our results of operations, financial condition, and cash flows could be adversely impacted.

For example, several tax proposals have been set forth that would, if enacted, make significant changes to U.S. tax laws. Such prior proposals have included an increase in the U.S. income tax rate applicable to corporations (such as the Company) from 21% to 28%. Congress may consider, and could include some or all of these proposals in connection with tax reform that may be undertaken. It is unclear whether these or similar changes will be enacted and, if enacted, how soon any such changes could take effect. The passage of any legislation as a result of these proposals and other similar changes in U.S. federal income tax laws could adversely affect the Company’s business and future profitability.

The Company may seek to expand its business operations, including to jurisdictions in which tax laws may not be favorable, its obligations may change or fluctuate, become significantly more complex or become subject to greater risk of examination by taxing authorities, any of which could adversely affect the Company’s after-tax profitability and financial results.

In the event that the Company’s business expands domestically or internationally, its effective tax rates may fluctuate widely in the future. Future effective tax rates could be affected by operating losses in jurisdictions where no tax benefit can be recorded under GAAP, changes in deferred tax assets and liabilities, or changes in tax laws. Factors that could materially affect the Company’s future effective tax rates include, but are not limited to: (a) changes in tax laws or the regulatory environment, (b) changes in accounting and tax standards or practices, (c) changes in the composition of operating income by tax jurisdiction and (d) pre-tax operating results of the Company’s business.

Additionally, the Company may be subject to significant income, withholding, and other tax obligations in the United States and may become subject to taxation in numerous additional U.S. state and local and non-U.S. jurisdictions with respect to income, operations and subsidiaries related to those jurisdictions. The Company’s after-tax profitability and financial results could be subject to volatility or be affected by numerous factors, including (a) the availability of tax deductions, credits, exemptions, refunds and other benefits to reduce tax liabilities, (b) changes in the valuation of deferred tax assets and liabilities, if any, (c) the expected timing and amount of the release of any tax valuation allowances, (d) the tax treatment of stock-based compensation, (e) changes in the relative amount of earnings subject to tax in the various jurisdictions, (f) the potential business expansion into, or otherwise becoming subject to tax in, additional jurisdictions, (g) changes to existing intercompany structure (and any costs related thereto) and business operations, (h) the extent of intercompany transactions and the extent to which taxing authorities in relevant jurisdictions respect those intercompany transactions, and (i) the ability to structure business operations in an efficient and competitive manner. Outcomes from audits or examinations by taxing authorities could have an adverse effect on the Company’s after-tax profitability and financial condition. Additionally, the Internal Revenue Service and several foreign tax authorities have increasingly focused attention on intercompany transfer pricing with respect to sales of products and services and the use of intangibles. Tax authorities could disagree with the Company’s intercompany charges, cross-jurisdictional transfer pricing or other matters and assess additional taxes. If the Company does not prevail in any such disagreements, the Company’s profitability may be affected.

| 13 |

The Company’s after-tax profitability and financial results may also be adversely affected by changes in relevant tax laws and tax rates, treaties, regulations, administrative practices and principles, judicial decisions and interpretations thereof, in each case, possibly with retroactive effect.

The Company’s ability to utilize its net operating loss and tax credit carryforwards to offset future taxable income may be subject to certain limitations.

In general, under Section 382 of the Internal Revenue Code of 1986, as amended (the “IRC”), a corporation that undergoes an “ownership change” is subject to limitations on its ability to use its pre-change net operating loss carryforwards (“NOLs”) to offset future taxable income. The limitations apply if a corporation undergoes an “ownership change,” which is generally defined as a greater than 50 percentage point change (by value) in its equity ownership by certain stockholders over a three-year period. If the Company has experienced an ownership change at any time since its incorporation, the Company may be subject to limitations on its ability to utilize its existing NOLs and other tax attributes to offset taxable income or tax liability. In addition, future changes in the Company’s stock ownership, which may be outside of the Company’s control, may trigger an ownership change. Similar provisions of state tax law may also apply to limit the Company’s use of accumulated state tax attributes. As a result, even if the Company earns net taxable income in the future, its ability to use its pre-change NOL carryforwards and other tax attributes to offset such taxable income or tax liability may be subject to limitations, which could potentially result in increased future income tax liability to the Company.

Our business is dependent on third-party operators to provide flights for our customers. If third-party operators’ flights, which are required to serve a substantial portion of our business, are not available or do not perform adequately, our costs may increase and our business, financial condition, and results of operations could be adversely affected.

We rely on flyExclusive as a third-party operator to provide flights for our Vaunt product. As such, we are subject to the risk of disruptions to their operations, which has in the past and may in the future result from many of the same risk factors disclosed in this prospectus, such as the impact of adverse economic conditions and the inability of third parties to hire or retain skilled personnel, including pilots and mechanics. We expect that as competition in the private aviation market grows, the use of exclusive contractual arrangements with third-party aircraft operators, sometimes requiring volume guarantees and prepayments or deposits, may increase. This may require us to purchase or lease additional aircraft that may not be available or require us to incur significant capital or operating expenditures.

| 14 |

If our efforts to continue to build our strong brand identity and achieve high customer satisfaction and loyalty are not successful, we may not be able to attract or retain customers, and our operating results may be adversely affected.

Maintaining a good reputation globally is important to our business. We must continue to build and maintain a strong brand identity for our products and services, which have expanded over time. We believe that a strong brand identity will continue to be important in attracting customers. If our efforts to promote and maintain our brand are not successful, our operating results and our ability to attract customers will be adversely affected. From time to time, our customers may express dissatisfaction with our products and services, in part due to factors that could be outside of our control, such as the timing and availability of aircraft and service interruptions driven by prevailing political, regulatory, or natural conditions. To the extent dissatisfaction with our products and services is widespread or not adequately addressed, our brand may be adversely impacted, and our ability to attract and retain customers may be adversely affected. With respect to our planned expansion into additional markets, we will also need to establish our brand, and to the extent it is not successful, our business in new markets would be adversely impacted.

Through our marketing, advertising, and communications with our customers, we set the tone for the brand as aspirational but also within reach. We strive to create high levels of customer satisfaction through the experience provided by our team and representatives. The ease and reliability of our services, including our ability to provide high-quality customer support, helps us attract and retain customers. Our ability to provide effective and timely support is largely dependent on our ability to attract and retain skilled employees who can support our customers and are sufficiently knowledgeable about our product and services. As we continue to grow our business and improve our platform, we will face challenges related to providing quality support at an increased scale. Any failure to provide efficient customer support, or a market perception that we do not maintain high-quality support, could adversely affect our reputation, brand, business, financial condition, and results of operations.

Our reputation or brand image also could be adversely impacted by, among other things, any failure to maintain high ethical, social, and environmental sustainability practices for all of our operations and activities, our impact on the environment, public pressure from investors or policy groups to change our policies, such as movements to institute a “living wage,” customer perceptions of our advertising campaigns, sponsorship arrangements or marketing programs, customer perceptions of our use of social media, or customer perceptions of statements made by us, our employees and executives, agents or other third parties. We operate in a highly visible industry that has significant exposure to social media. Negative publicity, including as a result of misconduct by our customers, vendors, or employees, can spread rapidly through social media. Should we not respond in a timely and appropriate manner to address negative publicity, our brand and reputation may be significantly harmed. Damage to our reputation or brand image or loss of customer confidence in our services could adversely affect our business and financial results as well as require additional resources to rebuild or repair our reputation.

A delay or failure to identify and devise, invest in, and implement certain important technology, business, and other initiatives could have a material impact on our business, financial condition and results of operations.